[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Keith Kaplan [@KeithTradeSmith](/creator/twitter/KeithTradeSmith) on x 1327 followers Created: 2025-06-28 14:44:00 UTC MARKET UPDATE: Jason Bodner sends out a private note weekly. This is a summary of the one he just sent yesterday. Many stocks listed below and guess what, it's bullish! $PAYC, $SPOT, $MSFT, $BSY, $NVDA, $AVGO, $MTSI, $CRDO, and $KLAC below ... ~~~~~~~ Since April’s lows, the S&P XXX (SPY) has surged 24%, a relentless bull run. But one key indicator, the Big Money Index (BMI), hints at a potential pause. The BMI tracks money flows: up means cash floods equities, down means it’s fleeing. Its simplicity is its power, but nuances matter. I’ve long said it’s not about the BMI hitting overbought (above 80%)—it’s about when it falls from that peak. Even then, context is everything. Recently, the BMI shot up like a phoenix, hitting overbought before turning south. That might spark worry, but the data tells a different tale. This is likely a pause that refreshes. Post-COVID, the BMI stayed overbought for nearly four months. Right now, stock and ETF inflows are overwhelmingly green, with barely any red. The BMI, a 25-day moving average of flows, is dipping because inflows have intensified while outflows fade. Math backs this up: since May 12, when Trump announced a tariff stay, daily inflows averaged XXXX% of flows. If trends hold, the BMI should climb from XXXX% to XX% by July 1, diving deeper into overbought territory. What’s fueling this? Rising volumes and unusual activity. Markets are climbing on increasing inflows, with no signs of stopping. The money’s pouring into small and mid-cap stocks—84% of inflow signals since May XX target companies under $XX billion. Smaller firms drive growth; behemoths like NVIDIA $NVDA (up $600B since May 12) are outliers. #Growth sectors are dominating: #Tech, #Discretionary, and #Communications are soaring, while defensive #Utilities and #Staples lag. Tech’s rise from 10th to #1 since April X is staggering. This rally is broad and fierce. #Tech, #Industrials, #Financials, #Materials, #Discretionary, and even #Healthcare see massive inflows. #Staples bleed outflows, and #Utilities’ inflows have dried up. Tech alone accounts for XX% of all inflows since May 12, with XX% of that in Software and XX% in Semiconductors. Half of tech’s cash is fueling these subsectors—pure rocket fuel for growth. Drilling deeper, the top stocks tell the story. In Software: Paycom $PAYC ($264.80, XXXX Score), Spotify $SPOT ($775.90, 82.8), Microsoft $MSFT ($497.45, 81.0), Bentley Systems $BSY ($52.55, 81.0), and Meta $META ($726.09, 79.3). In #Semiconductors: NVIDIA $NVDA ($154.31, 84.5), Broadcom $AVGO ($270.17, 82.8), Macom $MTSI ($136.99, 77.6), Credo $CRDO ($91.92, 77.6), and KLA $KLAC ($893.00, 75.9). These names are where capital is piling in, driving markets higher. This is the beauty of following money flows. Inflows push markets up, growth sectors collect capital, tech leads with Software and Semis at the helm, and the best stocks soak up the cash. It’s that simple. I ignore the news—let the data speak. As Marcus Aurelius said: “Objective judgment, now. Unselfish action, now. Willing acceptance—now—of all external events. That’s all you need.” The bull is charging, led by tech’s fire. Small caps, growth sectors, and high-quality stocks are the engine. Don’t fear the BMI’s dip—expect it to rise. The data says this rally has legs. Where are you putting your money? #StockMarket #Investing #MoneyFlows #TechRally @MoneyFlows_com @lukedowney  XXX engagements  **Related Topics** [avgo](/topic/avgo) [nvda](/topic/nvda) [msft](/topic/msft) [money](/topic/money) [spy](/topic/spy) [rating agency](/topic/rating-agency) [$klac](/topic/$klac) [$msft](/topic/$msft) [Post Link](https://x.com/KeithTradeSmith/status/1938971651217265083)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Keith Kaplan @KeithTradeSmith on x 1327 followers

Created: 2025-06-28 14:44:00 UTC

Keith Kaplan @KeithTradeSmith on x 1327 followers

Created: 2025-06-28 14:44:00 UTC

MARKET UPDATE: Jason Bodner sends out a private note weekly. This is a summary of the one he just sent yesterday.

Many stocks listed below and guess what, it's bullish!

$PAYC, $SPOT, $MSFT, $BSY, $NVDA, $AVGO, $MTSI, $CRDO, and $KLAC below ...

