[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Eugene Ng [@EugeneNg_VCap](/creator/twitter/EugeneNg_VCap) on x 24.5K followers Created: 2025-05-09 08:15:09 UTC The Trade Desk $TTD 1Q25 Earnings - Rev $616m +25% ↗️🟢 - Adj EBITDA $208m +29% ↗️🟢 margin XX% +82 bps ✅ - EBIT $54m +90% ⤴️🟢 margin X% +301 bps ✅ - NG Net Inc $165m +26% ↗️🟢 margin XX% +14 bps ✅ - Net Inc $51m +60% ↗️🟢 margin X% +178 bps ✅ - OCF $291m +57% ↗️🟢 margin XX% +955 bps ✅ - FCF $230m +30% ↗️🟢 margin XX% +140 bps ✅ 2Q25 Mgmt Guide - Rev $682m +17% ↗️🟢 - Adj EBITDA $259m Biz Metrics (% share) - Customer retention >95% (past 11Y) ✅ - CTV (47.5%) - Mobile (35%) - Display (12.5%) - Audio (5%) - NA XX% spend - International XX% (growing faster) X | Strong quarter, uptake in Kokai adoption and upgrades I would say we're really proud of what we delivered in Q1. It was such a strong quarter for us -- and I would attribute the strength to the uptake in Kokai adoption and the early momentum from the upgrades that we talked about earlier in the year related to our business that we made in I wouldn't say that the Q4 to Q1 sequential strength was driven by political simply because we exited presidential cycle in the U.S., entered 2025 when we're not in an off-cycle and don't have much contribution. X | Recovered from 4Q24 miss with strong growth, seeing encouraging signs that changes made were the right ones As many of you know, in Q4, we experienced a setback as we undertook the most significant company upgrade in our 16-year history. I won't revisit the details today, but as company scale and complexity increases, changes and upgrades become necessary to unlock the next wave of growth. That's exactly what we did. And now we are beginning to see encouraging signs that the changes we made were the right ones. As you've seen from the press release, despite increasing economic uncertainty, we showed incredible resilience, growing revenue XX% YoY, far surpassing our own expectations. We continue to grow at a rate significantly higher than the broad digital marketing industry and gain market share. X | Strong progress on Kokai, adoption ahead of schedule, ⅔ clients using it, bulk of ad spend now on Kokai Let's talk now about our progress on Kokai. The core of Kokai has been delivered and adoption is now ahead of schedule. Around 2/3 of our clients are now using it and the bulk of the spend in our platform is now running through Kokai. We expect all clients to be using it by the end of the year. One thing about Kokai that I would like to underline whenever we go through a platform overhaul like this, and this is the biggest in our history, we are always trying to balance giving clients exactly what they want versus pushing the industry forward. X | Despite all features of Kokai fully launched, will will continue to iterate and ship product weekly, still got a few major pieces to ship Kokai is perhaps our biggest engineering achievement yet, and it is helping clients get the full value of the open Internet and manage the complexity of the open Internet at the same time. Even as all of the features of Kokai are fully launched. We will continue to iterate and ship product every week. As I said, Kokai adoption now represents the majority of our spend, almost 2/3, a signi cant acceleration from where we ended 2024, and clients are seeing major campaign improvements as a result Of course, we also have to talk about our focus on upgrading our product across the Board. There's still a lot of exciting things coming out of Kokai. It seems that we continue to upgrade -- so there are a few major pieces left that we expect to ship in the very near future. X | Will introduce a new approach for understanding and managing performance, and will continue to improve the polish, the navigation and the usability of Kokai We will introduce the final major components of Kokai, including a revolutionary new approach for understanding and managing the performance of deals. One of the most important things we do to realize the value of programmatic. We will also continue to improve the polish, the navigation and the usability. But to be clear, Kokai has already proven itself and the results are fantastic. The injection of our industry-leading CoA AI tools across every aspect of our platform has been a game changer, and we are just getting started. X | Kokai deliver lower cost per conversion and acquisitions Kokai campaign performance on Kokai continues to be exceptional. Kokai's delivering on lower funnel KPIs, including XX% lower cost per conversion and XX% lower cost per acquisition, and these improvements are helping unlock performance and performance budgets from existing clients, but also from new clients that are a bit more focused on the performance side of things. X | Overhauled the product process, business and product now more in sync, simplified GTM, seeing green shoots with strong JVP pipelines Lastly, I mentioned in our last call that we've made significant upgrades across the company. In engineering, we now have over XXX scrums all shipping product every week. We've overhauled the product process. And as a result, business and product and engineering