[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Curiosity [@Curiosity0x](/creator/twitter/Curiosity0x) on x XXX followers Created: 2025-06-02 16:13:30 UTC “I need XXXXX USDC, with ETH as collateral, X% interest, XX% LTV.” Soon, with @avon_xyz, you’ll be able to express this kind of intent for your onchain loans. Until now, borrowers were forced to accept whatever terms money markets offered. Don’t like ? Too bad. Move on. Lenders could, at best, choose a market that roughly fit their risk profile but couldn’t deploy precise strategies. Avon changes that with its order book model. Want a fixed or variable rate? XX% LTV? Just place an offer directly into the OB. If a lender on the other side agrees with those terms — bingo, you're matched. Yes, it adds complexity. But no worries: As a lender, simply pick a curated pool. Curators will deploy your funds into optimized strategies. As a borrower, just market borrow. You'll be matched with the best available quote. You may wonder: why hasn’t this been done before? Actually, the first version of Aave was order book based. But Ethereum mainnet wasn’t designed for that kind of architecture. Now, with @megaeth_labs, real-time matching and low-cost complex strategies are finally possible. Want to try? Join the Avon Telegram, turn on notifications, and get ready, @im0xPrince will distribute some access codes.  XXXXX engagements  **Related Topics** [hedging](/topic/hedging) [money](/topic/money) [onchain](/topic/onchain) [usdc](/topic/usdc) [coins made in usa](/topic/coins-made-in-usa) [coins bsc](/topic/coins-bsc) [coins stablecoin](/topic/coins-stablecoin) [coins solana ecosystem](/topic/coins-solana-ecosystem) [Post Link](https://x.com/Curiosity0x/status/1929572090480591207)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Curiosity @Curiosity0x on x XXX followers

