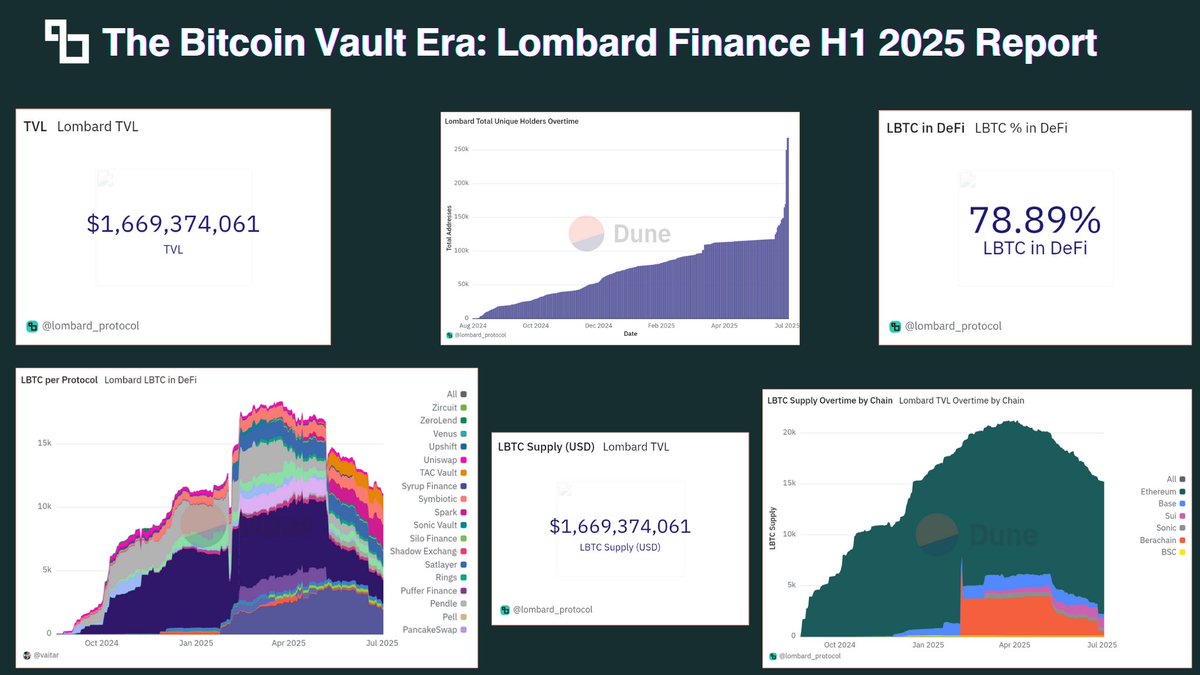

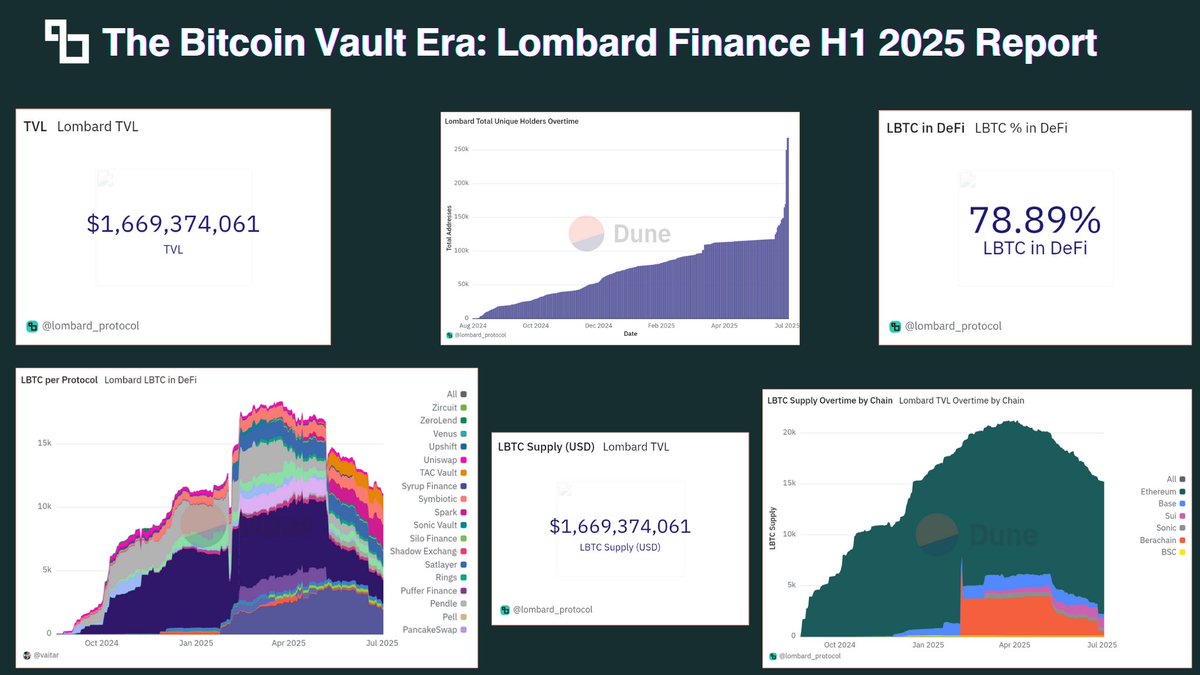

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  spacebyte ⛓ [@_thespacebyte](/creator/twitter/_thespacebyte) on x 21.7K followers Created: 2025-07-03 12:28:47 UTC The first half of 2025 marked a decisive turning point for Bitcoin in DeFi. While $WBTC continued to dominate in name recognition, $LBTC—the non-custodial, yield-generating vault token from @Lombard_Finance—quietly became the cornerstone of a new financial layer: BTCfi. [🧵] This H1 report explores how @Lombard_Finance has emerged as the leading BTCfi protocol by combining: • Non-custodial minting architecture • Composable DeFi vault strategies • A multi-chain $LBTC standard • Babylon-powered staking rewards ($BABY) 𝘍𝘳𝘰𝘮 𝘷𝘢𝘶𝘭𝘵 𝘭𝘢𝘶𝘯𝘤𝘩𝘦𝘴 𝘵𝘰 𝘦𝘹𝘱𝘰𝘯𝘦𝘯𝘵𝘪𝘢𝘭 𝘨𝘳𝘰𝘸𝘵𝘩 𝘪𝘯 $LBTC 𝘩𝘰𝘭𝘥𝘦𝘳𝘴, 𝘏1 𝘸𝘢𝘴 𝘵𝘩𝘦 𝘱𝘩𝘢𝘴𝘦 𝘸𝘩𝘦𝘳𝘦 𝘉𝘪𝘵𝘤𝘰𝘪𝘯’𝘴 𝘪𝘥𝘭𝘦 𝘤𝘢𝘱𝘪𝘵𝘢𝘭 𝘧𝘰𝘶𝘯𝘥 𝘯𝘦𝘸 𝘱𝘶𝘳𝘱𝘰𝘴𝘦. ----- 𝗣𝗿𝗼𝘁𝗼𝗰𝗼𝗹 𝗚𝗿𝗼𝘄𝘁𝗵 & 𝗔𝗱𝗼𝗽𝘁𝗶𝗼𝗻 Total Value Locked (TVL) • Jan 1, 2025 (estimated): ~$1.2B • June 30, 2025: ~$1.8B–$2.0B • Q1 → Q2 growth: +20–30% Vault-specific growth was driven by the Lombard DeFi Vault and Sentora Vault, with estimated TVLs of $500M–$700M and $300M–$500M respectively. Sonic and TAC Vaults showed smaller but steady adoption. $LBTC 𝗦𝘂𝗽𝗽𝗹𝘆 • Start of H1: XXXXXX $LBTC • End of H1: XXXXXX $LBTC • April ATH: XXXXXX $LBTC • Net Growth (Jan–Jun): +6.04% 𝗠𝘂𝗹𝘁𝗶-𝗖𝗵𝗮𝗶𝗻 𝗘𝘅𝗽𝗮𝗻𝘀𝗶𝗼𝗻 • Ethereum remains dominant with XXXXXX $LBTC (80%) • Notable growth on: - #Berachain: XXX $LBTC - #Base: XXX $LBTC - #Sonic: XXX $LBTC - #Sui: XX $LBTC 𝗨𝘀𝗲𝗿 𝗠𝗲𝘁𝗿𝗶𝗰𝘀 • XXXXXX wallets minted $LBTC • XXXXXX current holders • Vault user base estimated at 30,000+ active users 𝗩𝗮𝘂𝗹𝘁 𝗠𝘂𝗹𝘁𝗶𝗽𝗹𝗶𝗲𝗿𝘀 • Lombard DeFi Vault: 4x Lombard Lux + 3x Veda + 1x Babylon • Sentora & Concrete Vaults: 4–5x multipliers 𝗔𝘃𝗲𝗿𝗮𝗴𝗲 𝗔𝗣𝗬𝘀 • Lombard DeFi Vault: 12–15% • Sentora: 6–8% • Sonic & Concrete: 5–7% 𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝘆 𝗧𝘆𝗽𝗲𝘀 • Lending: Morpho Blue, Gearbox • LPing: Curve, Uniswap, Pendle LPT • Restaking: EigenLayer integration (April 2025) 𝗘𝗰𝗼𝘀𝘆𝘀𝘁𝗲𝗺 𝗚𝗿𝗼𝘄𝘁𝗵 & 𝗜𝗻𝘁𝗲𝗴𝗿𝗮𝘁𝗶𝗼𝗻𝘀 — Chain Deployments in H1 • Sonic, Berachain, Base, and Sui supported $LBTC vaults • Ethereum retained deep liquidity and composability — Top DeFi Integrations • Lending: Aave, Morpho, Gearbox • Yield: Pendle, EigenLayer, Veda • LP/DEX: Uniswap, Curve 𝗖𝗼𝗺𝗽𝗲𝘁𝗶𝘁𝗶𝘃𝗲 𝗣𝗼𝘀𝗶𝘁𝗶𝗼𝗻𝗶𝗻𝗴 $LBTC vs $WBTC vs $SolvBTC vs $cbETH • $LBTC: Non-custodial, multi-chain, yield-enabled • $WBTC: Custodial, most liquid, but no native yield • $SolvBTC: Babylon-native, less composable • $cbETH: Ethereum-only, no $BTC exposure 𝗣𝗲𝗴 𝗦𝘁𝗮𝗯𝗶𝗹𝗶𝘁𝘆 • $LBTC traded near 