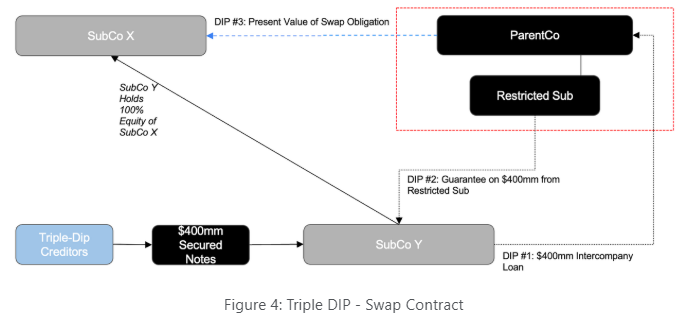

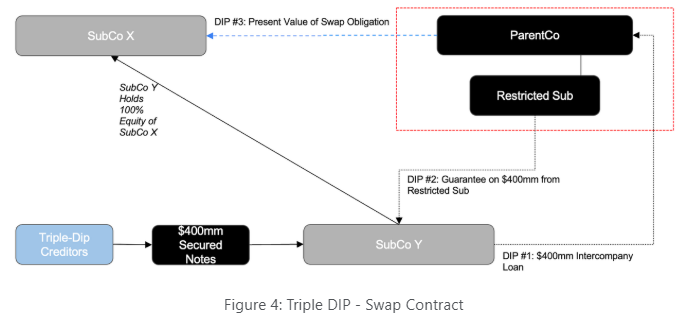

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Restructuring__ [@Restructuring__](/creator/twitter/Restructuring__) on x 38.6K followers Created: 2025-07-05 16:10:42 UTC 2) Option 2: Intercompany Derivative/Capital Structure Instruments Structuring A company could use swaps, options, and other derivative instruments between subsidiaries to create a third claim. Like the intercompany loan, a derivative instrument represents a contract between two parties, and if structured appropriately, it could represent additional recoveries for the triple-dip lenders. Figure #4 below depicts how this structure could arise. As it was in Figure #3, there is a first claim from the $400mm intercompany loan, and a second claim from the $400mm restricted company guarantee. However, the third claim is created via an interest swap contract entered into between SubCo X and ParentCo (using the $400mm upstreamed from SubCo Y). To briefly explain how swap contracts work, it is an agreement between two parties to exchange their interest payments for one another over a set period of time. Let’s say that we have a mortgage of $1,000,000, with a XX% fixed interest rate. If we believe that interest rates are going to be lower than this rate over the duration of a swap contract, an individual can engage in a swap contract with a bank. To do so, they would swap their XX% fixed interest rate for a rate that the bank provides, say SOFR + 2%. If the contract lasted X years, each year the bank would have to pay the XX% rate and the individual would only have to pay the SOFR + 2%. In our example swap contract, we can assume that it has a notional value of $400mm, where SubCo2 pays a fixed rate (i.e 5%), and ParentCo pays a floating rate (i.e SOFR+3%). If, at the time of the filing, the present value of the swap contract is positive to the benefit of SubCo X, it becomes an additional claim. Thus, if that swap contract reached a present value of $400mm, a third claim could be created.  XXX engagements  **Related Topics** [chapter 11](/topic/chapter-11) [Post Link](https://x.com/Restructuring__/status/1941530182587724190)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Restructuring__ @Restructuring__ on x 38.6K followers

Created: 2025-07-05 16:10:42 UTC

Restructuring__ @Restructuring__ on x 38.6K followers

Created: 2025-07-05 16:10:42 UTC

- Option 2: Intercompany Derivative/Capital Structure Instruments Structuring

A company could use swaps, options, and other derivative instruments between subsidiaries to create a third claim.

Like the intercompany loan, a derivative instrument represents a contract between two parties, and if structured appropriately, it could represent additional recoveries for the triple-dip lenders.

Figure #4 below depicts how this structure could arise.

As it was in Figure #3, there is a first claim from the $400mm intercompany loan, and a second claim from the $400mm restricted company guarantee.

However, the third claim is created via an interest swap contract entered into between SubCo X and ParentCo (using the $400mm upstreamed from SubCo Y).

To briefly explain how swap contracts work, it is an agreement between two parties to exchange their interest payments for one another over a set period of time. Let’s say that we have a mortgage of $1,000,000, with a XX% fixed interest rate. If we believe that interest rates are going to be lower than this rate over the duration of a swap contract, an individual can engage in a swap contract with a bank.

To do so, they would swap their XX% fixed interest rate for a rate that the bank provides, say SOFR + 2%. If the contract lasted X years, each year the bank would have to pay the XX% rate and the individual would only have to pay the SOFR + 2%.

In our example swap contract, we can assume that it has a notional value of $400mm, where SubCo2 pays a fixed rate (i.e 5%), and ParentCo pays a floating rate (i.e SOFR+3%).

If, at the time of the filing, the present value of the swap contract is positive to the benefit of SubCo X, it becomes an additional claim. Thus, if that swap contract reached a present value of $400mm, a third claim could be created.

XXX engagements

Related Topics chapter 11