[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Dulce [@litigious_dulce](/creator/twitter/litigious_dulce) on x 2731 followers Created: 2025-07-05 16:16:07 UTC Profitability does hinge on scale though! Yes, cost of electricity and ASIC efficiency both matter tremendously, but even if you have both, you can be unprofitable if you lack scale. See $CIFR, which has best-in-class electricity cost and very good ASIC efficiency. If scale improves margins by 10%, and IREN has a net profit margin of 20%, then that’s the difference between a slightly profitable company and a very profitable company. Regarding ROIC, let’s say IREN spent $20m/EH, so $1B total for its ASICs. Let’s then say that it makes a net profit of about $250m/year for the next three years (assume $X paid in taxes because of the Big Beautiful Bill). The ROIC then for 2025-2028 (assume up until the halving) is 25%, which is very good. Now what about post-halving? Let’s assume hashprice drops to $XX (many miners will be forced to shut-off due to inferior bitcoin mining economics, resulting in lower network hashrate). ROIC probably falls to 10%, at least until Bitcoin price rebounds. However,assume that the ASICs are fully depreciated in 2029 so that this cost no longer appears on their balance sheet. What will ROIC be then? I would guess around 25%, but who can say right? The future is quite unknowable. At a minimum, the ROIC should be significantly better than XX% though. Now let’s consider the strategic benefits of Bitcoin mining. First and foremost, it is IREN’s Best Alternative to a Negotiated Agreement (BATNA). BATNA is the most advantageous course of action a party can take if negotiations fail and no agreement is reached. It serves as a benchmark for evaluating any proposed deal. Rather than accepting unfavorable terms out of fear that no deal will be made, a negotiator with a clear BATNA can walk away confidently, knowing they have a viable alternative. Understanding your BATNA gives you leverage. The stronger your fallback option, the less pressure you feel to compromise. In this instance, when IREN is negotiating colocation, any new proposal must provide better returns than bitcoin mining to be worth considering. BATNA protects against accepting deals that are worse than IREN’s existing alternatives. In high-stakes situations, which IREN is in, BATNA can shift the balance of power entirely. Then consider the load balancing/curtailment dynamics bitcoin mining enables (e.g., regulatory compliance)… we are well beyond a simplistic framing of bitcoin mining that can be accurately represented by one or two financial metrics. This is why I don’t weigh ROIC perhaps as heavily as you do (even though my above hypothetical scenario would suggest the ROIC is quite good anyways). If IREN were a typical bitcoin miner, then I wouldn’t buy it. For example, there’s a reason why I don’t have a position in Cleanspark even though I do think its operations are pretty solid. IREN’s plans are extremely sophisticated, but it is this sophistication that affords optionality, and optionality is how a company thrives in a volatile market.  XXXXX engagements  **Related Topics** [iren](/topic/iren) [$cifr](/topic/$cifr) [cipher mining](/topic/cipher-mining) [stocks bitcoin treasuries](/topic/stocks-bitcoin-treasuries) [Post Link](https://x.com/litigious_dulce/status/1941531548295077900)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Dulce @litigious_dulce on x 2731 followers

