[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Rose Celine Investments 🌹 [@realroseceline](/creator/twitter/realroseceline) on x 7975 followers Created: 2025-07-05 23:05:30 UTC $ZETA What is Zeta? Zeta Global is a marketing tech (martech) company that helps brands use data + AI to personalize customer outreach. Think of it like a smarter way to do email, text, web ads, and CRM, all informed by data on what customers want. What could $ZETA become in X years? A $2B+ revenue platform Zeta’s management has targeted 20%+ annual revenue growth. If it delivers, revenue could grow from ~$1b today to $2B+ by 2029. A profitable, asset light, cash generating business They say they can hit 25%+ EBITDA margins long term (I think it’s reasonable because the biz is asset light). That means $500m+ EBITDA on $2B in revenue, if scale and efficiency kicks in they can probably do more than 25%, that would be a pleasant surprise. Mini Salesforce $CRM or Adobe $ADBE for midsize brands Zeta’s pitch is that they offer XX% of the power of Salesforce Marketing Cloud or Adobe for a fraction of the price, and without needing a whole IT team to run it. That positions them to grab market share among mid sized companies that are underserved. An AI marketing platform Zeta is heavily leaning into AI and automation, including predictive analytics and real time audience segmentation. If that delivers results (and cost savings), they can build a stronger moat over time. What could go wrong? Execution risk: they need to keep growing and turn the corner on GAAP profitability. Competition: Salesforce, Adobe, Oracle, and even startups are fierce competitors. Customer churn: marketing budgets are cyclical and can get cut quickly in downturns. What could the stock be worth? Totally speculative, but if: Revenue hits $2B They maintain a XX% EBITDA margin Trade at 15–20x EBITDA (reasonable) Then the valuation could be ~$10b (vs ~$3.5 today), meaning ~3x upside in X years (~40% CAGR), if everything goes right. RED flag 🚩 It all looks good, until you check the cash flow statement and see the SBC line. Stock based comp makes up around a quarter of $ZETA’s revenue. Even if management brings it down to XX% at $2B revenue, that’s still $200M. So the $500M we estimated drops to $300M, and the whole equation completely changes. The reality is $ZETA is in a tough spot, they need to keep issuing stock to retain talent, and that’s a major drag on investor returns. What could the stock be worth if we account for SBC? Totally speculative, but if: Revenue hits $2B They maintain a XX% EBITDA margin Trade at 15–20x EBITDA (reasonable) XX% SBC ($200m) Then the valuation could be ~$6b (vs ~$3.5 today), meaning a mid to high teens return. 🌹  XXXXXX engagements  **Related Topics** [ai to](/topic/ai-to) [quarterly earnings](/topic/quarterly-earnings) [$2b](/topic/$2b) [ads](/topic/ads) [coins ai](/topic/coins-ai) [$zeta](/topic/$zeta) [celine](/topic/celine) [zetachain](/topic/zetachain) [Post Link](https://x.com/realroseceline/status/1941634570920788470)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Rose Celine Investments 🌹 @realroseceline on x 7975 followers

Created: 2025-07-05 23:05:30 UTC

Rose Celine Investments 🌹 @realroseceline on x 7975 followers

Created: 2025-07-05 23:05:30 UTC

$ZETA

What is Zeta?

Zeta Global is a marketing tech (martech) company that helps brands use data + AI to personalize customer outreach. Think of it like a smarter way to do email, text, web ads, and CRM, all informed by data on what customers want.

What could $ZETA become in X years?

