[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Say No To Trading [@SayNoToTrading](/creator/twitter/SayNoToTrading) on x 6338 followers Created: 2025-06-29 10:52:35 UTC Did you get enough chip fab equip stocks during April lows? If you didn’t get enough $KLAC, $LRCX, $ASML, $TER, $ENTG etc. I have one potential idea to share. Of the XX names in my chips account, only X is red and that is Onto Innovation $ONTO. Normally I would say average up on long term winners when they take a dip. Don’t chase a loser. Maybe that holds true here and I should stop what I’m about to say, but I’ll say it anyway. Because long term, this stock is a winner. $ONTO is similar to $KLAC albeit much smaller. Both provide process control tools like inspection and metrology for semiconductor manufacturing. While they are competitors, you could argue they are complementary too. Onto has some niches in metrology, lithography, and advanced packaging. It has been, especially before decline, one of the best performers in sector. For first time in years, valuation is not insane. You can see in my buying history how current price is actually below April lows. I plan on keeping my XXX lowest cost $ONTO shares, paired with my XXX $KLAC.  XXXXXX engagements  **Related Topics** [ter](/topic/ter) [asml](/topic/asml) [dip](/topic/dip) [$ter](/topic/$ter) [$asml](/topic/$asml) [$klac](/topic/$klac) [stocks](/topic/stocks) [fab](/topic/fab) [Post Link](https://x.com/SayNoToTrading/status/1939275802052579660)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Say No To Trading @SayNoToTrading on x 6338 followers

Created: 2025-06-29 10:52:35 UTC

Say No To Trading @SayNoToTrading on x 6338 followers

Created: 2025-06-29 10:52:35 UTC

Did you get enough chip fab equip stocks during April lows?

If you didn’t get enough $KLAC, $LRCX, $ASML, $TER, $ENTG etc. I have one potential idea to share.

