[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Eugene Ng [@EugeneNg_VCap](/creator/twitter/EugeneNg_VCap) on x 24.5K followers Created: 2025-05-08 09:06:20 UTC MercadoLibre $MELI 1Q25 Earnings - Rev $5.9b +37% ↗️🟢 - GP $2.8b +37% ↗️🟢 margin XX% -X bps ↘️🔴 - Adj EBITDA $935m +37% ↗️🟢 margin XX% +1 bps ✅ - DC $1452m +41% ↗️🟢 margin XX% +69 bps ✅ - EBIT $763m +45% ↗️🟢 margin XX% +67 bps ✅ - Net Inc $494m +44% ↗️🟢 margin X% +38 bps ✅ - OCF $1021m -XX% ↘️🟠 margin XX% -1769 bps ↘️🔴 - FCF $749m -XX% ↘️🟠 margin XX% -1886 bps ↘️🔴 Revenue By Segment - Net Svc Rev $5320m +35% ↗️🟢 - Net Pdt Rev $615m +63% ↗️🟢 - Ad Rev +50% FXN ↗️🟢 - Comm Net Rev $3.3b +32% ↗️🟢 - Comm Svc Rev $2.7b +27% ↗️🟢 - Comm Pdt Rev $0.6b +64% ↗️🟢 - Fintech Net Rev $2.6b +43% ↗️🟢 - Fin Svcs Net Rev $1.5b +39% ↗️🟢 - Credit Net Rev $1.1b +49% ↗️🟢 - Product Net Rev $13m +30% ↗️🟢 Biz Metrics - Fintech MAU 64m +31% ↗️🟢 - Active Buyers 67m +26% ↗️🟢 - GMV $13.3b +17% ↗️🟢 - Items Sold 492m +28% ↗️🟢 - TPV $58.3b +43% ↗️🟢 - Acquiring TPV $40.3b +32% ↗️🟢 - Pymt Txn 3.3b +38% ↗️🟢 - Active Sellers with Credit XXXX% 📶🟢 - Same+ND Shipments 143.3m +25% ↗️🟢 - Fintech AUM $11.3b +103% ↗️🟢 - Credit Portfolio $7.8bn +75% ↗️🟢 - NIMAL XXXX% ↘️🟠 (upmarket+more CC) - Past due 15-90 XXX% ➡️🟢 - Past due >90 XXXX% ➡️🟢 - Provision >15D XXX% ➡️🟢 - Past due >90 XXX% ➡️🟢 Revenue Growth Rates by Country/Segment - Brazil +20% ↗️🟢 +41% FXN ↗️🟢 - Mexico +26% ↗️🟢 +51% FXN ↗️🟢 - Argentina +125% ↗️🟢 +184% FXN ↗️🟢 - Commerce +32% ↗️🟢 +57% FXN ↗️🟢 - Fintech +43% ↗️🟢 +73% FXN ↗️🟢 - Total MELI +37% ↗️🟢 +64% FXN ↗️🟢 GMV Growth Rates by Country - Brazil +10% ↗️🟡 +30% FXN ↗️🟢 - Mexico +2% ↗️🟡 +23% FXN ↗️🟢 - Argentina +77% ↗️🟢 +126% FXN ↗️🟢 - Total MELI +17% ↗️🟢 +40% FXN ↗️🟢 TPV Growth Rates - TPV Total +43% ↗️🟢 +72% FXN ↗️🟢 - TPV Acquiring +32% ↗️🟢+59% FXN ↗️🟢 Direct Contribution by Geography - BR Rev $3.1b +20% ↗️🟢 - BR DC $542m -X% ↘️🟠 margin XX% -XXX bps ↘️🔴 - MX Rev $1.2b +26% ↗️🟢 - MX DC $217m -X% ↘️🟠 margin XX% -XXX bps ↘️🔴 - AR Rev $1.4b +125% ⤴️🟢 - AR DC $648m +189% ⤴️🟢 margin XX% +1047 bps ✅ - OT Rev $249m +41% ↗️🟢 - OT DC $45m +114% ⤴️🟢 margin XX% +614 bps ✅ X | Strong quarter We are excited to kick off 2025 with another great quarter at MercadoLibre as we continue to deliver strong growth across both e-commerce and ntech. In Q1, we maintained the rapid pace of net revenue growth achieved in 2024, while making solid progress on all of our strategic initiatives. This momentum is fueled by continued investments and improvements in the valuable position for us. X | Continue to be strong in e-commerce, 1P was particularly strong In e-commerce, we continue to deliver strong growth, outpacing all of our major markets, brand preference metrics for our marketplace with all-time high in Brazil, Mexico, Argentina and Chile in the quarter. 1P had a tremendous Q1 with GMV growth +102% YoY with strong performance across markets and across categories. And I would say that's the consequence of continuing to improve selection and price competitiveness we also continue to make progress in terms of managing the business through more and more technology. X | Particularly within 1P, supermarkets doing well, better unit economics than 3P, getting revenues from advertising, margins are improving We improved our promotional activities and special dates and last but not least, we are increasing the share of 1P within supermarket. And we are doing so because it helps us get more e ective in getting consistency and availability of supply day after day. But it also brings efficiency and improvement in economics, right? So 1P in supermarket actually has better unit economics than 3P as we managed to operate with massive movements in our warehouses operating by pallets and master cases. We managed to get better revenues from advertising through our relationships with manufacturers. So 1P is and will definitely play a strategic role in supermarket moving forward. going to the question on margins. YoY, margins in supermarket in particular, continue to improve. X | See FMCG as huge opportunity, low e-commerce penetration, and typically increases buying think in general terms, e-commerce penetration in FMCG is pretty low. So Longer term, the opportunity is huge. We are just starting with this category, both ourselves and probably some of our competitors. So we are excited with everything we see and with everything we can build us to push that penetration closer to what e-commerce represents to the general retail. On halo effect, I was just mentioning before, we do measure downstream impact of supermarkets. So buyers who buy CPG in MercadoLibre end up buying more of general merchandise in MercadoLibre as well, and that's very positive. X | Don’t see any impact from US tariffs, importing from US, rather than selling to US So there's more volume coming into Argentina that presents an opportunity for us as well because we are shipping products from the U.S. But at the same time, some international players will come into Argentina, but we much rather see an open market than