Created: 2025-07-05 16:16:07 UTC

Dulce @litigious_dulce on x 2731 followers

Created: 2025-07-05 16:16:07 UTC

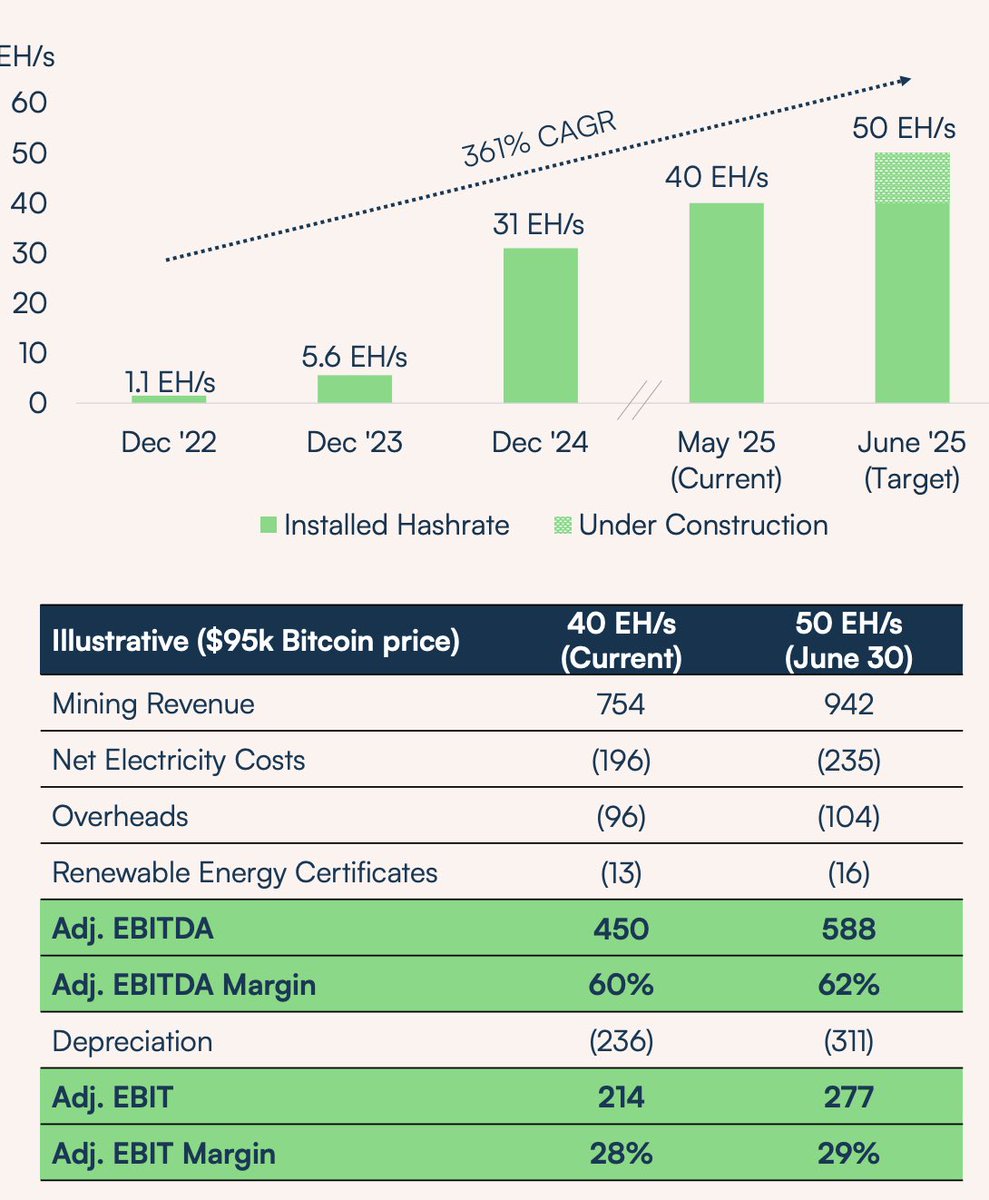

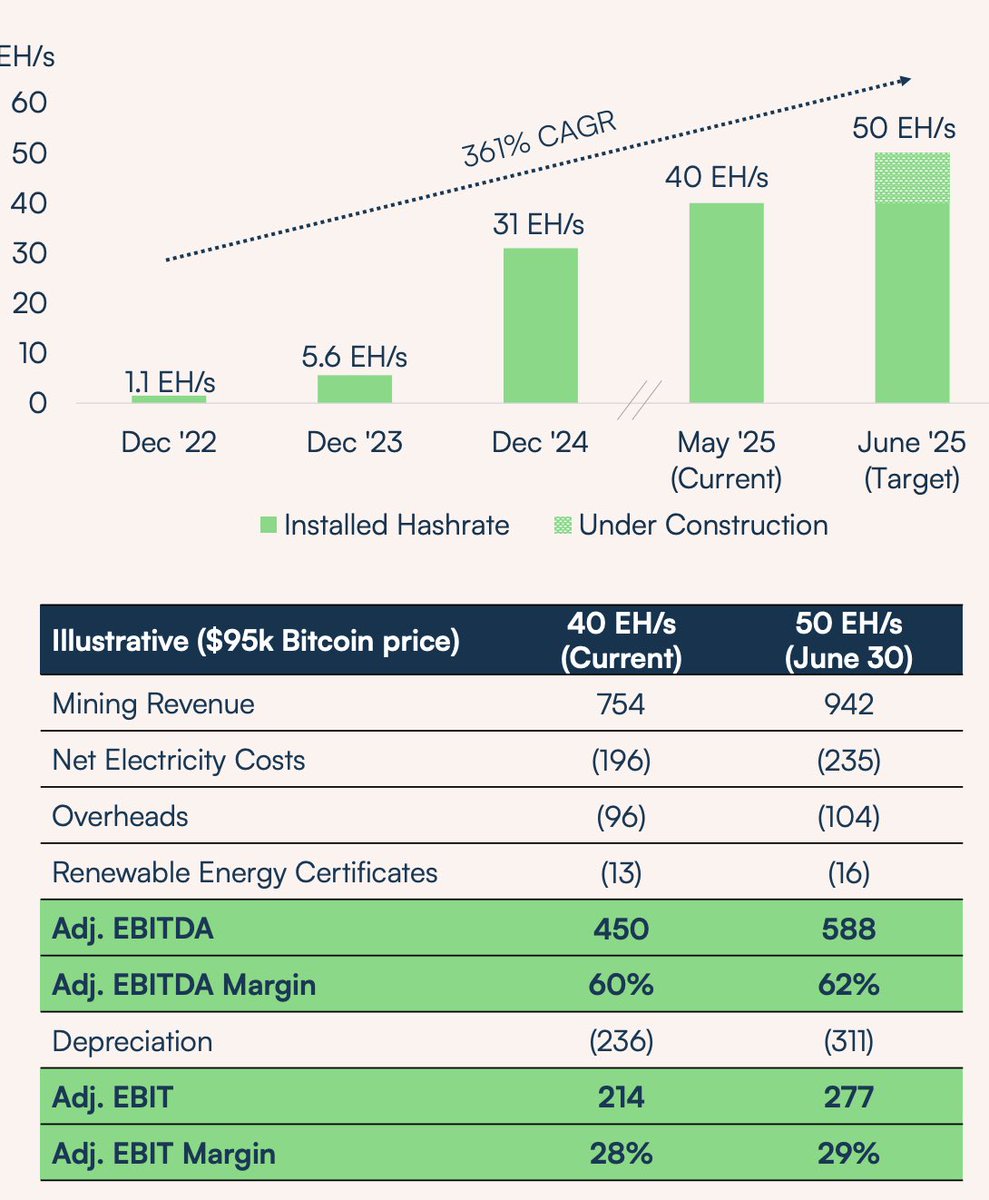

Profitability does hinge on scale though! Yes, cost of electricity and ASIC efficiency both matter tremendously, but even if you have both, you can be unprofitable if you lack scale. See $CIFR, which has best-in-class electricity cost and very good ASIC efficiency. If scale improves margins by 10%, and IREN has a net profit margin of 20%, then that’s the difference between a slightly profitable company and a very profitable company.

Regarding ROIC, let’s say IREN spent $20m/EH, so $1B total for its ASICs. Let’s then say that it makes a net profit of about $250m/year for the next three years (assume $X paid in taxes because of the Big Beautiful Bill). The ROIC then for 2025-2028 (assume up until the halving) is 25%, which is very good.

Now what about post-halving? Let’s assume hashprice drops to $XX (many miners will be forced to shut-off due to inferior bitcoin mining economics, resulting in lower network hashrate). ROIC probably falls to 10%, at least until Bitcoin price rebounds.

However,assume that the ASICs are fully depreciated in 2029 so that this cost no longer appears on their balance sheet. What will ROIC be then? I would guess around 25%, but who can say right? The future is quite unknowable. At a minimum, the ROIC should be significantly better than XX% though.