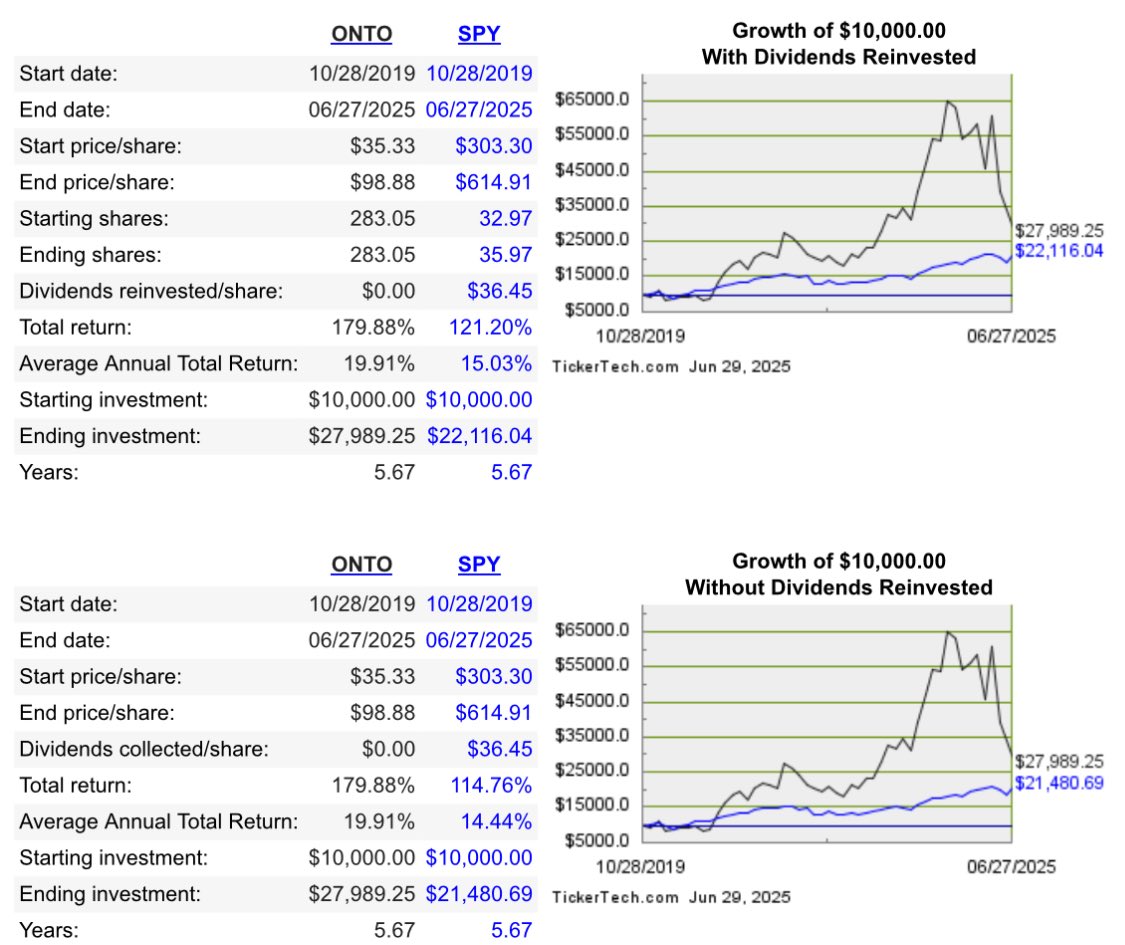

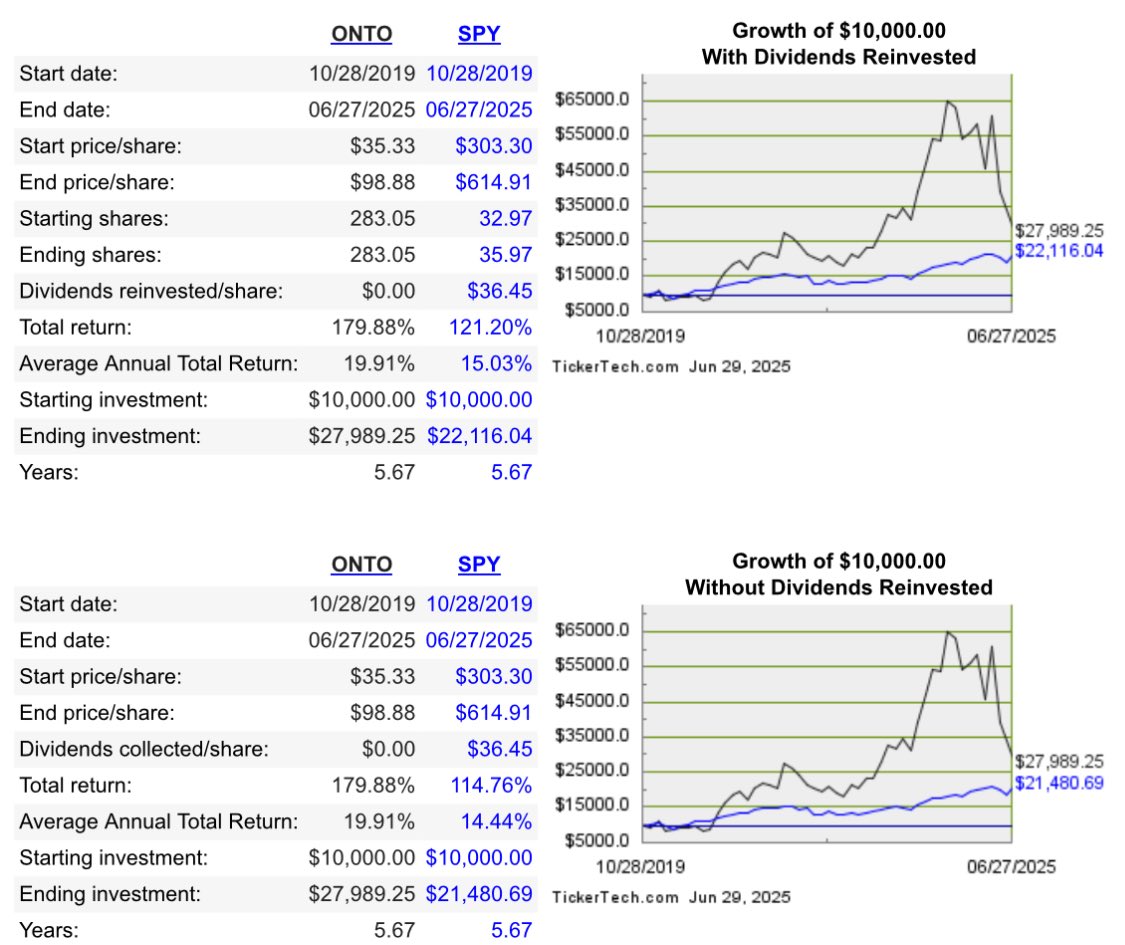

Of the XX names in my chips account, only X is red and that is Onto Innovation $ONTO.

Normally I would say average up on long term winners when they take a dip. Don’t chase a loser.

Maybe that holds true here and I should stop what I’m about to say, but I’ll say it anyway. Because long term, this stock is a winner.

$ONTO is similar to $KLAC albeit much smaller.

Both provide process control tools like inspection and metrology for semiconductor manufacturing.

While they are competitors, you could argue they are complementary too.

Onto has some niches in metrology, lithography, and advanced packaging.

It has been, especially before decline, one of the best performers in sector.

For first time in years, valuation is not insane.

You can see in my buying history how current price is actually below April lows.

I plan on keeping my XXX lowest cost $ONTO shares, paired with my XXX $KLAC.

XXXXXX engagements