a gross market. So to summarize, I think for the most part, we haven't seen a big impact of related to tariffs in the U.S X | Watching TikTok Shops in Brazil and Mexico, focus on low-value items, for now more overlap with other platforms than MELI, but watching closely, can provide opportunity So on TikTok, I think it's still early days. So they launched in Mexico a few months back, they are just launching in Brazil, so we don't have too much info to share with you. Of course, we are paranoid, so we follow them closely, but there's not much to be shared. In Mexico, they seem to be focused on low-value items coming from domestic sellers to be seen what their strategy is going to be in Brazil. Taking a step back, I would say that there seems to be a higher overlap in data value prop with some other platforms more than with MercadoLibre but again, time will tell, right? So we will follow that X closely and decide how to respond. To wrap this X up. I would say that typically, when there's a new entrant in the e-commerce space, particularly when they come with a di erent playbook, they tend to bring new users who used to shop o ine into the online world, and that will create another opportunity for us as well, and we hope we can take advantage of that one. X | Using higher deposit rates to attract customers, more of marketing to position MELI as the leading digital bank Our strategy of offering attractive remuneration of deposits is proving to be a powerful to attract, retain and engage users. Our credit portfolio grew by XX% YoY while maintaining delinquency at comfortable levels. I'd say that the main driver for that is really it's marketing positioning ourselves as really the leading digital bank…And part of the value proposition is that we are the account that pays the most in Brazil. And so we are making sure that continues to be the case. X | XXX% of CDI is conditional on three criteria to increase customer stickiness and association that MELI is a digital bank There are limits to that. As you know, we there are X different conditions you have to keep in order to get the XXX% of CDI you have to be part of our loyalty program. You have to put together the money in a special pot and there's a limit of a few thousand reals that you can invest in that part. So I think it's working nicely. We have created a lot of awareness, and people associated us more and more with digital bank. And so thinking I'd say, in the very other direction. X | Argentina was the standout with recovery and extremely high profitability Argentina performed exceptionally well in Q1 in all of our business unita with U.S. dollar revenues more than doubling year-on-year. The stabilization of the macroeconomic environment has helped us to fully leverage the strength of our brands and value proposition in the country income from operations grew at a faster pace than revenue, helped by the strong performance in Argentina. XX | Argentina had lower inflation, decreasing interest rates and helping with funding costs of the credit book, optimistic about Argentina And just to complement, Andrew, yes, we're seeing, clearly, stabilization of Argentina. We have seen it for the past few quarters. But obviously, you have a tough comp last year was a really tough quarter in Q1. So that also help us with the comparison. But having said that, we've seen lower in ation decreasing interest rate, which is helping us with our credit book. Our credit book grew by 4x year-on-year in Argentina in dollar terms, not only that, but improved profitability as well that's helping profitability in Argentina asset under management from a very large base in Argentina continues to grow, grew at XX% YoY and profitability overall, the consolidated profitability for Argentina improved by XX percentage points during the quarter compared to last year. So we think we are very optimistic on Argentina, not only because of macro, but more important than that because of all the brands that we have in Argentina, both from [ Magali ] and Mercado Pago, the user experience that we have in Argentina, performing extremely well, Margins have improved and this is the reason why not only because of comp from last year, but also genuine and sustainable improvements in profitability we're seeing in Argentina so far. XX | Argentina delinquencies are the lowest because private sector has lower debt and credit markets were closed so people use MercadoPago and tend to pay back quicker, and has better credit quality With regards to Argentina. In Argentina, I would say that our -- is a country where we find delinquencies to be the lowest. Part of the reason behind that is that it's a country where the private sector has lower debt than in every other market just because the credit markets were closed for so long and also that people really use Mercado Pago pretty much every day. So they tend to pay us back quickly because we are in many cases, their primary account that they need us for their everyday lives. And so the credit quality in Argentina continues to