are more in sync than they've been in years. We simplified our go-to-market teams and their org structures. While it is still early, we are already seeing green shoots. Our JVP pipeline and the number of JVPs in active contract negotiations are at all-time highs. X | Continue to focus on growing JVPs, now XX% of spend under JVPs, which is growing faster There's still more to come on that but the trend line is awesome, and it's good enough to validate that we've made the right choices. Also validating in that same way is our strong JVP pipeline. As we've highlighted before, over XX% of our spend is now under JVPs. And then you can think of JVPs as partnerships with long-term commitments and vision for what we'll do together. And that continues to grow XX% faster than overall spend. So when we put those together, our business grows faster. And so naturally, we're focused on more of those. X | Continue to grow faster and gain market share versus the industry We continue to grow at a rate significantly higher than the broad digital marketing industry and gain market share. As you know, we have a long history of setting goals and hitting them. We're happy to report that we did it again. We also have a long history of growing faster than all of the other scaled players in our industry, and we did that again, too. XX | Google’s challenges will focus them to focus on their core business, and be less focused on the open internet, allowing TTD who was won in a unfair market, to do better in a fairer market think the news yesterday about Apple's decision to focus more on the AI search engines rather than Google as a result of the remedy of that rst trial is as signi cant as anything. And it tells you what's to come, which is Google has got to focus on its core business. And as they focus on the core business, which is largely about search, and that includes Gemini and also YouTube, that means they are going to be less focused on the open Internet. And that means for us that we can go participate in the open Internet with less competition, but even more signi cant than less competition is the fact that Google has been disrupting the competitive market that we would have thrived even more. So I stand by what I said, again, again, including in the prepared remarks that we were winning in an unfair market and the market is getting fair already. XX | Q1 saw intensifiying pressure with growing concerns amongst clients First, the macro environment. As I mentioned before, Q4 was relatively stable, though signs of volatility we're building beneath the surface have made a contentious election cycle. That pressure intensified in Q1 with growing concern among clients. As you know, our primary clients are the largest brands in the world and the agencies that serve them. All of whom are navigating increasing volatility so far in 2025. XX | Acquired Sincera, a metadata company that crawls internet to give clients more data and signal to improve ad performance, plan to offer Open Sincera Another massive upgrade we have made to improve the supply chain was the acquisition of Sincera. Most outside of ad tech don't know the company. So for the uninitiated, Sincera is a metadata company that crawls the Internet looking for insights about the supply chain of advertising, and seeks to shine a light of transparency on that supply chain. Following the acquisition, we have been working to invest Sincera data across Kokai, so our clients can have as much data and signal as possible about ad performance. But it doesn't stop there. In the coming months, we plan to relaunch their product for the ad tech community and offer a new version of Sincera called Open Sincera. This product will be free to advertisers, to agencies, to ad tech companies, to sellers and to publishers who want to better understand the supply chain and how to make it more efficient. XX | Vivek Kundra joins as COO from EVP, Salesforce We've hired a new COO, Vivid Kandra. He joined the company as our new Chief Operating O cer. So that may be a well-known name to many of you as he was the first ever Chief Information O cer for the United States Federal Government back in 2009. But perhaps most relevant to us, he spent several years at Salesforce and is a key driver of growth at a time when they were pretty much the same size and scale as we are now. These kind of appointments will help us achieve our very own high-growth expectations in the years ahead. XX | TTD is pointed to the entire open Internet and think nearly all global advertising will be transacted programmatically at end state, best positioned to win lion share The Trade Desk is pointed at the entire open Internet, and nearly all of global advertising will be transacted programmatically at end state. We are convinced that based on the current landscape and current competitive set, we are the best positioned to win the lion's share of market share at end state. We simply need to execute between here and there. XX | Significant shifts in Google, Apple, Meta that is making the market more competitive and more fair But so far this year, there have been some massive shifts that have significantly upgraded