[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  LIBERTUM [@libertum_token](/creator/twitter/libertum_token) on x 12.4K followers Created: 2025-06-07 09:08:30 UTC 🚀 Getting Started with B-DEX: Your Step-by-Step Guide to Investing in Tokenized Real-World Assets 🌍 Libertum’s RWA Bonding DEX (B-DEX) is now live — enabling investors to earn real yield from tokenized real estate and other real-world assets through AI Manging Agents, with full flexibility and 24/7 liquidity. Here’s a quick guide to help you invest in your first RWA bonding token, like JVC100 — our debut asset managing a unit in Jumeirah Village Circle, Dubai: ✅ Step-by-Step: How to Invest in B-DEX 1️⃣ Get USDC on Base Chain You’ll need USDC on the Base network. If you don’t have it yet, we recommend using Synapse Protocol to bridge from Ethereum or other chains. #USDC @USDC 2️⃣ Visit the Bonding DEX At launch (June 10), we’ll share the official B-DEX link. Stay tuned! 3️⃣ Connect Your Wallet Use MetaMask or any Web3 wallet. Ensure your wallet is switched to Base Chain. @base 4️⃣ Select Your Token (e.g., JVC100) Browse available bonded tokens. JVC100 is our first — backed by real real estate and offering ~8% APY. 5️⃣ Choose Your Allocation Each token represents $XXX of asset value. Decide how many you want to purchase. 6️⃣ Confirm & Buy Approve the transaction and make sure to have a small amount of ETH on Base to cover gas/network fees. 7️⃣ Wait for Bonding Confirmation Once your bonding token is fully bonded, it will become active for staking and trading. 8️⃣ Stake Your Tokens Head to the Staking Portal, select your bonding token (e.g., JVC100), and stake to start earning yield in USDC. 9️⃣ Enjoy APY + Liquidity You’ll earn passive income via APY — and you can unstake, sell, or trade tokens anytime on Uniswap. It’s real yield with full flexibility. @Uniswap 💡 Why B-DEX? ✅ AI Managing Agent looking after the real-world assets 💰 Yield in stablecoins 🔁 No lockups. No Manipulation 🔥 Undistributed yield is used to buy & burn tokens 🌍 Real estate meets Web3 — the way it should Have questions? Drop us a message or head to to learn more. #BDEX #Libertum #RWA #RealWorldAssets #Tokenization #CryptoInvesting #BaseChain #USDC #DeFi #YieldFarming #RealEstateOnChain #Web3 #CryptoGuide #HowToInvest  XXXXXX engagements  **Related Topics** [token](/topic/token) [coins ai](/topic/coins-ai) [coins real estate](/topic/coins-real-estate) [bonding](/topic/bonding) [rwa](/topic/rwa) [coins real world assets](/topic/coins-real-world-assets) [realworld](/topic/realworld) [tokenized](/topic/tokenized) [Post Link](https://x.com/libertum_token/status/1931277074649460749)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