0.996–1.01 BTC throughout H1 • Tight peg maintained due to on-chain vault redemptions and oracle design 𝗕𝗧𝗖𝗳𝗶 𝘃𝘀 𝗘𝗧𝗛𝗳𝗶 • Lido TVL remains dominant, but Lombard is growing faster in Bitcoin-native TVL • LBTC introduces capital efficiency where $WBTC and $stETH do not intersect 𝗠𝗶𝗹𝗲𝘀𝘁𝗼𝗻𝗲𝘀 April: $LBTC surpasses 21K minted May: Concrete & Sentora vaults oversubscribed June: Sonic vault campaign closes with 300+ $LBTC TVL 𝗛𝟮 𝗢𝘂𝘁𝗹𝗼𝗼𝗸 Key Catalysts to Watch: • Lombard token launch and governance shift • Vault expansion to Starknet and Cosmos-based chains • Pendle LPT integrations • Babylon Phase X yield acceleration 𝗖𝗹𝗼𝘀𝗶𝗻𝗴 𝗧𝗵𝗼𝘂𝗴𝗵𝘁 H1 2025 confirmed a powerful thesis: $BTC capital doesn’t have to be idle. @Lombard_Finance didn’t just create a new wrapper—it built a vault-powered BTCfi economy. With non-custodial security, staking yield, and composability across chains, $LBTC is positioned to become the real stable $BTC of DeFi.  XXXXXX engagements  **Related Topics** [wbtc](/topic/wbtc) [protocol](/topic/protocol) [lombardfinance](/topic/lombardfinance) [coins btcfi](/topic/coins-btcfi) [token](/topic/token) [vault](/topic/vault) [$lbtcthe](/topic/$lbtcthe) [bitcoin](/topic/bitcoin) [Post Link](https://x.com/_thespacebyte/status/1940749563180060805)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

