[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  DuRtY Crypto [@DuRtY_Crypto](/creator/twitter/DuRtY_Crypto) on x 8492 followers Created: 2025-06-27 10:13:30 UTC PulseChain. Breaking News! Devs have discovered a way to use the original MakerDAO to grant yield to pDAI holders. There may be multiple protocols to enable yield generation, lending, and help with peg! Do you like Chai? Before we begin, please keep in mind that all of these protocols have risks. Please do your own research and due diligence before interacting or testing. My strategy will be to sit back and watch it all play out. Secondly, some of the protocols here have conflicting opinions within the community. I will give you all the information I have. With that being said, let's get started. 1) (NEW) Earn Trustless pDAI Yield with Chai? Introducing Chai. Chai is an token from the MakerDAO ecosystem that lets users earn interest from the Dai Savings Rate (DSR) while keeping their tokens transferable. When Dai is converted to Chai, it's deposited into MakerDAO’s Pot contract, and the Chai balance grows in value over time. On PulseChain, a proxy version of Chai appears to be tested on-chain, likely interacting with a forked MakerDAO setup, though no front-end exists yet. I first heard about it from my blind friend 0xDareDevil (More on him later), then found an older post by NineIron that helped confirm the details. You guys can look up this TX Hash and try to figure out what's going on: (Two Days Ago) 0x232479fbe81ffcb8ec02c035eb154016668849f2ded463172abba8bbba7dcd70 Since MakerDAO is immutable (can't be changed), he speculates that proxy contracts (sits on top of smart contract) are being used. If Chai works on PulseChain, pDAI holders can earn passive interest by converting their pDAI into Chai without locking it up. This makes pDAI more useful and attractive, potentially increasing demand and utility across PulseChain DeFi. 2) Improved AAVE V3 Fork, Lending / Borrowing? Cattie ESM'd MakerDAO. Price dropped -99%, proceeded to pump Atropa ecosystem tokens, sent $500K+ through Tornado Cash (due to wallet watchers and endless Q's), admitted the money belongs to the pDAI community, promised post mortem report of how funds will be used on-chain, convinced a dev to launch on PulseChain, paid the $100K fee, sent the initial LP to the founder. Arbitrum launch canceled, only focused on PulseChain. PLS, PLSX, and pDAI lending and borrowing. Launch in July. Founder posted "Some hold pDAI. Some use pDAI. But legends loop it". If this happens, it would support the hyperloop theory. Essentially an attempt to have a decentralized stablecoin like Luna and UST tried to do last cycle, except pDAI would be overcollateralized and not be a total fail death spiral. History in the making? I will avoid saying its name for this post because it's blacklisted in pDAI TG (due to opposing views). I personally think everyone is benevolent, but whatever. 3) Compound Lending Reboot? cDAI I have made numerous posts on this topic, good to read. Essentially cDAI (Compound DAI) Total Reserve has officially surpassed the 'Bad Debt' on MakerDAO. NineIron ponders whether a broken cDAI contract can fix and boost pDAI. Essentially someone needs to have 400K pCOMP to control governance and update a specific formula. Once this is fixed, the speculation is that Compound will be solvent, and the 'bad debt' is cleared. A community member says "Comp becomes solvent, cDAI begins accruing interest, users deposit pDAI, pumping pDAI". NineIron says that the 5996 (Extractor Viet Guy), which I think is a psyop in itself, is also the XXX wallet. So who is the XXX wallet? It is the creator of LNKR and is trying to fix the cDAI contract. It would be funny if the person everyone thought was stealing from PulseChain, ended up being the guy that clears MakerDAO's bad debt. NineIron says " I found this by following the same wallets that are running pMKR. It is also notable that RHs 2822 wallet owns a small amount of CHAI and i always see it as a clue that we are focused in the right area." "Why would the wallet running most of the function on pMKR set this up and start playing with it now as it requires capital in the vaults to utilize the savings rate. There are a few reasons, but one is potentially to get ready for the collateralization of pMKR vaults." "There is a lot of on-chain activity this past week. Seeing additional use cases for pDAI become a priority is a positive. These wallets are building an ecosystem where pDAI's peg using pMKR is critical to its success. pDAI to $1." 