[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Afonso [@0xafonso](/creator/twitter/0xafonso) on x 2785 followers Created: 2025-06-29 13:27:19 UTC 🚀🔥 Abel Finance on Aptos: Supply & Borrow Dynamics Unveiled 🔥🚀 Ready to see how DeFi power-users and retail alike are moving millions on Aptos? Let’s break down the 🔑 stats! 💰 Supply vs. Withdraw Balance • Total Supply: XXX K txns by XX K users, $XXXX M (avg. $379) • Total Withdraw: XXXXX K txns by XXXX K users, $XXXX M (avg. $405) Users are cashing out slightly more per txn—profit-taking or yield rotations in action! 💸 📈 Monthly Volume Waves 🎄 Dec ’23 Peak: Both Supply & Withdraw hit ~6 K txns (∼$9.5 M)—holiday hustle! 🌸 Mar–Apr ’24 Crescendo: Supply ~8.2 K / $XXXX M & Withdraw ~7.9 K / $XXXX M—DeFi fever! 🛑 Jun ’25 Cool‑Down: Under X K txns & just a few thousand $—consolidation mode! 🧊 🔢 Txn Size Spectrum • Micro (<$10): ~59 K supply vs. XX K withdraw—mass participation! 🙌 • Sweet Spot ($100–$500): ~37 K / XXXX K—core liquidity zone. 💹 • Whale Moves (>$100 K): XXX K supply vs. XXX K withdraw—big bets stay bullish! 🐳 🪙 Top Assets Supplied & Borrowed • Supply: APT (104.9 K txns, $XXX M), USDT (21.1 K, $XX M), USDC (2.6 K, $XXXX M) • Borrow: USDT (4 K, $X M), APT (4.1 K, $X M), USDC (2.5 K, $XXXX M) Stablecoins for leverage + APT for yield = DeFi mainstays! 🔄 🏦 Borrow vs. Repay Discipline • Borrow: XXXX K txns, $XXXX M (avg. $934) • Repay: XXXX K txns, $XXXXX M (avg. $X 111) Users repay bigger—strong risk management on-chain! ✅ 🌟 Conclusion: From micro‑stakes to whale‑plays, Abel Finance (@abelfinance) on @Aptos blends broad participation with serious leverage strategies. After peaks in late ’23 and spring ’24, the platform’s now in a healthy consolidation—poised for the next DeFi chapter! 📖  XXX engagements  **Related Topics** [$529m](/topic/$529m) [avg](/topic/avg) [$522m](/topic/$522m) [finance](/topic/finance) [Post Link](https://x.com/0xafonso/status/1939314740179656806)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Afonso @0xafonso on x 2785 followers

