[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Say No To Trading [@SayNoToTrading](/creator/twitter/SayNoToTrading) on x 6338 followers Created: 2025-07-01 05:20:30 UTC I have every right to be critical of $ASTS because I wrote the very first article for it on Seeking Alpha with a "Strong Buy" rating over X years ago titled: AST SpaceMobile: 20-100x Return Or XXX% Loss, It's A Binary Bet If you bought then or anytime after, worst case is you're up XXX% and best case you are up, yes, over 20x. This was a ~2,500 word deep dive not just into the company itself, but especially the science. I really drilled home that their phased-array approach, although extremely difficult, was XXX% possible per the science. Here's an excerpt: I also walked readers through the graveyard of space-based phone service attempts and the fact that 20+ years prior (now 25+) I had invested in Globalstar $GSAT. Back then, ticker was $GSTRF and I think I was in 6th grade. I bought the very first day the $ASTS deal was announced on December 17, 2020. So I'm a true day-1 AST SpaceMobile investor. I had invested over 6-figures in the common stock and warrants when share price was in single digits. Many people told me they 10x'd or more their investment due to my article (my return was not that good). But I don't own now and rather than write another essay as to why, I will just summarize it: They continuously over-promise and under-deliver. Those new to the name, say in the past couple years, may not get this. Yes, I get they launched X Block X BlueBird satellites, which successfully unfolded last year. I also get that Block X BlueBird satellites, 3x larger with 10x capacity are scheduled for launch I believe this month. A potential catalyst to propel the stock another leg up. Fact is, business has greatly been de-risked. Thing is, when stock hit $X last year, it was already moderately de-risked, too. The biggest factor today? Extreme sentiment. I'm talking retail fervor (and don't rebuttal me with Palmer Luckey not being retail, I know). I can't say I will never buy back into $ASTS but as it stands now, I'm a big believer in history being the best predictor of the future. Specifically, unlike Abel Avellan, Rocket Lab's $RKLB Peter Beck is more on the opposite side; under promising and overdelivering. This is why I am comfortable ONLY investing in Rocket Lab among the publicly traded space stocks. I've made money on $ASTS and am just not comfortable with the risk/reward as it stands today. That's not to say share price can't go to $70, $100, $150, or higher. When retail piles on, there's no telling where a stock goes. But what I know is, between $RKLB and $ASTS, there's only one company I'm comfortable permanently holding if retail fervor were to disappear. Lastly, for your amusement, their financial projections from December 2020 attached.  XXXXXX engagements  **Related Topics** [$asts](/topic/$asts) [Post Link](https://x.com/SayNoToTrading/status/1939917006440182260)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Say No To Trading @SayNoToTrading on x 6338 followers

