[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  The Smart Ape 🔥 [@the_smart_ape](/creator/twitter/the_smart_ape) on x 56.5K followers Created: 2025-07-01 11:01:42 UTC Sometimes, all you need is a bit of common sense, some quick math, and @pendle_fi. YT farming can help you secure 2x or even 3x, with pretty solid confidence. @aegis_im distributes XXX% of its total supply every week to sYUSD DeFi users, and as always, Pendle is the best way to maximize this. Let’s do the maths: Each YT $sYUSD earns you XX points per day, out of a total XXX million points distributed daily. $X worth of YT sYUSD gives you about XX YT, which equals roughly XXXXX points daily until maturity on September 4, 2025 (64 days left). Put simply, every $X of YT held from now until maturity earns you about XXXXXXXXX% of the total supply. Alright, but what does that actually mean in value? That’s the tricky part, and the piece I’m least certain about. But here’s what we know: Aegis raised $2M in a pre-seed round at a $50M FDV. It’s very rare for a project’s FDV to drop below the valuation at which VCs bought, and since their tokens are locked, they can’t dump immediately post-launch. So, I’d say $50M FDV is a reasonable floor. At that FDV, the total airdrop would be worth about $XXXX for every $X of YT, which is nearly a 4x in just a few weeks, using a conservative estimate. Personally, I think a post-launch FDV of $75M is more likely, which would push this closer to a 6x by farming YT. The math can be a bit dense, but YT points farming is really compelling, even if it’s not for everyone. Key risks to understand: The FDV can’t be predicted with absolute certainty, you can estimate it based on fundraising rounds, but the final number depends on the market and tokenomics. Points are distributed per protocol based on TVL. The higher the TVL, the more points are handed out, so your share gets diluted if more capital flows in. Once you grasp the math and the risks, that’s when you can really have fun with it!  XXXXX engagements  **Related Topics** [$syusd](/topic/$syusd) [pendlefi](/topic/pendlefi) [Post Link](https://x.com/the_smart_ape/status/1940002872546005286)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

The Smart Ape 🔥 @the_smart_ape on x 56.5K followers

Created: 2025-07-01 11:01:42 UTC

The Smart Ape 🔥 @the_smart_ape on x 56.5K followers

Created: 2025-07-01 11:01:42 UTC

Sometimes, all you need is a bit of common sense, some quick math, and @pendle_fi.

YT farming can help you secure 2x or even 3x, with pretty solid confidence.

@aegis_im distributes XXX% of its total supply every week to sYUSD DeFi users, and as always, Pendle is the best way to maximize this.

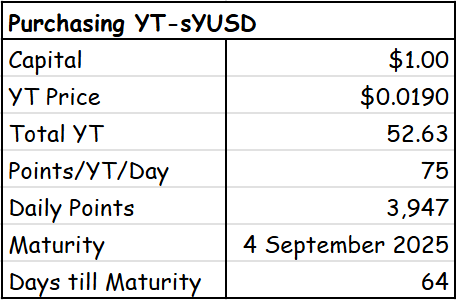

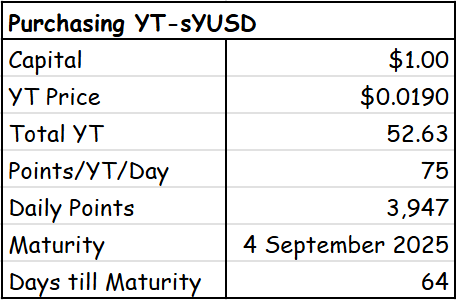

Let’s do the maths:

Each YT $sYUSD earns you XX points per day, out of a total XXX million points distributed daily.

$X worth of YT sYUSD gives you about XX YT, which equals roughly XXXXX points daily until maturity on September 4, 2025 (64 days left). Put simply, every $X of YT held from now until maturity earns you about XXXXXXXXX% of the total supply. Alright, but what does that actually mean in value?

That’s the tricky part, and the piece I’m least certain about. But here’s what we know: Aegis raised $2M in a pre-seed round at a $50M FDV.

It’s very rare for a project’s FDV to drop below the valuation at which VCs bought, and since their tokens are locked, they can’t dump immediately post-launch.

So, I’d say $50M FDV is a reasonable floor. At that FDV, the total airdrop would be worth about $XXXX for every $X of YT, which is nearly a 4x in just a few weeks, using a conservative estimate. Personally, I think a post-launch FDV of $75M is more likely, which would push this closer to a 6x by farming YT.

The math can be a bit dense, but YT points farming is really compelling, even if it’s not for everyone.

Key risks to understand:

The FDV can’t be predicted with absolute certainty, you can estimate it based on fundraising rounds, but the final number depends on the market and tokenomics.

Points are distributed per protocol based on TVL. The higher the TVL, the more points are handed out, so your share gets diluted if more capital flows in. Once you grasp the math and the risks, that’s when you can really have fun with it!

XXXXX engagements