Now let’s consider the strategic benefits of Bitcoin mining. First and foremost, it is IREN’s Best Alternative to a Negotiated Agreement (BATNA). BATNA is the most advantageous course of action a party can take if negotiations fail and no agreement is reached. It serves as a benchmark for evaluating any proposed deal. Rather than accepting unfavorable terms out of fear that no deal will be made, a negotiator with a clear BATNA can walk away confidently, knowing they have a viable alternative.

Understanding your BATNA gives you leverage. The stronger your fallback option, the less pressure you feel to compromise. In this instance, when IREN is negotiating colocation, any new proposal must provide better returns than bitcoin mining to be worth considering. BATNA protects against accepting deals that are worse than IREN’s existing alternatives. In high-stakes situations, which IREN is in, BATNA can shift the balance of power entirely.

Then consider the load balancing/curtailment dynamics bitcoin mining enables (e.g., regulatory compliance)… we are well beyond a simplistic framing of bitcoin mining that can be accurately represented by one or two financial metrics. This is why I don’t weigh ROIC perhaps as heavily as you do (even though my above hypothetical scenario would suggest the ROIC is quite good anyways).

If IREN were a typical bitcoin miner, then I wouldn’t buy it. For example, there’s a reason why I don’t have a position in Cleanspark even though I do think its operations are pretty solid. IREN’s plans are extremely sophisticated, but it is this sophistication that affords optionality, and optionality is how a company thrives in a volatile market.

XXXXX engagements

Related Topics iren $cifr cipher mining stocks bitcoin treasuries