4) A Mysterious Dev Created an Upgraded MakerDAO Fork called PAI In the past Cattie said "A benevolent community developer has been working hard to create one of the other shadows. Your community has successfully picked up on his work in the past couple of days. And shared some of the deployed contracts. But that's no "pioneer". And this developer deserves the credit for his work. It's not Richard Heart. And not James. And not 5996. And neither Surfacing. He deserves credit. You have known him for a while if you were in the Maker Telegram." Also in Cattie's roadmap she mentioned "Community dev finishes working on upgraded Maker fork with a new stablecoin and launches it so you can use your pDAI to open vaults (or get more pDAI if the pDAI vaults get liquidated for cheaper). Nobody knows what all of this exactly entails, but people are creating interesting things behind the scenes. 5) Atropa Maria Attempting to peg three pStables (pUSDC, pUSDT, pDAI) 1:1:1 theory? Atropa pressurized complex liquidity web to help faciliate pStables to peg? There are mints, burns, many tokens, deep rabbit hole, meet ups, class talks, riddles, IRC chat, and much more involved. Atropa Maria is also connected to a large sum of money X figure+ early Hexican? Cattie says "Atropa is just X of the shadows of ressurrection of pDAI". Note: Atropa Maria is also creating Dysnomia L2 which is a never before done game. I have made countless posts on this subject, lets continue. 6) Spark Protocol? PulseChain snapshot occured exactly one day after Spark Protocol launched. Timing seems purposeful and precise. Could this be used on PulseChain to earn yield on pDAI? To earn interest through SparkFi, you deposit DAI and receive sDAI, which automatically grows in value over time based on the Dai Savings Rate. You can redeem sDAI back for more DAI whenever you want, with no lock-up. MakerDAO guys involved like Hexonaut who happen to be supporters of the ecosystem. NineIron doesn't seem as convinced for those one yet, but we shall see. 7) Random Ones: Curve, Balancer? (Zero Evidence for these as of now) 8) Bonus: 0X DareDevil (Secret Front-End For Peg / Hyperloop?) Who is he? Crypto genius in the making! Blind boy in technology! Follower of the Word , and Dr. of the Law! "Do you want me to tell you what's got the blind man so excited!? It's a front end… I was invited to a repo to test and offer some suggestions for Accessability for front end that is going to be a mechanism for the peg and hyper loop". "No it wasn't specifically a front end for the maker DAO…a staking feature for an upgraded maker DAO was only a small feature of what this actually does. And you can test a collateralization for a fork version of the maker DAO called PAI. But I think everybody knows about that already." /The End. If you made it this far, don't forget to follow and turn alerts on. Let me know your thoughts in the comments. If there is any source or piece of information you guys need, lmk.  XXXXX engagements  **Related Topics** [acquisition](/topic/acquisition) [chai](/topic/chai) [holders](/topic/holders) [devs](/topic/devs) [breaking news](/topic/breaking-news) [pulsechain](/topic/pulsechain) [coins layer 1](/topic/coins-layer-1) [coins made in usa](/topic/coins-made-in-usa) [Post Link](https://x.com/DuRtY_Crypto/status/1938541188392640729)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

