[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Fabius DeFi [@FabiusDefi](/creator/twitter/FabiusDefi) on x 12.9K followers Created: 2025-07-04 14:11:34 UTC After Bitcoin, Ethereum is the Chosen One! 👑 Ethereum is turning into Wall Street’s go-to yield asset. WuBlockchain data (June 27) shows SharpLink Gaming holding XXXXXXX ETH ($458 M) with XX% staked, Coinbase sitting on XXXXXXX ETH ($281 M), and Bit Digital pivoting entirely to ETH staking with XXXXXX ETH (~$59 M). On-chain signals back it up: $XXXX B of ETH flowed into accumulator addresses in June, L2 launches are multiplying, and ETFs are still accelerating. Public firms are treating ETH like a bond, earning native yield instead of paying to borrow. Staking converts ETH into sETH yield generators; treasury inflows are at record levels. It’s the narrative TradFi gets: stablecoins + stocks moving on-chain + native yield = institution-ready asset. Could $ETH now rival $BTC as the preferred corporate treasury asset? The data, inflows, and on-chain behavior say it might just be possible.  XXXXX engagements  **Related Topics** [signals](/topic/signals) [onchain](/topic/onchain) [staking](/topic/staking) [gaming](/topic/gaming) [bitcoin](/topic/bitcoin) [coins layer 1](/topic/coins-layer-1) [coins bitcoin ecosystem](/topic/coins-bitcoin-ecosystem) [coins pow](/topic/coins-pow) [Post Link](https://x.com/FabiusDefi/status/1941137816148422689)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Fabius DeFi @FabiusDefi on x 12.9K followers

Created: 2025-07-04 14:11:34 UTC

Fabius DeFi @FabiusDefi on x 12.9K followers

Created: 2025-07-04 14:11:34 UTC

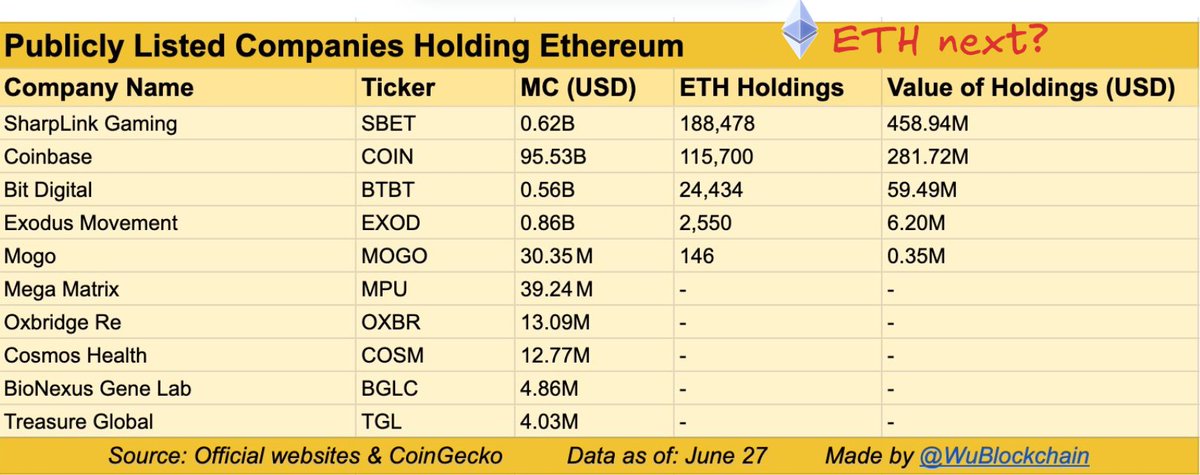

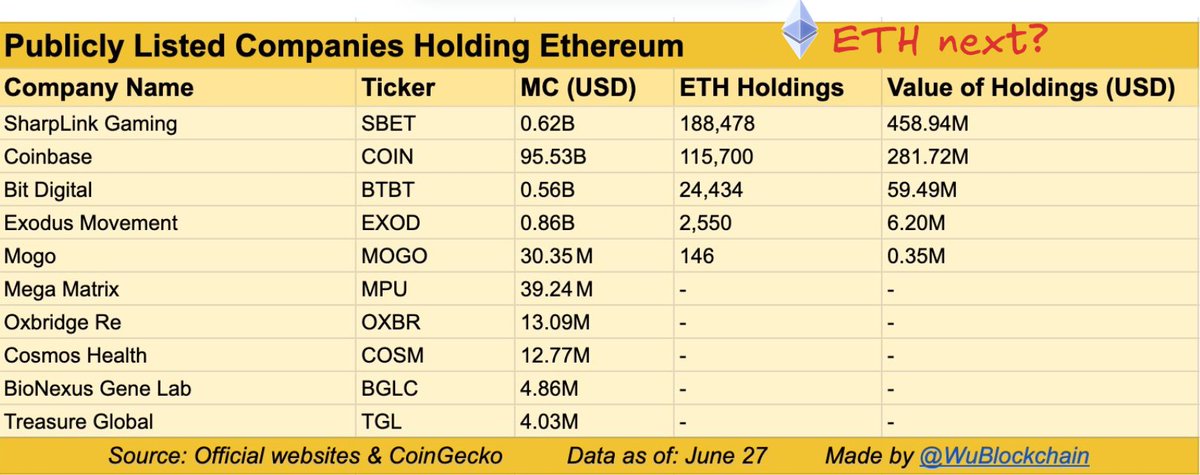

After Bitcoin, Ethereum is the Chosen One! 👑

Ethereum is turning into Wall Street’s go-to yield asset.

WuBlockchain data (June 27) shows SharpLink Gaming holding XXXXXXX ETH ($458 M) with XX% staked, Coinbase sitting on XXXXXXX ETH ($281 M), and Bit Digital pivoting entirely to ETH staking with XXXXXX ETH (~$59 M).

On-chain signals back it up: $XXXX B of ETH flowed into accumulator addresses in June, L2 launches are multiplying, and ETFs are still accelerating. Public firms are treating ETH like a bond, earning native yield instead of paying to borrow.

Staking converts ETH into sETH yield generators; treasury inflows are at record levels. It’s the narrative TradFi gets: stablecoins + stocks moving on-chain + native yield = institution-ready asset.

Could $ETH now rival $BTC as the preferred corporate treasury asset? The data, inflows, and on-chain behavior say it might just be possible.

XXXXX engagements

Related Topics signals onchain staking gaming bitcoin coins layer 1 coins bitcoin ecosystem coins pow