spacebyte ⛓ @_thespacebyte on x 21.7K followers

Created: 2025-07-03 12:28:47 UTC

spacebyte ⛓ @_thespacebyte on x 21.7K followers

Created: 2025-07-03 12:28:47 UTC

The first half of 2025 marked a decisive turning point for Bitcoin in DeFi.

While $WBTC continued to dominate in name recognition, $LBTC—the non-custodial, yield-generating vault token from @Lombard_Finance—quietly became the cornerstone of a new financial layer: BTCfi. [🧵]

This H1 report explores how @Lombard_Finance has emerged as the leading BTCfi protocol by combining:

• Non-custodial minting architecture • Composable DeFi vault strategies • A multi-chain $LBTC standard • Babylon-powered staking rewards ($BABY)

𝘍𝘳𝘰𝘮 𝘷𝘢𝘶𝘭𝘵 𝘭𝘢𝘶𝘯𝘤𝘩𝘦𝘴 𝘵𝘰 𝘦𝘹𝘱𝘰𝘯𝘦𝘯𝘵𝘪𝘢𝘭 𝘨𝘳𝘰𝘸𝘵𝘩 𝘪𝘯 $LBTC 𝘩𝘰𝘭𝘥𝘦𝘳𝘴, 𝘏1 𝘸𝘢𝘴 𝘵𝘩𝘦 𝘱𝘩𝘢𝘴𝘦 𝘸𝘩𝘦𝘳𝘦 𝘉𝘪𝘵𝘤𝘰𝘪𝘯’𝘴 𝘪𝘥𝘭𝘦 𝘤𝘢𝘱𝘪𝘵𝘢𝘭 𝘧𝘰𝘶𝘯𝘥 𝘯𝘦𝘸 𝘱𝘶𝘳𝘱𝘰𝘴𝘦.

𝗣𝗿𝗼𝘁𝗼𝗰𝗼𝗹 𝗚𝗿𝗼𝘄𝘁𝗵 & 𝗔𝗱𝗼𝗽𝘁𝗶𝗼𝗻

Total Value Locked (TVL)

• Jan 1, 2025 (estimated): ~$1.2B

• June 30, 2025: ~$1.8B–$2.0B

• Q1 → Q2 growth: +20–30%

Vault-specific growth was driven by the Lombard DeFi Vault and Sentora Vault, with estimated TVLs of $500M–$700M and $300M–$500M respectively. Sonic and TAC Vaults showed smaller but steady adoption.

$LBTC 𝗦𝘂𝗽𝗽𝗹𝘆

• Start of H1: XXXXXX $LBTC

• End of H1: XXXXXX $LBTC

• April ATH: XXXXXX $LBTC

• Net Growth (Jan–Jun): +6.04%

𝗠𝘂𝗹𝘁𝗶-𝗖𝗵𝗮𝗶𝗻 𝗘𝘅𝗽𝗮𝗻𝘀𝗶𝗼𝗻

• Ethereum remains dominant with XXXXXX $LBTC (80%)

• Notable growth on:

- #Berachain: XXX $LBTC

- #Base: XXX $LBTC

- #Sonic: XXX $LBTC

- #Sui: XX $LBTC

𝗨𝘀𝗲𝗿 𝗠𝗲𝘁𝗿𝗶𝗰𝘀

• XXXXXX wallets minted $LBTC • XXXXXX current holders • Vault user base estimated at 30,000+ active users

𝗩𝗮𝘂𝗹𝘁 𝗠𝘂𝗹𝘁𝗶𝗽𝗹𝗶𝗲𝗿𝘀

• Lombard DeFi Vault: 4x Lombard Lux + 3x Veda + 1x Babylon

• Sentora & Concrete Vaults: 4–5x multipliers

𝗔𝘃𝗲𝗿𝗮𝗴𝗲 𝗔𝗣𝗬𝘀

• Lombard DeFi Vault: 12–15%

• Sentora: 6–8%

• Sonic & Concrete: 5–7%

𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝘆 𝗧𝘆𝗽𝗲𝘀

• Lending: Morpho Blue, Gearbox

• LPing: Curve, Uniswap, Pendle LPT

• Restaking: EigenLayer integration (April 2025)

𝗘𝗰𝗼𝘀𝘆𝘀𝘁𝗲𝗺 𝗚𝗿𝗼𝘄𝘁𝗵 & 𝗜𝗻𝘁𝗲𝗴𝗿𝗮𝘁𝗶𝗼𝗻𝘀

— Chain Deployments in H1

• Sonic, Berachain, Base, and Sui supported $LBTC vaults

• Ethereum retained deep liquidity and composability

— Top DeFi Integrations

• Lending: Aave, Morpho, Gearbox

• Yield: Pendle, EigenLayer, Veda

• LP/DEX: Uniswap, Curve

𝗖𝗼𝗺𝗽𝗲𝘁𝗶𝘁𝗶𝘃𝗲 𝗣𝗼𝘀𝗶𝘁𝗶𝗼𝗻𝗶𝗻𝗴

$LBTC vs $WBTC vs $SolvBTC vs $cbETH

• $LBTC: Non-custodial, multi-chain, yield-enabled

• $WBTC: Custodial, most liquid, but no native yield

• $SolvBTC: Babylon-native, less composable

• $cbETH: Ethereum-only, no $BTC exposure

𝗣𝗲𝗴 𝗦𝘁𝗮𝗯𝗶𝗹𝗶𝘁𝘆

• $LBTC traded near 0.996–1.01 BTC throughout H1

• Tight peg maintained due to on-chain vault redemptions and oracle design

𝗕𝗧𝗖𝗳𝗶 𝘃𝘀 𝗘𝗧𝗛𝗳𝗶

• Lido TVL remains dominant, but Lombard is growing faster in Bitcoin-native TVL

• LBTC introduces capital efficiency where $WBTC and $stETH do not intersect

𝗠𝗶𝗹𝗲𝘀𝘁𝗼𝗻𝗲𝘀

April: $LBTC surpasses 21K minted

May: Concrete & Sentora vaults oversubscribed

June: Sonic vault campaign closes with 300+ $LBTC TVL

𝗛𝟮 𝗢𝘂𝘁𝗹𝗼𝗼𝗸

Key Catalysts to Watch:

• Lombard token launch and governance shift

• Vault expansion to Starknet and Cosmos-based chains

• Pendle LPT integrations

• Babylon Phase X yield acceleration

𝗖𝗹𝗼𝘀𝗶𝗻𝗴 𝗧𝗵𝗼𝘂𝗴𝗵𝘁

H1 2025 confirmed a powerful thesis: $BTC capital doesn’t have to be idle.

@Lombard_Finance didn’t just create a new wrapper—it built a vault-powered BTCfi economy. With non-custodial security, staking yield, and composability across chains, $LBTC is positioned to become the real stable $BTC of DeFi.

XXXXXX engagements

Related Topics wbtc protocol lombardfinance coins btcfi token vault $lbtcthe bitcoin