DuRtY Crypto @DuRtY_Crypto on x 8492 followers

Created: 2025-06-27 10:13:30 UTC

DuRtY Crypto @DuRtY_Crypto on x 8492 followers

Created: 2025-06-27 10:13:30 UTC

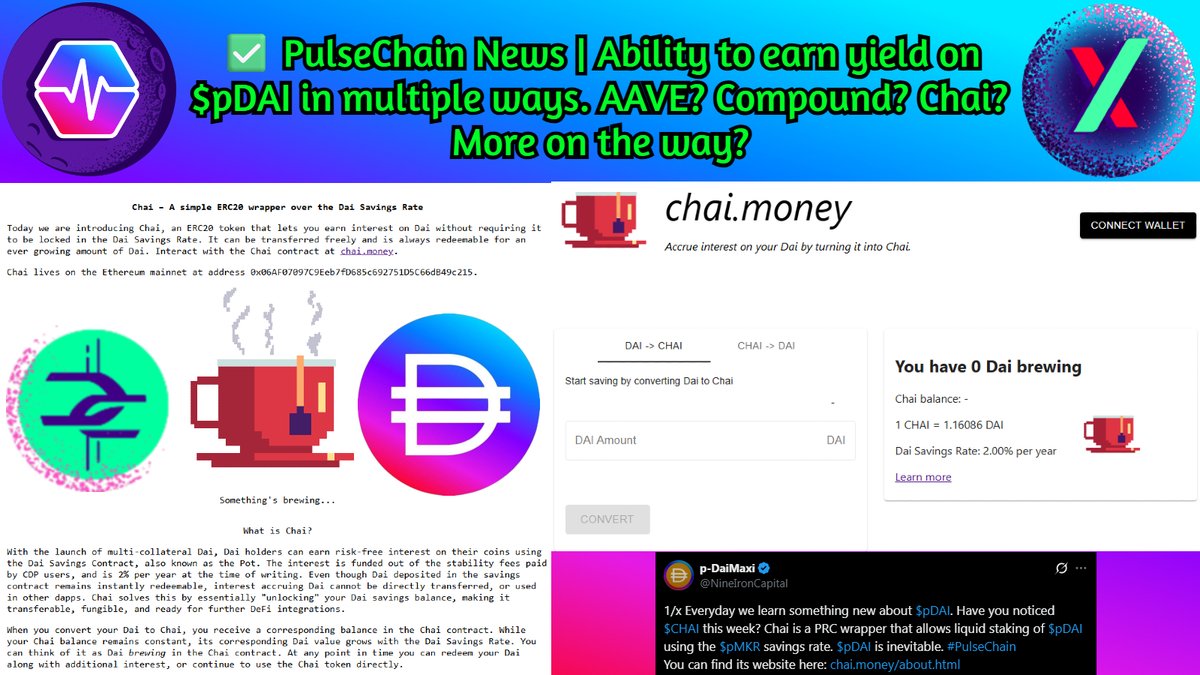

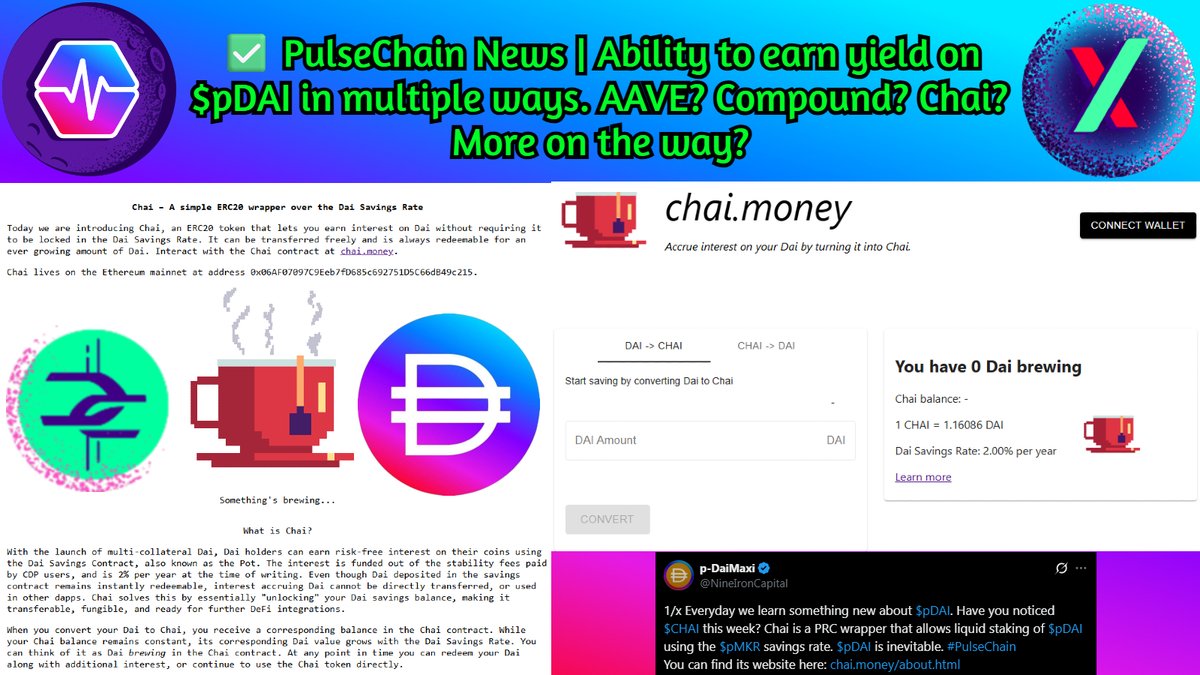

PulseChain. Breaking News! Devs have discovered a way to use the original MakerDAO to grant yield to pDAI holders. There may be multiple protocols to enable yield generation, lending, and help with peg!

Do you like Chai?

Before we begin, please keep in mind that all of these protocols have risks. Please do your own research and due diligence before interacting or testing. My strategy will be to sit back and watch it all play out.

Secondly, some of the protocols here have conflicting opinions within the community. I will give you all the information I have. With that being said, let's get started.

- (NEW) Earn Trustless pDAI Yield with Chai? Introducing Chai. Chai is an token from the MakerDAO ecosystem that lets users earn interest from the Dai Savings Rate (DSR) while keeping their tokens transferable. When Dai is converted to Chai, it's deposited into MakerDAO’s Pot contract, and the Chai balance grows in value over time. On PulseChain, a proxy version of Chai appears to be tested on-chain, likely interacting with a forked MakerDAO setup, though no front-end exists yet. I first heard about it from my blind friend 0xDareDevil (More on him later), then found an older post by NineIron that helped confirm the details.

You guys can look up this TX Hash and try to figure out what's going on: (Two Days Ago)

0x232479fbe81ffcb8ec02c035eb154016668849f2ded463172abba8bbba7dcd70

Since MakerDAO is immutable (can't be changed), he speculates that proxy contracts (sits on top of smart contract) are being used.

