[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  CIN [@Chinwo2](/creator/twitter/Chinwo2) on x 1335 followers Created: 2025-06-28 06:50:16 UTC GIGAHYDRATION on Polkadot: A Deep Dive into APRs and Risks‼️ Polkadot’s new GIGAHYDRATION campaign is live via the Hydration DEX, backed by a X M DOT treasury grant to incentivize on‑chain liquidity. Over XX months, rewards are split roughly into X M DOT for stablecoins, X M DOT for general LPs, and X M DOT to mint “GIGADOT” stake tokens. At launch (June 2024), Hydration promised very high APRs – press materials noted initial LP yields “above the XXX% APY mark” (up to XXX% APR) on incentivized pools. As of late June 2025 the campaign is ongoing and top pools are still earning triple‑digit APRs. In particular, tokenized BTC (tBTC), the Aave token (AAVE), and the verse‑ASTR token (vASTR) pools are among the highest‑yielding, reflecting the campaign’s focus on those markets. Other pools – such as DOT itself, GLMR (Moonbeam) or USD stablecoin pools – show more moderate APRs. Stablecoin pairs (e.g. USDC/USDT) and major base tokens generally yield lower double‑digit APRs since they have deeper liquidity and lower risk. Hydration’s own documents and announcements highlight that rewards cover “native stablecoins, DOT, BTC and several ecosystem coins,” consistent with the asset list. LPs should be aware of the usual risks. Impermanent loss can occur if token prices diverge significantly, reducing net gains. Even though Hydration’s design supports single‑asset LPing via an omnibus pool, price moves still matter: large divergences versus the hub token (H2O) translate to IL for LPs. Slippage on trades is another factor in thin markets, and extreme volatility in crypto markets could amplify losses. Token liquidity itself can be an issue – for example, staked LSTs (like vASTR or HDX) or campaign reward tokens may not trade heavily, so exiting positions might move prices sharply. Finally, remember that these APRs depend on DOT incentives: yields will stabilize once the grant is spent or if governance votes about “boosts.” Every few weeks Hydration’s on‑chain governance votes can reallocate APR boosts among assets, so future returns carry some uncertainty. In summary, the Hydration GIGAHYDRATION campaign is providing high APRs for Polkadot DeFi liquidity – with top pools (tBTC, AAVE, vASTR) still above high digit yields – but it is not without caveats. The opportunity is appealing for risk-tolerant yield seekers, but one should weigh the high rewards against the possibility of impermanent loss, slippage, limited liquidity, and the nature of the incentives. Become GIGAHYDRATED ___ Thanks to @Polkadot  XXX engagements  **Related Topics** [1m](/topic/1m) [stablecoins](/topic/stablecoins) [2m](/topic/2m) [onchain](/topic/onchain) [dot](/topic/dot) [5m](/topic/5m) [hydration](/topic/hydration) [deep dive](/topic/deep-dive) [Post Link](https://x.com/Chinwo2/status/1938852430076117205)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

CIN @Chinwo2 on x 1335 followers

Created: 2025-06-28 06:50:16 UTC

CIN @Chinwo2 on x 1335 followers

Created: 2025-06-28 06:50:16 UTC

GIGAHYDRATION on Polkadot: A Deep Dive into APRs and Risks‼️

Polkadot’s new GIGAHYDRATION campaign is live via the Hydration DEX, backed by a X M DOT treasury grant to incentivize on‑chain liquidity. Over XX months, rewards are split roughly into X M DOT for stablecoins, X M DOT for general LPs, and X M DOT to mint “GIGADOT” stake tokens. At launch (June 2024), Hydration promised very high APRs – press materials noted initial LP yields “above the XXX% APY mark” (up to XXX% APR) on incentivized pools.

