[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Front Runners [@frontrunnersx](/creator/twitter/frontrunnersx) on x 17.1K followers Created: 2025-07-06 11:30:00 UTC CRYPTO REVENUE SURGE: Who’s Winning in DeFi Right Now DeFi Revenue Rebounds Sharply • Monthly DeFi fees hit $577M in June, up XX% from April’s low of $366M • Indicates strong recovery in onchain activity and user engagement What’s Driving It • PancakeSwap ( $CAKE ): $275M in fees from 0.17%–0.25% per trade • PumpDotfun: Over $75M earned in June alone • Lending protocols ( $AAVE & $MKR ): Generated $100M from interest and liquidations Sector Trends: Winners & Losers • Top Revenue Performers: Stablecoin issuers & DEXs • Biggest Growth MoM: – DEX Aggregators: +298% – Lending protocols: +57% • Declining Segments: Trading apps, bots, and launchpads DeFi is resurging fast, driven by core protocols and real usage. DEXs, aggregators, and lending markets are leading onchain fee generation across DeFi, signaling strong fundamentals beneath the hype. Research done by @kshitizkapoor_  XXXXX engagements  **Related Topics** [mkr](/topic/mkr) [lending](/topic/lending) [$75m](/topic/$75m) [pumpdotfun](/topic/pumpdotfun) [$275m](/topic/$275m) [pancakeswap](/topic/pancakeswap) [onchain](/topic/onchain) [$366m](/topic/$366m) [Post Link](https://x.com/frontrunnersx/status/1941821933756059891)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Front Runners @frontrunnersx on x 17.1K followers

Created: 2025-07-06 11:30:00 UTC

Front Runners @frontrunnersx on x 17.1K followers

Created: 2025-07-06 11:30:00 UTC

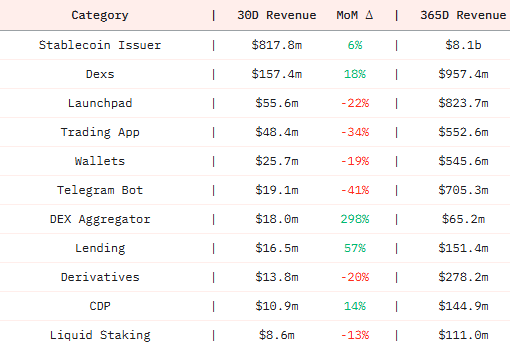

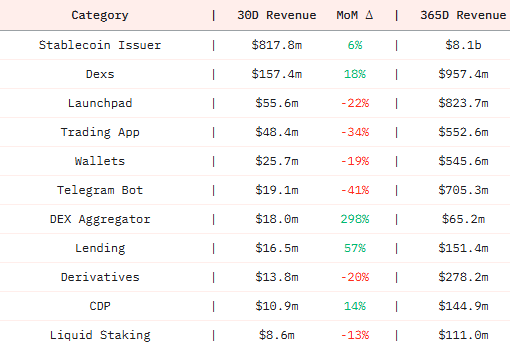

CRYPTO REVENUE SURGE: Who’s Winning in DeFi Right Now

DeFi Revenue Rebounds Sharply

• Monthly DeFi fees hit $577M in June, up XX% from April’s low of $366M • Indicates strong recovery in onchain activity and user engagement

What’s Driving It

• PancakeSwap ( $CAKE ): $275M in fees from 0.17%–0.25% per trade • PumpDotfun: Over $75M earned in June alone • Lending protocols ( $AAVE & $MKR ): Generated $100M from interest and liquidations

Sector Trends: Winners & Losers

• Top Revenue Performers: Stablecoin issuers & DEXs • Biggest Growth MoM: – DEX Aggregators: +298% – Lending protocols: +57% • Declining Segments: Trading apps, bots, and launchpads

DeFi is resurging fast, driven by core protocols and real usage. DEXs, aggregators, and lending markets are leading onchain fee generation across DeFi, signaling strong fundamentals beneath the hype.

Research done by @kshitizkapoor_

XXXXX engagements

Related Topics mkr lending $75m pumpdotfun $275m pancakeswap onchain $366m