[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Cheeezzyyyy [@0xCheeezzyyyy](/creator/twitter/0xCheeezzyyyy) on x 6780 followers Created: 2025-06-16 13:23:56 UTC RWA-Fi on @arbitrum is quietly scaling with maturity. Since Q3 2024, the sector has grown steadily reaching new ATH TVL of ~$263M across XX tokenised real-world assets. Current breakdown shows institutional traction & asset diversity: 🔸 US Treasuries: XX% ($173.3M) driven by institutional-grade funds 🔸 EU Treasuries: XXXX% ($84M) led by @Spiko_finance’s $EUTBL 🔸 Real Estate: XXX% ($4.8M) 🔸 Equities/Indices: <0.5% (~$1M) Notably, the ecosystem’s depth has matured w/ new verticals taking shape beyond basic RWA exposure: X. (Leading) Institutional Funds: 🔹 @BlackRock: $BUIDL fund exposed to ST low-risk T-bills 🔹@FTI_Global: $BENJI fund offering onchain access to onchain US Govt. Money Fund (FOXBB) 🔹@WisdomTreeFunds: Access to XX tokenised funds incl. equities, fixed income etc. 🔹Wellington Management: ULTRA Fund → US Treasury securities, (reverse) repos & cash reserves X. Tokenised Yield & Treasuries: 🔹@OndoFinance: $USDY stablecoin backed by US T-bills 🔹@OpenEden_X: $TBILL backed by US T-bills w/ real-time Proof-of-Reserves 🔹@Spiko_finance: $USTBL & $EUTBL tokenised money market fund X. Real Estate / Alternative Assets: 🔹@EstateProtocol: Tokenised residential & commercial properties 🔹Libre Capital: Private credit, hedge fund & real estate w/ insti-partnerships (Brevan Howard & Hamilton Lane) X. Equities & Private Credit: 🔹@BackedFi: Tokenised ETFs & stocks 🔹@BerryInvesting: Tokenised stocks, ETFs & MMFs 🔹@centrifuge: Real-world credit & debt pools 🔹@DinariGlobal: Tokenisation of public company shares 🔹@DigiFTTech: Regulated exchange for tokenised securities (issuance + secondary trading) X. DeFi-Native: 🔹 @GainsNetwork_io: Forex, commodities & crypto perps 🔹 @OstiumLabs: Perps trading + RWA asset collateralisation ----- These are early signals pointing toward Arbitrum becoming the de facto L2 for RWA liquidity where traditional capital meets DeFi-native programmability. Still early & uponly from here imo. h/t @EntropyAdvisors for the @Dune insights  XXXXXX engagements  **Related Topics** [eutbl](/topic/eutbl) [coins real estate](/topic/coins-real-estate) [$84m](/topic/$84m) [$1733m](/topic/$1733m) [coins real world assets](/topic/coins-real-world-assets) [realworld](/topic/realworld) [$263m](/topic/$263m) [tvl](/topic/tvl) [Post Link](https://x.com/0xCheeezzyyyy/status/1934602848421159009)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Cheeezzyyyy @0xCheeezzyyyy on x 6780 followers

