[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Hiyoko₿ [@hiyoko_peep](/creator/twitter/hiyoko_peep) on x 6813 followers Created: 2025-06-24 23:52:22 UTC 📊 How to Calculate mNAV (Multiples of Net Asset Value) mNAV is defined by the following formula: mNAV = (Stock Price × Shares Outstanding) ÷ (BTC Price × BTC Holdings) = Market Cap ÷ BTC NAV This is the standard form of mNAV, expressed in fiat currency (like yen or USD). --- 💡 What if you want to express it in BTC terms? If you want to calculate BTC-denominated mNAV, simply divide both the numerator and denominator (i.e., Market Cap and BTC NAV) by the BTC price. This eliminates fiat currency fluctuations and lets you evaluate everything from a Bitcoin-native perspective. It’s especially useful for deriving theoretical values, as it removes any dependency on BTC’s price. The simplified formula becomes: BTC-denominated mNAV = BTC-denominated Market Cap ÷ Company’s BTC Holdings --- 📘 Want to use Logarithms? You can also take the base-10 logarithm of the mNAV: Log₁₀(mNAV) = Log₁₀(Market Cap ÷ BTC NAV) = Log₁₀(Market Cap) − Log₁₀(BTC NAV) This is handy when plotting mNAV over time, since it makes trends and slope changes more visible 📈✨ For BTC-based calculations: BTC-based Log₁₀(mNAV) = Log₁₀(BTC-denominated Market Cap) − Log₁₀(Company’s BTC Holdings) --- 🔍 What information do you need? The three most important components are: X. BTC Price → Get this from or CoinMarketCap X. BTC Holdings → Check each company’s official website, investor relations (IR), or X (formerly Twitter) ※ For Metaplanet, it’s super easy to copy & paste from their official site! X. Market Cap → Use to view daily market cap trends for many companies around the world 🌍 All of this data is publicly available and completely free. Feel free to explore and use it! 🥰📊✨ --- By putting it all together, you can easily generate graphs like the ones shown in Metaplanet’s official financial reports 👀📈  XXXXX engagements  **Related Topics** [united states dollar](/topic/united-states-dollar) [currency](/topic/currency) [fiat](/topic/fiat) [nav](/topic/nav) [market cap](/topic/market-cap) [stocks](/topic/stocks) [alternative investment](/topic/alternative-investment) [fund manager](/topic/fund-manager) [Post Link](https://x.com/hiyoko_peep/status/1937660099981721791)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Hiyoko₿ @hiyoko_peep on x 6813 followers

Created: 2025-06-24 23:52:22 UTC

Hiyoko₿ @hiyoko_peep on x 6813 followers

Created: 2025-06-24 23:52:22 UTC

📊 How to Calculate mNAV (Multiples of Net Asset Value)

mNAV is defined by the following formula:

mNAV = (Stock Price × Shares Outstanding) ÷ (BTC Price × BTC Holdings) = Market Cap ÷ BTC NAV

This is the standard form of mNAV, expressed in fiat currency (like yen or USD).

💡 What if you want to express it in BTC terms?

If you want to calculate BTC-denominated mNAV, simply divide both the numerator and denominator (i.e., Market Cap and BTC NAV) by the BTC price.

This eliminates fiat currency fluctuations and lets you evaluate everything from a Bitcoin-native perspective. It’s especially useful for deriving theoretical values, as it removes any dependency on BTC’s price.

The simplified formula becomes:

