[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  SMC Global [@smcglobal](/creator/twitter/smcglobal) on x 21.6K followers Created: 2025-06-30 12:41:06 UTC How healthy are India’s Small Finance Banks? Here’s a snapshot of Gross Non-Performing Assets (GNPA) ratios as of Q4 FY25: [1] Ujjivan Small Finance Bank: XXXX% [2] AU SMALL FINANCE BANK: XXXX% [3] Jana Small FB: XXXX% [4] Equitas Small Finance Bank: XXXX% [5] Utkarsh Small Finance Bank: XXXX% Lower GNPA reflects stronger asset quality and better credit risk management. Notably, Utkarsh stands out with a significantly higher GNPA, warranting close monitoring. Disclaimer: For informational purposes only. Not investment advice.  XXXXX engagements  **Related Topics** [asset allocation](/topic/asset-allocation) [credit default swaps](/topic/credit-default-swaps) [finance](/topic/finance) [$aubankbo](/topic/$aubankbo) [Post Link](https://x.com/smcglobal/status/1939665499098640412)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

SMC Global @smcglobal on x 21.6K followers

Created: 2025-06-30 12:41:06 UTC

SMC Global @smcglobal on x 21.6K followers

Created: 2025-06-30 12:41:06 UTC

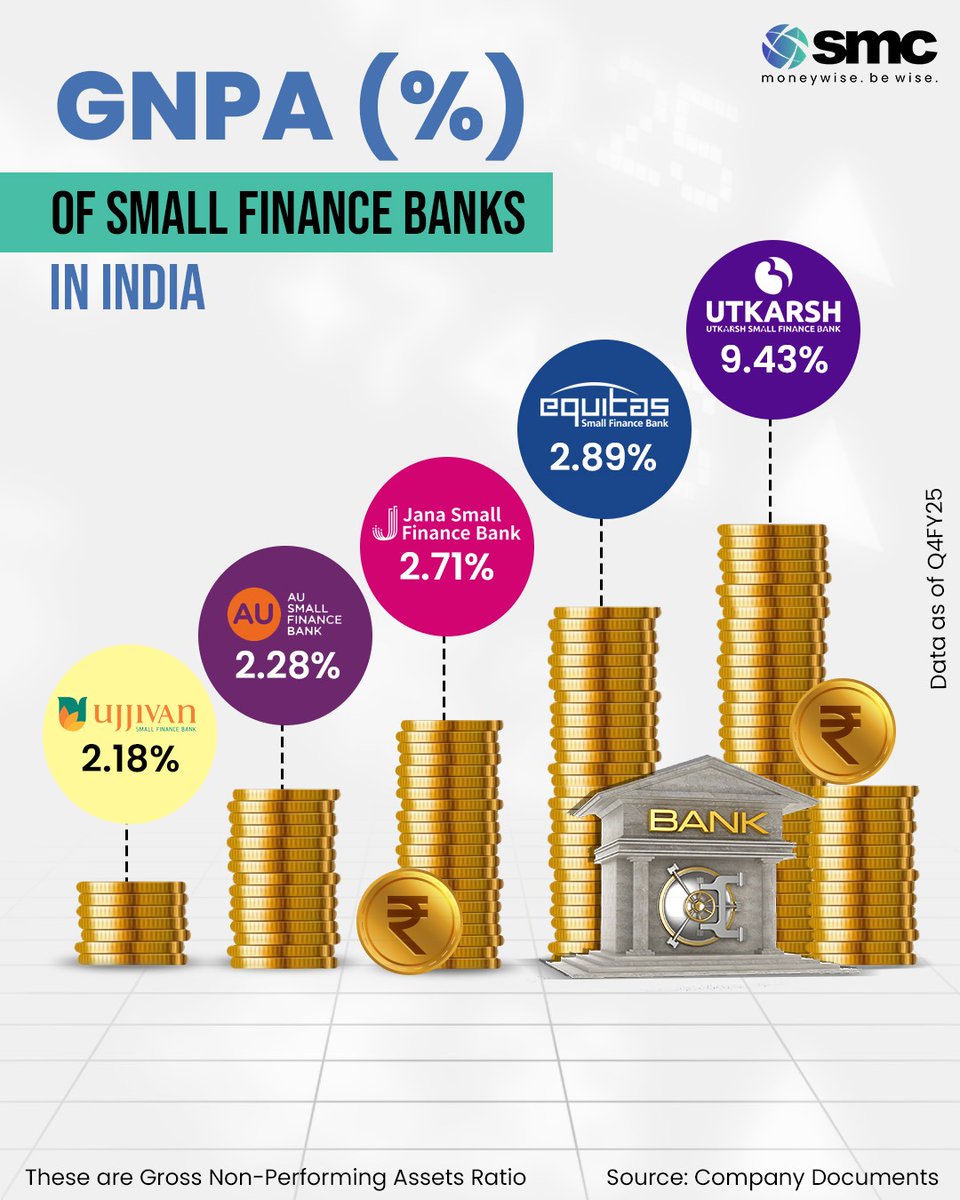

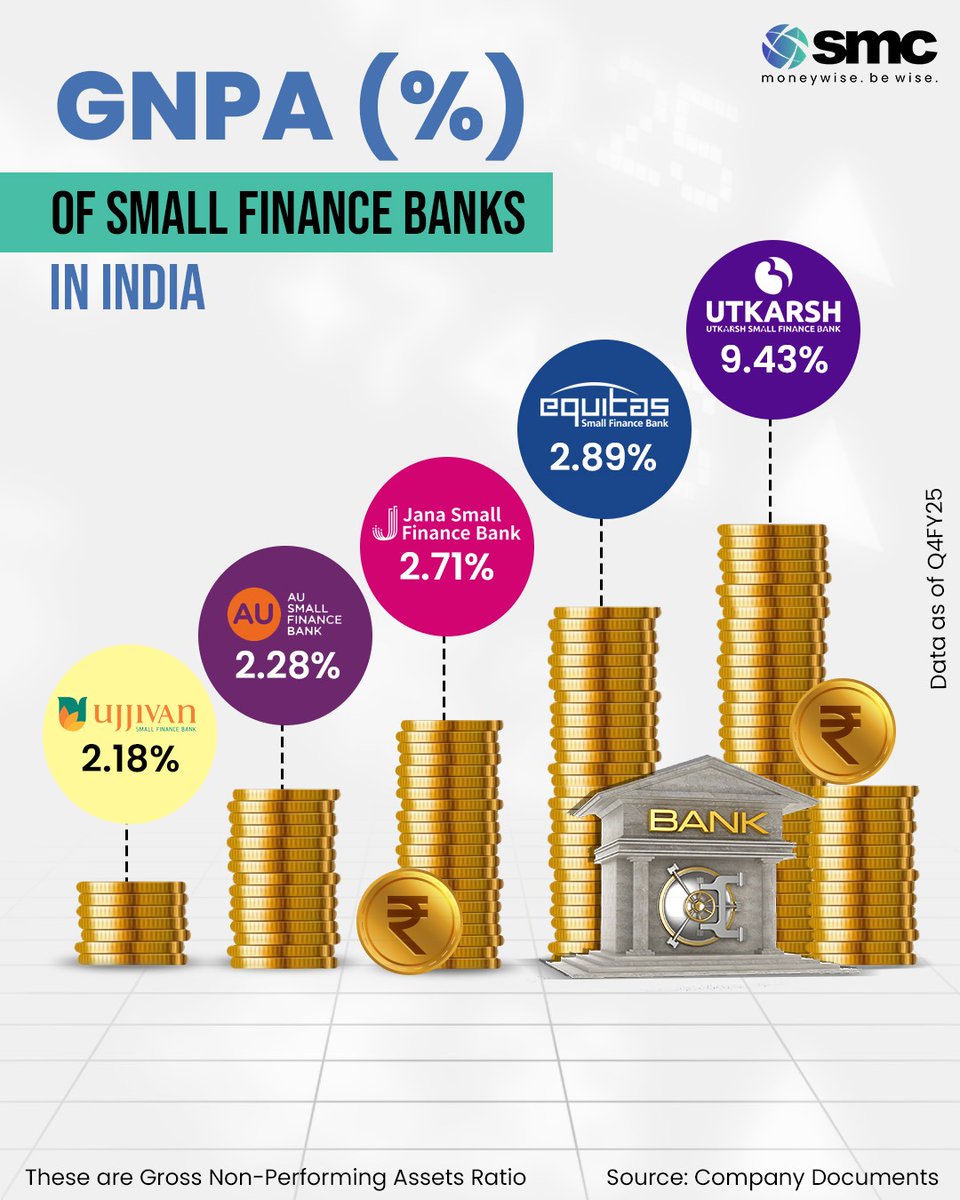

How healthy are India’s Small Finance Banks?

Here’s a snapshot of Gross Non-Performing Assets (GNPA) ratios as of Q4 FY25:

[1] Ujjivan Small Finance Bank: XXXX% [2] AU SMALL FINANCE BANK: XXXX% [3] Jana Small FB: XXXX% [4] Equitas Small Finance Bank: XXXX% [5] Utkarsh Small Finance Bank: XXXX%

Lower GNPA reflects stronger asset quality and better credit risk management. Notably, Utkarsh stands out with a significantly higher GNPA, warranting close monitoring.

Disclaimer: For informational purposes only. Not investment advice.

XXXXX engagements

Related Topics asset allocation credit default swaps finance $aubankbo