the prospects of the open Internet and the Trade Desk. Here are a few of them. First, Google has been declared an illegal monopoly in two separate instances in 2025 by the U.S. courts. Of course, the same has happened in various government cases all over the world. Fourth, Google announced that it is not going to eradicate cookies from its market-leading Chrome browser. So naturally, you may ask, what do all these changes mean for -- the Trade Desk and the open Internet. First, we've been winning share in the DSP race year after year and quarter after quarter. And we've done that in an unfair market. We think the signal that comes from all of these ships is that one that points to a more fair and more competitive market, which is what we built our business for. Our model is designed to compete. As we've said before, if we can win share in an unfair market against the biggest tech players in the world, as we have over the last XX years, imagine what we can do in a fair market XX | Google DV360, Amazon DSP will continue to focus on their own properties Doing so will significantly improve competition, transparency and fairness in the ad market for all participants. I continue to believe that Google will stop trying to monetize the open Internet and instead focus more on their destinations. I expect that Amazon will continue on the same path. DV360 is primarily technology to buy YouTube. Amazon's DSP is primarily a product built to buy Amazon's Prime video XX | TTD can be agile, adjust quickly because its more data driven Programmatic advertising is extremely agile. Because our technology buys one impression at a time and evaluates every single impression, we can adjust quickly. We also can be more data-driven than the other forms of advertising. XX | CTV currently having more supply than demand, and is a buyers market, consumers will see fewer but more relevant ads, and will perform better Because of the pressure on consumers over the last X quarters, CTV and streamers have invested more into advertising. We're seeing more supply than demand in all forms of advertising, but that is especially important in CTV. In general, this dynamic makes for more of a buyer's market, but additionally, this is having a great impact on market dynamics. As a result, in general, CTV companies are once again leading the supply dynamics of the open Internet. They are plugging directly into our demand. They are also describing their supply in greater detail than ever. Nearly every scaled player has adopted UID2 and those that have not are under monetizing their inventory. We expect that the market dynamics are going to create the best ad-funded television experience for consumers in the history of television. They will see fewer ads. They will be personally relevant and these fewer ads will make more money for content owners than linear and broadcast ever did, and they will perform better for advertisers per dollar than spray and pray ever did. XX | NY Post and VIZIO seeing strong gains from using OpenPath With OpenPath, they were able to increase their fill rates by 4x and improved programmatic revenue by 79%, all because they are able to provide advertisers, our clients with clear visibility into what they're buying. [indiscernible] dozens more examples -- the New York Post saw its digital advertising fill rate increase more than 8x and programmatic revenue increased XX% with Openpath. In the world of CTV, VIZIO sats programmatic revenue increased XX% and another major network saw their ll rate increase 7x, leading to a revenue increase of over 25%. XX | Continue to see strength of underlying business That said, we are encouraged by the strength of our underlying business, driven by continued progress on Kokai is our enhancements to our engineering and go-to-market teams and a growing pipeline of joint business plans. We remain confident in the fundamental drivers of our revenue growth, especially given our track record of gaining market share during periods of economic volatility. Assuming the macro environment remains stable, and we do not see deterioration in economic conditions ➡️ Final Thoughts on The Trade Desk $TTD Jeff Green and his team proved their mantle and worked hard to deliver the strong growth in 1Q25 after the poor execution in 4Q24. TTD continues to execute and be open to take in feedback and continue to reiterate on Kokai and keep improving on it and drive growing customer adoption. The continued shipping of product updates is testament. The acquisition of Sincera is highly strategic to improve ad performance that is a space to watch. The alignment of business and product is much needed and is showing back green shoots in the rebound. Continue to have confidence in Jeff and his management to bring it to greater heights.  XXXXX engagements  **Related Topics** [$259m](/topic/$259m) [$682m](/topic/$682m) [$230m](/topic/$230m) [$291m](/topic/$291m) [$51m](/topic/$51m) [$165m](/topic/$165m) [$54m](/topic/$54m) [$208m](/topic/$208m) [Post Link](https://x.com/EugeneNg_VCap/status/1920754397996609762)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Eugene Ng @EugeneNg_VCap on x 24.5K followers

