[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Dimitry Nakhla | Babylon Capital® [@DimitryNakhla](/creator/twitter/DimitryNakhla) on x 14.5K followers Created: 2025-06-24 15:05:45 UTC A quality valuation analysis on $ASML 🧘🏽♂️ •NTM P/E Ratio: 28.96x •10-Year Mean: 31.05x •NTM FCF Yield: XXXX% •10-Year Mean: XXXX% As you can see, $ASML appears to be trading below fair value Going forward, investors can receive ~7% MORE in earnings per share & ~1% MORE in FCF per share🧠*** Before we get into valuation, let’s take a look at why $ASML is an excellent business (*Financials in USD*) BALANCE SHEET✅ •Cash & Short Term Inv: $9.85B •Long-Term Debt: $3.98B $ASML has a strong balance sheet & 70x FFO Interest Coverage RETURN ON CAPITAL✅ •2021: XXXX% •2022: XXXX% •2023: XXXX% •2024: XXXX% •LTM: XXXX% RETURN ON EQUITY✅ •2021: XXXX% •2022: XXXX% •2023: XXXX% •2024: XXXX% •LTM: XXXX% $ASML has excellent return metrics, highlighting the financial efficiency of the business REVENUES✅ •2014: $7.09B •2024: $29.28B •CAGR: XXXXX% FREE CASH FLOW* • $ASML FCF is very sporadic due to heavy capital expenditures & isn’t necessarily the most reliable way to analyze the company’s value NORMALIZED EPS✅ •2014: $XXXX •2024: $XXXXX •CAGR: XXXXX% SHARE BUYBACKS✅ •2018 Shares Outstanding: 426.40M •LTM Shares Outstanding: 393.30M By reducing its shares outstanding ~7.7%, $ASML increased its EPS by ~8.3% (assuming X growth) MARGINS✅ •LTM Gross Margins: XXXX% •LTM Operating Margins: XXXX% •LTM Net Income Margins: XXXX% ***NOW TO VALUATION 🧠 As stated above, investors can expect to receive ~7% MORE in EPS & X% MORE in FCF per share Using Benjamin Graham’s 2G rule of thumb, $ASML has to grow earnings at a XXXXX% CAGR over the next several years to justify its valuation Today, analysts anticipate 2025 - 2027 EPS growth over the next few years to be more than the (14.48%) required growth rate: 2025E: $XXXXX (22.0% YoY) *FY Dec 2026E: $XXXXX (13.8% YoY) 2027E: $XXXXX (21.3% YoY) $ASML has a decent track record of meeting analyst estimates ~2 years out. HOWEVER, let’s be