[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Eugene Ng [@EugeneNg_VCap](/creator/twitter/EugeneNg_VCap) on x 24.5K followers Created: 2025-05-08 02:16:55 UTC Paycom Software $PAYC 1Q25 Earnings - Rev $531m +6% ↗️🟡 - GP $446m +6% ↗️🟡 margin XX% -XX bps ↘️🔴 - Adj EBITDA $253m +10% ↗️🟡 margin XX% +182 bps ✅ - EBIT $185m -XX% ↘️🟠 margin XX% -2228 bps ↘️🔴 - NG Net Inc $158m +8% ↗️🟡 margin XX% +40 bps ✅ - Net Inc $139m -XX% ↘️🟠 margin XX% -2317 bps ↘️🔴 - OCF $183m +23% ↗️🟢 margin XX% +468 bps ✅ - FCF $145m +44% ↗️🟢 margin XX% +711 bps ✅ FY25 Mgmt Guide (raised) - Rev $2.038bn +8% ↗️🟡 - Recurring Rev +9% - Adj EBITDA $858m ~42% margins X | Saw meaningful increase in sales, strong momentum, setting up for 2025 and beyond with acceleration in Q4 Sales continues to break records, including the rst quarter, where we saw a meaningful increase in book sales. We also saw an increase in the number of units sold for the quarter as compared to the same period last year. We have a strong balance sheet with high-margin organic growth. We are building on strong momentum, and I'm very pleased with how this is setting us up for even stronger results through the rest of 2025 and beyond. Yes, Jason, we've talked about being consistent for the Q2, Q3 and Q4 with a little acceleration in Q4 on recurring revenue. That's how we're looking at that. X | NPS increased significantly by XX% YoY We are executing very well in delivering strong ROI for our clients as they are experiencing the bene ts of our full solution automation strategy. Recent product enhancements and client-focused initiatives are driving positive trends across our client usage metrics, and our Net Promoter Score increased another XX points YoY. X | Improving NPS flowing through to more product utilization and higher retention So we do report retention once a year. Obviously, it's reflected. The net of it is reflected in both of our current quarter achievements as well as any future guidance. We did talk about on the call how our Net Promoter continues to go up, and also that we are continuing to see more utilization of all of our products as we've removed more and more impediments to good usage. All of that is meant to have a positive impact on our retention. So those are all early indicators of things that we would expect to be reporting at the end of the year. X | Saw little impact from tariffs thus far, continue to monitor Yes, I'll take the tariffs. I mean, I would say it's still early to kind of be able to judge specifically. I would say we don't have much direct exposure to it. We're not over concentrated down market where you might see more of the maybe mom-and-pop impact a little bit more than what you could from a total employee base impact. But ultimately, anything that impacts our clients does impact us. It's just -- we haven't seen anything yet. And -- but it is something that we'll continue to monitor. I would say that it would have to have an impact on employee count and the overall employment, I would say, to really have a meaningful impact on us. But like everyone else, it's something we're monitoring. X | Not seeing any changes to demand Yes. I mean, the mid-market opportunity, I mean, I would say everywhere for us is going very well. I mean, we're not seeing any changes to demand. If anything, I've always kind of said we also create demand ourselves by the work we do. And as I just talked about, rst quarter was up meaningfully for both revenue from a book sales perspective as well as for units. X | GONE’s automated time-off solution is helping organisations save time, reducing errors, lower costs and staffing shortages We have the most automated solution in the industry and our clients routinely attested this. Our award-winning solution, GONE, is a perfect example of how Paycom simplifies tests through automation and AI. GONE is the industry's first fully automated time-o solution that decisions all time-off requests based on customizable guidelines set by the company's time-off rules. Before GONE, XX% of an organization's labor cost went substantially unmanaged, creating scheduling errors, increased cost from overpayments, staffing shortages and employee uncertainty over pending time-o requests. According to a Forrester study, GONE's automation delivers an ROI of up to XXX% for clients. delivers an ROI of up to XXX% for clients. GONE continues to receive recognition. Most recently, Fast Company magazine named Paycom, one of the world's most innovative companies for a second time. This honor speci cally recognized GONE and is a testament to how Paycom is shaping our industry by setting new standards for automation across the globe. X | BETI continues to help clients process payrolls faster and cut time on errors Another example of automation that is changing our industry is Beti. Our award-winning payroll solution continues to be a major selling point. Organizations looking to reduce the labor needed to process payroll by up to XX% and also cut the time spent correcting payroll errors by up to 85%. Beti allows clients to focus resources on profit-driving initiatives as it eliminates human involvement in non-revenue-generating tasks like post payroll adjustments, check reversals, voids, ledger corrections and more. X | BETI helped to bring back a client that left, and went back to PAYC in X hours versus X days for the previous vendor Thanks to Beti and the importance of perfect payrolls, we are also successfully getting former clients back onto the Paycom platform. We recently brought back a XXX