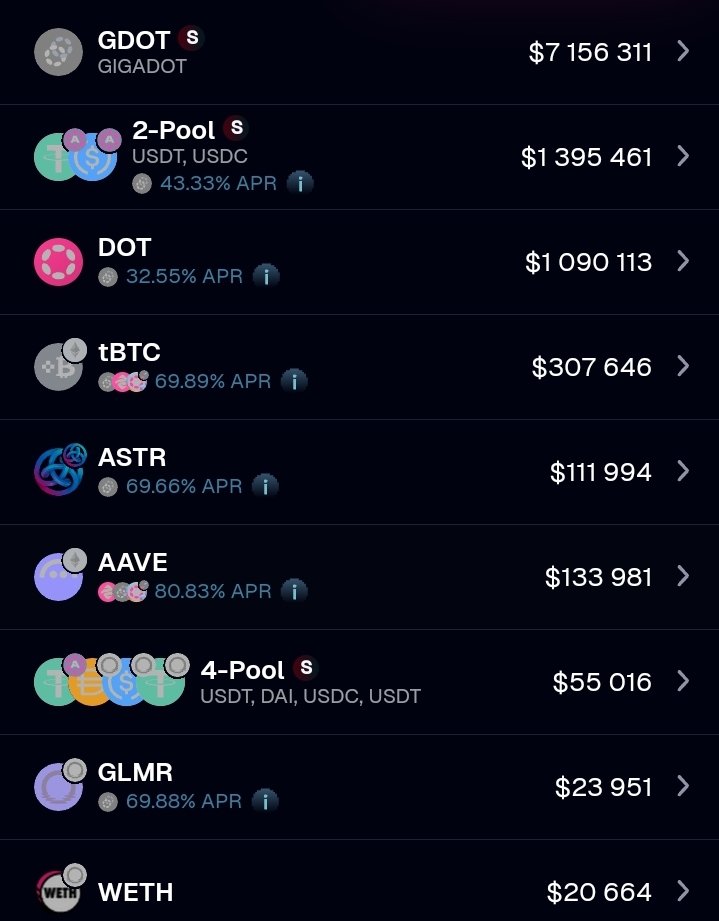

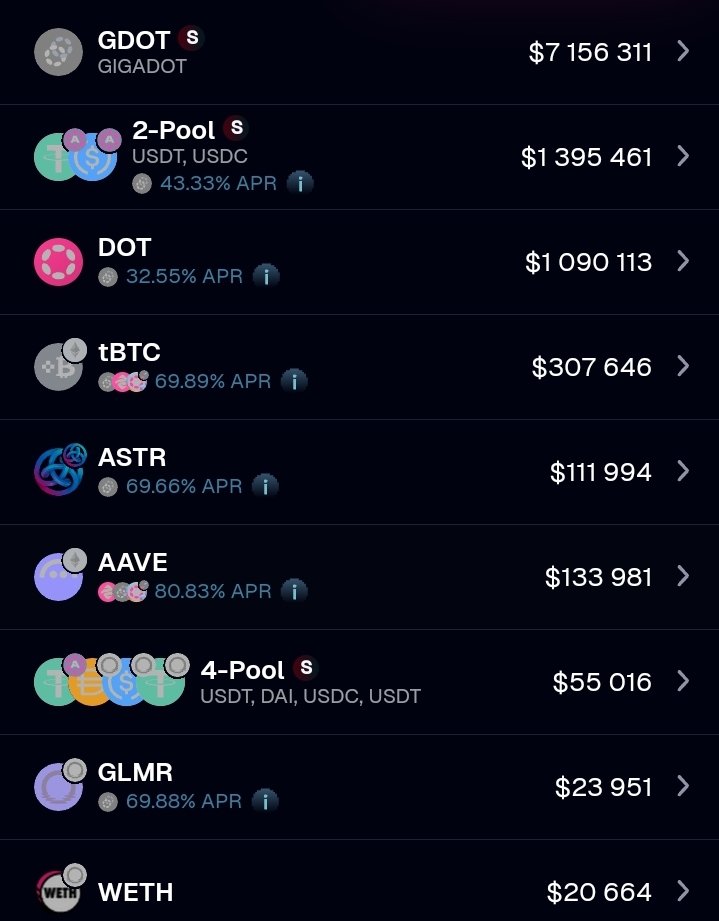

As of late June 2025 the campaign is ongoing and top pools are still earning triple‑digit APRs. In particular, tokenized BTC (tBTC), the Aave token (AAVE), and the verse‑ASTR token (vASTR) pools are among the highest‑yielding, reflecting the campaign’s focus on those markets. Other pools – such as DOT itself, GLMR (Moonbeam) or USD stablecoin pools – show more moderate APRs. Stablecoin pairs (e.g. USDC/USDT) and major base tokens generally yield lower double‑digit APRs since they have deeper liquidity and lower risk. Hydration’s own documents and announcements highlight that rewards cover “native stablecoins, DOT, BTC and several ecosystem coins,” consistent with the asset list.

LPs should be aware of the usual risks. Impermanent loss can occur if token prices diverge significantly, reducing net gains. Even though Hydration’s design supports single‑asset LPing via an omnibus pool, price moves still matter: large divergences versus the hub token (H2O) translate to IL for LPs. Slippage on trades is another factor in thin markets, and extreme volatility in crypto markets could amplify losses. Token liquidity itself can be an issue – for example, staked LSTs (like vASTR or HDX) or campaign reward tokens may not trade heavily, so exiting positions might move prices sharply. Finally, remember that these APRs depend on DOT incentives: yields will stabilize once the grant is spent or if governance votes about “boosts.” Every few weeks Hydration’s on‑chain governance votes can reallocate APR boosts among assets, so future returns carry some uncertainty.

In summary, the Hydration GIGAHYDRATION campaign is providing high APRs for Polkadot DeFi liquidity – with top pools (tBTC, AAVE, vASTR) still above high digit yields – but it is not without caveats. The opportunity is appealing for risk-tolerant yield seekers, but one should weigh the high rewards against the possibility of impermanent loss, slippage, limited liquidity, and the nature of the incentives.

Become GIGAHYDRATED ___ Thanks to @Polkadot

XXX engagements

Related Topics 1m stablecoins 2m onchain dot 5m hydration deep dive