[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Delphi Digital [@Delphi_Digital](/creator/twitter/Delphi_Digital) on x 208.2K followers Created: 2025-05-06 16:03:27 UTC DeFi yields have declined. Rather than recycling TradFi yields, the real opportunity comes from generating crypto-native yield through DePIN & AI infrastructure. @USDai_Official unlocks this potential by bringing a multi-billion dollar compute financing market on-chain. Today, stablecoin yield has largely come from lending revenue & T-Bills. However, the AI revolution presents an untapped source of yield: the physical infrastructure powering it. The problem is hardware is illiquid, but USDAI tackles the issue by transforming hardware into liquid, productive capital with its synthetic dollar. DePIN operators can collateralize hardware assets. Through USDAI InfraFi looping, operators collateralize hardware for fixed-rate, amortizing loans. These loans prioritize lender safety with ~70% LTV (~30% equity cushion) and ongoing principal repayment, enabling operators to leverage hardware for faster scaling and potentially higher returns. How does it work? First, USDAI uses the CALIBER framework with legal standards like UCC Section X and rigorous due diligence processes (site visits, insurance) to create NFTs bringing physical hardware like GPUs on chain. Secondly, USDAI uses a modular underwriting system to ensure loan quality & scalability. @PermianLabs will be the sole underwriter at launch specializing in compute assets. As USDAI grows, additional underwriters will be onboarded to support other emerging hardware-intensive businesses. Stablecoin Powered By Compute USDai itself is the synthetic dollar backed by assets held within a portfolio of hardware-backed lending pools. It aggregates value from underlying Liquid Credit Tokens (LCTs) which represent shares in specific loan pools. Initially, USDai will be made up of T-bills powered by @m0foundation during the bootstrapping phase, offering stable treasury yields for early liquidity. As more hardware loans are underwritten, this backing will shift over time. USDai can be staked for sUSDai, which will receive T-bill yield initially and hardware loan yield later on. The goal is to eventually increase yield to XXX% hardware backing, targeting returns significantly higher than traditional rates. Recognizing that high hardware backing impacts liquidity, USDAI also plans to implement QEV (Queue Extractable Value), an auction mechanism designed to manage redemptions efficiently during these later stages. This approach connects DeFi's efficiency with real-world hardware needs, offering operators crucial leverage and DeFi users a novel, RWA-backed yield source tied directly to the AI revolution's infrastructure growth.  XXXXXX engagements  **Related Topics** [lending](/topic/lending) [coins stablecoin](/topic/coins-stablecoin) [onchain](/topic/onchain) [money](/topic/money) [coins ai](/topic/coins-ai) [delphi](/topic/delphi) [Post Link](https://x.com/Delphi_Digital/status/1919785085986889959)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Delphi Digital @Delphi_Digital on x 208.2K followers

Created: 2025-05-06 16:03:27 UTC

Delphi Digital @Delphi_Digital on x 208.2K followers

Created: 2025-05-06 16:03:27 UTC

DeFi yields have declined. Rather than recycling TradFi yields, the real opportunity comes from generating crypto-native yield through DePIN & AI infrastructure.

@USDai_Official unlocks this potential by bringing a multi-billion dollar compute financing market on-chain.

Today, stablecoin yield has largely come from lending revenue & T-Bills. However, the AI revolution presents an untapped source of yield: the physical infrastructure powering it.

The problem is hardware is illiquid, but USDAI tackles the issue by transforming hardware into liquid, productive capital with its synthetic dollar.

DePIN operators can collateralize hardware assets. Through USDAI InfraFi looping, operators collateralize hardware for fixed-rate, amortizing loans.

These loans prioritize lender safety with 70% LTV (30% equity cushion) and ongoing principal repayment, enabling operators to leverage hardware for faster scaling and potentially higher returns.

How does it work?