Created: 2025-05-09 08:15:09 UTC

Eugene Ng @EugeneNg_VCap on x 24.5K followers

Created: 2025-05-09 08:15:09 UTC

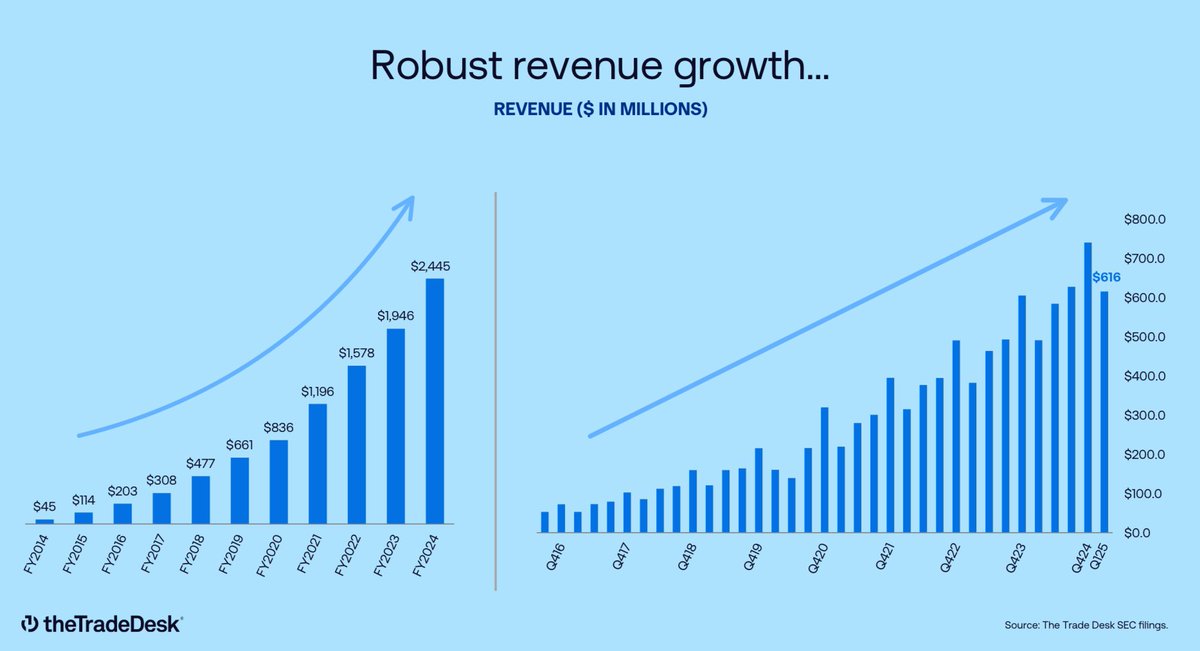

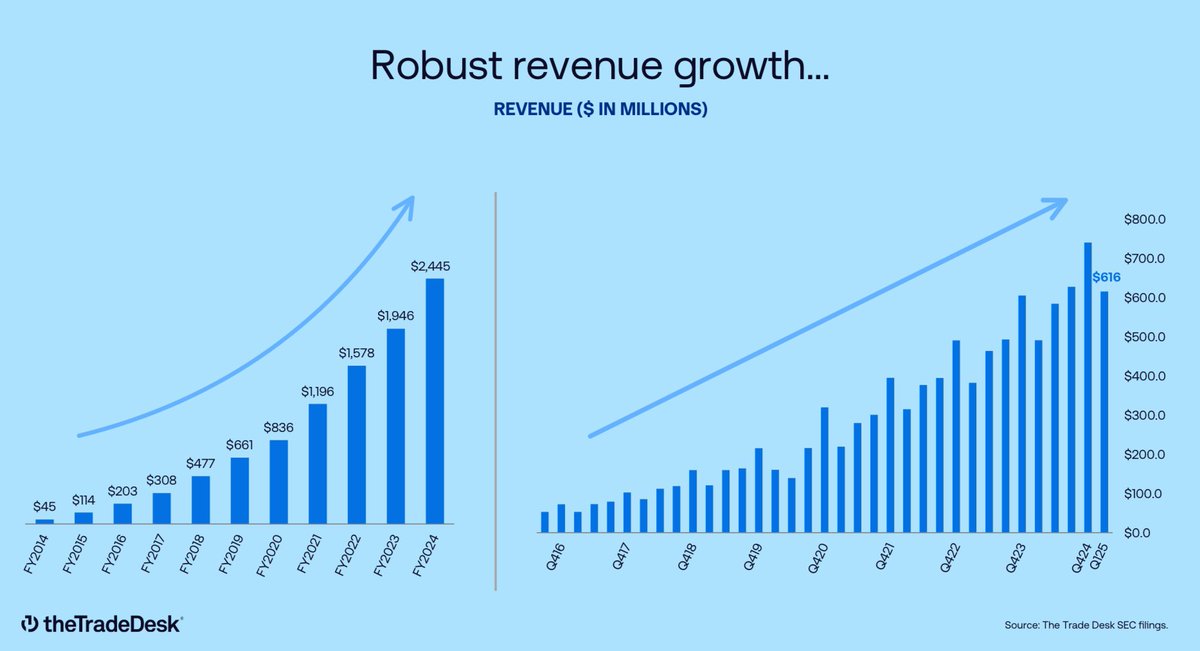

The Trade Desk $TTD 1Q25 Earnings

- Rev $616m +25% ↗️🟢

- Adj EBITDA $208m +29% ↗️🟢 margin XX% +82 bps ✅

- EBIT $54m +90% ⤴️🟢 margin X% +301 bps ✅

- NG Net Inc $165m +26% ↗️🟢 margin XX% +14 bps ✅

- Net Inc $51m +60% ↗️🟢 margin X% +178 bps ✅

- OCF $291m +57% ↗️🟢 margin XX% +955 bps ✅

- FCF $230m +30% ↗️🟢 margin XX% +140 bps ✅

2Q25 Mgmt Guide

- Rev $682m +17% ↗️🟢

- Adj EBITDA $259m

Biz Metrics (% share)

- Customer retention >95% (past 11Y) ✅

- CTV (47.5%)

- Mobile (35%)

- Display (12.5%)

- Audio (5%)

- NA XX% spend

- International XX% (growing faster)

X | Strong quarter, uptake in Kokai adoption and upgrades

I would say we're really proud of what we delivered in Q1. It was such a strong quarter for us -- and I would attribute the strength to the uptake in Kokai adoption and the early momentum from the upgrades that we talked about earlier in the year related to our business that we made in I wouldn't say that the Q4 to Q1 sequential strength was driven by political simply because we exited presidential cycle in the U.S., entered 2025 when we're not in an off-cycle and don't have much contribution.

X | Recovered from 4Q24 miss with strong growth, seeing encouraging signs that changes made were the right ones

As many of you know, in Q4, we experienced a setback as we undertook the most significant company upgrade in our 16-year history. I won't revisit the details today, but as company scale and complexity increases, changes and upgrades become necessary to unlock the next wave of growth. That's exactly what we did. And now we are beginning to see encouraging signs that the changes we made were the right ones. As you've seen from the press release, despite increasing economic uncertainty, we showed incredible resilience, growing revenue XX% YoY, far surpassing our own expectations. We continue to grow at a rate significantly higher than the broad digital marketing industry and gain market share.

X | Strong progress on Kokai, adoption ahead of schedule, ⅔ clients using it, bulk of ad spend now on Kokai