If Chai works on PulseChain, pDAI holders can earn passive interest by converting their pDAI into Chai without locking it up. This makes pDAI more useful and attractive, potentially increasing demand and utility across PulseChain DeFi.

- Improved AAVE V3 Fork, Lending / Borrowing?

Cattie ESM'd MakerDAO. Price dropped -99%, proceeded to pump Atropa ecosystem tokens, sent $500K+ through Tornado Cash (due to wallet watchers and endless Q's), admitted the money belongs to the pDAI community, promised post mortem report of how funds will be used on-chain, convinced a dev to launch on PulseChain, paid the $100K fee, sent the initial LP to the founder. Arbitrum launch canceled, only focused on PulseChain. PLS, PLSX, and pDAI lending and borrowing. Launch in July.

Founder posted "Some hold pDAI. Some use pDAI. But legends loop it". If this happens, it would support the hyperloop theory. Essentially an attempt to have a decentralized stablecoin like Luna and UST tried to do last cycle, except pDAI would be overcollateralized and not be a total fail death spiral. History in the making?

I will avoid saying its name for this post because it's blacklisted in pDAI TG (due to opposing views). I personally think everyone is benevolent, but whatever.

- Compound Lending Reboot? cDAI

I have made numerous posts on this topic, good to read. Essentially cDAI (Compound DAI) Total Reserve has officially surpassed the 'Bad Debt' on MakerDAO. NineIron ponders whether a broken cDAI contract can fix and boost pDAI. Essentially someone needs to have 400K pCOMP to control governance and update a specific formula. Once this is fixed, the speculation is that Compound will be solvent, and the 'bad debt' is cleared.