conservative & assume $ASML ends 2027 with $35.00*** in EPS (~6% below current estimates) & see its CAGR potential assuming different multiples: 31x P/E: $1,085💵 … ~13.4% CAGR 30x P/E: $1,050💵 … ~12.0% CAGR 29x P/E: $1,015💵 … ~10.5% CAGR 28x P/E: $980💵 … ~9.0% CAGR 27x P/E: $945💵 … ~7.5% CAGR As you can see, $ASML appears to have attractive return potential if we assume greater or equal to 29x EPS (below its 10-year mean, current multiple, & justified given its quality, moat & growth rate) Today at $807💵 $ASML appears to be a good consideration for investment, albeit with extreme volatility Less than X months ago (in the latest $ASML analysis) I stated: “Today at $687💵 $ASML appears to be a strong consideration for investment” Of course $ASML was a much better deal then, yet those looking to accumulate today can account for a margin of safety by accumulating in tranches (e.g. 1/3 at $807, 1/3 at $710, 1/3 at $625) #stocks #investing ___ 𝐃𝐈𝐒𝐂𝐋𝐎𝐒𝐔𝐑𝐄‼️: 𝐓𝐡𝐢𝐬 𝐢𝐬 𝐍𝐎𝐓 𝐈𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭 𝐀𝐝𝐯𝐢𝐜𝐞. 𝐁𝐚𝐛𝐲𝐥𝐨𝐧 𝐂𝐚𝐩𝐢𝐭𝐚𝐥® 𝐚𝐧𝐝 𝐢𝐭𝐬 𝐫𝐞𝐩𝐫𝐞𝐬𝐞𝐧𝐭𝐚𝐭𝐢𝐯𝐞𝐬 𝐦𝐚𝐲 𝐡𝐚𝐯𝐞 𝐩𝐨𝐬𝐢𝐭𝐢𝐨𝐧𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐬𝐞𝐜𝐮𝐫𝐢𝐭𝐢𝐞𝐬 𝐝𝐢𝐬𝐜𝐮𝐬𝐬𝐞𝐝 𝐢𝐧 𝐭𝐡𝐢𝐬 𝐭𝐰𝐞𝐞𝐭. 𝐓𝐡𝐞 𝐢𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧 𝐜𝐨𝐧𝐭𝐚𝐢𝐧𝐞𝐝 𝐢𝐧 𝐭𝐡𝐢𝐬 𝐭𝐰𝐞𝐞𝐭 𝐢𝐬 𝐢𝐧𝐭𝐞𝐧𝐝𝐞𝐝 𝐟𝐨𝐫 𝐢𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧𝐚𝐥 𝐩𝐮𝐫𝐩𝐨𝐬𝐞𝐬 𝐨𝐧𝐥𝐲 𝐚𝐧𝐝 𝐬𝐡𝐨𝐮𝐥𝐝 𝐧𝐨𝐭 𝐛𝐞 𝐜𝐨𝐧𝐬𝐭𝐫𝐮𝐞𝐝 𝐚𝐬 𝐢𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭 𝐚𝐝𝐯𝐢𝐜𝐞 𝐭𝐨 𝐦𝐞𝐞𝐭 𝐭𝐡𝐞 𝐬𝐩𝐞𝐜𝐢𝐟𝐢𝐜 𝐧𝐞𝐞𝐝𝐬 𝐨𝐟 𝐚𝐧𝐲 𝐢𝐧𝐝𝐢𝐯𝐢𝐝𝐮𝐚𝐥 𝐨𝐫 𝐬𝐢𝐭𝐮𝐚𝐭𝐢𝐨𝐧. 𝐏𝐚𝐬𝐭 𝐩𝐞𝐫𝐟𝐨𝐫𝐦𝐚𝐧𝐜𝐞 𝐢𝐬 𝐧𝐨 𝐠𝐮𝐚𝐫𝐚𝐧𝐭𝐞𝐞 𝐨𝐟 𝐟𝐮𝐭𝐮𝐫𝐞 𝐫𝐞𝐬𝐮𝐥𝐭𝐬. 𝐈𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧 𝐜𝐨𝐧𝐭𝐚𝐢𝐧𝐞𝐝 𝐢𝐧 𝐭𝐡𝐢𝐬 𝐭𝐰𝐞𝐞𝐭 𝐡𝐚𝐬 𝐛𝐞𝐞𝐧 𝐨𝐛𝐭𝐚𝐢𝐧𝐞𝐝 𝐟𝐫𝐨𝐦 𝐬𝐨𝐮𝐫𝐜𝐞𝐬 𝐛𝐞𝐥𝐢𝐞𝐯𝐞𝐝 𝐭𝐨 𝐛𝐞 𝐫𝐞𝐥𝐢𝐚𝐛𝐥𝐞, 𝐛𝐮𝐭 𝐢𝐬 𝐧𝐨𝐭 𝐠𝐮𝐚𝐫𝐚𝐧𝐭𝐞𝐞𝐝 𝐚𝐬 𝐭𝐨 𝐜𝐨𝐦𝐩𝐥𝐞𝐭𝐞𝐧𝐞𝐬𝐬 𝐨𝐫 𝐚𝐜𝐜𝐮𝐫𝐚𝐜𝐲.  XXXXX engagements  **Related Topics** [asml](/topic/asml) [quarterly earnings](/topic/quarterly-earnings) [$asml](/topic/$asml) [Post Link](https://x.com/DimitryNakhla/status/1937527574285963539)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Dimitry Nakhla | Babylon Capital® @DimitryNakhla on x 14.5K followers