be very good, and that has driven up increases Martin mentioned in terms of portfolio size, both on the consumer and on the merchant side of the business. XX | Looks like MELI will launch a credit card in Argentina possibly in H2 on the fintech side, that is mostly related to our credit card in those countries. And we have not launched a credit card in Argentina. So when we do, definitely, we will invest also in building that portfolio? which was the potential evolution of the credit card in Argentina, we expect this to be a very relevant card in the market. It's I would say that we have been learning, we first launched in Brazil, then we were able to run faster in Mexico, and I believe we have a very strong position in Argentina, and we would expect it to be interesting. Obviously, we will be cautious as we adapt the models to the local country, each country is different, but we expect to be able to do that in the second to start issuing cards in the second half of the year. XX | Saw more aggressive competition in Mexico in pricing and financing, was lacking selection to compete but identified and fixing it We epically saw more aggressive competition, both in terms of pricing and nancing in this category. And in some cases, we lacked some of the selection that we needed to compete. We have clearly identi ed the issue and have several targets initiatives to deal with this, such as some selected adjustments to our premium take rates, some rebates to improve price competitiveness and some other things we are already seeing positive results coming from each of those. XX | Not seen any deterioration in credit portfolio, continue to be profitable and NPLs healthy start with Brazil and our risk appetite in Brazil. We have not seen any deterioration in our portfolio. I think that both on the consumer side and on the credit side, we continue to be very profitable and NPLs continue to be very healthy. And now in Brazil, as I mentioned, the credit card book the recent cohort has the lowest rst payment defaults we have seen XX | NIMAL is moving lower, due to higher share lower risk / lower NIML credit card and moving more up market with consumers of the credit book, overall lower risk, lower spreads there are several moving parts when we look at our portfolio of loans, basically the one had, we are increasing the share of credit cards to the overall portfolio, the share of credit card portfolio's. And even though, yes, credit cards have a lower NIMAL than other parts of the portfolio the NIMAL of credit card itself has been improving. We never had such a good quarter as this one. So the asset quality is super good. What is changing is the share there. And also as the we grow our portfolio and all the cohorts mature the percentage of cohorts that are older and therefore, with a positive NIMAL will increase. And therefore, this goes in the opposite direction. This improves and o sets the change in mix. Then we are moving upmarket and by moving up markets both in the merchant and particularly in the consumer side of the credit book. And this what it means is we will have a little bit lower risk, but also lower spreads because of the very credit we are o ering. And so I would say that those have been the main drivers behind the change of mix in the credit portfolio. So it's safer. We have less default, but we have an impact in revenue yield and in bad debt. So it's safer. We have less default, but we have an impact in revenue yield and bad debt yield. XX | Capex activity remains on the similar path But given our current scenario and our internal projections, there are no changes to what we announced in the past in terms of footprint. So we were very active in deploying a large number of ful llment centers last year. I think this Q, in particular, the number was a bit lower, but that's just because of seasonality and time to market in setting up new facilities, but we'll continue building and expanding our footprint as needed in order to deal with the demand that we think we will continue generating in the marketplace. Osvaldo Giménez Executive And to complement from a nancial perspective, if you take logistics investment or CapEx and logistics this quarter as performance of revenues is consistent with what we had a year ago. So similar path from a nance perspective. ➡️ Key takeaways for MercadoLibre $MELI MELI continues to grow its e-commerce and fintech business strongly with a long run of growth with still low penetration. Strong discipline in terms of credit risk management and reinvestment in logistics infrastructure to continue to cement its moat and the leading e-commerce and fintech player in LATAM.  XXXXX engagements  **Related Topics** [$749m](/topic/$749m) [$1021m](/topic/$1021m) [$494m](/topic/$494m) [$763m](/topic/$763m) [$1452m](/topic/$1452m) [$935m](/topic/$935m) [$28b](/topic/$28b) [$59b](/topic/$59b) [Post Link](https://x.com/EugeneNg_VCap/status/1920404891052486776)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Eugene Ng @EugeneNg_VCap on x 24.5K followers