employee health care company, who quickly realized the pain they brought on themselves by switching to another provider. With this other provider, this client lost the transparency and ability to x errors before they became problems. In fact, their employees were some of the biggest advocates and encourage this client to return to Paycom because they missed having control over the accuracy of their pay. Once employees experience Beti, they don't want to go backwards in technology. The client returned to us within X months and went from processing payroll in X days with their previous vendor to X hours with Beti. X | Focused on getting clients back We're also focused on that. We want every client to come back. I mean, there's no questions asked on our part, let's get going. And so we do have a strategy to get clients that have left back. We also have a strategy to make sure that clients are receiving the value so that they don't have to go through that pain of a conversion to just to turn around and come back to us. And so that remains a part of our overall strategy. It has, and we're having a lot of success with that. XX | Raised FY25 guide slightly Now let me turn to guidance for 2025. We continue to have success selling and onboarding new logos. Based on our strong Q1 results and outlook for the remainder of the year, we are raising our full year revenue and adjusted EBITDA guidance ranges. XX | Authorization as payment institution from Central Bank of Ireland allows Paycom to move money throughout Europe So Ireland and being there allows us to get to the rest of Europe from there. And we've been focused on continuing to build out our product. I mentioned global HCM that works for all countries. We continue to onboard for that. We actually process native payroll in for other countries other than the U.S., which includes the banking side of it. And so we're continuing to do that. And this was one of the steps that you take to be able to continue to move further into Europe This allows us to move money throughout Europe. The last yard of a payroll is actually getting it into the employee's account correctly. And if you do everything else right, you don't do that part, you kind of did nothing. So for us to make sure that we ensure the highest quality for all of our clients, we like to keep the ball in our hand, and this is something that's required to do that. XX | Re-ramping up sales, seeing positive traction Yes. So well, first on the sell side, I would say that we've been continuing to get better and better in sales. I do believe that our sales sta is the best in the world at what they do. And we did have a reconstitution, if you will, of training early part of last year, as Amy kind of took over the group to get back to the normal blocking and tackling that we've always done here at Paycom. That resulted in increased sales, especially as well as increased units, new logo adds. Obviously, those came on throughout the year and most would have all started by now. And then as we turned into first quarter, we saw a continuation of the same, up meaningfully in both book sales and units. And so activity matters in sales. XX | Remained focused on automating the product even though it has a near-term negative profitability impact And then, of course, having a product that's getting better and better and better as we go to market, removing barriers of usage. And then as far as the -- on the efficiency side, we're automating our product for the client -- we're automating our product for the client, and we're also automating things internally. There are several tasks that we have to perform on the back end that we've been able to automate, and that has an impact on our adjusted EBITDA across the board, but it also has an impact on the client experience. And that's really why we're doing a lot of the things that we're doing through automation. I'd like to say the only reason a client even calls us is due to the deficiency in the software that we create. And so a lot of our focus has been removing impediments, removing clicks and really focusing on allowing the client to have a full solution -- fully solution automated product. And so that's been impacting our margins, and that's been impacting our sales. XX | Remain focused on creating value from automation And so we're that type of business, we create value for our clients when we automate, we create value for ourselves when we automate, and that's what we've been focused on for quite some time now, and it's rolling out. It's actually rolling out. It's not just a goal. We're actually achieving it rolling out throughout the product as well as our back end. ➡️ Final Takeaways on Paycom Software $PAYC Organic growth seems to have bottom and is reaccelerating and the dark clouds lifting. Seeing some signs of improving sales, winning back customers who had left. Would like to see stronger push on sales with more urgency While the FY25 annual revenue guide seems somewhat soft, with the strong sales effort and product innovation, growth could reaccelerate onwards driving Paycom to deliver strong durable and profitable organic growth for a long time.  XXXXX engagements  **Related Topics** [ebit](/topic/ebit) [$145m](/topic/$145m) [$183m](/topic/$183m) [$139m](/topic/$139m) [$158m](/topic/$158m) [$185m](/topic/$185m) [$253m](/topic/$253m) [$446m](/topic/$446m) [Post Link](https://x.com/EugeneNg_VCap/status/1920301861451804835)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Eugene Ng @EugeneNg_VCap on x 24.5K followers

