[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  spacebyte ⛓ [@_thespacebyte](/creator/twitter/_thespacebyte) on x 26K followers Created: 2025-05-31 10:45:25 UTC Bitcoin ETFs saw $358.6M in net outflows yesterday — the largest since March XX. This broke a 10-day streak of inflows that brought in over $4.26B. • $GBTC: -$107.5M • $FBTC (Fidelity): -$166.3M • $ARKB (Ark/21Shares): -$89.2M • $BITB (Bitwise): -$70.9M • Others (VanEck, Invesco, Valkyrie, etc.) were also in red Only IBIT (BlackRock) stood alone with +125M inflows, showing continued institutional conviction. What this means: -> This outflow likely reflects profit-taking, rotation, or rebalancing — not structural weakness. -> Volume surge suggests healthy liquidity. -> BlackRock inflows = signal that matters most. This isn't the start of a breakdown. It's a breather — and strong hands are still holding.  XXXXXX engagements  **Related Topics** [$709m](/topic/$709m) [$892m](/topic/$892m) [$1663m](/topic/$1663m) [$1075m](/topic/$1075m) [$426b](/topic/$426b) [$3586m](/topic/$3586m) [bitcoin](/topic/bitcoin) [coins layer 1](/topic/coins-layer-1) [Post Link](https://x.com/_thespacebyte/status/1928764750944473290)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

spacebyte ⛓ @_thespacebyte on x 26K followers

Created: 2025-05-31 10:45:25 UTC

spacebyte ⛓ @_thespacebyte on x 26K followers

Created: 2025-05-31 10:45:25 UTC

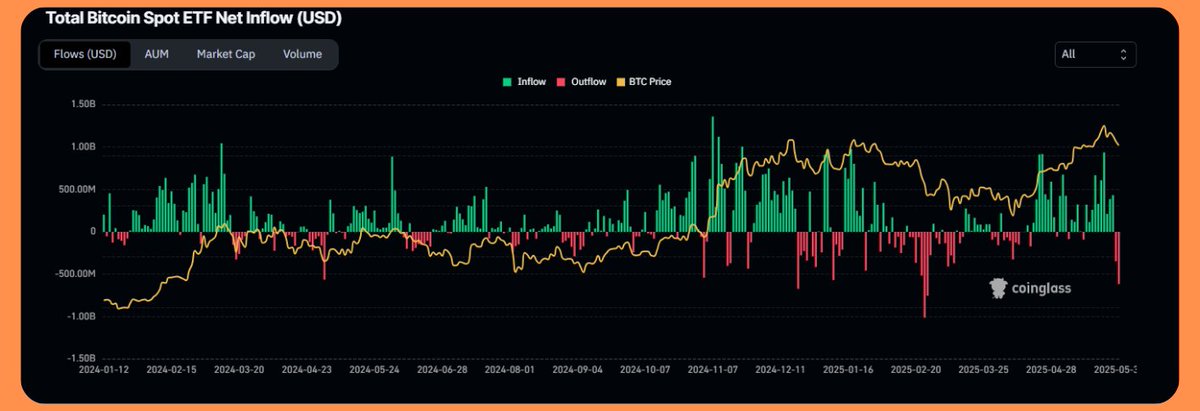

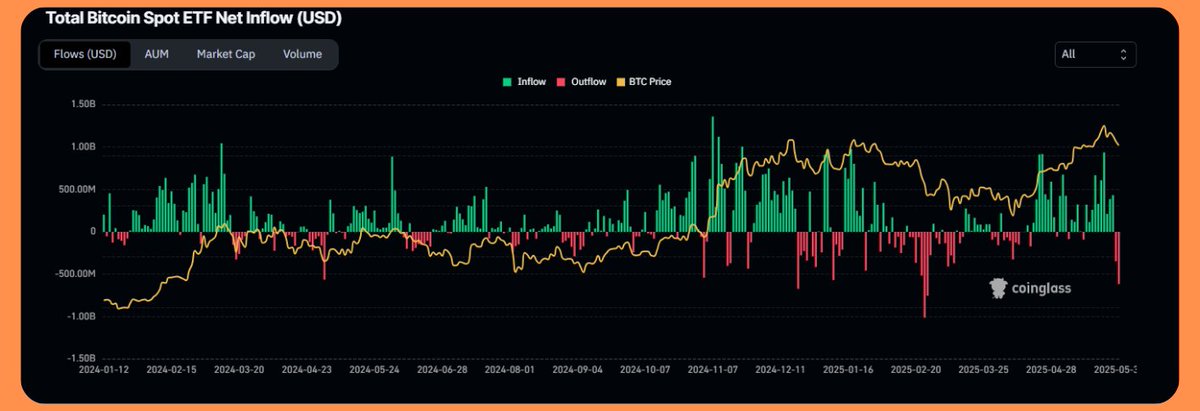

Bitcoin ETFs saw $358.6M in net outflows yesterday — the largest since March XX.

This broke a 10-day streak of inflows that brought in over $4.26B.

• $GBTC: -$107.5M • $FBTC (Fidelity): -$166.3M • $ARKB (Ark/21Shares): -$89.2M • $BITB (Bitwise): -$70.9M • Others (VanEck, Invesco, Valkyrie, etc.) were also in red

Only IBIT (BlackRock) stood alone with +125M inflows, showing continued institutional conviction.

What this means:

-> This outflow likely reflects profit-taking, rotation, or rebalancing — not structural weakness.

-> Volume surge suggests healthy liquidity.

-> BlackRock inflows = signal that matters most.

This isn't the start of a breakdown. It's a breather — and strong hands are still holding.

XXXXXX engagements

Related Topics $709m $892m $1663m $1075m $426b $3586m bitcoin coins layer 1