[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Say No To Trading [@SayNoToTrading](/creator/twitter/SayNoToTrading) on x 6140 followers Created: 2025-06-26 16:35:27 UTC Everyone seems to focus on upside potential of a stock. You need to focus on downside potential, first. Don't worry about upside of a great company, as it should take care of itself in time. When I say Centene $CNC is a better risk/reward than Oscar Health $OSCR, it is exactly that; the ratio of perceived downside probability relative to that of the upside. This does not mean I think $CNC will necessarily offer a greater % gain in the next few months or years. In fact, it probably won't if Oscar keeps delivering. It means I think the odds of making money vs. losing money favor buying it over Oscar. At today's price for each. Less than X weeks ago, $OSCR was in the $13s. If you need reminder, see screenshot. Today we're at $20s. If Oscar share price falls 35%, it takes it back just X weeks. XX% is a brutal decline. $CNC is in the $54s. To fall XX% would take price to $XX. Anything is possible, so I never say never, but it would require some ground shattering news like accounting fraud, major elimination of Medicaid (much more than proposed), or similar. On the other hand, $OSCR could fall XX% merely for no company specific reason. They could do NOTHING wrong and have stock fall 35%. Just the mood of the market could take it back to June 13th level.  XXXXX engagements  **Related Topics** [care of](/topic/care-of) [oscar](/topic/oscar) [$cnc](/topic/$cnc) [stocks healthcare](/topic/stocks-healthcare) [$oscr](/topic/$oscr) [Post Link](https://x.com/SayNoToTrading/status/1938274922746548511)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Say No To Trading @SayNoToTrading on x 6140 followers

Created: 2025-06-26 16:35:27 UTC

Say No To Trading @SayNoToTrading on x 6140 followers

Created: 2025-06-26 16:35:27 UTC

Everyone seems to focus on upside potential of a stock.

You need to focus on downside potential, first.

Don't worry about upside of a great company, as it should take care of itself in time.

When I say Centene $CNC is a better risk/reward than Oscar Health $OSCR, it is exactly that; the ratio of perceived downside probability relative to that of the upside.

This does not mean I think $CNC will necessarily offer a greater % gain in the next few months or years. In fact, it probably won't if Oscar keeps delivering.

It means I think the odds of making money vs. losing money favor buying it over Oscar. At today's price for each.

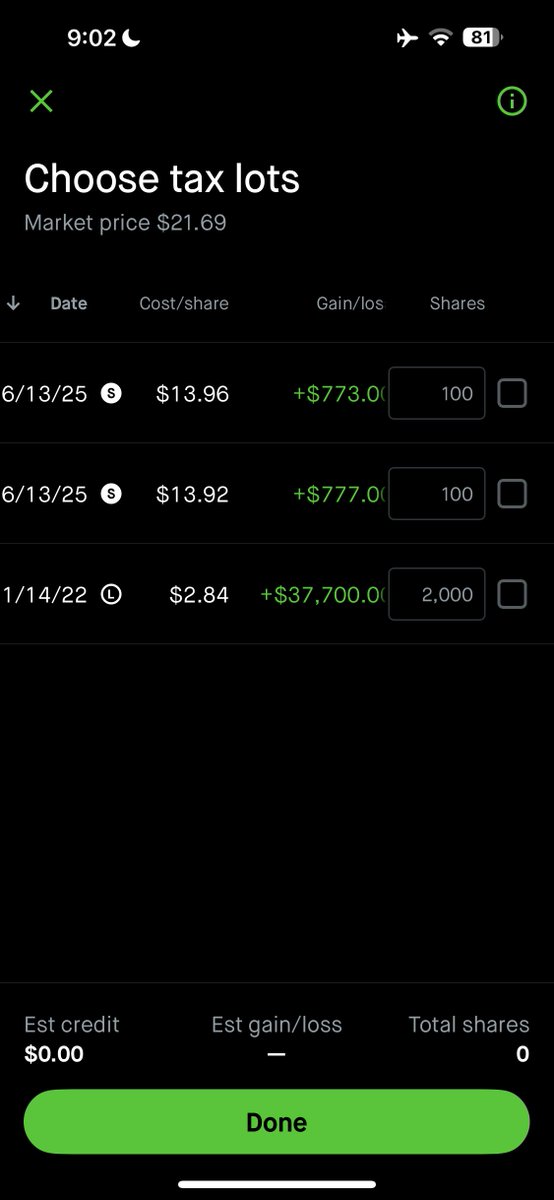

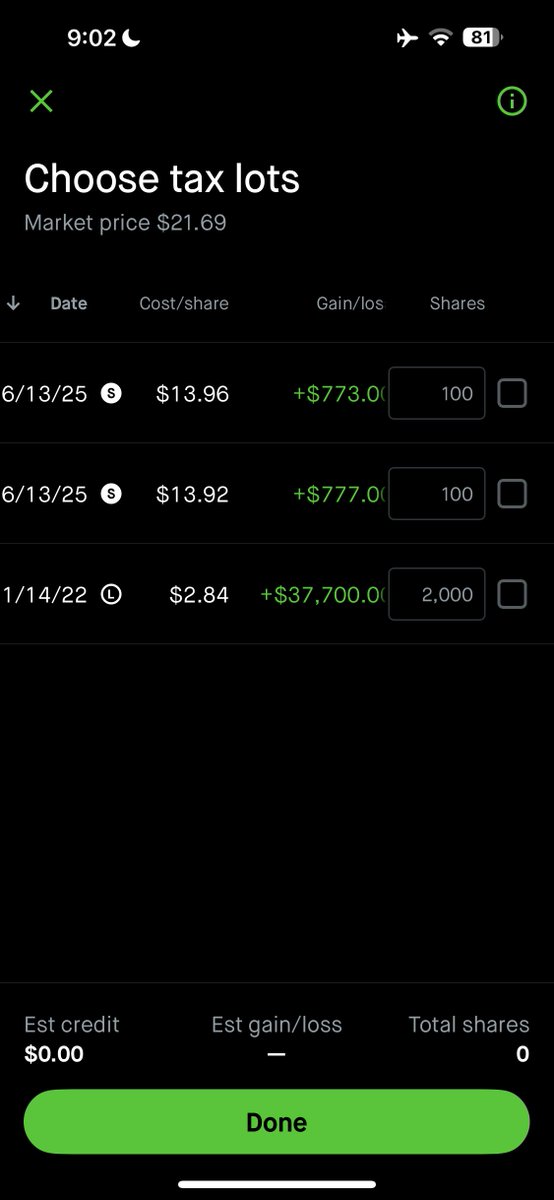

Less than X weeks ago, $OSCR was in the $13s. If you need reminder, see screenshot.

Today we're at $20s. If Oscar share price falls 35%, it takes it back just X weeks.

XX% is a brutal decline.

$CNC is in the $54s. To fall XX% would take price to $XX.

Anything is possible, so I never say never, but it would require some ground shattering news like accounting fraud, major elimination of Medicaid (much more than proposed), or similar.

On the other hand, $OSCR could fall XX% merely for no company specific reason. They could do NOTHING wrong and have stock fall 35%. Just the mood of the market could take it back to June 13th level.

XXXXX engagements

Related Topics care of oscar $cnc stocks healthcare $oscr