[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  LTValue [@qualitybargain](/creator/twitter/qualitybargain) on x 2283 followers Created: 2025-06-04 23:30:14 UTC Quick look at Bel Fuse (class B shares, ticker $BELFB), an ok quality (and improving) connectors business trading at a reasonable valuation. Have been following it for some time now. Market cap is $915m, not covered all that well. ADV is ~$5.8m so big enough now that slightly larger funds can look at it. Business has been around for a long time (>70 years), was family owned and only had X CEOs during that period. Farouq joined in 2021 as a strategic advisor of some kind and catalysed effort to turn the business around. Made many successful changes (go read the posts and commentary on VIC for further background on what happened). Farouq was recently named CEO in 2025 and currently owns ~$4.5m of stock. There is still some low-hanging fruit left to go but focus is shifting on growth and operating leverage. Class-B is more liquid and entitled to receive slightly higher (by 5%) dividend than Class-A but has no voting rights. ~55% of the business is in 'harsh environment' which is high quality (specc'd in high failure products with long demand visibility, mostly sole source, low competition). Mostly defence, aerospace, rail, and e-mobility. X% is low quality (consumer). Rest (areas like test and measurement, automation, ag) is somewhere in the middle. Has a decent ROIC of ~12-15%. Quite working capital intensive and cash conversion is a bit lumpy - so not the highest quality business, but it's ok. Trades at ~9.5x NTM EBITDA and ~12-13x PE. Connectors market is highly fragmented with only a few large, listed players. Amphenol trades at ~20x EBITDA with similar ~40% gross margin but has captured AI tailwinds so growing much faster, and higher operating margins of ~20% (vs. Bel at XX% in FY24). The others are ~12x EBITDA which is closer to where I think an improved Bel should trade. Gross margins of Bel used to be terrible. Now at ~38% (Amphenol is ~35%) they are in upper quartile of industry (went through process of removing negative SKU-level data after integrating ERPs to one system, some pricing). Recent X years has seen cyclical weakness (in networking end market and across the distribution channel) due to post-COVID over-ordering. Order dynamics now positive again and business has at least stabilised. There's more to go on fundamental margin improvement with procurement over the next 12-18m (price negotiation, spend consolidation, identifying of alternate suppliers, automation and other cost optimization opportunities). Otherwise with top-line returning to growth I think the business has path to get to ~18-20% operating margin by ~FY29 as R&D and SG&A is reasonably stable. There is also a meaningful improvement opportunity on working capital (elevated currently at ~33% of revenue due to excess inventory and not much effort made yet on optimising receivables) which should be a benefit to cash conversion as some of those items normalise (should go back towards ~25%). So assuming that margin story plays out, no hiccups on integration of Enercon, and business grows top-line ~MSD in FY26-29, then returns look decent today (~mid-teens IRR) even with no multiple expansion (as this case implies low-teens EPS growth, towards mid-teens if allocating some FCF to buybacks). EBITDA growth is higher mainly due to FY25 step-up from the recent Enercon deal, which I don't think is being fully appreciated by the market currently. More bullish case is that you also get multiple expansion to ~12x EBITDA, in which case the returns are more attractive. Tariffs are a potential risk (25% of sales come into the US from other countries, of that ~10% comes from China, balance is Europe, India, Israel, Mexico). Was plenty of discussion on Q1 2025 earnings call. Other risks would be 1) end markets remain cyclically weak for longer than expected or 2) operating leverage doesn't come through as top-line recovers. I have a small position in PA, for a while was not sure what to do with it and didn't have much clarity on business quality or demand trends, but after doing more work and speaking to mgmt, feel more inclined to hold onto it. Don't think conviction is there yet for a larger, concentrated holding though. Disclaimer: not investment advice, do your own work.  XXXXX engagements  **Related Topics** [$58m](/topic/$58m) [$915m](/topic/$915m) [market cap](/topic/market-cap) [$belfb](/topic/$belfb) [ticker](/topic/ticker) [stocks](/topic/stocks) [bel](/topic/bel) [Post Link](https://x.com/qualitybargain/status/1930406771576975641)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

