[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Ray Wang [@rwang07](/creator/twitter/rwang07) on x 14.2K followers Created: 2025-05-05 21:08:06 UTC Report: China's 28nm foundry capacity to hit XX% by 2027 as SMIC, HLMC, Nexchip ramp up China is rapidly expanding mature-node chip production at key sites, including SMIC's fabs in Beijing, Shenzhen, Shanghai Lingang, and Xiqing; Hua Hong Semiconductor's phase-two 12-inch fab in Wuxi; Nexchip Semiconductor's N3 facility; and the second-phase 12-inch project by Beijing Yandong Micro Electronic. With these ongoing investments, analysts estimate China's global share of 28nm capacity could exceed XX% by 2027. Omdia reports that while mature-node expansion is sluggish outside China, domestic foundries are rapidly scaling up their 12-inch capacity. Between 2024 and 2027, China's 12-inch mature-node capacity is projected to grow at a CAGR of 26.8%. Globally, excluding TSMC, the pure-play foundry market for mature nodes is forecast to rise from US$32.26 billion in 2023 to US$47.27 billion in 2027, with a CAGR of 10.0%. Initially driven by mobile processors and baseband chips, 28nm demand has shifted since 2017 toward OTT set-top boxes, smart TVs, automotive electronics, and IoT devices. SMIC began mass production of 28nm chips in 2015 and completed its high-k metal gate (HKMG) process development in 2018. Since 2020, the company has expanded 28nm and higher-node production lines across four sites. HLMC achieved 28nm production readiness by late 2018, and Nexchip has completed functionality verification for its 28nm logic chips. Compared to FinFET-based nodes like 16nm and 14nm, the 28nm/22nm platform offers a compelling balance of performance and cost, making it ideal for OLED drivers, mid-range processors, ISPs, flash memory, and Wi-Fi X. The transition of high-resolution CMOS image sensors (CIS) to 28nm is further driving structural growth. Thanks to its broad applicability, 28nm has emerged as a primary target for semiconductor capital investment in China. SEMI reports that global semiconductor equipment sales hit US$117.14 billion in 2024, a XX% year-over-year increase and the fourth gain in five years. The market has grown from US$71.2 billion in 2019, surpassing the 2022 peak of US$107.64 billion. China, South Korea, and Taiwan remain the top three countries for semiconductor equipment spending, collectively accounting for XX% of global share. China has emerged as the largest buyer, with its share of global equipment spending rising from XXXX% in 2020 to XXXX% in 2024, now absorbing more than XX% of worldwide shipments. From 2020 to 2024, China's annual equipment spending grew by 39.0%, 58%, -4.6%, 29.0%, and 35%, respectively.  XXXXX engagements  **Related Topics** [fab](/topic/fab) [hua hong](/topic/hua-hong) [lingang](/topic/lingang) [$2607hk](/topic/$2607hk) [shanghai](/topic/shanghai) [beijing](/topic/beijing) [china](/topic/china) [Post Link](https://x.com/rwang07/status/1919499366953324713)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Ray Wang @rwang07 on x 14.2K followers

Created: 2025-05-05 21:08:06 UTC

Ray Wang @rwang07 on x 14.2K followers

Created: 2025-05-05 21:08:06 UTC

Report: China's 28nm foundry capacity to hit XX% by 2027 as SMIC, HLMC, Nexchip ramp up

