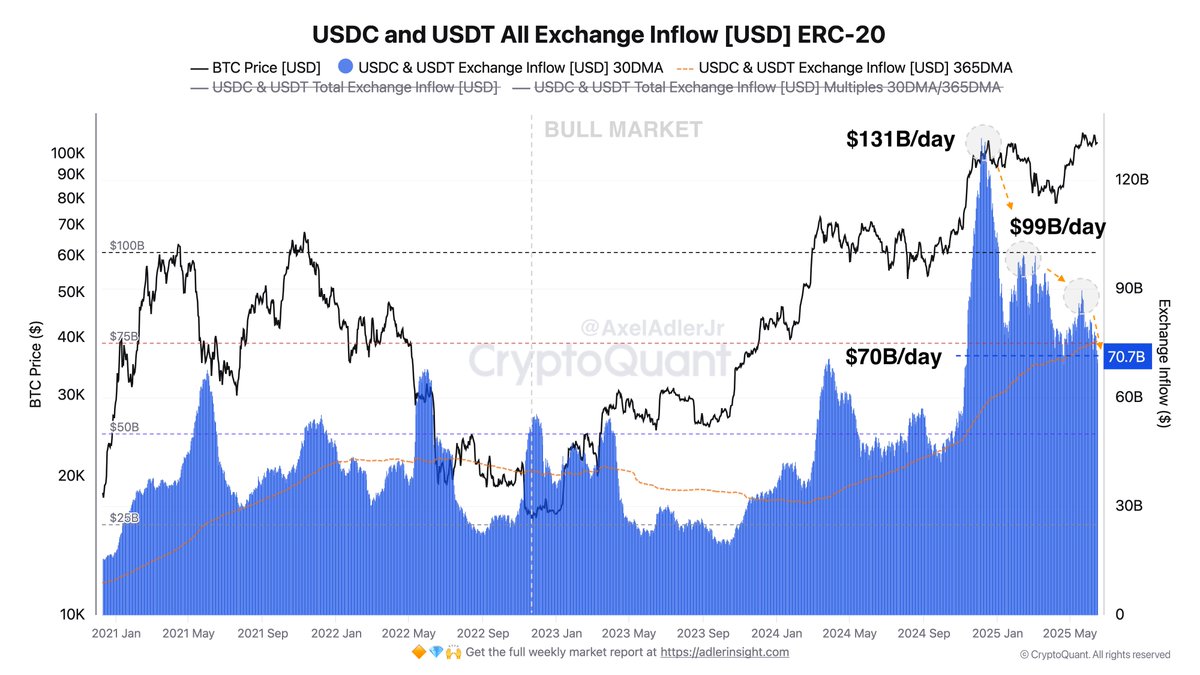

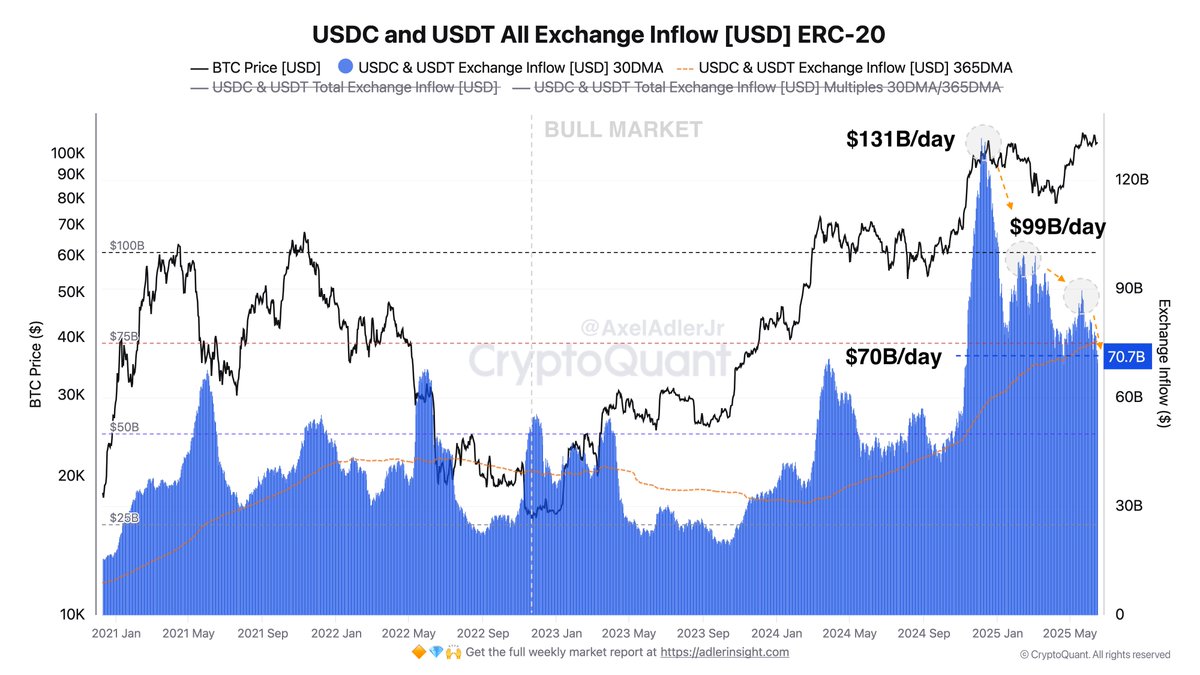

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Axel 💎🙌 Adler Jr [@AxelAdlerJr](/creator/twitter/AxelAdlerJr) on x 25.9K followers Created: 2025-06-16 06:27:03 UTC In December 2024, when BTC was trading between $98K and $100K, average daily inflows of USDT and USDC into all centralized exchanges (CEXs) reached a record high of $131B. By June, that figure had dropped to $70B per day - $5B below the 365-day average of $75B and $61B below the peak. This represents a sustained slowdown in exchange-directed liquidity compared to the beginning of the year, although current levels still remain significantly higher than those seen at the start of the bull cycle. The decline reflects a natural cooling of excess bullish momentum, while BTC remaining above $100K signals that market participants are willing to maintain positions and limit selling. We are currently witnessing a phase of consolidation and base-building ahead of the next move.  XXXXX engagements  **Related Topics** [$61b](/topic/$61b) [$75b](/topic/$75b) [$5b](/topic/$5b) [$70b](/topic/$70b) [$131b](/topic/$131b) [exchanges cexs](/topic/exchanges-cexs) [exchanges](/topic/exchanges) [usdt](/topic/usdt) [Post Link](https://x.com/AxelAdlerJr/status/1934497935598731552)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Axel 💎🙌 Adler Jr @AxelAdlerJr on x 25.9K followers

Created: 2025-06-16 06:27:03 UTC

Axel 💎🙌 Adler Jr @AxelAdlerJr on x 25.9K followers

Created: 2025-06-16 06:27:03 UTC

In December 2024, when BTC was trading between $98K and $100K, average daily inflows of USDT and USDC into all centralized exchanges (CEXs) reached a record high of $131B. By June, that figure had dropped to $70B per day - $5B below the 365-day average of $75B and $61B below the peak. This represents a sustained slowdown in exchange-directed liquidity compared to the beginning of the year, although current levels still remain significantly higher than those seen at the start of the bull cycle.

The decline reflects a natural cooling of excess bullish momentum, while BTC remaining above $100K signals that market participants are willing to maintain positions and limit selling.

We are currently witnessing a phase of consolidation and base-building ahead of the next move.

XXXXX engagements

Related Topics $61b $75b $5b $70b $131b exchanges cexs exchanges usdt