A community member says "Comp becomes solvent, cDAI begins accruing interest, users deposit pDAI, pumping pDAI".

NineIron says that the 5996 (Extractor Viet Guy), which I think is a psyop in itself, is also the XXX wallet. So who is the XXX wallet? It is the creator of LNKR and is trying to fix the cDAI contract. It would be funny if the person everyone thought was stealing from PulseChain, ended up being the guy that clears MakerDAO's bad debt.

NineIron says " I found this by following the same wallets that are running pMKR. It is also notable that RHs 2822 wallet owns a small amount of CHAI and i always see it as a clue that we are focused in the right area."

"Why would the wallet running most of the function on pMKR set this up and start playing with it now as it requires capital in the vaults to utilize the savings rate. There are a few reasons, but one is potentially to get ready for the collateralization of pMKR vaults."

"There is a lot of on-chain activity this past week. Seeing additional use cases for pDAI become a priority is a positive. These wallets are building an ecosystem where pDAI's peg using pMKR is critical to its success. pDAI to $1."

- A Mysterious Dev Created an Upgraded MakerDAO Fork called PAI

In the past Cattie said "A benevolent community developer has been working hard to create one of the other shadows. Your community has successfully picked up on his work in the past couple of days. And shared some of the deployed contracts. But that's no "pioneer". And this developer deserves the credit for his work. It's not Richard Heart. And not James. And not 5996. And neither Surfacing. He deserves credit. You have known him for a while if you were in the Maker Telegram."

Also in Cattie's roadmap she mentioned "Community dev finishes working on upgraded Maker fork with a new stablecoin and launches it so you can use your pDAI to open vaults (or get more pDAI if the pDAI vaults get liquidated for cheaper).

Nobody knows what all of this exactly entails, but people are creating interesting things behind the scenes.

- Atropa Maria Attempting to peg three pStables (pUSDC, pUSDT, pDAI) 1:1:1 theory?

Atropa pressurized complex liquidity web to help faciliate pStables to peg? There are mints, burns, many tokens, deep rabbit hole, meet ups, class talks, riddles, IRC chat, and much more involved. Atropa Maria is also connected to a large sum of money X figure+ early Hexican?

Cattie says "Atropa is just X of the shadows of ressurrection of pDAI".

Note: Atropa Maria is also creating Dysnomia L2 which is a never before done game.

I have made countless posts on this subject, lets continue.

- Spark Protocol?

PulseChain snapshot occured exactly one day after Spark Protocol launched. Timing seems purposeful and precise. Could this be used on PulseChain to earn yield on pDAI?

To earn interest through SparkFi, you deposit DAI and receive sDAI, which automatically grows in value over time based on the Dai Savings Rate. You can redeem sDAI back for more DAI whenever you want, with no lock-up.

MakerDAO guys involved like Hexonaut who happen to be supporters of the ecosystem.

NineIron doesn't seem as convinced for those one yet, but we shall see.

Random Ones: Curve, Balancer? (Zero Evidence for these as of now)

Bonus: 0X DareDevil (Secret Front-End For Peg / Hyperloop?)

Who is he? Crypto genius in the making! Blind boy in technology! Follower of the Word , and Dr. of the Law!

"Do you want me to tell you what's got the blind man so excited!? It's a front end… I was invited to a repo to test and offer some suggestions for Accessability for front end that is going to be a mechanism for the peg and hyper loop".

"No it wasn't specifically a front end for the maker DAO…a staking feature for an upgraded maker DAO was only a small feature of what this actually does. And you can test a collateralization for a fork version of the maker DAO called PAI. But I think everybody knows about that already."

/The End.

If you made it this far, don't forget to follow and turn alerts on. Let me know your thoughts in the comments. If there is any source or piece of information you guys need, lmk.

XXXXX engagements

Related Topics acquisition chai holders devs breaking news pulsechain coins layer 1 coins made in usa