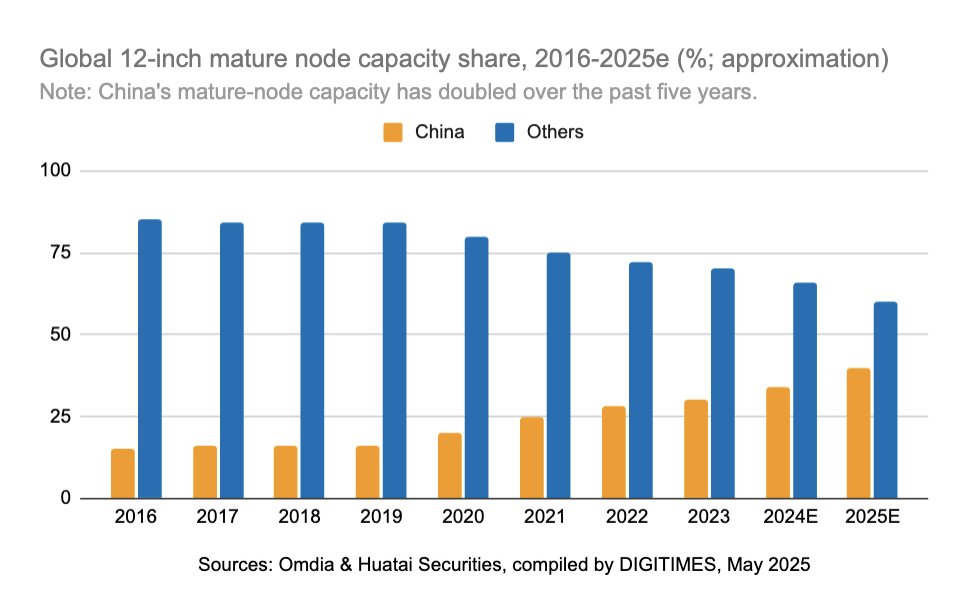

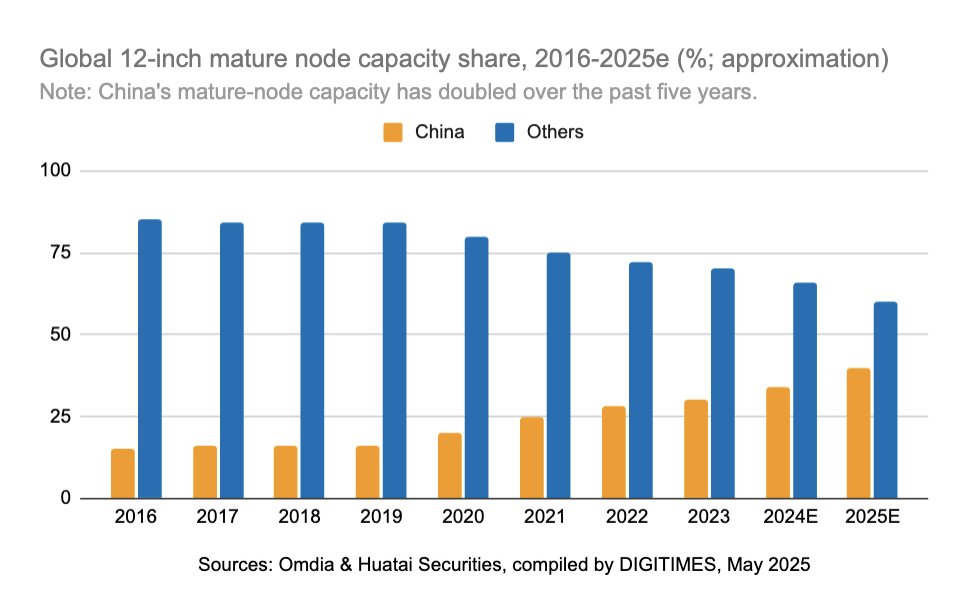

China is rapidly expanding mature-node chip production at key sites, including SMIC's fabs in Beijing, Shenzhen, Shanghai Lingang, and Xiqing; Hua Hong Semiconductor's phase-two 12-inch fab in Wuxi; Nexchip Semiconductor's N3 facility; and the second-phase 12-inch project by Beijing Yandong Micro Electronic. With these ongoing investments, analysts estimate China's global share of 28nm capacity could exceed XX% by 2027.

Omdia reports that while mature-node expansion is sluggish outside China, domestic foundries are rapidly scaling up their 12-inch capacity.

Between 2024 and 2027, China's 12-inch mature-node capacity is projected to grow at a CAGR of 26.8%. Globally, excluding TSMC, the pure-play foundry market for mature nodes is forecast to rise from US$32.26 billion in 2023 to US$47.27 billion in 2027, with a CAGR of 10.0%.

Initially driven by mobile processors and baseband chips, 28nm demand has shifted since 2017 toward OTT set-top boxes, smart TVs, automotive electronics, and IoT devices. SMIC began mass production of 28nm chips in 2015 and completed its high-k metal gate (HKMG) process development in 2018. Since 2020, the company has expanded 28nm and higher-node production lines across four sites.

HLMC achieved 28nm production readiness by late 2018, and Nexchip has completed functionality verification for its 28nm logic chips. Compared to FinFET-based nodes like 16nm and 14nm, the 28nm/22nm platform offers a compelling balance of performance and cost, making it ideal for OLED drivers, mid-range processors, ISPs, flash memory, and Wi-Fi X. The transition of high-resolution CMOS image sensors (CIS) to 28nm is further driving structural growth.

Thanks to its broad applicability, 28nm has emerged as a primary target for semiconductor capital investment in China.

SEMI reports that global semiconductor equipment sales hit US$117.14 billion in 2024, a XX% year-over-year increase and the fourth gain in five years. The market has grown from US$71.2 billion in 2019, surpassing the 2022 peak of US$107.64 billion.

China, South Korea, and Taiwan remain the top three countries for semiconductor equipment spending, collectively accounting for XX% of global share. China has emerged as the largest buyer, with its share of global equipment spending rising from XXXX% in 2020 to XXXX% in 2024, now absorbing more than XX% of worldwide shipments.

From 2020 to 2024, China's annual equipment spending grew by 39.0%, 58%, -4.6%, 29.0%, and 35%, respectively.

XXXXX engagements

Related Topics fab hua hong lingang $2607hk shanghai beijing china