Created: 2025-05-08 09:06:20 UTC

Eugene Ng @EugeneNg_VCap on x 24.5K followers

Created: 2025-05-08 09:06:20 UTC

MercadoLibre $MELI 1Q25 Earnings

- Rev $5.9b +37% ↗️🟢

- GP $2.8b +37% ↗️🟢 margin XX% -X bps ↘️🔴

- Adj EBITDA $935m +37% ↗️🟢 margin XX% +1 bps ✅

- DC $1452m +41% ↗️🟢 margin XX% +69 bps ✅

- EBIT $763m +45% ↗️🟢 margin XX% +67 bps ✅

- Net Inc $494m +44% ↗️🟢 margin X% +38 bps ✅

- OCF $1021m -XX% ↘️🟠 margin XX% -1769 bps ↘️🔴

- FCF $749m -XX% ↘️🟠 margin XX% -1886 bps ↘️🔴

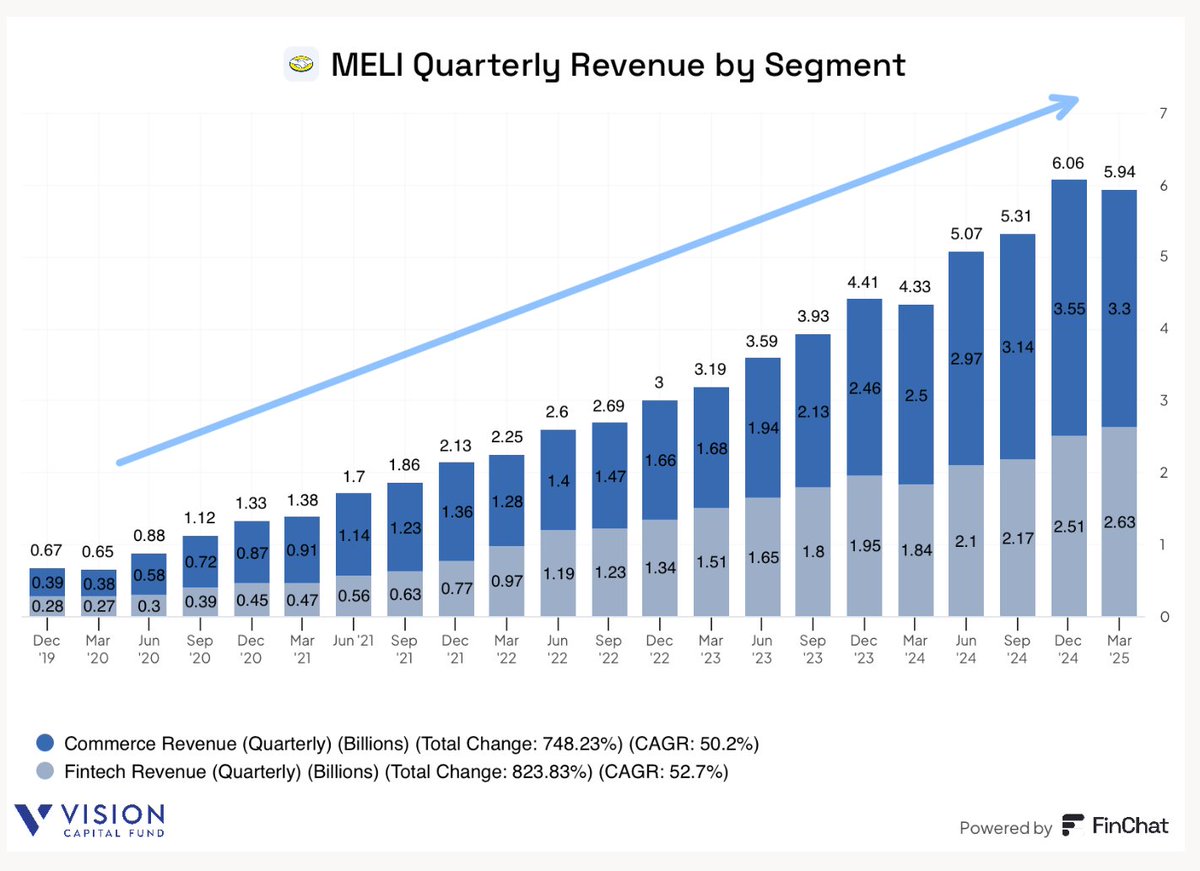

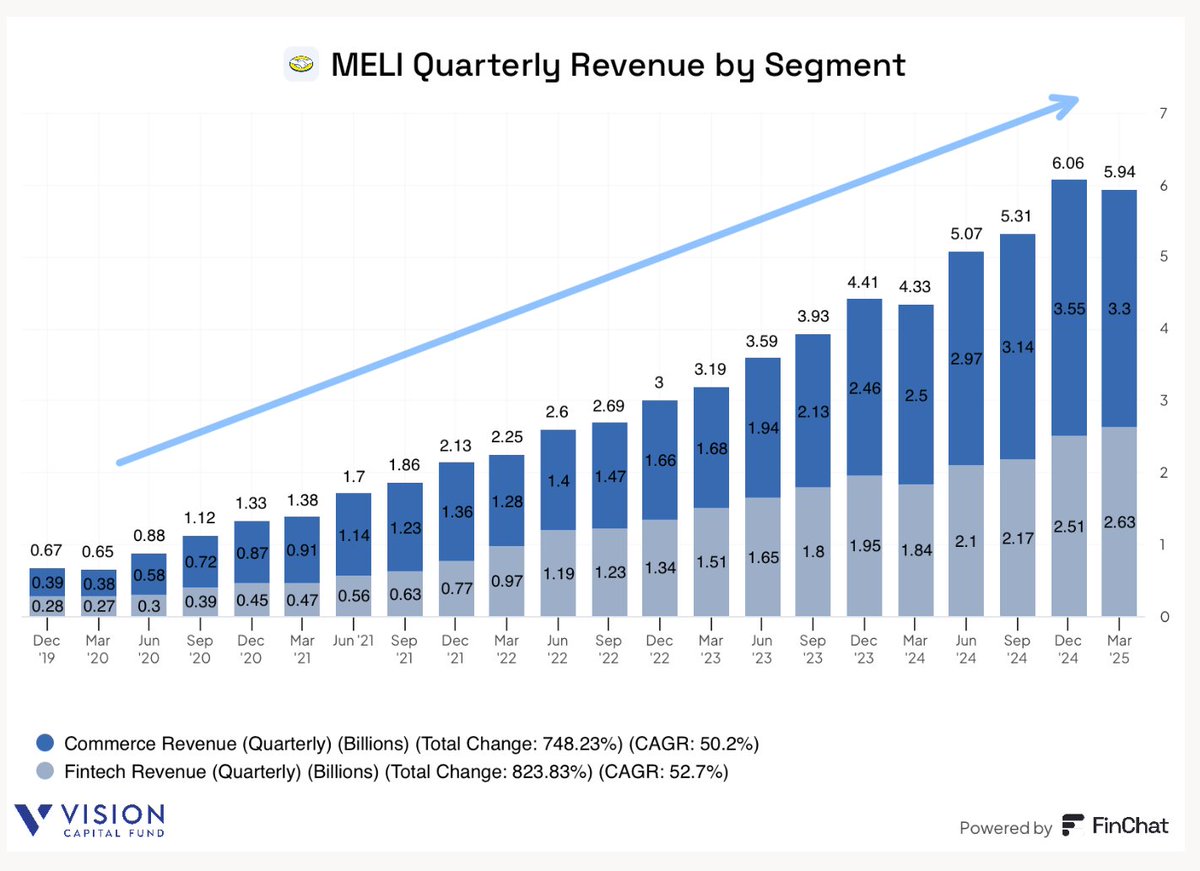

Revenue By Segment

Net Svc Rev $5320m +35% ↗️🟢

Net Pdt Rev $615m +63% ↗️🟢

Ad Rev +50% FXN ↗️🟢

Comm Net Rev $3.3b +32% ↗️🟢

Comm Svc Rev $2.7b +27% ↗️🟢

Comm Pdt Rev $0.6b +64% ↗️🟢

Fintech Net Rev $2.6b +43% ↗️🟢

Fin Svcs Net Rev $1.5b +39% ↗️🟢

Credit Net Rev $1.1b +49% ↗️🟢

Product Net Rev $13m +30% ↗️🟢

Biz Metrics

- Fintech MAU 64m +31% ↗️🟢

- Active Buyers 67m +26% ↗️🟢

- GMV $13.3b +17% ↗️🟢

- Items Sold 492m +28% ↗️🟢

- TPV $58.3b +43% ↗️🟢

- Acquiring TPV $40.3b +32% ↗️🟢

