[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  AMARAL Capital [@AmaralPartners](/creator/twitter/AmaralPartners) on x XXX followers Created: 2025-06-12 00:14:56 UTC 2/x - MPT's FCF ( - ) & Does Not "Cover" Existing Dividend - OCF was nearly zero in Q1:25, - MPT burned nearly ~$100MM in the quarter before WC and dividends, - We estimate >$100MM of tenant support + other "CAPX" spending in the quarter w/ no new WC loans repaid, - "Burn" worse once reflecting full quarter of new higher interest cost (est. ~$125MM/qtr.), - Even including new ML1 "rent," which will require more tenant support, FCF still ( - ), and - Given that MPT cannot afford the dividend today with low-growth cash flow, a higher share count post-raise will assuredly require another dividend cut. The new bonds have a cumulative ~$1.547BN restricted payments basket over X years (0.32/sh x 600MM shares x X years = already ~$1.3BN).  XXX engagements  **Related Topics** [$125mmqtr](/topic/$125mmqtr) [$100mm](/topic/$100mm) [dividend](/topic/dividend) [Post Link](https://x.com/AmaralPartners/status/1932954737156161674)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

AMARAL Capital @AmaralPartners on x XXX followers

Created: 2025-06-12 00:14:56 UTC

AMARAL Capital @AmaralPartners on x XXX followers

Created: 2025-06-12 00:14:56 UTC

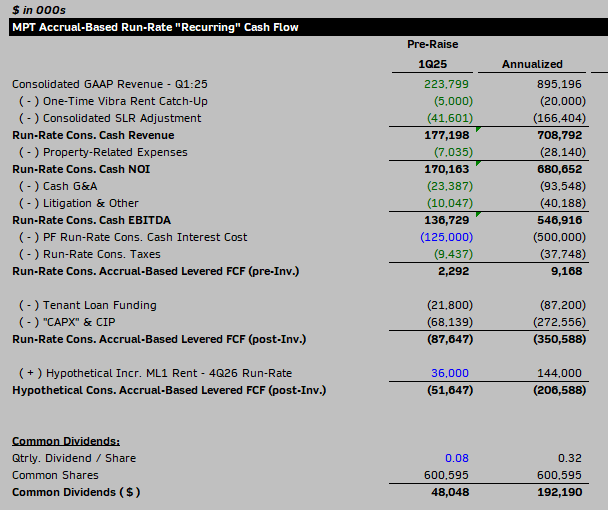

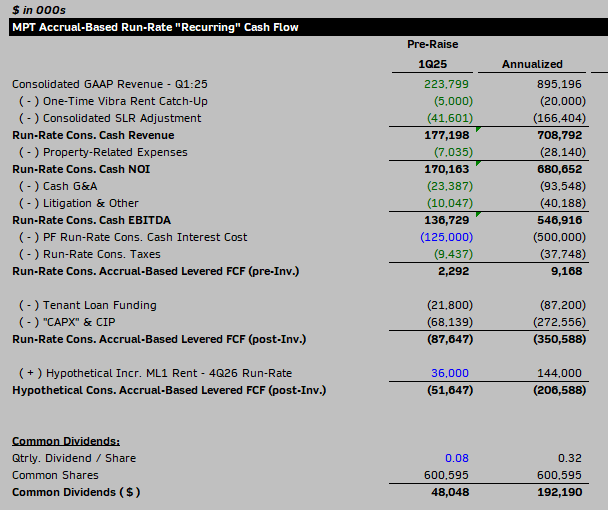

2/x - MPT's FCF ( - ) & Does Not "Cover" Existing Dividend

- OCF was nearly zero in Q1:25,

- MPT burned nearly ~$100MM in the quarter before WC and dividends,

- We estimate >$100MM of tenant support + other "CAPX" spending in the quarter w/ no new WC loans repaid,

- "Burn" worse once reflecting full quarter of new higher interest cost (est. ~$125MM/qtr.),

- Even including new ML1 "rent," which will require more tenant support, FCF still ( - ), and

- Given that MPT cannot afford the dividend today with low-growth cash flow, a higher share count post-raise will assuredly require another dividend cut. The new bonds have a cumulative ~$1.547BN restricted payments basket over X years (0.32/sh x 600MM shares x X years = already ~$1.3BN).

XXX engagements