Created: 2025-05-08 02:16:55 UTC

Eugene Ng @EugeneNg_VCap on x 24.5K followers

Created: 2025-05-08 02:16:55 UTC

Paycom Software $PAYC 1Q25 Earnings

- Rev $531m +6% ↗️🟡

- GP $446m +6% ↗️🟡 margin XX% -XX bps ↘️🔴

- Adj EBITDA $253m +10% ↗️🟡 margin XX% +182 bps ✅

- EBIT $185m -XX% ↘️🟠 margin XX% -2228 bps ↘️🔴

- NG Net Inc $158m +8% ↗️🟡 margin XX% +40 bps ✅

- Net Inc $139m -XX% ↘️🟠 margin XX% -2317 bps ↘️🔴

- OCF $183m +23% ↗️🟢 margin XX% +468 bps ✅

- FCF $145m +44% ↗️🟢 margin XX% +711 bps ✅

FY25 Mgmt Guide (raised)

- Rev $2.038bn +8% ↗️🟡

- Recurring Rev +9%

- Adj EBITDA $858m ~42% margins

X | Saw meaningful increase in sales, strong momentum, setting up for 2025 and beyond with acceleration in Q4

Sales continues to break records, including the rst quarter, where we saw a meaningful increase in book sales. We also saw an increase in the number of units sold for the quarter as compared to the same period last year.

We have a strong balance sheet with high-margin organic growth. We are building on strong momentum, and I'm very pleased with how this is setting us up for even stronger results through the rest of 2025 and beyond.

Yes, Jason, we've talked about being consistent for the Q2, Q3 and Q4 with a little acceleration in Q4 on recurring revenue. That's how we're looking at that.

X | NPS increased significantly by XX% YoY

We are executing very well in delivering strong ROI for our clients as they are experiencing the bene ts of our full solution automation strategy. Recent product enhancements and client-focused initiatives are driving positive trends across our client usage metrics, and our Net Promoter Score increased another XX points YoY.

X | Improving NPS flowing through to more product utilization and higher retention

So we do report retention once a year. Obviously, it's reflected. The net of it is reflected in both of our current quarter achievements as well as any future guidance. We did talk about on the call how our Net Promoter continues to go up, and also that we are continuing to see more utilization of all of our products as we've removed more and more impediments to good usage. All of that is meant to have a positive impact on our retention. So those are all early indicators of things that we would expect to be reporting at the end of the year.

X | Saw little impact from tariffs thus far, continue to monitor

Yes, I'll take the tariffs. I mean, I would say it's still early to kind of be able to judge specifically. I would say we don't have much direct exposure to it. We're not over concentrated down market where you might see more of the maybe mom-and-pop impact a little bit more than what you could from a total employee base impact. But ultimately, anything that impacts our clients does impact us. It's just -- we haven't seen anything yet. And -- but it is something that we'll continue to monitor. I would say that it would have to have an impact on employee count and the overall employment, I would say, to really have a meaningful impact on us. But like everyone else, it's something we're monitoring.