- Pymt Txn 3.3b +38% ↗️🟢

- Active Sellers with Credit XXXX% 📶🟢

- Same+ND Shipments 143.3m +25% ↗️🟢

- Fintech AUM $11.3b +103% ↗️🟢

- Credit Portfolio $7.8bn +75% ↗️🟢

- NIMAL XXXX% ↘️🟠 (upmarket+more CC)

- Past due 15-90 XXX% ➡️🟢

- Past due >90 XXXX% ➡️🟢

- Provision >15D XXX% ➡️🟢

- Past due >90 XXX% ➡️🟢

Revenue Growth Rates by Country/Segment

- Brazil +20% ↗️🟢 +41% FXN ↗️🟢

- Mexico +26% ↗️🟢 +51% FXN ↗️🟢

- Argentina +125% ↗️🟢 +184% FXN ↗️🟢

- Commerce +32% ↗️🟢 +57% FXN ↗️🟢

- Fintech +43% ↗️🟢 +73% FXN ↗️🟢

- Total MELI +37% ↗️🟢 +64% FXN ↗️🟢

GMV Growth Rates by Country

- Brazil +10% ↗️🟡 +30% FXN ↗️🟢

- Mexico +2% ↗️🟡 +23% FXN ↗️🟢

- Argentina +77% ↗️🟢 +126% FXN ↗️🟢

- Total MELI +17% ↗️🟢 +40% FXN ↗️🟢

TPV Growth Rates

- TPV Total +43% ↗️🟢 +72% FXN ↗️🟢

- TPV Acquiring +32% ↗️🟢+59% FXN ↗️🟢

Direct Contribution by Geography

- BR Rev $3.1b +20% ↗️🟢

- BR DC $542m -X% ↘️🟠 margin XX% -XXX bps ↘️🔴

- MX Rev $1.2b +26% ↗️🟢

- MX DC $217m -X% ↘️🟠 margin XX% -XXX bps ↘️🔴

- AR Rev $1.4b +125% ⤴️🟢

- AR DC $648m +189% ⤴️🟢 margin XX% +1047 bps ✅

- OT Rev $249m +41% ↗️🟢

- OT DC $45m +114% ⤴️🟢 margin XX% +614 bps ✅

X | Strong quarter

We are excited to kick off 2025 with another great quarter at MercadoLibre as we continue to deliver strong growth across both e-commerce and ntech. In Q1, we maintained the rapid pace of net revenue growth achieved in 2024, while making solid progress on all of our strategic initiatives. This momentum is fueled by continued investments and improvements in the valuable position for us.

X | Continue to be strong in e-commerce, 1P was particularly strong

In e-commerce, we continue to deliver strong growth, outpacing all of our major markets, brand preference metrics for our marketplace with all-time high in Brazil, Mexico, Argentina and Chile in the quarter. 1P had a tremendous Q1 with GMV growth +102% YoY with strong performance across markets and across categories. And I would say that's the consequence of continuing to improve selection and price competitiveness we also continue to make progress in terms of managing the business through more and more technology.