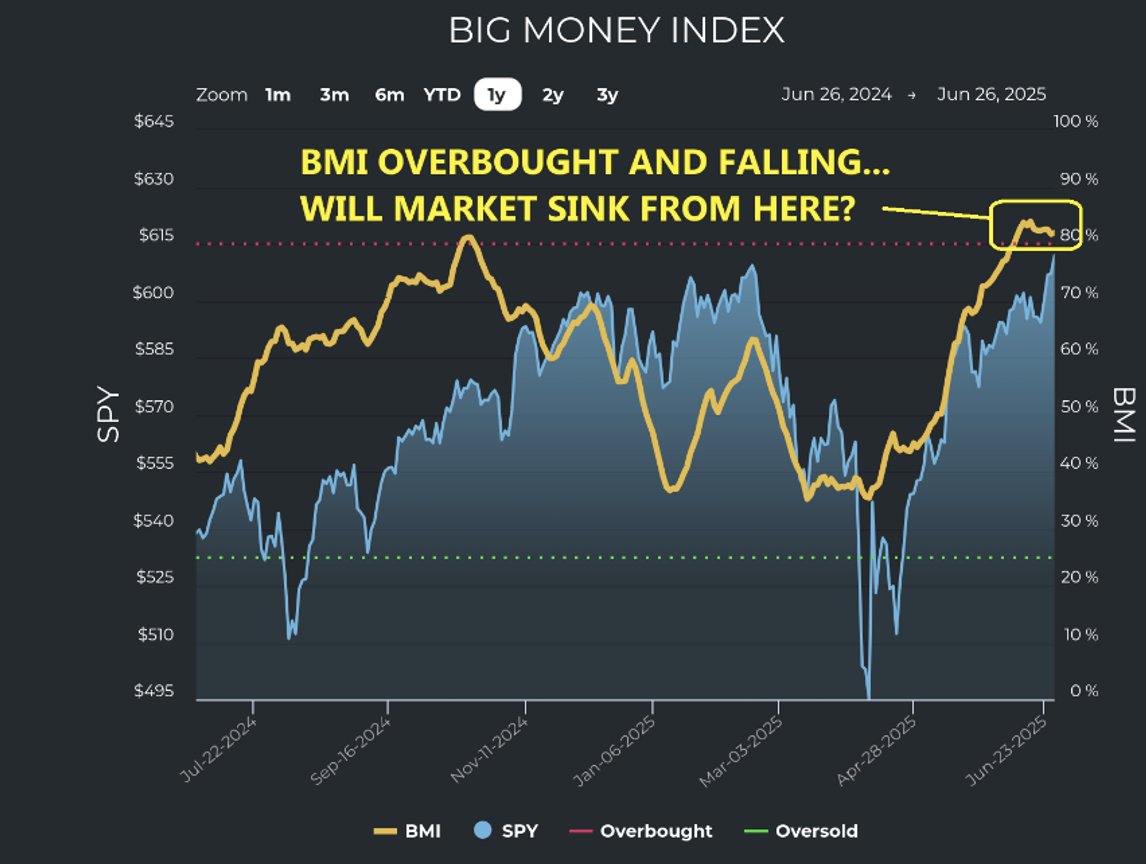

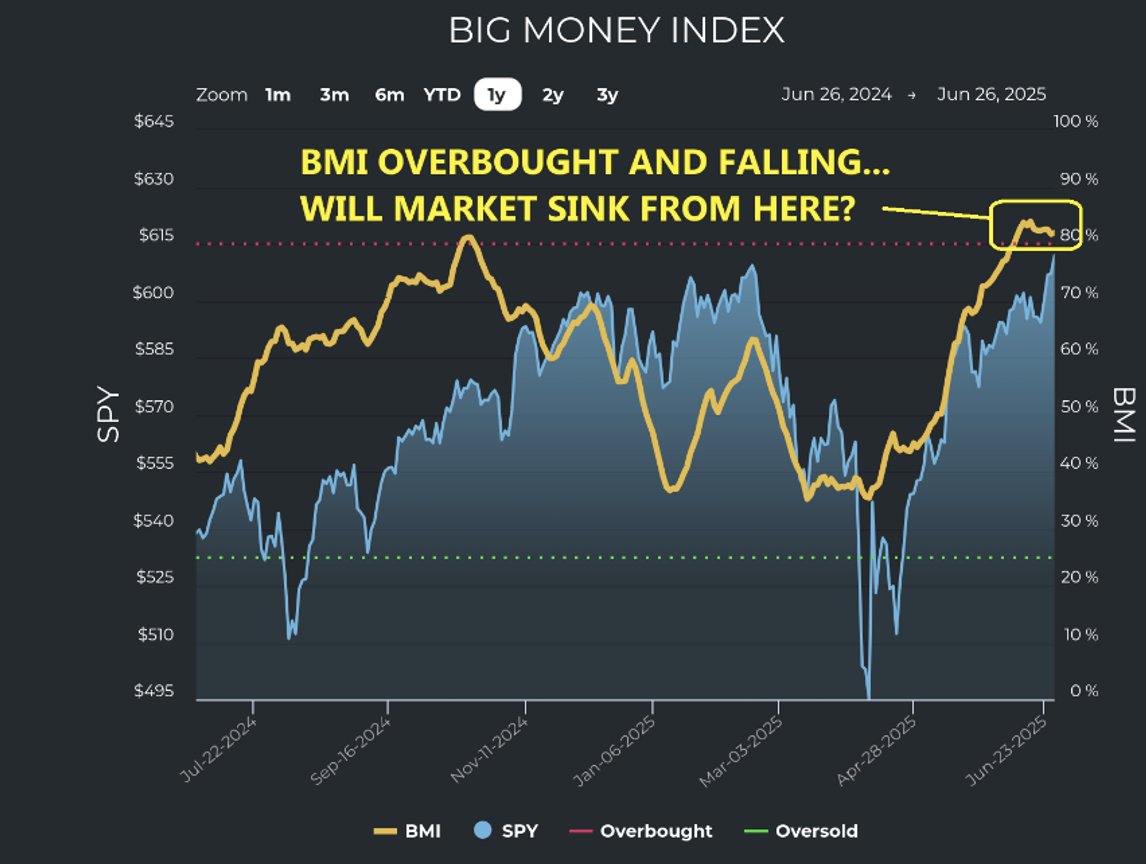

Since April’s lows, the S&P XXX (SPY) has surged 24%, a relentless bull run. But one key indicator, the Big Money Index (BMI), hints at a potential pause.

The BMI tracks money flows: up means cash floods equities, down means it’s fleeing. Its simplicity is its power, but nuances matter. I’ve long said it’s not about the BMI hitting overbought (above 80%)—it’s about when it falls from that peak. Even then, context is everything.

Recently, the BMI shot up like a phoenix, hitting overbought before turning south. That might spark worry, but the data tells a different tale.

This is likely a pause that refreshes. Post-COVID, the BMI stayed overbought for nearly four months. Right now, stock and ETF inflows are overwhelmingly green, with barely any red.

The BMI, a 25-day moving average of flows, is dipping because inflows have intensified while outflows fade.

Math backs this up: since May 12, when Trump announced a tariff stay, daily inflows averaged XXXX% of flows. If trends hold, the BMI should climb from XXXX% to XX% by July 1, diving deeper into overbought territory.

What’s fueling this? Rising volumes and unusual activity.

Markets are climbing on increasing inflows, with no signs of stopping. The money’s pouring into small and mid-cap stocks—84% of inflow signals since May XX target companies under $XX billion.

Smaller firms drive growth; behemoths like NVIDIA $NVDA (up $600B since May 12) are outliers.

#Growth sectors are dominating: #Tech, #Discretionary, and #Communications are soaring, while defensive #Utilities and #Staples lag. Tech’s rise from 10th to #1 since April X is staggering.