X | Not seeing any changes to demand

Yes. I mean, the mid-market opportunity, I mean, I would say everywhere for us is going very well. I mean, we're not seeing any changes to demand. If anything, I've always kind of said we also create demand ourselves by the work we do. And as I just talked about, rst quarter was up meaningfully for both revenue from a book sales perspective as well as for units.

X | GONE’s automated time-off solution is helping organisations save time, reducing errors, lower costs and staffing shortages

We have the most automated solution in the industry and our clients routinely attested this. Our award-winning solution, GONE, is a perfect example of how Paycom simplifies tests through automation and AI. GONE is the industry's first fully automated time-o solution that decisions all time-off requests based on customizable guidelines set by the company's time-off rules. Before GONE, XX% of an organization's labor cost went substantially unmanaged, creating scheduling errors, increased cost from overpayments, staffing shortages and employee uncertainty over pending time-o requests. According to a Forrester study, GONE's automation delivers an ROI of up to XXX% for clients. delivers an ROI of up to XXX% for clients. GONE continues to receive recognition. Most recently, Fast Company magazine named Paycom, one of the world's most innovative companies for a second time. This honor speci cally recognized GONE and is a testament to how Paycom is shaping our industry by setting new standards for automation across the globe.

X | BETI continues to help clients process payrolls faster and cut time on errors

Another example of automation that is changing our industry is Beti. Our award-winning payroll solution continues to be a major selling point. Organizations looking to reduce the labor needed to process payroll by up to XX% and also cut the time spent correcting payroll errors by up to 85%. Beti allows clients to focus resources on profit-driving initiatives as it eliminates human involvement in non-revenue-generating tasks like post payroll adjustments, check reversals, voids, ledger corrections and more.

X | BETI helped to bring back a client that left, and went back to PAYC in X hours versus X days for the previous vendor

Thanks to Beti and the importance of perfect payrolls, we are also successfully getting former clients back onto the Paycom platform. We recently brought back a XXX employee health care company, who quickly realized the pain they brought on themselves by switching to another provider. With this other provider, this client lost the transparency and ability to x errors before they became problems. In fact, their employees were some of the biggest advocates and encourage this client to return to Paycom because they missed having control over the accuracy of their pay. Once employees experience Beti, they don't want to go backwards in technology. The client returned to us within X months and went from processing payroll in X days with their previous vendor to X hours with Beti.

X | Focused on getting clients back

We're also focused on that. We want every client to come back. I mean, there's no questions asked on our part, let's get going. And so we do have a strategy to get clients that have left back. We also have a strategy to make sure that clients are receiving the value so that they don't have to go through that pain of a conversion to just to turn around and come back to us. And so that remains a part of our overall strategy. It has, and we're having a lot of success with that.

XX | Raised FY25 guide slightly

Now let me turn to guidance for 2025. We continue to have success selling and onboarding new logos. Based on our strong Q1 results and outlook for the remainder of the year, we are raising our full year revenue and adjusted EBITDA guidance ranges.

XX | Authorization as payment institution from Central Bank of Ireland allows Paycom to move money throughout Europe

So Ireland and being there allows us to get to the rest of Europe from there. And we've been focused on continuing to build out our product. I mentioned global HCM that works for all countries. We continue to onboard for that. We actually process native payroll in for other countries other than the U.S., which includes the banking side of it. And so we're continuing to do that. And this was one of the steps that you take to be able to continue to move further into Europe

This allows us to move money throughout Europe. The last yard of a payroll is actually getting it into the employee's account correctly. And if you do everything else right, you don't do that part, you kind of did nothing. So for us to make sure that we ensure the highest quality for all of our clients, we like to keep the ball in our hand, and this is something that's required to do that.

XX | Re-ramping up sales, seeing positive traction

Yes. So well, first on the sell side, I would say that we've been continuing to get better and better in sales. I do believe that our sales sta is the best in the world at what they do. And we did have a reconstitution, if you will, of training early part of last year, as Amy kind of took over the group to get back to the normal blocking and tackling that we've always done here at Paycom. That resulted in increased sales, especially as well as increased units, new logo adds. Obviously, those came on throughout the year and most would have all started by now. And then as we turned into first quarter, we saw a continuation of the same, up meaningfully in both book sales and units. And so activity matters in sales.