Created: 2025-06-29 13:27:19 UTC

Afonso @0xafonso on x 2785 followers

Created: 2025-06-29 13:27:19 UTC

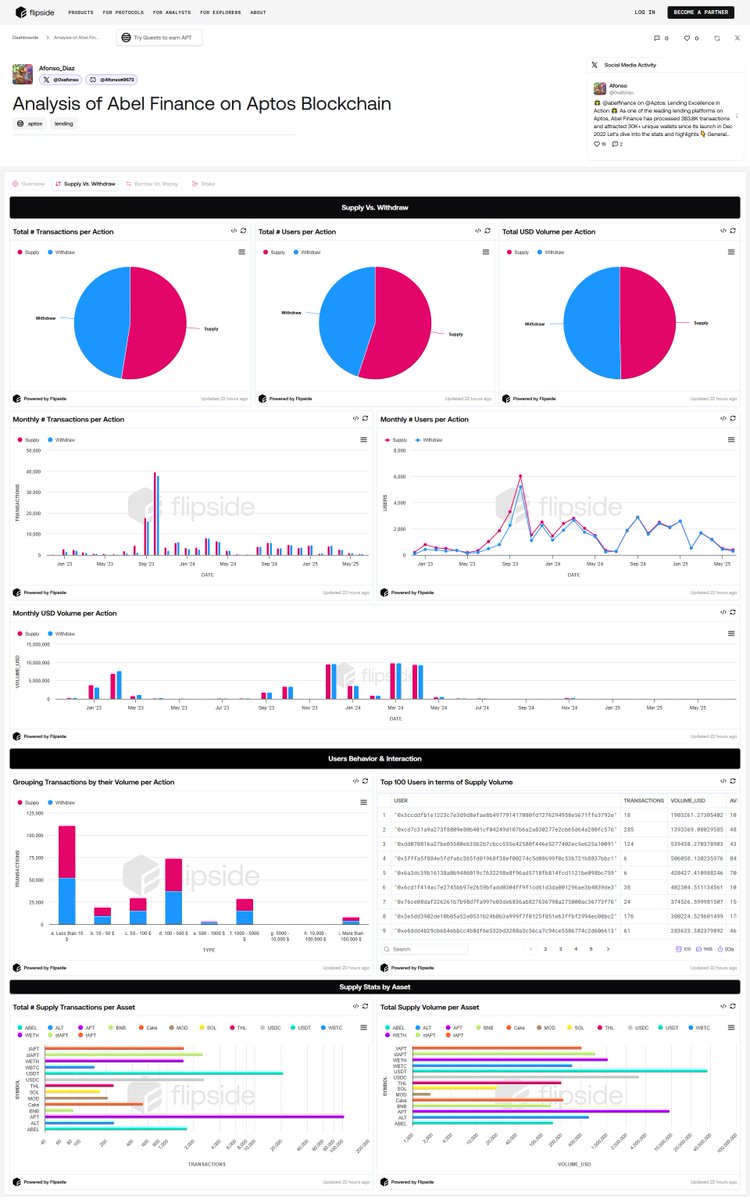

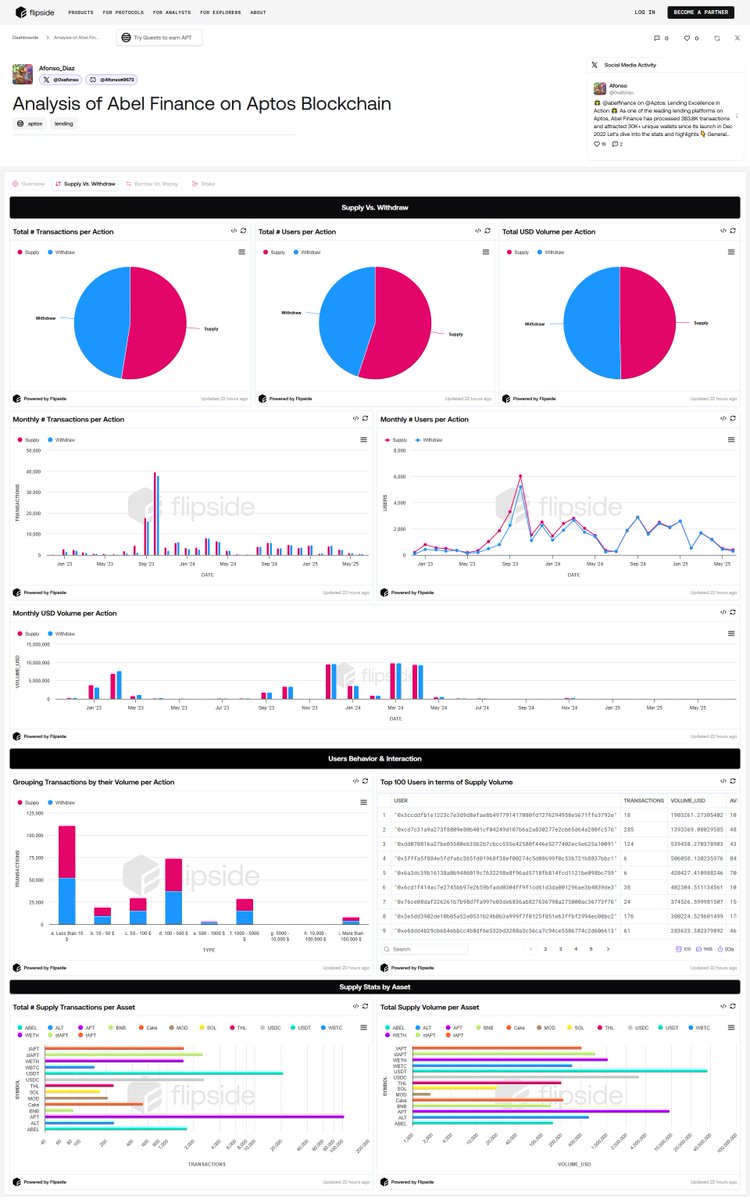

🚀🔥 Abel Finance on Aptos: Supply & Borrow Dynamics Unveiled 🔥🚀

Ready to see how DeFi power-users and retail alike are moving millions on Aptos? Let’s break down the 🔑 stats!

💰 Supply vs. Withdraw Balance

• Total Supply: XXX K txns by XX K users, $XXXX M (avg. $379) • Total Withdraw: XXXXX K txns by XXXX K users, $XXXX M (avg. $405) Users are cashing out slightly more per txn—profit-taking or yield rotations in action! 💸

📈 Monthly Volume Waves

🎄 Dec ’23 Peak: Both Supply & Withdraw hit ~6 K txns (∼$9.5 M)—holiday hustle! 🌸 Mar–Apr ’24 Crescendo: Supply ~8.2 K / $XXXX M & Withdraw ~7.9 K / $XXXX M—DeFi fever! 🛑 Jun ’25 Cool‑Down: Under X K txns & just a few thousand $—consolidation mode! 🧊

🔢 Txn Size Spectrum

• Micro (<$10): ~59 K supply vs. XX K withdraw—mass participation! 🙌 • Sweet Spot ($100–$500): ~37 K / XXXX K—core liquidity zone. 💹 • Whale Moves (>$100 K): XXX K supply vs. XXX K withdraw—big bets stay bullish! 🐳

🪙 Top Assets Supplied & Borrowed

• Supply: APT (104.9 K txns, $XXX M), USDT (21.1 K, $XX M), USDC (2.6 K, $XXXX M) • Borrow: USDT (4 K, $X M), APT (4.1 K, $X M), USDC (2.5 K, $XXXX M) Stablecoins for leverage + APT for yield = DeFi mainstays! 🔄

🏦 Borrow vs. Repay Discipline

• Borrow: XXXX K txns, $XXXX M (avg. $934) • Repay: XXXX K txns, $XXXXX M (avg. $X 111) Users repay bigger—strong risk management on-chain! ✅

🌟 Conclusion:

From micro‑stakes to whale‑plays, Abel Finance (@abelfinance) on @Aptos blends broad participation with serious leverage strategies. After peaks in late ’23 and spring ’24, the platform’s now in a healthy consolidation—poised for the next DeFi chapter! 📖

XXX engagements