Let's talk now about our progress on Kokai. The core of Kokai has been delivered and adoption is now ahead of schedule. Around 2/3 of our clients are now using it and the bulk of the spend in our platform is now running through Kokai. We expect all clients to be using it by the end of the year. One thing about Kokai that I would like to underline whenever we go through a platform overhaul like this, and this is the biggest in our history, we are always trying to balance giving clients exactly what they want versus pushing the industry forward.

X | Despite all features of Kokai fully launched, will will continue to iterate and ship product weekly, still got a few major pieces to ship

Kokai is perhaps our biggest engineering achievement yet, and it is helping clients get the full value of the open Internet and manage the complexity of the open Internet at the same time. Even as all of the features of Kokai are fully launched. We will continue to iterate and ship product every week. As I said, Kokai adoption now represents the majority of our spend, almost 2/3, a signi cant acceleration from where we ended 2024, and clients are seeing major campaign improvements as a result

Of course, we also have to talk about our focus on upgrading our product across the Board. There's still a lot of exciting things coming out of Kokai. It seems that we continue to upgrade -- so there are a few major pieces left that we expect to ship in the very near future.

X | Will introduce a new approach for understanding and managing performance, and will continue to improve the polish, the navigation and the usability of Kokai

We will introduce the final major components of Kokai, including a revolutionary new approach for understanding and managing the performance of deals. One of the most important things we do to realize the value of programmatic. We will also continue to improve the polish, the navigation and the usability. But to be clear, Kokai has already proven itself and the results are fantastic. The injection of our industry-leading CoA AI tools across every aspect of our platform has been a game changer, and we are just getting started.

