[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Elite🏝 [@Eliteonchain](/creator/twitter/Eliteonchain) on x 22.3K followers Created: 2025-06-23 13:52:53 UTC Ethereum spot ETFs recorded $40.24M in net inflows from June 16–20, according to coinglass. Here’s the breakdown: • BlackRock ($ETHA): +$48.19M last week → Total inflow: $5.28B • Grayscale ETH Mini: +$10.59M → Cumulative: $745M • Fidelity ($FETH): –$14.91M this week → Still at $1.58B total inflow Despite mixed flows, the market-wide ETF NAV now stands at $9.6B, representing XXXX% of $ETH’s total market cap. How this impacts $ETH's price: X. These ETFs buy real $ETH — reducing liquid supply X. Institutions don’t trade — they accumulate and hold X. $ETH already has low float (due to staking & burning) X. ETF demand tightens the market further Big Picture: $ETH’s price hasn’t moved much — yet. But ETF flows are slow, steady, and sticky. They’re setting a new demand floor that could push $ETH higher over time. So chads, what do you think? Are ETFs bullish or already priced in? Drop your thoughts👇  XXXXXX engagements  **Related Topics** [$eths](/topic/$eths) [$96b](/topic/$96b) [nav](/topic/nav) [fund manager](/topic/fund-manager) [$158b](/topic/$158b) [$1491m](/topic/$1491m) [$745m](/topic/$745m) [$1059m](/topic/$1059m) [Post Link](https://x.com/Eliteonchain/status/1937146845542732035)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Elite🏝 @Eliteonchain on x 22.3K followers

Created: 2025-06-23 13:52:53 UTC

Elite🏝 @Eliteonchain on x 22.3K followers

Created: 2025-06-23 13:52:53 UTC

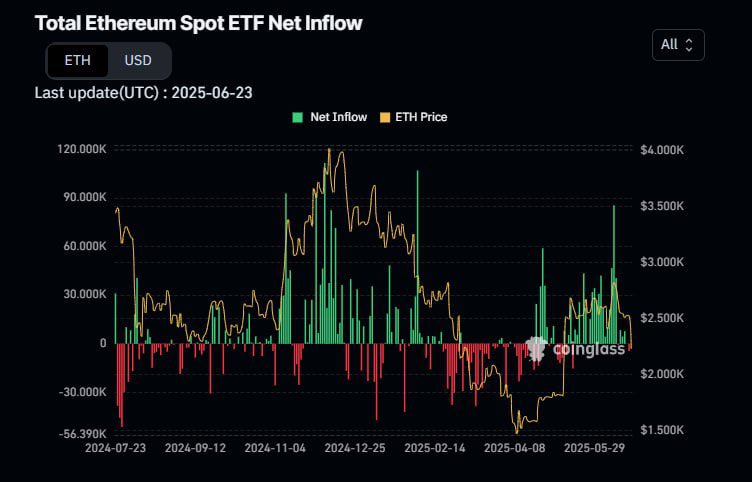

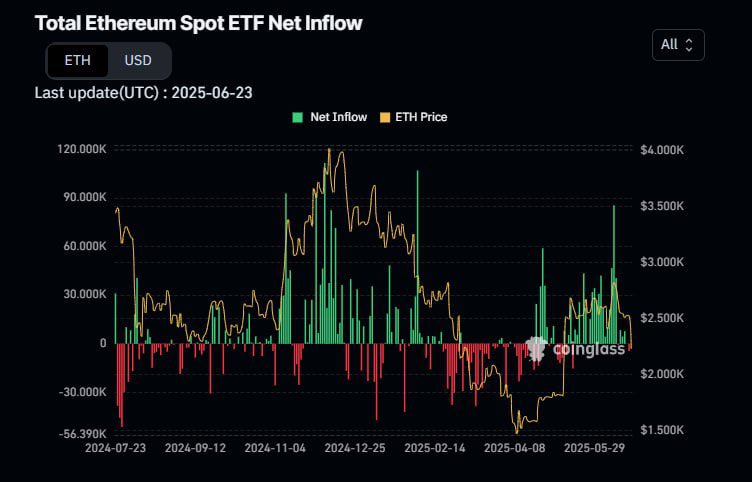

Ethereum spot ETFs recorded $40.24M in net inflows from June 16–20, according to coinglass.

Here’s the breakdown:

• BlackRock ($ETHA): +$48.19M last week → Total inflow: $5.28B • Grayscale ETH Mini: +$10.59M → Cumulative: $745M • Fidelity ($FETH): –$14.91M this week → Still at $1.58B total inflow

Despite mixed flows, the market-wide ETF NAV now stands at $9.6B, representing XXXX% of $ETH’s total market cap.

How this impacts $ETH's price:

X. These ETFs buy real $ETH — reducing liquid supply

X. Institutions don’t trade — they accumulate and hold

X. $ETH already has low float (due to staking & burning)

X. ETF demand tightens the market further

Big Picture:

$ETH’s price hasn’t moved much — yet. But ETF flows are slow, steady, and sticky. They’re setting a new demand floor that could push $ETH higher over time.

So chads, what do you think? Are ETFs bullish or already priced in?

Drop your thoughts👇

XXXXXX engagements

Related Topics $eths $96b nav fund manager $158b $1491m $745m $1059m