XX | Remained focused on automating the product even though it has a near-term negative profitability impact

And then, of course, having a product that's getting better and better and better as we go to market, removing barriers of usage. And then as far as the -- on the efficiency side, we're automating our product for the client -- we're automating our product for the client, and we're also automating things internally. There are several tasks that we have to perform on the back end that we've been able to automate, and that has an impact on our adjusted EBITDA across the board, but it also has an impact on the client experience. And that's really why we're doing a lot of the things that we're doing through automation. I'd like to say the only reason a client even calls us is due to the deficiency in the software that we create. And so a lot of our focus has been removing impediments, removing clicks and really focusing on allowing the client to have a full solution -- fully solution automated product. And so that's been impacting our margins, and that's been impacting our sales.

XX | Remain focused on creating value from automation

And so we're that type of business, we create value for our clients when we automate, we create value for ourselves when we automate, and that's what we've been focused on for quite some time now, and it's rolling out. It's actually rolling out. It's not just a goal. We're actually achieving it rolling out throughout the product as well as our back end.

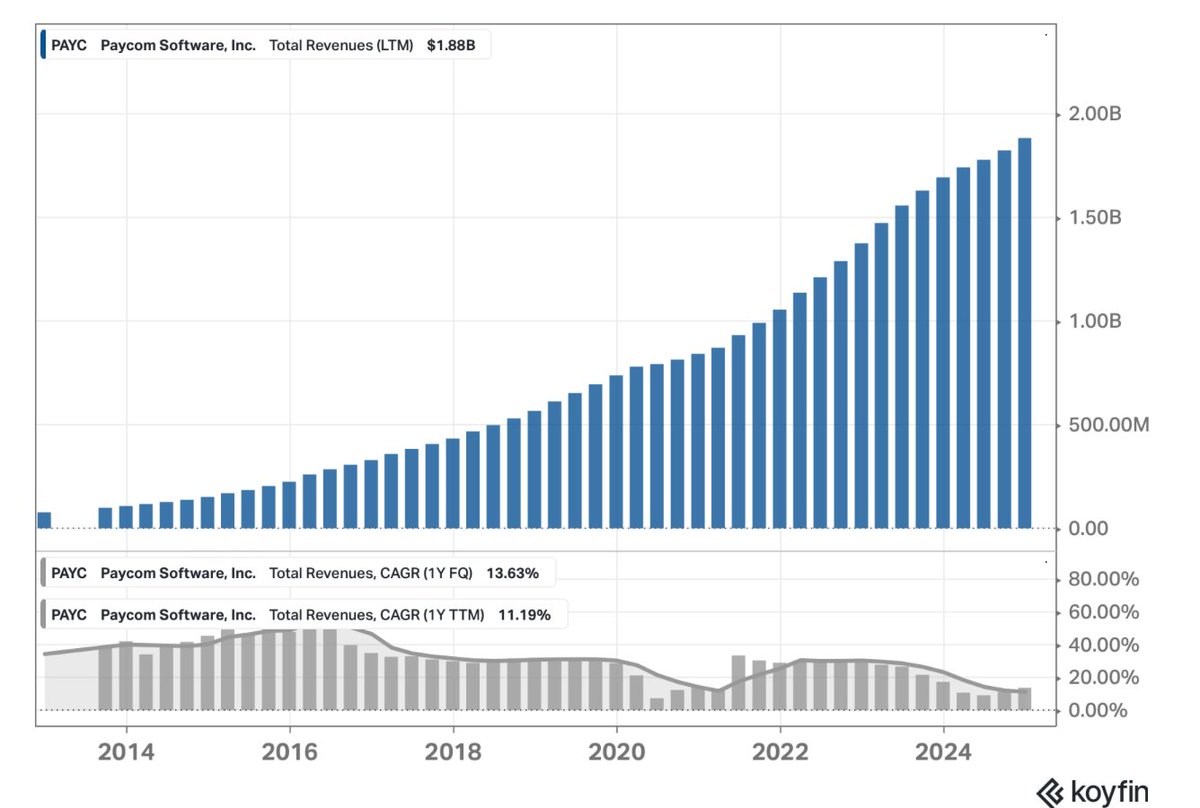

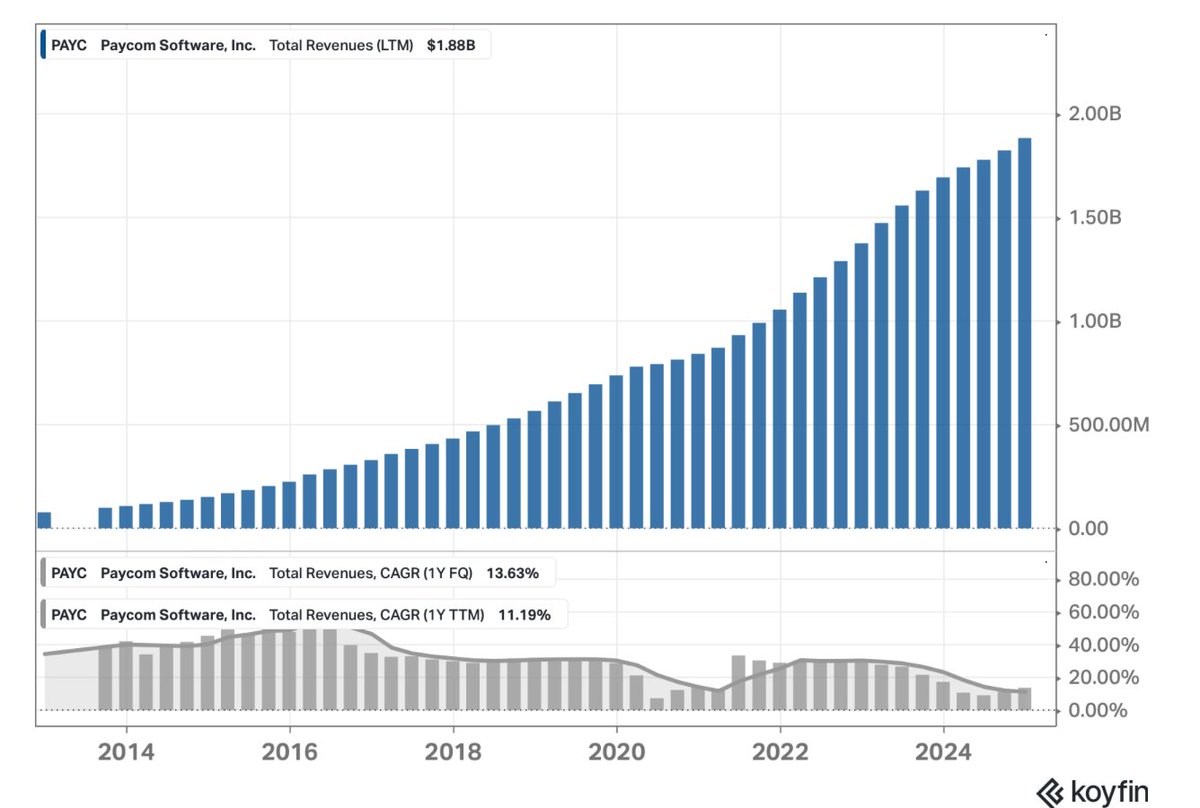

➡️ Final Takeaways on Paycom Software $PAYC

Organic growth seems to have bottom and is reaccelerating and the dark clouds lifting. Seeing some signs of improving sales, winning back customers who had left. Would like to see stronger push on sales with more urgency

While the FY25 annual revenue guide seems somewhat soft, with the strong sales effort and product innovation, growth could reaccelerate onwards driving Paycom to deliver strong durable and profitable organic growth for a long time.

XXXXX engagements

Related Topics ebit $145m $183m $139m $158m $185m $253m $446m