Created: 2025-06-02 16:13:30 UTC

Curiosity @Curiosity0x on x XXX followers

Created: 2025-06-02 16:13:30 UTC

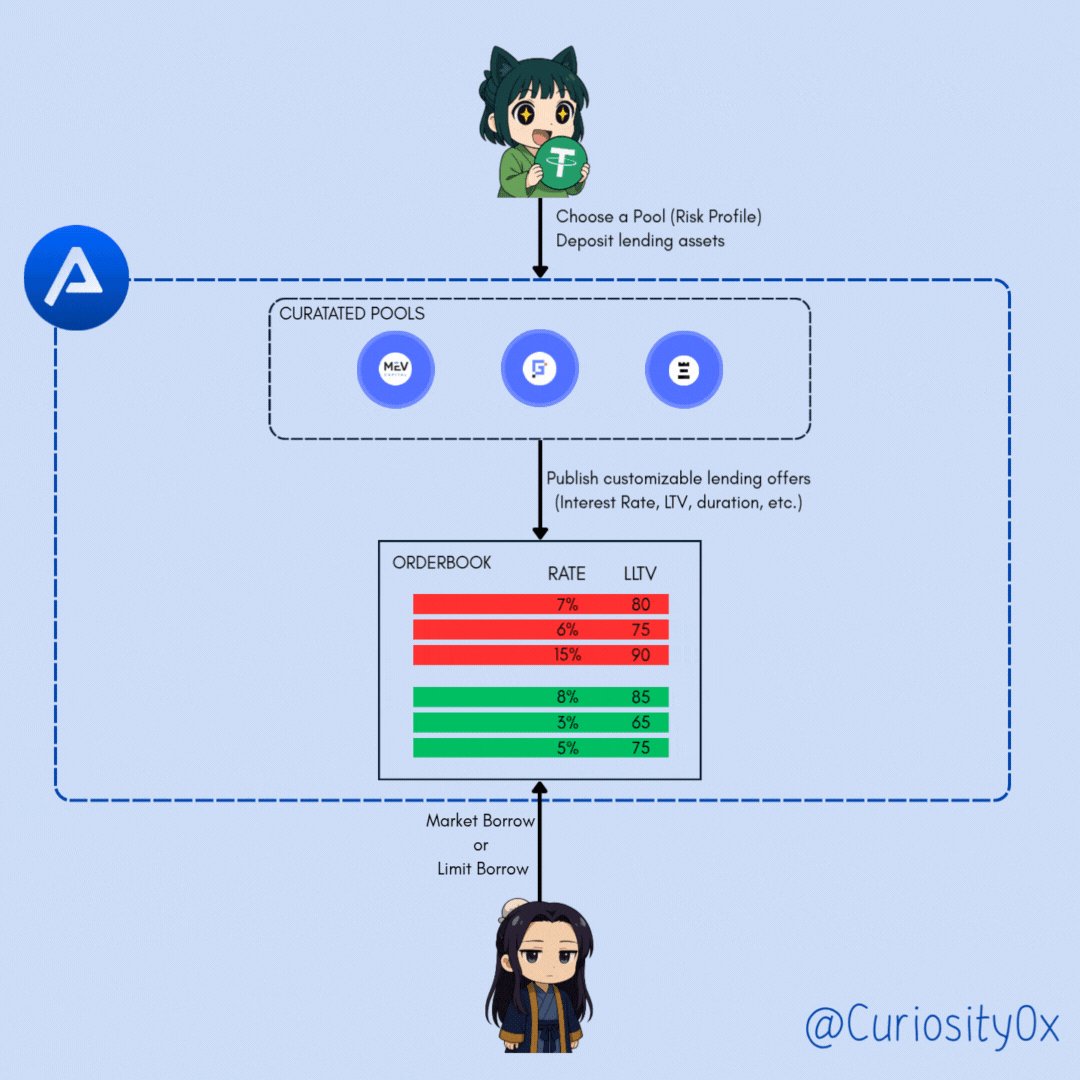

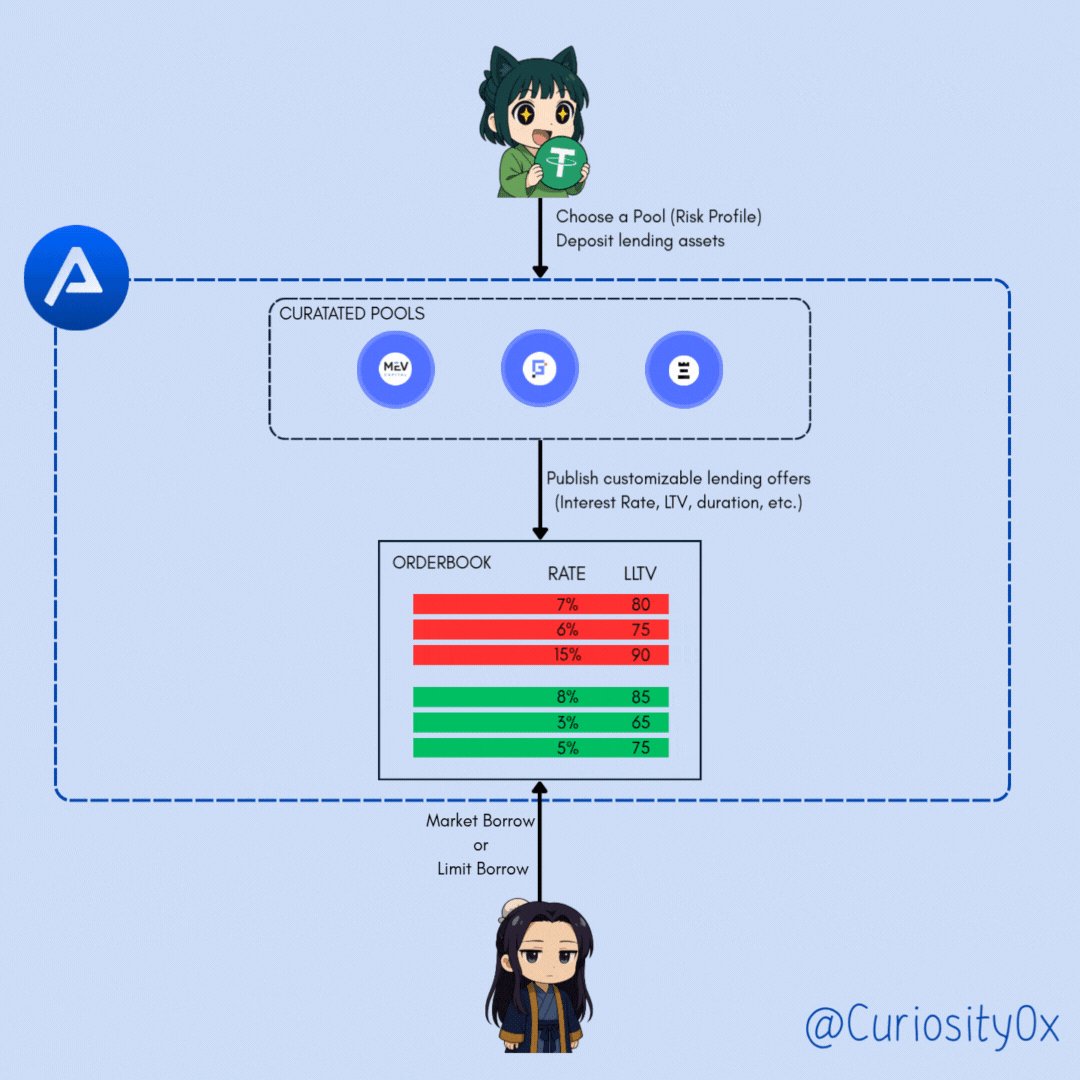

“I need XXXXX USDC, with ETH as collateral, X% interest, XX% LTV.”

Soon, with @avon_xyz, you’ll be able to express this kind of intent for your onchain loans.

Until now, borrowers were forced to accept whatever terms money markets offered.

Don’t like ? Too bad. Move on.

Lenders could, at best, choose a market that roughly fit their risk profile but couldn’t deploy precise strategies.

Avon changes that with its order book model.

Want a fixed or variable rate? XX% LTV?

Just place an offer directly into the OB.

If a lender on the other side agrees with those terms — bingo, you're matched.

Yes, it adds complexity.

But no worries:

As a lender, simply pick a curated pool. Curators will deploy your funds into optimized strategies.

As a borrower, just market borrow. You'll be matched with the best available quote.

You may wonder: why hasn’t this been done before?

Actually, the first version of Aave was order book based.

But Ethereum mainnet wasn’t designed for that kind of architecture.

Now, with @megaeth_labs, real-time matching and low-cost complex strategies are finally possible.

Want to try? Join the Avon Telegram, turn on notifications, and get ready, @im0xPrince will distribute some access codes.

XXXXX engagements

Related Topics hedging money onchain usdc coins made in usa coins bsc coins stablecoin coins solana ecosystem