[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Kaff 📊 [@Kaffchad](/creator/twitter/Kaffchad) on x 25K followers Created: 2025-07-02 09:32:04 UTC No doubt #InfoFi is booming and #Kaito is leading the charge. But behind the hype, what’s really going on? As we can see some of projects got listed on the Kaito Leaderboard and then saw heavy post-TGE dumps. ▫️ $LOUD: $13M → $450K ▫️ $Sophon: $240M → $65M ▫️ $BOOP: $100M → $9M So the question is: does Kaito actually curate what gets on the board or is it just pay-to-play? I believe Kaito does curate carefully. From what I’ve seen, most projects listed share common traits: – Fully doxxed teams – Live products with real usage – Unique product ideas or strong innovation – Reputable backers and decent funding Still, once a project hits TGE, everything changes. Kaito can’t guarantee price action, noone can do it. Even Binance listings often follow the same pattern: initial hype, then sell-offs. But let’s be real, #InfoFi is not about guaranteed profits or chart pumping. It’s about open access to high-signal data, good or bad, rewarding attention, not shilling. To get listed on the Kaito Leaderboard, a project typically needs: $150K kaito fee + Kaito Pro subscription + Reward pool for yappers = ~$300K at least I think This fee can be used for buyback $Kaito and/or add additional rewards for their yappers. As the result, kaito has achieved – 200K+ monthly active yappers – $106M+ in value distributed – $33M+ in protocol revenue from 700+ number of team running on Kaito. → So, Yappers and projects are all wins.  XXXXXX engagements  **Related Topics** [100m](/topic/100m) [$9m](/topic/$9m) [$100m](/topic/$100m) [$65m](/topic/$65m) [$240m](/topic/$240m) [$sophon](/topic/$sophon) [$450k](/topic/$450k) [$13m](/topic/$13m) [Post Link](https://x.com/Kaffchad/status/1940342699644871058)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Kaff 📊 @Kaffchad on x 25K followers

Created: 2025-07-02 09:32:04 UTC

Kaff 📊 @Kaffchad on x 25K followers

Created: 2025-07-02 09:32:04 UTC

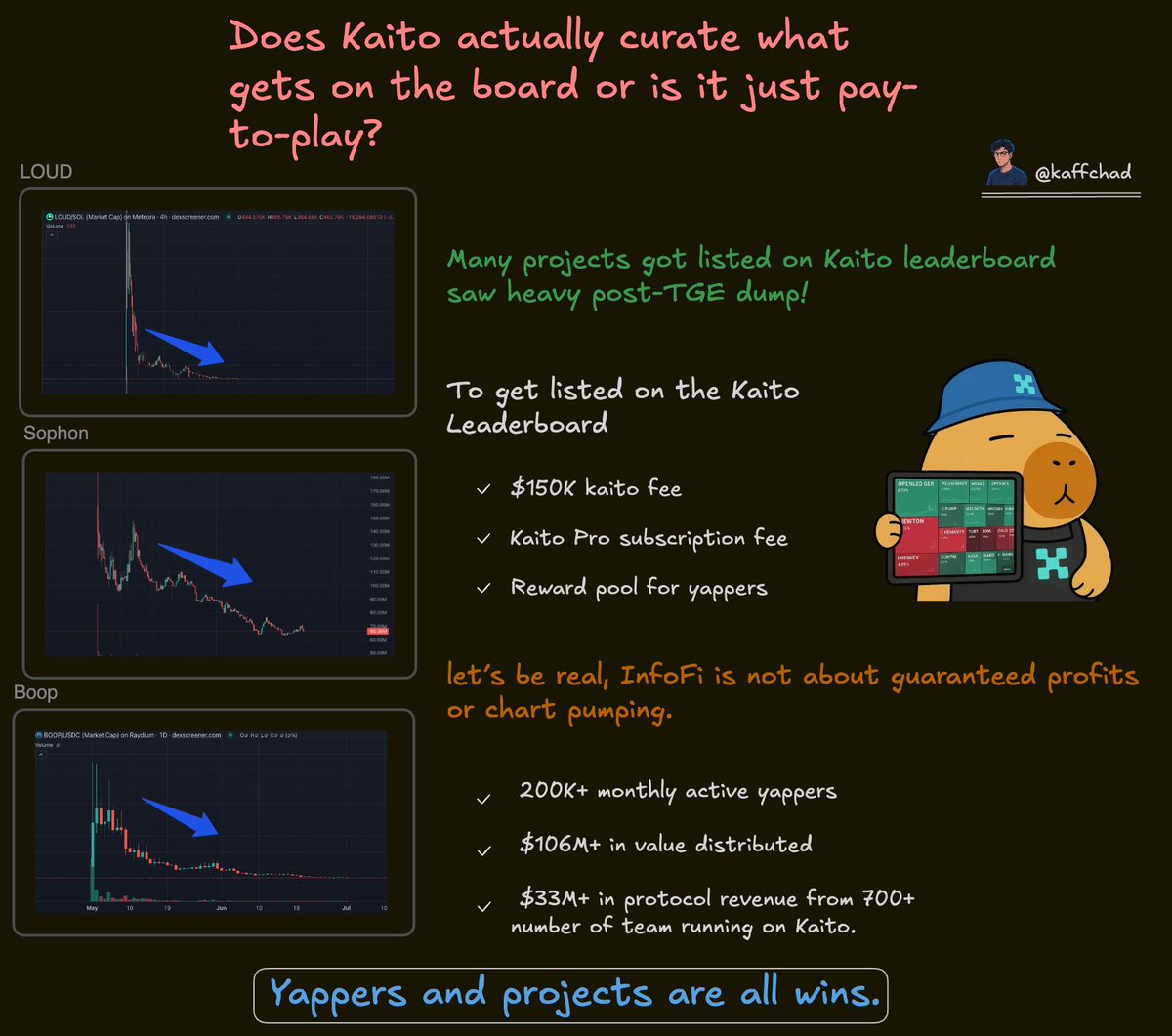

No doubt #InfoFi is booming and #Kaito is leading the charge. But behind the hype, what’s really going on?

As we can see some of projects got listed on the Kaito Leaderboard and then saw heavy post-TGE dumps.

▫️ $LOUD: $13M → $450K ▫️ $Sophon: $240M → $65M ▫️ $BOOP: $100M → $9M

So the question is: does Kaito actually curate what gets on the board or is it just pay-to-play?

I believe Kaito does curate carefully. From what I’ve seen, most projects listed share common traits:

– Fully doxxed teams

– Live products with real usage

– Unique product ideas or strong innovation

– Reputable backers and decent funding

Still, once a project hits TGE, everything changes. Kaito can’t guarantee price action, noone can do it. Even Binance listings often follow the same pattern: initial hype, then sell-offs.

But let’s be real, #InfoFi is not about guaranteed profits or chart pumping.

It’s about open access to high-signal data, good or bad, rewarding attention, not shilling.

To get listed on the Kaito Leaderboard, a project typically needs:

$150K kaito fee + Kaito Pro subscription + Reward pool for yappers = ~$300K at least I think

This fee can be used for buyback $Kaito and/or add additional rewards for their yappers.

As the result, kaito has achieved

– 200K+ monthly active yappers

– $106M+ in value distributed

– $33M+ in protocol revenue from 700+ number of team running on Kaito.

→ So, Yappers and projects are all wins.

XXXXXX engagements