This rally is broad and fierce. #Tech, #Industrials, #Financials, #Materials, #Discretionary, and even #Healthcare see massive inflows. #Staples bleed outflows, and #Utilities’ inflows have dried up.

Tech alone accounts for XX% of all inflows since May 12, with XX% of that in Software and XX% in Semiconductors. Half of tech’s cash is fueling these subsectors—pure rocket fuel for growth.

Drilling deeper, the top stocks tell the story. In Software: Paycom $PAYC ($264.80, XXXX Score), Spotify $SPOT ($775.90, 82.8), Microsoft $MSFT ($497.45, 81.0), Bentley Systems $BSY ($52.55, 81.0), and Meta $META ($726.09, 79.3).

In #Semiconductors: NVIDIA $NVDA ($154.31, 84.5), Broadcom $AVGO ($270.17, 82.8), Macom $MTSI ($136.99, 77.6), Credo $CRDO ($91.92, 77.6), and KLA $KLAC ($893.00, 75.9). These names are where capital is piling in, driving markets higher.

This is the beauty of following money flows. Inflows push markets up, growth sectors collect capital, tech leads with Software and Semis at the helm, and the best stocks soak up the cash. It’s that simple. I ignore the news—let the data speak.

As Marcus Aurelius said: “Objective judgment, now. Unselfish action, now. Willing acceptance—now—of all external events. That’s all you need.”

The bull is charging, led by tech’s fire. Small caps, growth sectors, and high-quality stocks are the engine. Don’t fear the BMI’s dip—expect it to rise. The data says this rally has legs. Where are you putting your money?

#StockMarket #Investing #MoneyFlows #TechRally

@MoneyFlows_com @lukedowney

XXX engagements

**Related Topics**

[avgo](/mdx/topic/avgo)

[nvda](/mdx/topic/nvda)

[msft](/mdx/topic/msft)

[money](/mdx/topic/money)

[spy](/mdx/topic/spy)

[rating agency](/mdx/topic/rating-agency)

[$klac](/mdx/topic/$klac)

[$msft](/mdx/topic/$msft)

[Post Link](https://x.com/KeithTradeSmith/status/1938971651217265083)