X | Kokai deliver lower cost per conversion and acquisitions

Kokai campaign performance on Kokai continues to be exceptional. Kokai's delivering on lower funnel KPIs, including XX% lower cost per conversion and XX% lower cost per acquisition, and these improvements are helping unlock performance and performance budgets from existing clients, but also from new clients that are a bit more focused on the performance side of things.

X | Overhauled the product process, business and product now more in sync, simplified GTM, seeing green shoots with strong JVP pipelines

Lastly, I mentioned in our last call that we've made significant upgrades across the company. In engineering, we now have over XXX scrums all shipping product every week. We've overhauled the product process. And as a result, business and product and engineering are more in sync than they've been in years. We simplified our go-to-market teams and their org structures. While it is still early, we are already seeing green shoots. Our JVP pipeline and the number of JVPs in active contract negotiations are at all-time highs.

X | Continue to focus on growing JVPs, now XX% of spend under JVPs, which is growing faster

There's still more to come on that but the trend line is awesome, and it's good enough to validate that we've made the right choices. Also validating in that same way is our strong JVP pipeline. As we've highlighted before, over XX% of our spend is now under JVPs. And then you can think of JVPs as partnerships with long-term commitments and vision for what we'll do together. And that continues to grow XX% faster than overall spend. So when we put those together, our business grows faster. And so naturally, we're focused on more of those.

X | Continue to grow faster and gain market share versus the industry

We continue to grow at a rate significantly higher than the broad digital marketing industry and gain market share. As you know, we have a long history of setting goals and hitting them. We're happy to report that we did it again. We also have a long history of growing faster than all of the other scaled players in our industry, and we did that again, too.

XX | Google’s challenges will focus them to focus on their core business, and be less focused on the open internet, allowing TTD who was won in a unfair market, to do better in a fairer market

think the news yesterday about Apple's decision to focus more on the AI search engines rather than Google as a result of the remedy of that rst trial is as signi cant as anything. And it tells you what's to come, which is Google has got to focus on its core business. And as they focus on the core business, which is largely about search, and that includes Gemini and also YouTube, that means they are going to be less focused on the open Internet.

And that means for us that we can go participate in the open Internet with less competition, but even more signi cant than less competition is the fact that Google has been disrupting the competitive market that we would have thrived even more. So I stand by what I said, again, again, including in the prepared remarks that we were winning in an unfair market and the market is getting fair already.

XX | Q1 saw intensifiying pressure with growing concerns amongst clients

First, the macro environment. As I mentioned before, Q4 was relatively stable, though signs of volatility we're building beneath the surface have made a contentious election cycle. That pressure intensified in Q1 with growing concern among clients. As you know, our primary clients are the largest brands in the world and the agencies that serve them. All of whom are navigating increasing volatility so far in 2025.

XX | Acquired Sincera, a metadata company that crawls internet to give clients more data and signal to improve ad performance, plan to offer Open Sincera

Another massive upgrade we have made to improve the supply chain was the acquisition of Sincera. Most outside of ad tech don't know the company. So for the uninitiated, Sincera is a metadata company that crawls the Internet looking for insights about the supply chain of advertising, and seeks to shine a light of transparency on that supply chain. Following the acquisition, we have been working to invest Sincera data across Kokai, so our clients can have as much data and signal as possible about ad performance. But it doesn't stop there. In the coming months, we plan to relaunch their product for the ad tech community and offer a new version of Sincera called Open Sincera. This product will be free to advertisers, to agencies, to ad tech companies, to sellers and to publishers who want to better understand the supply chain and how to make it more efficient.

XX | Vivek Kundra joins as COO from EVP, Salesforce

We've hired a new COO, Vivid Kandra. He joined the company as our new Chief Operating O cer. So that may be a well-known name to many of you as he was the first ever Chief Information O cer for the United States Federal Government back in 2009. But perhaps most relevant to us, he spent several years at Salesforce and is a key driver of growth at a time when they were pretty much the same size and scale as we are now. These kind of appointments will help us achieve our very own high-growth expectations in the years ahead.