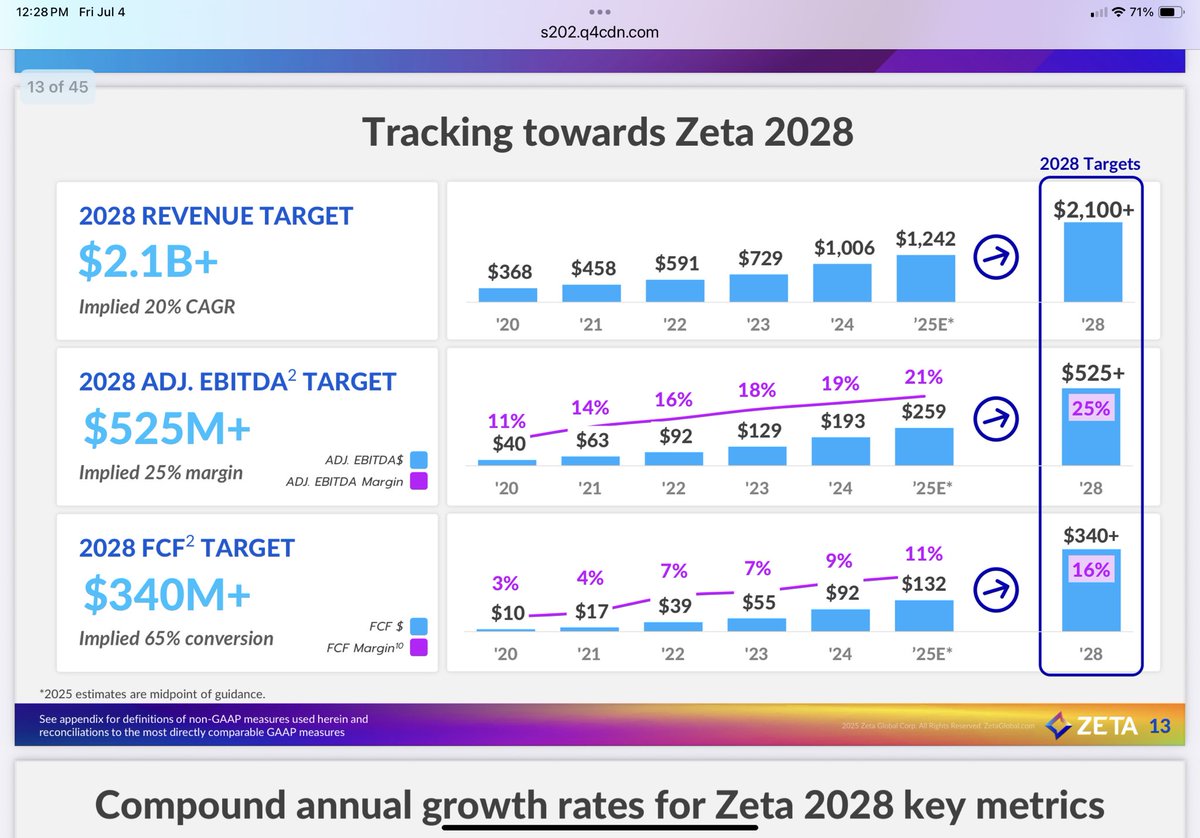

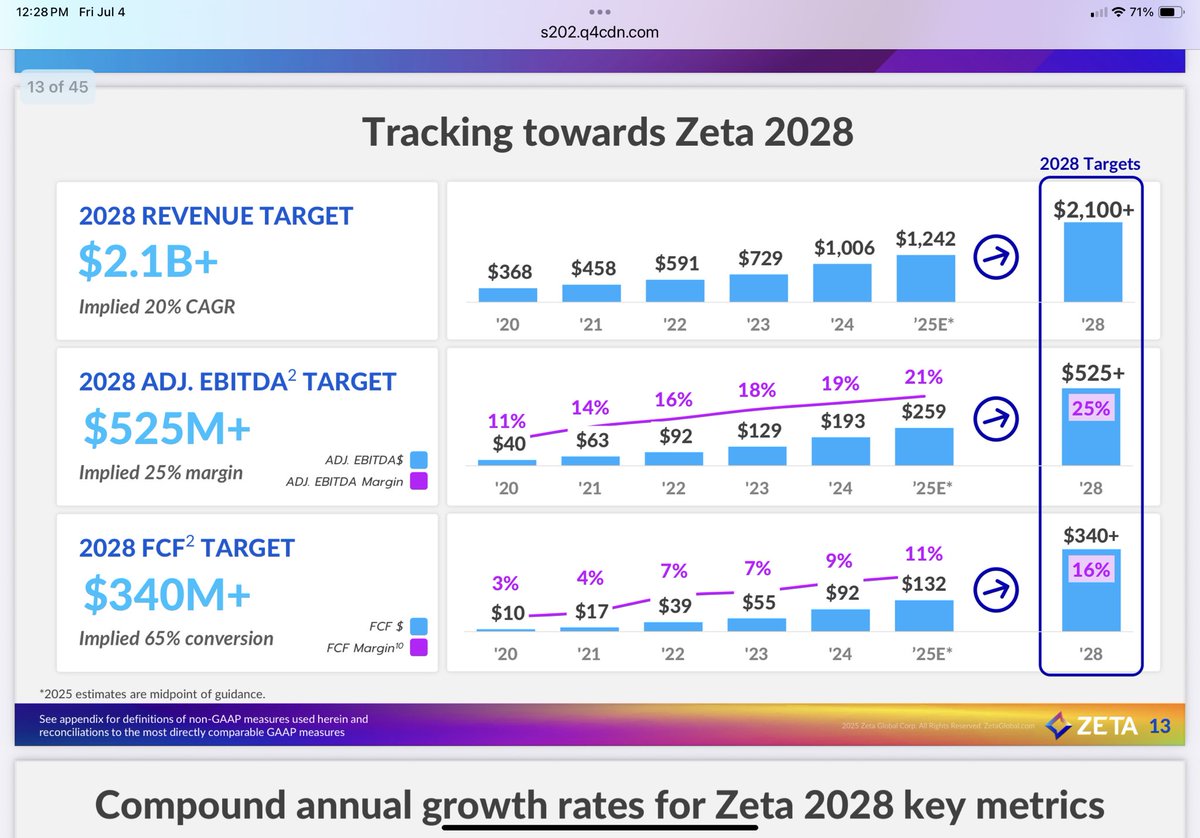

A $2B+ revenue platform

Zeta’s management has targeted 20%+ annual revenue growth. If it delivers, revenue could grow from ~$1b today to $2B+ by 2029.

A profitable, asset light, cash generating business

They say they can hit 25%+ EBITDA margins long term (I think it’s reasonable because the biz is asset light). That means $500m+ EBITDA on $2B in revenue, if scale and efficiency kicks in they can probably do more than 25%, that would be a pleasant surprise.

Mini Salesforce $CRM or Adobe $ADBE for midsize brands

Zeta’s pitch is that they offer XX% of the power of Salesforce Marketing Cloud or Adobe for a fraction of the price, and without needing a whole IT team to run it. That positions them to grab market share among mid sized companies that are underserved.

An AI marketing platform

Zeta is heavily leaning into AI and automation, including predictive analytics and real time audience segmentation. If that delivers results (and cost savings), they can build a stronger moat over time.

What could go wrong?

Execution risk: they need to keep growing and turn the corner on GAAP profitability.