Created: 2025-06-16 13:23:56 UTC

Cheeezzyyyy @0xCheeezzyyyy on x 6780 followers

Created: 2025-06-16 13:23:56 UTC

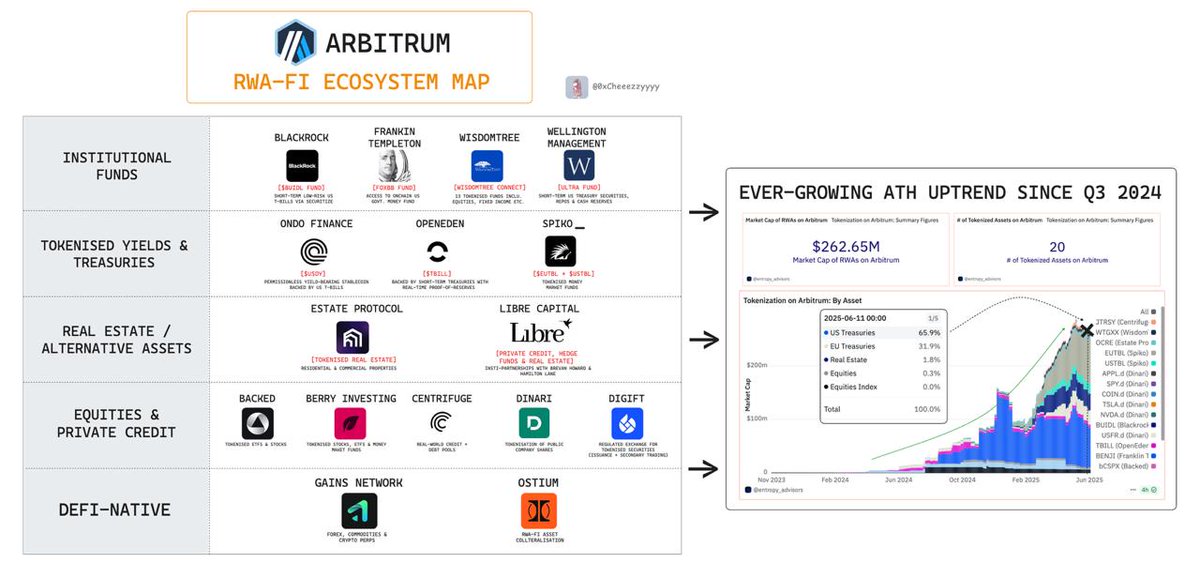

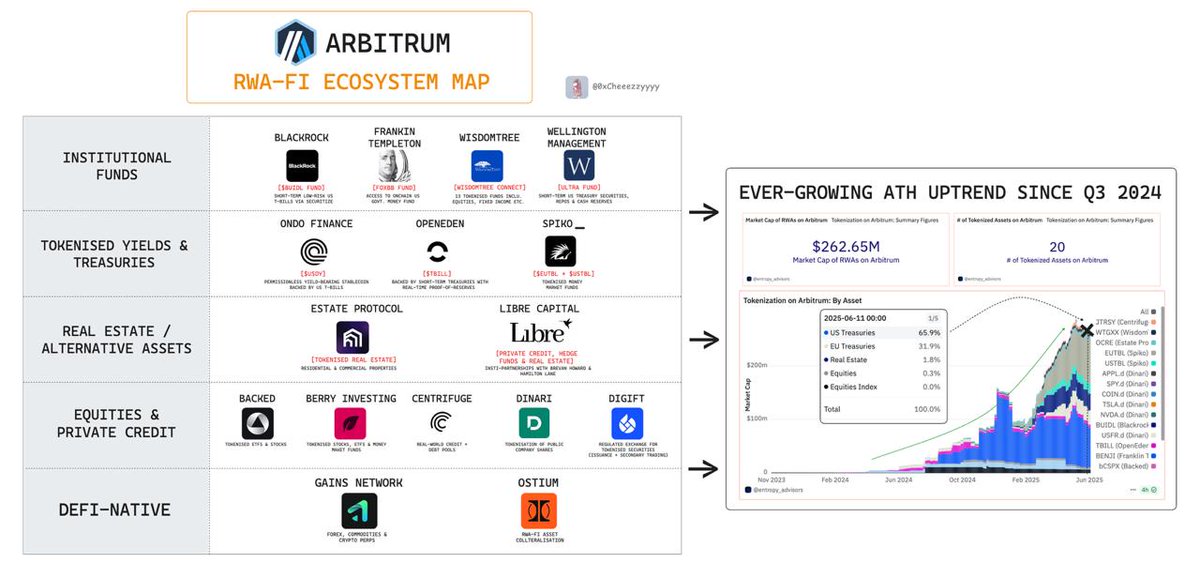

RWA-Fi on @arbitrum is quietly scaling with maturity.

Since Q3 2024, the sector has grown steadily reaching new ATH TVL of ~$263M across XX tokenised real-world assets.

Current breakdown shows institutional traction & asset diversity:

🔸 US Treasuries: XX% ($173.3M) driven by institutional-grade funds 🔸 EU Treasuries: XXXX% ($84M) led by @Spiko_finance’s $EUTBL 🔸 Real Estate: XXX% ($4.8M) 🔸 Equities/Indices: <0.5% (~$1M)

Notably, the ecosystem’s depth has matured w/ new verticals taking shape beyond basic RWA exposure:

X. (Leading) Institutional Funds: 🔹 @BlackRock: $BUIDL fund exposed to ST low-risk T-bills 🔹@FTI_Global: $BENJI fund offering onchain access to onchain US Govt. Money Fund (FOXBB) 🔹@WisdomTreeFunds: Access to XX tokenised funds incl. equities, fixed income etc. 🔹Wellington Management: ULTRA Fund → US Treasury securities, (reverse) repos & cash reserves

X. Tokenised Yield & Treasuries: 🔹@OndoFinance: $USDY stablecoin backed by US T-bills 🔹@OpenEden_X: $TBILL backed by US T-bills w/ real-time Proof-of-Reserves 🔹@Spiko_finance: $USTBL & $EUTBL tokenised money market fund

X. Real Estate / Alternative Assets: 🔹@EstateProtocol: Tokenised residential & commercial properties 🔹Libre Capital: Private credit, hedge fund & real estate w/ insti-partnerships (Brevan Howard & Hamilton Lane)

X. Equities & Private Credit: 🔹@BackedFi: Tokenised ETFs & stocks 🔹@BerryInvesting: Tokenised stocks, ETFs & MMFs 🔹@centrifuge: Real-world credit & debt pools 🔹@DinariGlobal: Tokenisation of public company shares 🔹@DigiFTTech: Regulated exchange for tokenised securities (issuance + secondary trading)

X. DeFi-Native: 🔹 @GainsNetwork_io: Forex, commodities & crypto perps 🔹 @OstiumLabs: Perps trading + RWA asset collateralisation

These are early signals pointing toward Arbitrum becoming the de facto L2 for RWA liquidity where traditional capital meets DeFi-native programmability.

Still early & uponly from here imo.

h/t @EntropyAdvisors for the @Dune insights

XXXXXX engagements

Related Topics eutbl coins real estate $84m $1733m coins real world assets realworld $263m tvl