[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Equity Insights Elite [@EquityInsightss](/creator/twitter/EquityInsightss) on x 47.1K followers Created: 2025-05-31 10:48:10 UTC Earnings Season Sectoral Summary #Q4FY25 Lot of companies delivered blockbuster earnings🔥 Lot of Action in Mid/SmallCap💹 Strong Results: - Financials - Housing Finance, Select NBFC's - Few Auto Ancillaries (Lumax, Lumax Auto, Gabriel, Fiem...) - Pharma - CRDMO, API - Capital Markets (Exchanges, MFD, Asset & Wealth M) - Recycling & few in Water Treatment (Va Tech, Enviro Infra..) - Capital Goods (PEB, Turbines & Generator, Industrial Gears & Equipment's, Compressors etc) - Real Estate, Co Working - EMS - B2B Jewellery, Jewellery & Value Retailers - Renewables, EPC (Cashflow concerns) - Power - T&D , W&C, Transformer - Consumer Durables - Packaging Films (Margin Expansion) - Select Agro Chemicals/Chemicals - Defence - Aviation & Hotels - Telecom - Hospitals - Life Insurance - Sugar - Alcoholic Beverages Weak/Mixed Results: - Textiles - Banks (NIM's compression) - Dairy - Cement - Building Materials - LargeCap IT, Midcap IT (Ex Persistent, Coforge) - Paints - QSR (Muted SSSG) - Paper - FMCG (Muted Growth) Overall, earnings growth has been good over the Smallcaps & Midcaps space Keep tracking lot of bottoms up opportunity Tried to cover as many companies as I could List of all good companies, for study purposes⏬  XXXXXX engagements  **Related Topics** [infra](/topic/infra) [exchanges](/topic/exchanges) [mergers and acquisitions](/topic/mergers-and-acquisitions) [finance](/topic/finance) [Post Link](https://x.com/EquityInsightss/status/1928765440899051573)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Equity Insights Elite @EquityInsightss on x 47.1K followers