LTValue @qualitybargain on x 2283 followers

Created: 2025-06-04 23:30:14 UTC

LTValue @qualitybargain on x 2283 followers

Created: 2025-06-04 23:30:14 UTC

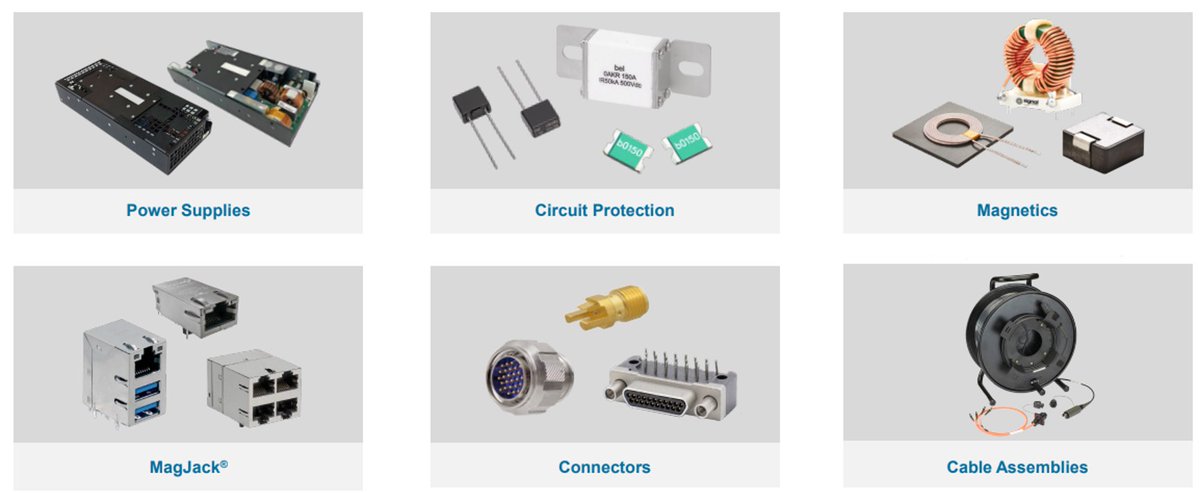

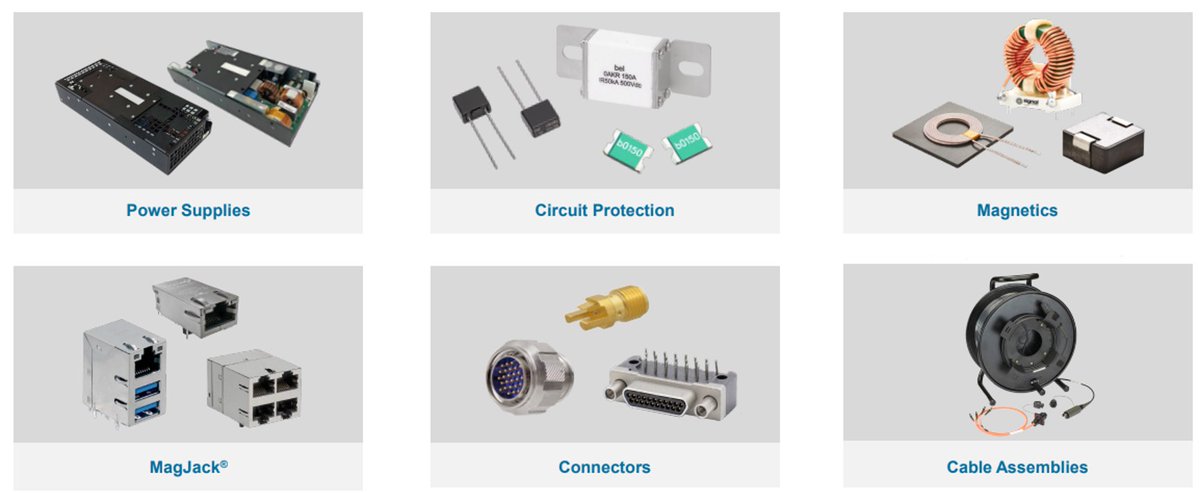

Quick look at Bel Fuse (class B shares, ticker $BELFB), an ok quality (and improving) connectors business trading at a reasonable valuation. Have been following it for some time now.