LIBERTUM @libertum_token on x 12.4K followers

Created: 2025-06-07 09:08:30 UTC

LIBERTUM @libertum_token on x 12.4K followers

Created: 2025-06-07 09:08:30 UTC

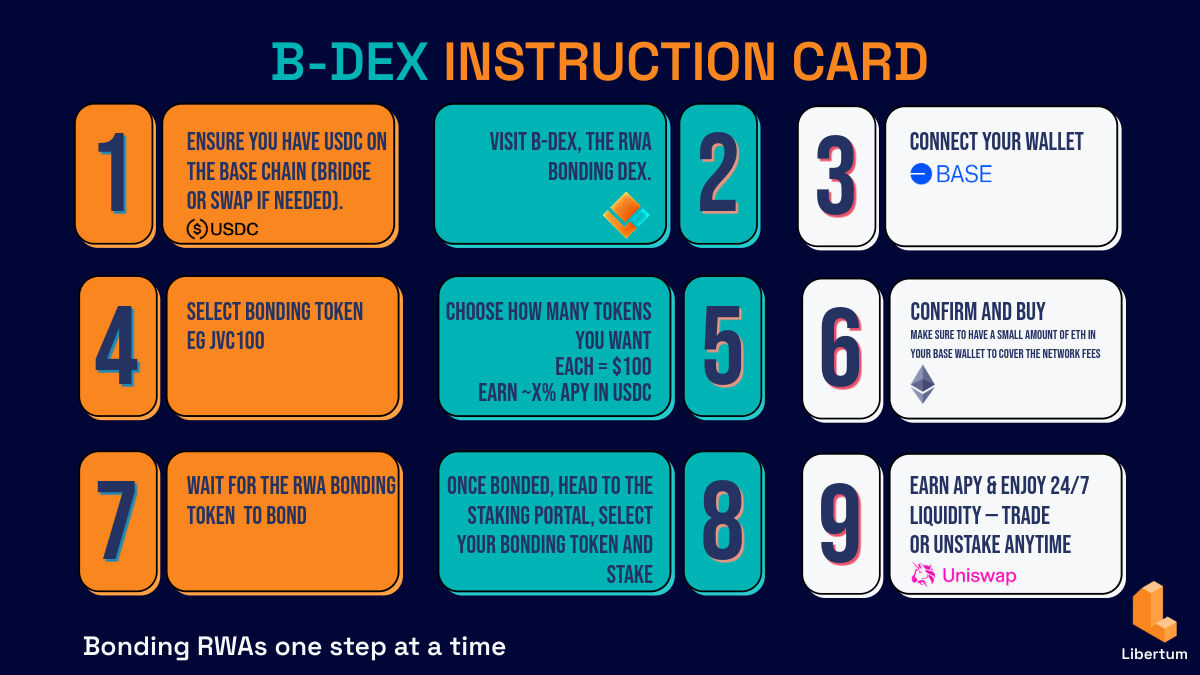

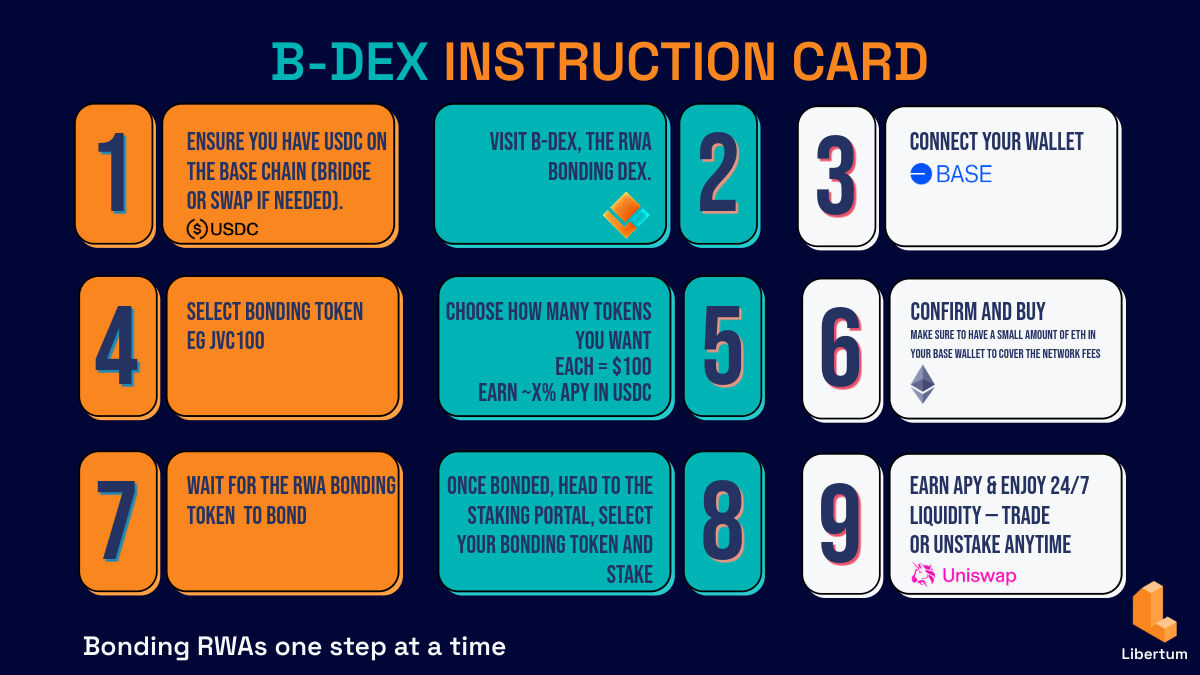

🚀 Getting Started with B-DEX: Your Step-by-Step Guide to Investing in Tokenized Real-World Assets 🌍

Libertum’s RWA Bonding DEX (B-DEX) is now live — enabling investors to earn real yield from tokenized real estate and other real-world assets through AI Manging Agents, with full flexibility and 24/7 liquidity.

Here’s a quick guide to help you invest in your first RWA bonding token, like JVC100 — our debut asset managing a unit in Jumeirah Village Circle, Dubai:

✅ Step-by-Step: How to Invest in B-DEX 1️⃣ Get USDC on Base Chain You’ll need USDC on the Base network. If you don’t have it yet, we recommend using Synapse Protocol to bridge from Ethereum or other chains. #USDC @USDC

2️⃣ Visit the Bonding DEX At launch (June 10), we’ll share the official B-DEX link. Stay tuned!

3️⃣ Connect Your Wallet Use MetaMask or any Web3 wallet. Ensure your wallet is switched to Base Chain. @base

4️⃣ Select Your Token (e.g., JVC100) Browse available bonded tokens. JVC100 is our first — backed by real real estate and offering ~8% APY.

5️⃣ Choose Your Allocation Each token represents $XXX of asset value. Decide how many you want to purchase.

6️⃣ Confirm & Buy Approve the transaction and make sure to have a small amount of ETH on Base to cover gas/network fees.

7️⃣ Wait for Bonding Confirmation Once your bonding token is fully bonded, it will become active for staking and trading.

8️⃣ Stake Your Tokens Head to the Staking Portal, select your bonding token (e.g., JVC100), and stake to start earning yield in USDC.

9️⃣ Enjoy APY + Liquidity You’ll earn passive income via APY — and you can unstake, sell, or trade tokens anytime on Uniswap. It’s real yield with full flexibility. @Uniswap

💡 Why B-DEX?

✅ AI Managing Agent looking after the real-world assets

💰 Yield in stablecoins

🔁 No lockups. No Manipulation

🔥 Undistributed yield is used to buy & burn tokens

🌍 Real estate meets Web3 — the way it should

Have questions? Drop us a message or head to to learn more.

#BDEX #Libertum #RWA #RealWorldAssets #Tokenization #CryptoInvesting #BaseChain #USDC #DeFi #YieldFarming #RealEstateOnChain #Web3 #CryptoGuide #HowToInvest

XXXXXX engagements

Related Topics token coins ai coins real estate bonding rwa coins real world assets realworld tokenized