Created: 2025-05-31 10:48:10 UTC

Equity Insights Elite @EquityInsightss on x 47.1K followers

Created: 2025-05-31 10:48:10 UTC

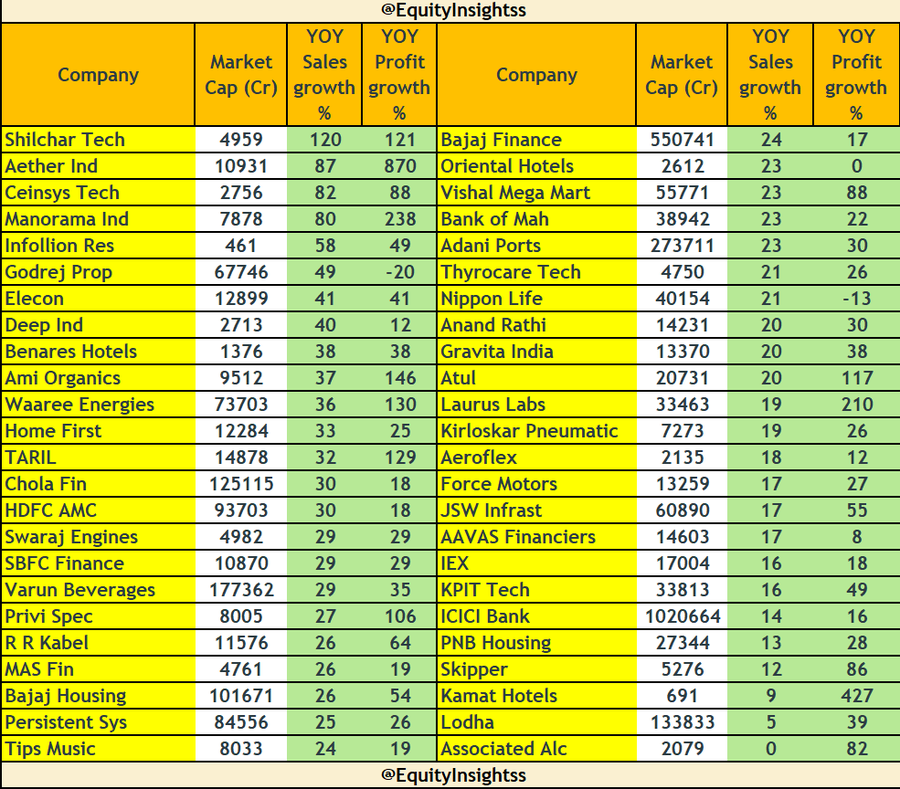

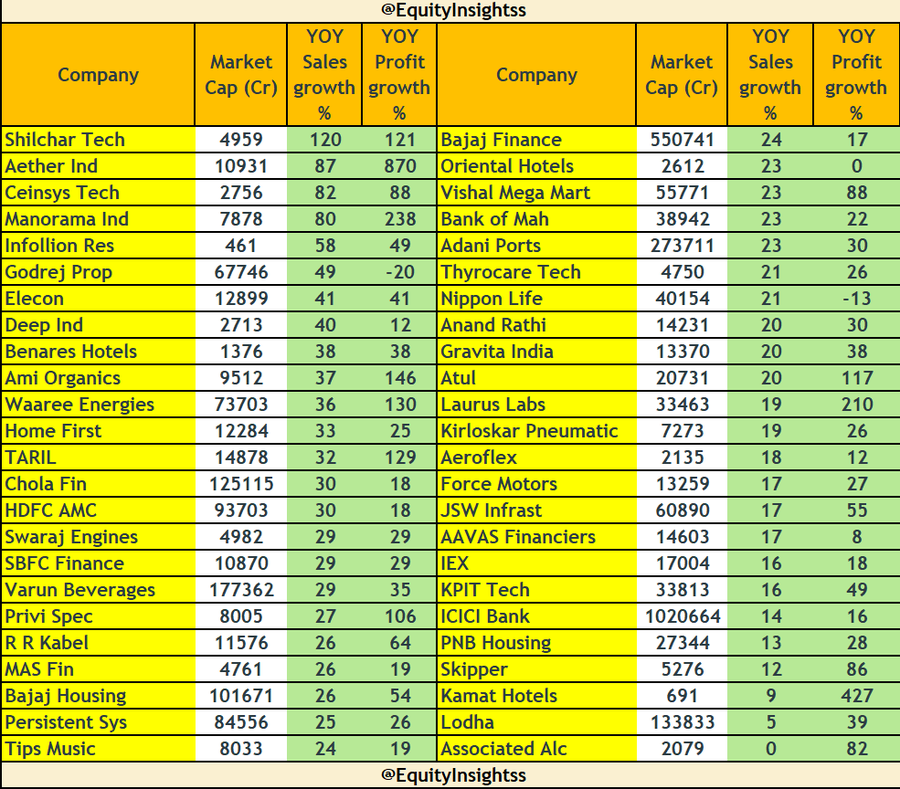

Earnings Season Sectoral Summary #Q4FY25

Lot of companies delivered blockbuster earnings🔥 Lot of Action in Mid/SmallCap💹

Strong Results:

- Financials - Housing Finance, Select NBFC's

- Few Auto Ancillaries (Lumax, Lumax Auto, Gabriel, Fiem...)

- Pharma - CRDMO, API

- Capital Markets (Exchanges, MFD, Asset & Wealth M)

- Recycling & few in Water Treatment (Va Tech, Enviro Infra..)

- Capital Goods (PEB, Turbines & Generator, Industrial Gears & Equipment's, Compressors etc)

- Real Estate, Co Working

- EMS

- B2B Jewellery, Jewellery & Value Retailers

- Renewables, EPC (Cashflow concerns)

- Power - T&D , W&C, Transformer

- Consumer Durables

- Packaging Films (Margin Expansion)

- Select Agro Chemicals/Chemicals

- Defence

- Aviation & Hotels

- Telecom

- Hospitals

- Life Insurance

- Sugar

- Alcoholic Beverages

Weak/Mixed Results:

- Textiles

- Banks (NIM's compression)

- Dairy

- Cement

- Building Materials

- LargeCap IT, Midcap IT (Ex Persistent, Coforge)

- Paints

- QSR (Muted SSSG)

- Paper

- FMCG (Muted Growth)

Overall, earnings growth has been good over the Smallcaps & Midcaps space

Keep tracking lot of bottoms up opportunity

Tried to cover as many companies as I could List of all good companies, for study purposes⏬

XXXXXX engagements

Related Topics infra exchanges mergers and acquisitions finance