Market cap is $915m, not covered all that well. ADV is ~$5.8m so big enough now that slightly larger funds can look at it. Business has been around for a long time (>70 years), was family owned and only had X CEOs during that period. Farouq joined in 2021 as a strategic advisor of some kind and catalysed effort to turn the business around. Made many successful changes (go read the posts and commentary on VIC for further background on what happened). Farouq was recently named CEO in 2025 and currently owns ~$4.5m of stock. There is still some low-hanging fruit left to go but focus is shifting on growth and operating leverage.

Class-B is more liquid and entitled to receive slightly higher (by 5%) dividend than Class-A but has no voting rights.

~55% of the business is in 'harsh environment' which is high quality (specc'd in high failure products with long demand visibility, mostly sole source, low competition). Mostly defence, aerospace, rail, and e-mobility. X% is low quality (consumer). Rest (areas like test and measurement, automation, ag) is somewhere in the middle.

Has a decent ROIC of ~12-15%. Quite working capital intensive and cash conversion is a bit lumpy - so not the highest quality business, but it's ok.

Trades at ~9.5x NTM EBITDA and ~12-13x PE. Connectors market is highly fragmented with only a few large, listed players. Amphenol trades at ~20x EBITDA with similar ~40% gross margin but has captured AI tailwinds so growing much faster, and higher operating margins of ~20% (vs. Bel at XX% in FY24). The others are ~12x EBITDA which is closer to where I think an improved Bel should trade.

Gross margins of Bel used to be terrible. Now at ~38% (Amphenol is ~35%) they are in upper quartile of industry (went through process of removing negative SKU-level data after integrating ERPs to one system, some pricing).

Recent X years has seen cyclical weakness (in networking end market and across the distribution channel) due to post-COVID over-ordering. Order dynamics now positive again and business has at least stabilised.

There's more to go on fundamental margin improvement with procurement over the next 12-18m (price negotiation, spend consolidation, identifying of alternate suppliers, automation and other cost optimization opportunities). Otherwise with top-line returning to growth I think the business has path to get to ~18-20% operating margin by ~FY29 as R&D and SG&A is reasonably stable.

There is also a meaningful improvement opportunity on working capital (elevated currently at ~33% of revenue due to excess inventory and not much effort made yet on optimising receivables) which should be a benefit to cash conversion as some of those items normalise (should go back towards ~25%).

So assuming that margin story plays out, no hiccups on integration of Enercon, and business grows top-line MSD in FY26-29, then returns look decent today (mid-teens IRR) even with no multiple expansion (as this case implies low-teens EPS growth, towards mid-teens if allocating some FCF to buybacks). EBITDA growth is higher mainly due to FY25 step-up from the recent Enercon deal, which I don't think is being fully appreciated by the market currently.

More bullish case is that you also get multiple expansion to ~12x EBITDA, in which case the returns are more attractive.

Tariffs are a potential risk (25% of sales come into the US from other countries, of that ~10% comes from China, balance is Europe, India, Israel, Mexico). Was plenty of discussion on Q1 2025 earnings call.

Other risks would be 1) end markets remain cyclically weak for longer than expected or 2) operating leverage doesn't come through as top-line recovers.

I have a small position in PA, for a while was not sure what to do with it and didn't have much clarity on business quality or demand trends, but after doing more work and speaking to mgmt, feel more inclined to hold onto it. Don't think conviction is there yet for a larger, concentrated holding though.

Disclaimer: not investment advice, do your own work.

XXXXX engagements

Related Topics $58m $915m market cap $belfb ticker stocks bel