Created: 2025-06-24 15:05:45 UTC

Dimitry Nakhla | Babylon Capital® @DimitryNakhla on x 14.5K followers

Created: 2025-06-24 15:05:45 UTC

A quality valuation analysis on $ASML 🧘🏽♂️

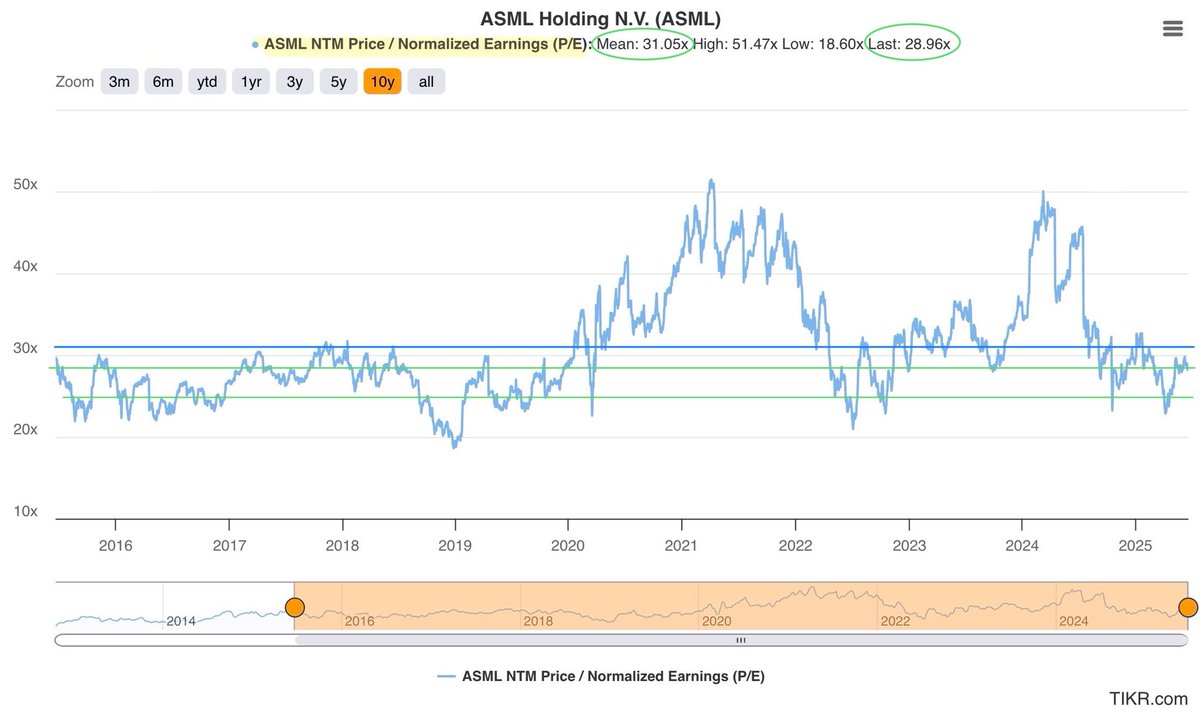

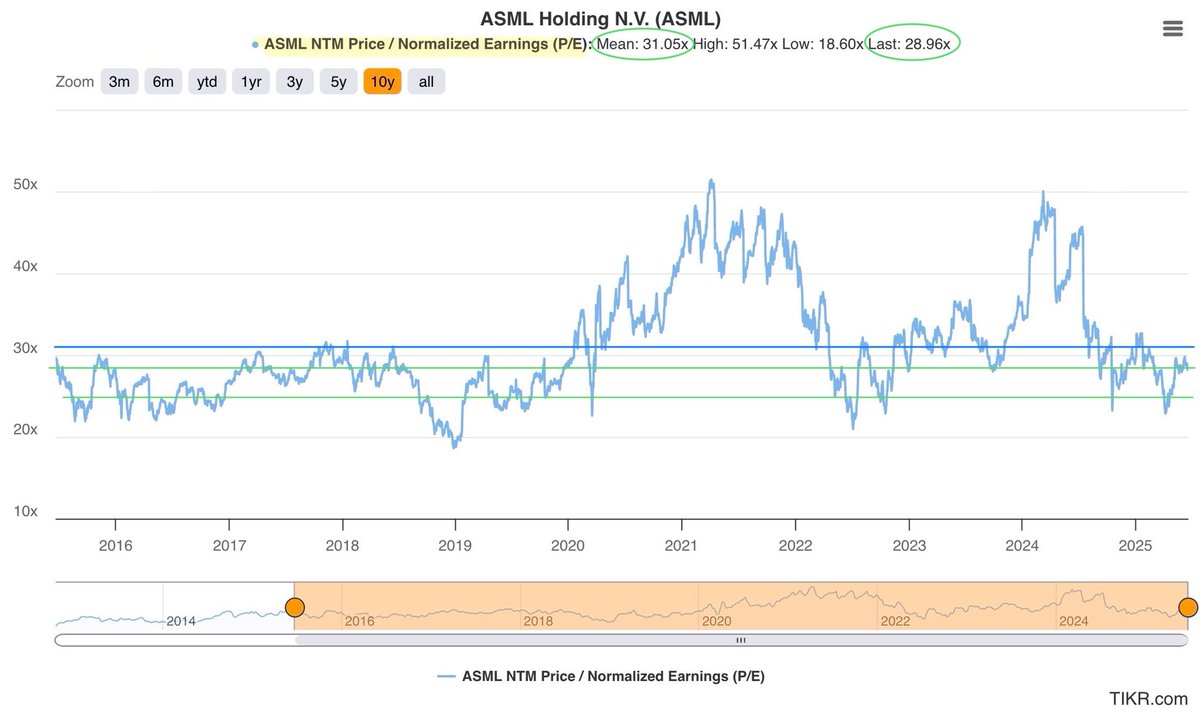

•NTM P/E Ratio: 28.96x •10-Year Mean: 31.05x

•NTM FCF Yield: XXXX% •10-Year Mean: XXXX%

As you can see, $ASML appears to be trading below fair value

Going forward, investors can receive ~7% MORE in earnings per share & ~1% MORE in FCF per share🧠***

Before we get into valuation, let’s take a look at why $ASML is an excellent business (Financials in USD)

BALANCE SHEET✅ •Cash & Short Term Inv: $9.85B •Long-Term Debt: $3.98B

$ASML has a strong balance sheet & 70x FFO Interest Coverage

RETURN ON CAPITAL✅ •2021: XXXX% •2022: XXXX% •2023: XXXX% •2024: XXXX% •LTM: XXXX%

RETURN ON EQUITY✅ •2021: XXXX% •2022: XXXX% •2023: XXXX% •2024: XXXX% •LTM: XXXX%

$ASML has excellent return metrics, highlighting the financial efficiency of the business

REVENUES✅ •2014: $7.09B •2024: $29.28B •CAGR: XXXXX%

FREE CASH FLOW* • $ASML FCF is very sporadic due to heavy capital expenditures & isn’t necessarily the most reliable way to analyze the company’s value

NORMALIZED EPS✅ •2014: $XXXX •2024: $XXXXX •CAGR: XXXXX%

SHARE BUYBACKS✅ •2018 Shares Outstanding: 426.40M •LTM Shares Outstanding: 393.30M

By reducing its shares outstanding ~7.7%, $ASML increased its EPS by ~8.3% (assuming X growth)

MARGINS✅ •LTM Gross Margins: XXXX% •LTM Operating Margins: XXXX% •LTM Net Income Margins: XXXX%