Created: 2025-07-01 05:20:30 UTC

Say No To Trading @SayNoToTrading on x 6338 followers

Created: 2025-07-01 05:20:30 UTC

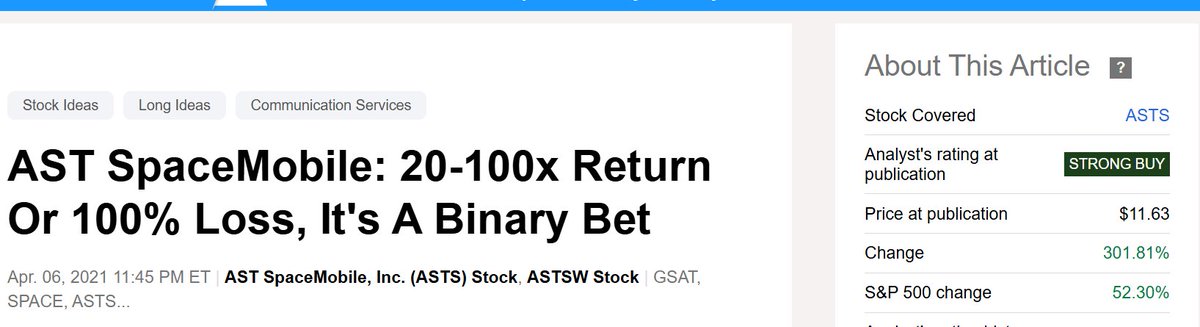

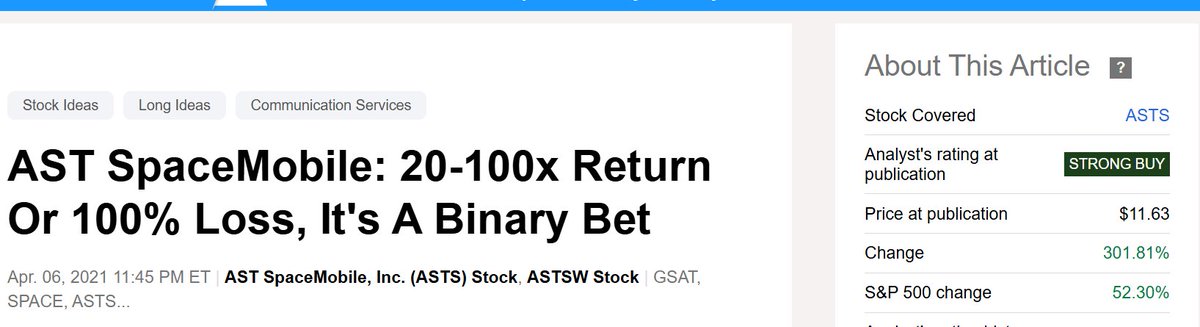

I have every right to be critical of $ASTS because I wrote the very first article for it on Seeking Alpha with a "Strong Buy" rating over X years ago titled:

AST SpaceMobile: 20-100x Return Or XXX% Loss, It's A Binary Bet

If you bought then or anytime after, worst case is you're up XXX% and best case you are up, yes, over 20x.

This was a ~2,500 word deep dive not just into the company itself, but especially the science.

I really drilled home that their phased-array approach, although extremely difficult, was XXX% possible per the science. Here's an excerpt:

I also walked readers through the graveyard of space-based phone service attempts and the fact that 20+ years prior (now 25+) I had invested in Globalstar $GSAT. Back then, ticker was $GSTRF and I think I was in 6th grade.

I bought the very first day the $ASTS deal was announced on December 17, 2020. So I'm a true day-1 AST SpaceMobile investor. I had invested over 6-figures in the common stock and warrants when share price was in single digits.

Many people told me they 10x'd or more their investment due to my article (my return was not that good).

But I don't own now and rather than write another essay as to why, I will just summarize it:

They continuously over-promise and under-deliver.

Those new to the name, say in the past couple years, may not get this.

Yes, I get they launched X Block X BlueBird satellites, which successfully unfolded last year.

I also get that Block X BlueBird satellites, 3x larger with 10x capacity are scheduled for launch I believe this month. A potential catalyst to propel the stock another leg up.

Fact is, business has greatly been de-risked.

Thing is, when stock hit $X last year, it was already moderately de-risked, too.

The biggest factor today? Extreme sentiment. I'm talking retail fervor (and don't rebuttal me with Palmer Luckey not being retail, I know).

I can't say I will never buy back into $ASTS but as it stands now, I'm a big believer in history being the best predictor of the future.

Specifically, unlike Abel Avellan, Rocket Lab's $RKLB Peter Beck is more on the opposite side; under promising and overdelivering.

This is why I am comfortable ONLY investing in Rocket Lab among the publicly traded space stocks. I've made money on $ASTS and am just not comfortable with the risk/reward as it stands today.

That's not to say share price can't go to $70, $100, $150, or higher. When retail piles on, there's no telling where a stock goes.

But what I know is, between $RKLB and $ASTS, there's only one company I'm comfortable permanently holding if retail fervor were to disappear.

Lastly, for your amusement, their financial projections from December 2020 attached.

XXXXXX engagements

Related Topics $asts