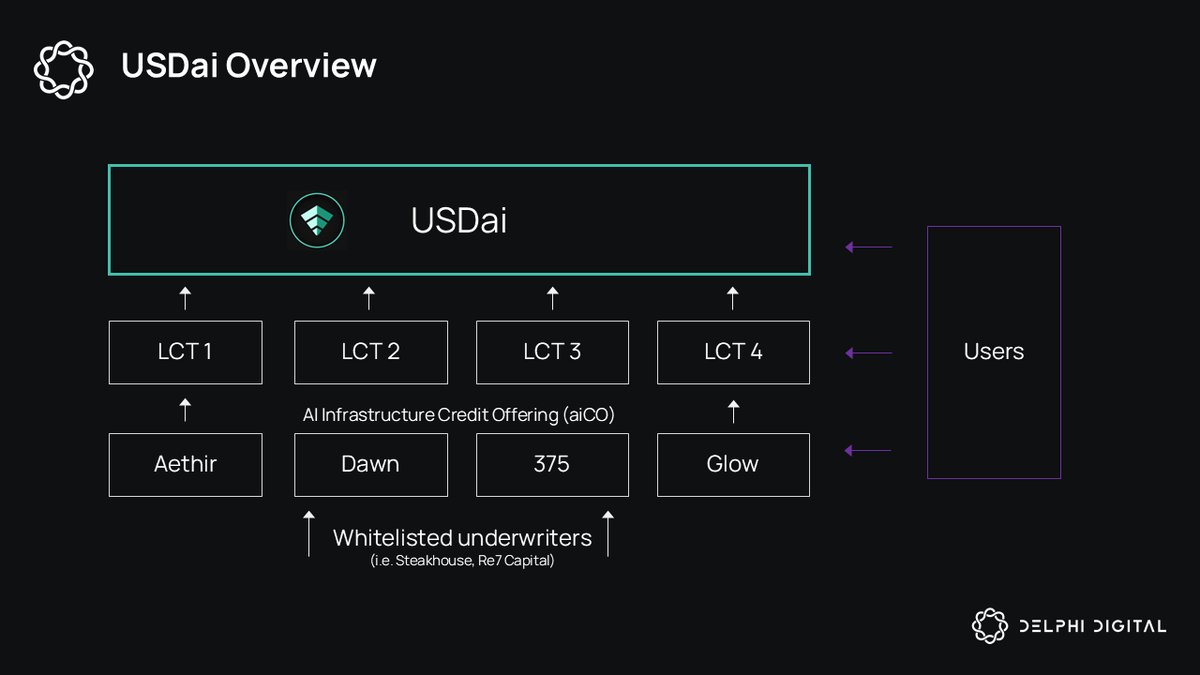

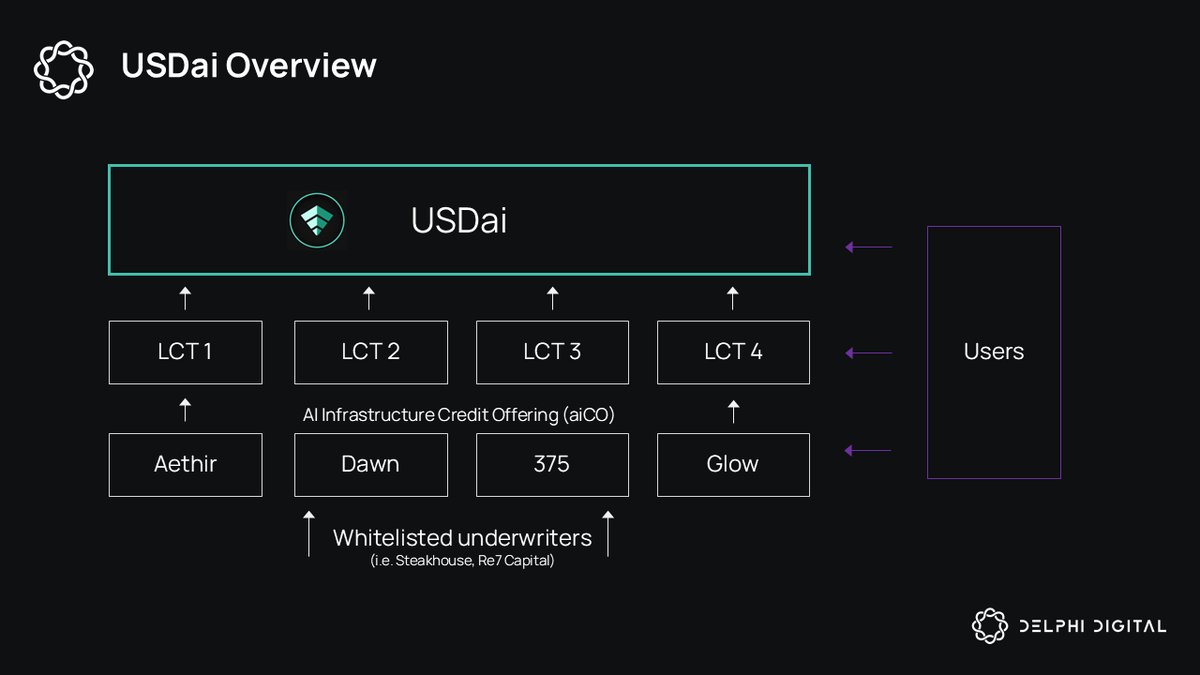

First, USDAI uses the CALIBER framework with legal standards like UCC Section X and rigorous due diligence processes (site visits, insurance) to create NFTs bringing physical hardware like GPUs on chain. Secondly, USDAI uses a modular underwriting system to ensure loan quality & scalability. @PermianLabs will be the sole underwriter at launch specializing in compute assets.

As USDAI grows, additional underwriters will be onboarded to support other emerging hardware-intensive businesses.

Stablecoin Powered By Compute

USDai itself is the synthetic dollar backed by assets held within a portfolio of hardware-backed lending pools. It aggregates value from underlying Liquid Credit Tokens (LCTs) which represent shares in specific loan pools. Initially, USDai will be made up of T-bills powered by @m0foundation during the bootstrapping phase, offering stable treasury yields for early liquidity.

As more hardware loans are underwritten, this backing will shift over time. USDai can be staked for sUSDai, which will receive T-bill yield initially and hardware loan yield later on. The goal is to eventually increase yield to XXX% hardware backing, targeting returns significantly higher than traditional rates.

Recognizing that high hardware backing impacts liquidity, USDAI also plans to implement QEV (Queue Extractable Value), an auction mechanism designed to manage redemptions efficiently during these later stages.

This approach connects DeFi's efficiency with real-world hardware needs, offering operators crucial leverage and DeFi users a novel, RWA-backed yield source tied directly to the AI revolution's infrastructure growth.

XXXXXX engagements

Related Topics lending coins stablecoin onchain money coins ai delphi