Competition: Salesforce, Adobe, Oracle, and even startups are fierce competitors.

Customer churn: marketing budgets are cyclical and can get cut quickly in downturns.

What could the stock be worth?

Totally speculative, but if:

Revenue hits $2B They maintain a XX% EBITDA margin Trade at 15–20x EBITDA (reasonable)

Then the valuation could be $10b (vs ~$3.5 today), meaning ~3x upside in X years (40% CAGR), if everything goes right.

RED flag 🚩

It all looks good, until you check the cash flow statement and see the SBC line. Stock based comp makes up around a quarter of $ZETA’s revenue.

Even if management brings it down to XX% at $2B revenue, that’s still $200M. So the $500M we estimated drops to $300M, and the whole equation completely changes.

The reality is $ZETA is in a tough spot, they need to keep issuing stock to retain talent, and that’s a major drag on investor returns.

What could the stock be worth if we account for SBC?

Totally speculative, but if:

Revenue hits $2B They maintain a XX% EBITDA margin Trade at 15–20x EBITDA (reasonable) XX% SBC ($200m)

Then the valuation could be ~$6b (vs ~$3.5 today), meaning a mid to high teens return.

🌹

XXXXXX engagements

Related Topics ai to quarterly earnings $2b ads coins ai $zeta celine zetachain