***NOW TO VALUATION 🧠

As stated above, investors can expect to receive ~7% MORE in EPS & X% MORE in FCF per share

Using Benjamin Graham’s 2G rule of thumb, $ASML has to grow earnings at a XXXXX% CAGR over the next several years to justify its valuation

Today, analysts anticipate 2025 - 2027 EPS growth over the next few years to be more than the (14.48%) required growth rate:

2025E: $XXXXX (22.0% YoY) *FY Dec 2026E: $XXXXX (13.8% YoY) 2027E: $XXXXX (21.3% YoY)

$ASML has a decent track record of meeting analyst estimates 2 years out. HOWEVER, let’s be conservative & assume $ASML ends 2027 with $35.00*** in EPS (6% below current estimates) & see its CAGR potential assuming different multiples:

31x P/E: $1,085💵 … ~13.4% CAGR

30x P/E: $1,050💵 … ~12.0% CAGR

29x P/E: $1,015💵 … ~10.5% CAGR

28x P/E: $980💵 … ~9.0% CAGR

27x P/E: $945💵 … ~7.5% CAGR

As you can see, $ASML appears to have attractive return potential if we assume greater or equal to 29x EPS (below its 10-year mean, current multiple, & justified given its quality, moat & growth rate)

Today at $807💵 $ASML appears to be a good consideration for investment, albeit with extreme volatility

Less than X months ago (in the latest $ASML analysis) I stated:

“Today at $687💵 $ASML appears to be a strong consideration for investment”

Of course $ASML was a much better deal then, yet those looking to accumulate today can account for a margin of safety by accumulating in tranches (e.g. 1/3 at $807, 1/3 at $710, 1/3 at $625)