X | Particularly within 1P, supermarkets doing well, better unit economics than 3P, getting revenues from advertising, margins are improving

We improved our promotional activities and special dates and last but not least, we are increasing the share of 1P within supermarket. And we are doing so because it helps us get more e ective in getting consistency and availability of supply day after day. But it also brings efficiency and improvement in economics, right? So 1P in supermarket actually has better unit economics than 3P as we managed to operate with massive movements in our warehouses operating by pallets and master cases. We managed to get better revenues from advertising through our relationships with manufacturers. So 1P is and will definitely play a strategic role in supermarket moving forward. going to the question on margins. YoY, margins in supermarket in particular, continue to improve.

X | See FMCG as huge opportunity, low e-commerce penetration, and typically increases buying

think in general terms, e-commerce penetration in FMCG is pretty low. So Longer term, the opportunity is huge. We are just starting with this category, both ourselves and probably some of our competitors. So we are excited with everything we see and with everything we can build us to push that penetration closer to what e-commerce represents to the general retail. On halo effect, I was just mentioning before, we do measure downstream impact of supermarkets. So buyers who buy CPG in MercadoLibre end up buying more of general merchandise in MercadoLibre as well, and that's very positive.

X | Don’t see any impact from US tariffs, importing from US, rather than selling to US

So there's more volume coming into Argentina that presents an opportunity for us as well because we are shipping products from the U.S. But at the same time, some international players will come into Argentina, but we much rather see an open market than a gross market. So to summarize, I think for the most part, we haven't seen a big impact of related to tariffs in the U.S

X | Watching TikTok Shops in Brazil and Mexico, focus on low-value items, for now more overlap with other platforms than MELI, but watching closely, can provide opportunity

So on TikTok, I think it's still early days. So they launched in Mexico a few months back, they are just launching in Brazil, so we don't have too much info to share with you. Of course, we are paranoid, so we follow them closely, but there's not much to be shared. In Mexico, they seem to be focused on low-value items coming from domestic sellers to be seen what their strategy is going to be in Brazil. Taking a step back, I would say that there seems to be a higher overlap in data value prop with some other platforms more than with MercadoLibre but again, time will tell, right? So we will follow that X closely and decide how to respond. To wrap this X up. I would say that typically, when there's a new entrant in the e-commerce space, particularly when they come with a di erent playbook, they tend to bring new users who used to shop o ine into the online world, and that will create another opportunity for us as well, and we hope we can take advantage of that one.

X | Using higher deposit rates to attract customers, more of marketing to position MELI as the leading digital bank

Our strategy of offering attractive remuneration of deposits is proving to be a powerful to attract, retain and engage users. Our credit portfolio grew by XX% YoY while maintaining delinquency at comfortable levels.

I'd say that the main driver for that is really it's marketing positioning ourselves as really the leading digital bank…And part of the value proposition is that we are the account that pays the most in Brazil. And so we are making sure that continues to be the case.

X | XXX% of CDI is conditional on three criteria to increase customer stickiness and association that MELI is a digital bank

There are limits to that. As you know, we there are X different conditions you have to keep in order to get the XXX% of CDI you have to be part of our loyalty program. You have to put together the money in a special pot and there's a limit of a few thousand reals that you can invest in that part. So I think it's working nicely. We have created a lot of awareness, and people associated us more and more with digital bank. And so thinking I'd say, in the very other direction.

X | Argentina was the standout with recovery and extremely high profitability

Argentina performed exceptionally well in Q1 in all of our business unita with U.S. dollar revenues more than doubling year-on-year. The stabilization of the macroeconomic environment has helped us to fully leverage the strength of our brands and value proposition in the country income from operations grew at a faster pace than revenue, helped by the strong performance in Argentina.

XX | Argentina had lower inflation, decreasing interest rates and helping with funding costs of the credit book, optimistic about Argentina

And just to complement, Andrew, yes, we're seeing, clearly, stabilization of Argentina. We have seen it for the past few quarters. But obviously, you have a tough comp last year was a really tough quarter in Q1. So that also help us with the comparison. But having said that, we've seen lower in ation decreasing interest rate, which is helping us with our credit book. Our credit book grew by 4x year-on-year in Argentina in dollar terms, not only that, but improved profitability as well that's helping profitability in Argentina asset under management from a very large base in Argentina continues to grow, grew at XX% YoY and profitability overall, the consolidated profitability for Argentina improved by XX percentage points during the quarter compared to last year. So we think we are very optimistic on Argentina, not only because of macro, but more important than that because of all the brands that we have in Argentina, both from [ Magali ] and Mercado Pago, the user experience that we have in Argentina, performing extremely well,

Margins have improved and this is the reason why not only because of comp from last year, but also genuine and sustainable improvements in profitability we're seeing in Argentina so far.