BTC-denominated mNAV = BTC-denominated Market Cap ÷ Company’s BTC Holdings

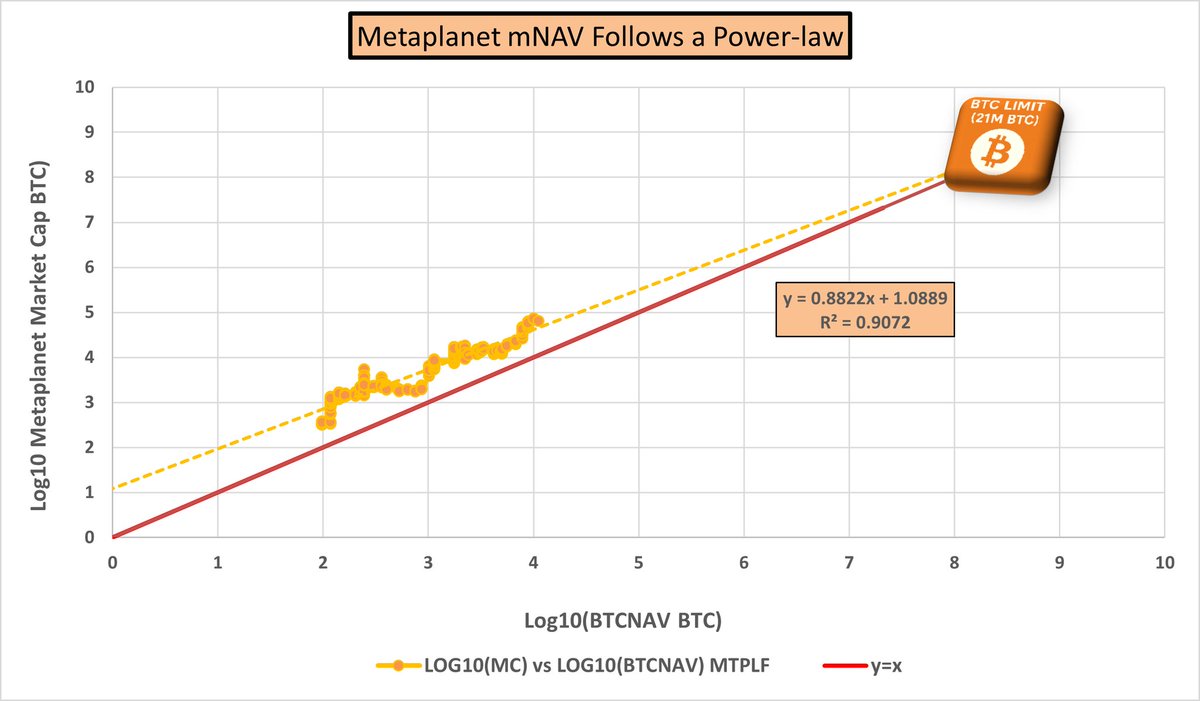

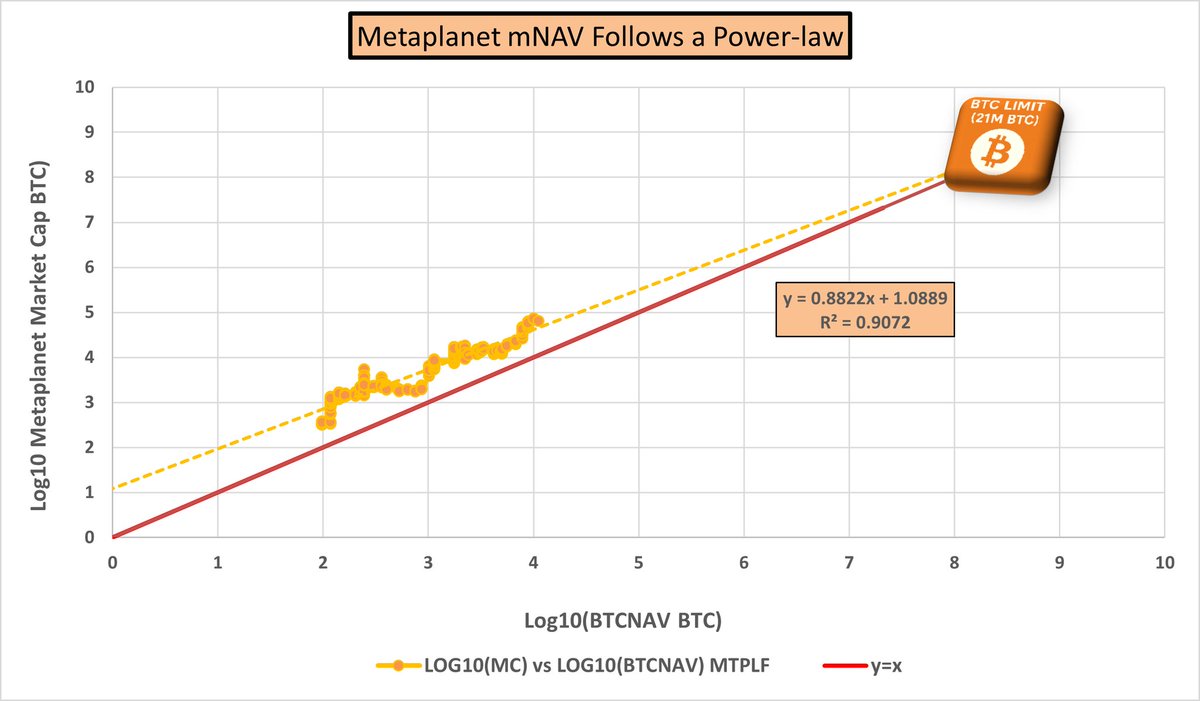

📘 Want to use Logarithms?

You can also take the base-10 logarithm of the mNAV:

Log₁₀(mNAV) = Log₁₀(Market Cap ÷ BTC NAV) = Log₁₀(Market Cap) − Log₁₀(BTC NAV)

This is handy when plotting mNAV over time, since it makes trends and slope changes more visible 📈✨

For BTC-based calculations:

BTC-based Log₁₀(mNAV) = Log₁₀(BTC-denominated Market Cap) − Log₁₀(Company’s BTC Holdings)

🔍 What information do you need?

The three most important components are:

X. BTC Price → Get this from or CoinMarketCap

X. BTC Holdings → Check each company’s official website, investor relations (IR), or X (formerly Twitter) ※ For Metaplanet, it’s super easy to copy & paste from their official site!

X. Market Cap → Use to view daily market cap trends for many companies around the world 🌍

All of this data is publicly available and completely free. Feel free to explore and use it! 🥰📊✨

By putting it all together, you can easily generate graphs like the ones shown in Metaplanet’s official financial reports 👀📈

XXXXX engagements

Related Topics united states dollar currency fiat nav market cap stocks alternative investment fund manager