#stocks #investing

𝐃𝐈𝐒𝐂𝐋𝐎𝐒𝐔𝐑𝐄‼️: 𝐓𝐡𝐢𝐬 𝐢𝐬 𝐍𝐎𝐓 𝐈𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭 𝐀𝐝𝐯𝐢𝐜𝐞. 𝐁𝐚𝐛𝐲𝐥𝐨𝐧 𝐂𝐚𝐩𝐢𝐭𝐚𝐥® 𝐚𝐧𝐝 𝐢𝐭𝐬 𝐫𝐞𝐩𝐫𝐞𝐬𝐞𝐧𝐭𝐚𝐭𝐢𝐯𝐞𝐬 𝐦𝐚𝐲 𝐡𝐚𝐯𝐞 𝐩𝐨𝐬𝐢𝐭𝐢𝐨𝐧𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐬𝐞𝐜𝐮𝐫𝐢𝐭𝐢𝐞𝐬 𝐝𝐢𝐬𝐜𝐮𝐬𝐬𝐞𝐝 𝐢𝐧 𝐭𝐡𝐢𝐬 𝐭𝐰𝐞𝐞𝐭.

𝐓𝐡𝐞 𝐢𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧 𝐜𝐨𝐧𝐭𝐚𝐢𝐧𝐞𝐝 𝐢𝐧 𝐭𝐡𝐢𝐬 𝐭𝐰𝐞𝐞𝐭 𝐢𝐬 𝐢𝐧𝐭𝐞𝐧𝐝𝐞𝐝 𝐟𝐨𝐫 𝐢𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧𝐚𝐥 𝐩𝐮𝐫𝐩𝐨𝐬𝐞𝐬 𝐨𝐧𝐥𝐲 𝐚𝐧𝐝 𝐬𝐡𝐨𝐮𝐥𝐝 𝐧𝐨𝐭 𝐛𝐞 𝐜𝐨𝐧𝐬𝐭𝐫𝐮𝐞𝐝 𝐚𝐬 𝐢𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭 𝐚𝐝𝐯𝐢𝐜𝐞 𝐭𝐨 𝐦𝐞𝐞𝐭 𝐭𝐡𝐞 𝐬𝐩𝐞𝐜𝐢𝐟𝐢𝐜 𝐧𝐞𝐞𝐝𝐬 𝐨𝐟 𝐚𝐧𝐲 𝐢𝐧𝐝𝐢𝐯𝐢𝐝𝐮𝐚𝐥 𝐨𝐫 𝐬𝐢𝐭𝐮𝐚𝐭𝐢𝐨𝐧. 𝐏𝐚𝐬𝐭 𝐩𝐞𝐫𝐟𝐨𝐫𝐦𝐚𝐧𝐜𝐞 𝐢𝐬 𝐧𝐨 𝐠𝐮𝐚𝐫𝐚𝐧𝐭𝐞𝐞 𝐨𝐟 𝐟𝐮𝐭𝐮𝐫𝐞 𝐫𝐞𝐬𝐮𝐥𝐭𝐬.

𝐈𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧 𝐜𝐨𝐧𝐭𝐚𝐢𝐧𝐞𝐝 𝐢𝐧 𝐭𝐡𝐢𝐬 𝐭𝐰𝐞𝐞𝐭 𝐡𝐚𝐬 𝐛𝐞𝐞𝐧 𝐨𝐛𝐭𝐚𝐢𝐧𝐞𝐝 𝐟𝐫𝐨𝐦 𝐬𝐨𝐮𝐫𝐜𝐞𝐬 𝐛𝐞𝐥𝐢𝐞𝐯𝐞𝐝 𝐭𝐨 𝐛𝐞 𝐫𝐞𝐥𝐢𝐚𝐛𝐥𝐞, 𝐛𝐮𝐭 𝐢𝐬 𝐧𝐨𝐭 𝐠𝐮𝐚𝐫𝐚𝐧𝐭𝐞𝐞𝐝 𝐚𝐬 𝐭𝐨 𝐜𝐨𝐦𝐩𝐥𝐞𝐭𝐞𝐧𝐞𝐬𝐬 𝐨𝐫 𝐚𝐜𝐜𝐮𝐫𝐚𝐜𝐲.

XXXXX engagements

Related Topics asml quarterly earnings $asml