[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Pendle Intern [@PendleIntern](/creator/twitter/PendleIntern) on x 19K followers Created: 2025-05-16 02:59:20 UTC YT-wstUSR is secretly yielding XXX% APY under the radar, plus you'd also be earning @ResolvLabs Points for 𝑭𝑹𝑬𝑬. @pendle_fi market is pricing this at XXXXX% APY, which means that the market thinks wstUSR will only average this much yield (including points!) from now until maturity on XX September 2025. Currently however, the actual yield output is XXXXX% APY and this is from USR staking yield alone, WITHOUT accounting for points. $ETH sentiment has generally improved which is beneficial for these delta-neutral stablecoins with short perp positions (receiving payment from positive funding). What this means is that you'll be getting a lot more yield than what you're paying here, PLUS you're also getting free points on top Assuming USR staking yield averages XXXXX% APY, you're projected to earn XXX% APY (59% profit). But what if it doesn't? Here are the various scenarios: Again, these are WITHOUT accounting for Resolv points so reality is that you have much more leeway than what is shown depending on S2 and $RESOLV performance. ------------- If you're holding a generally bullish sentiment for $ETH until September and/or for $RESOLV, YT-wstUSR is a good bet on these things, with the potential for a huuuuuge payout. Disclaimer: This was concocted in the absence of caffeine in Intern's system so needless to say, NFA 🫡  XXXXXX engagements  **Related Topics** [pendlefi](/topic/pendlefi) [staking](/topic/staking) [wstusr](/topic/wstusr) [resolvlabs](/topic/resolvlabs) [radar](/topic/radar) [intern](/topic/intern) [Post Link](https://x.com/PendleIntern/status/1923211636179152916)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Pendle Intern @PendleIntern on x 19K followers

Created: 2025-05-16 02:59:20 UTC

Pendle Intern @PendleIntern on x 19K followers

Created: 2025-05-16 02:59:20 UTC

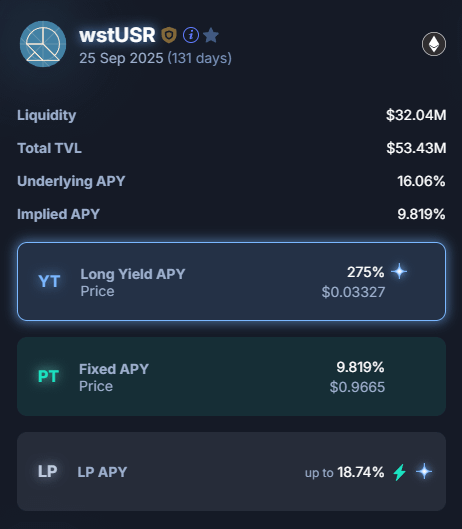

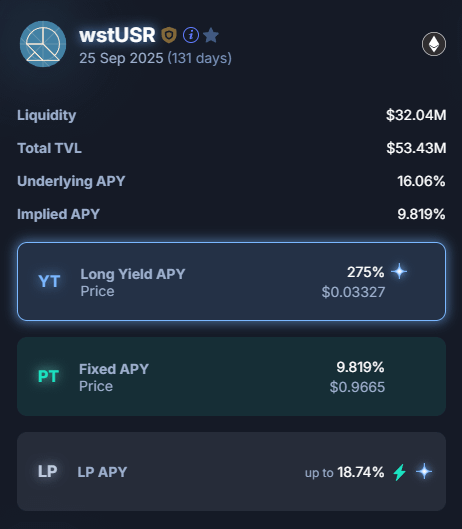

YT-wstUSR is secretly yielding XXX% APY under the radar, plus you'd also be earning @ResolvLabs Points for 𝑭𝑹𝑬𝑬.

@pendle_fi market is pricing this at XXXXX% APY, which means that the market thinks wstUSR will only average this much yield (including points!) from now until maturity on XX September 2025.

Currently however, the actual yield output is XXXXX% APY and this is from USR staking yield alone, WITHOUT accounting for points.

$ETH sentiment has generally improved which is beneficial for these delta-neutral stablecoins with short perp positions (receiving payment from positive funding).

What this means is that you'll be getting a lot more yield than what you're paying here, PLUS you're also getting free points on top

Assuming USR staking yield averages XXXXX% APY, you're projected to earn XXX% APY (59% profit).

But what if it doesn't? Here are the various scenarios:

Again, these are WITHOUT accounting for Resolv points so reality is that you have much more leeway than what is shown depending on S2 and $RESOLV performance.

If you're holding a generally bullish sentiment for $ETH until September and/or for $RESOLV, YT-wstUSR is a good bet on these things, with the potential for a huuuuuge payout.

Disclaimer: This was concocted in the absence of caffeine in Intern's system so needless to say, NFA 🫡

XXXXXX engagements

Related Topics pendlefi staking wstusr resolvlabs radar intern