XX | TTD is pointed to the entire open Internet and think nearly all global advertising will be transacted programmatically at end state, best positioned to win lion share

The Trade Desk is pointed at the entire open Internet, and nearly all of global advertising will be transacted programmatically at end state. We are convinced that based on the current landscape and current competitive set, we are the best positioned to win the lion's share of market share at end state. We simply need to execute between here and there.

XX | Significant shifts in Google, Apple, Meta that is making the market more competitive and more fair

But so far this year, there have been some massive shifts that have significantly upgraded the prospects of the open Internet and the Trade Desk. Here are a few of them. First, Google has been declared an illegal monopoly in two separate instances in 2025 by the U.S. courts. Of course, the same has happened in various government cases all over the world.

Fourth, Google announced that it is not going to eradicate cookies from its market-leading Chrome browser. So naturally, you may ask, what do all these changes mean for -- the Trade Desk and the open Internet. First, we've been winning share in the DSP race year after year and quarter after quarter. And we've done that in an unfair market. We think the signal that comes from all of these ships is that one that points to a more fair and more competitive market, which is what we built our business for. Our model is designed to compete. As we've said before, if we can win share in an unfair market against the biggest tech players in the world, as we have over the last XX years, imagine what we can do in a fair market

XX | Google DV360, Amazon DSP will continue to focus on their own properties

Doing so will significantly improve competition, transparency and fairness in the ad market for all participants. I continue to believe that Google will stop trying to monetize the open Internet and instead focus more on their destinations. I expect that Amazon will continue on the same path. DV360 is primarily technology to buy YouTube. Amazon's DSP is primarily a product built to buy Amazon's Prime video

XX | TTD can be agile, adjust quickly because its more data driven

Programmatic advertising is extremely agile. Because our technology buys one impression at a time and evaluates every single impression, we can adjust quickly. We also can be more data-driven than the other forms of advertising.

XX | CTV currently having more supply than demand, and is a buyers market, consumers will see fewer but more relevant ads, and will perform better

Because of the pressure on consumers over the last X quarters, CTV and streamers have invested more into advertising. We're seeing more supply than demand in all forms of advertising, but that is especially important in CTV. In general, this dynamic makes for more of a buyer's market, but additionally, this is having a great impact on market dynamics. As a result, in general, CTV companies are once again leading the supply dynamics of the open Internet. They are plugging directly into our demand. They are also describing their supply in greater detail than ever. Nearly every scaled player has adopted UID2 and those that have not are under monetizing their inventory. We expect that the market dynamics are going to create the best ad-funded television experience for consumers in the history of television. They will see fewer ads. They will be personally relevant and these fewer ads will make more money for content owners than linear and broadcast ever did, and they will perform better for advertisers per dollar than spray and pray ever did.

XX | NY Post and VIZIO seeing strong gains from using OpenPath

With OpenPath, they were able to increase their fill rates by 4x and improved programmatic revenue by 79%, all because they are able to provide advertisers, our clients with clear visibility into what they're buying. [indiscernible] dozens more examples -- the New York Post saw its digital advertising fill rate increase more than 8x and programmatic revenue increased XX% with Openpath. In the world of CTV, VIZIO sats programmatic revenue increased XX% and another major network saw their ll rate increase 7x, leading to a revenue increase of over 25%.

XX | Continue to see strength of underlying business

That said, we are encouraged by the strength of our underlying business, driven by continued progress on Kokai is our enhancements to our engineering and go-to-market teams and a growing pipeline of joint business plans. We remain confident in the fundamental drivers of our revenue growth, especially given our track record of gaining market share during periods of economic volatility. Assuming the macro environment remains stable, and we do not see deterioration in economic conditions

➡️ Final Thoughts on The Trade Desk $TTD

Jeff Green and his team proved their mantle and worked hard to deliver the strong growth in 1Q25 after the poor execution in 4Q24. TTD continues to execute and be open to take in feedback and continue to reiterate on Kokai and keep improving on it and drive growing customer adoption. The continued shipping of product updates is testament. The acquisition of Sincera is highly strategic to improve ad performance that is a space to watch. The alignment of business and product is much needed and is showing back green shoots in the rebound. Continue to have confidence in Jeff and his management to bring it to greater heights.

XXXXX engagements

Related Topics $259m $682m $230m $291m $51m $165m $54m $208m