XX | Argentina delinquencies are the lowest because private sector has lower debt and credit markets were closed so people use MercadoPago and tend to pay back quicker, and has better credit quality

With regards to Argentina. In Argentina, I would say that our -- is a country where we find delinquencies to be the lowest. Part of the reason behind that is that it's a country where the private sector has lower debt than in every other market just because the credit markets were closed for so long and also that people really use Mercado Pago pretty much every day. So they tend to pay us back quickly because we are in many cases, their primary account that they need us for their everyday lives. And so the credit quality in Argentina continues to be very good, and that has driven up increases Martin mentioned in terms of portfolio size, both on the consumer and on the merchant side of the business.

XX | Looks like MELI will launch a credit card in Argentina possibly in H2

on the fintech side, that is mostly related to our credit card in those countries. And we have not launched a credit card in Argentina. So when we do, definitely, we will invest also in building that portfolio? which was the potential evolution of the credit card in Argentina, we expect this to be a very relevant card in the market. It's I would say that we have been learning, we first launched in Brazil, then we were able to run faster in Mexico, and I believe we have a very strong position in Argentina, and we would expect it to be interesting. Obviously, we will be cautious as we adapt the models to the local country, each country is different, but we expect to be able to do that in the second to start issuing cards in the second half of the year.

XX | Saw more aggressive competition in Mexico in pricing and financing, was lacking selection to compete but identified and fixing it

We epically saw more aggressive competition, both in terms of pricing and nancing in this category. And in some cases, we lacked some of the selection that we needed to compete. We have clearly identi ed the issue and have several targets initiatives to deal with this, such as some selected adjustments to our premium take rates, some rebates to improve price competitiveness and some other things we are already seeing positive results coming from each of those.

XX | Not seen any deterioration in credit portfolio, continue to be profitable and NPLs healthy

start with Brazil and our risk appetite in Brazil. We have not seen any deterioration in our portfolio. I think that both on the consumer side and on the credit side, we continue to be very profitable and NPLs continue to be very healthy. And now in Brazil, as I mentioned, the credit card book the recent cohort has the lowest rst payment defaults we have seen

XX | NIMAL is moving lower, due to higher share lower risk / lower NIML credit card and moving more up market with consumers of the credit book, overall lower risk, lower spreads

there are several moving parts when we look at our portfolio of loans, basically the one had, we are increasing the share of credit cards to the overall portfolio, the share of credit card portfolio's. And even though, yes, credit cards have a lower NIMAL than other parts of the portfolio the NIMAL of credit card itself has been improving. We never had such a good quarter as this one. So the asset quality is super good. What is changing is the share there. And also as the we grow our portfolio and all the cohorts mature the percentage of cohorts that are older and therefore, with a positive NIMAL will increase. And therefore, this goes in the opposite direction. This improves and o sets the change in mix. Then we are moving upmarket and by moving up markets both in the merchant and particularly in the consumer side of the credit book. And this what it means is we will have a little bit lower risk, but also lower spreads because of the very credit we are o ering. And so I would say that those have been the main drivers behind the change of mix in the credit portfolio.

So it's safer. We have less default, but we have an impact in revenue yield and in bad debt. So it's safer. We have less default, but we have an impact in revenue yield and bad debt yield.

XX | Capex activity remains on the similar path

But given our current scenario and our internal projections, there are no changes to what we announced in the past in terms of footprint. So we were very active in deploying a large number of ful llment centers last year. I think this Q, in particular, the number was a bit lower, but that's just because of seasonality and time to market in setting up new facilities, but we'll continue building and expanding our footprint as needed in order to deal with the demand that we think we will continue generating in the marketplace. Osvaldo Giménez Executive And to complement from a nancial perspective, if you take logistics investment or CapEx and logistics this quarter as performance of revenues is consistent with what we had a year ago. So similar path from a nance perspective.

➡️ Key takeaways for MercadoLibre $MELI

MELI continues to grow its e-commerce and fintech business strongly with a long run of growth with still low penetration. Strong discipline in terms of credit risk management and reinvestment in logistics infrastructure to continue to cement its moat and the leading e-commerce and fintech player in LATAM.

XXXXX engagements

Related Topics $749m $1021m $494m $763m $1452m $935m $28b $59b