[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Sergey [@SergeyCYW](/creator/twitter/SergeyCYW) on x 6351 followers Created: 2025-04-23 04:06:58 UTC $ISRG Posts +28% Net Income Growth in Q1’25 — But Shares Dip Slightly Intuitive Surgical reported another strong quarter. Net Income climbed +28.2% YoY with Net Margin expanding to 31%, and EPS rose +27.2% YoY to $XXXX. Operating Income jumped +23.2%, supported by margin expansion to 26%, while EBITDA margin held at 31%, signaling durable profitability. Revenue increased +19.1% YoY to $2.25B, led by +25.0% growth in System sales and a +24.5% YoY rise in Da Vinci placements, reflecting continued momentum in surgical adoption. Recurring revenue also climbed +18.9%, showing strength in platform retention. Yet despite all of this, shares fell -XXX% post-earnings. Could it be concern around margin trends in Services? While Product Gross Profit grew +19.3% YoY, Services margin contracted significantly by -XXXX PPs YoY, despite only modest +6.9% growth in Services Gross Profit. That could signal pressure in high-margin service activities. Valuation remains elevated with EV/Sales at XXXX and Forward P/E at XXXX. With expectations this high, even a strong quarter might not be enough to drive upside without a beat or guidance raise. Operationally, $ISRG is executing well. The question is whether market sentiment can keep pace with fundamentals.  XXXXX engagements  **Related Topics** [$225b](/topic/$225b) [supported](/topic/supported) [eps](/topic/eps) [dip](/topic/dip) [stocks](/topic/stocks) [$isrg](/topic/$isrg) [stocks healthcare](/topic/stocks-healthcare) [Post Link](https://x.com/SergeyCYW/status/1914893736628417018)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Sergey @SergeyCYW on x 6351 followers

Created: 2025-04-23 04:06:58 UTC

Sergey @SergeyCYW on x 6351 followers

Created: 2025-04-23 04:06:58 UTC

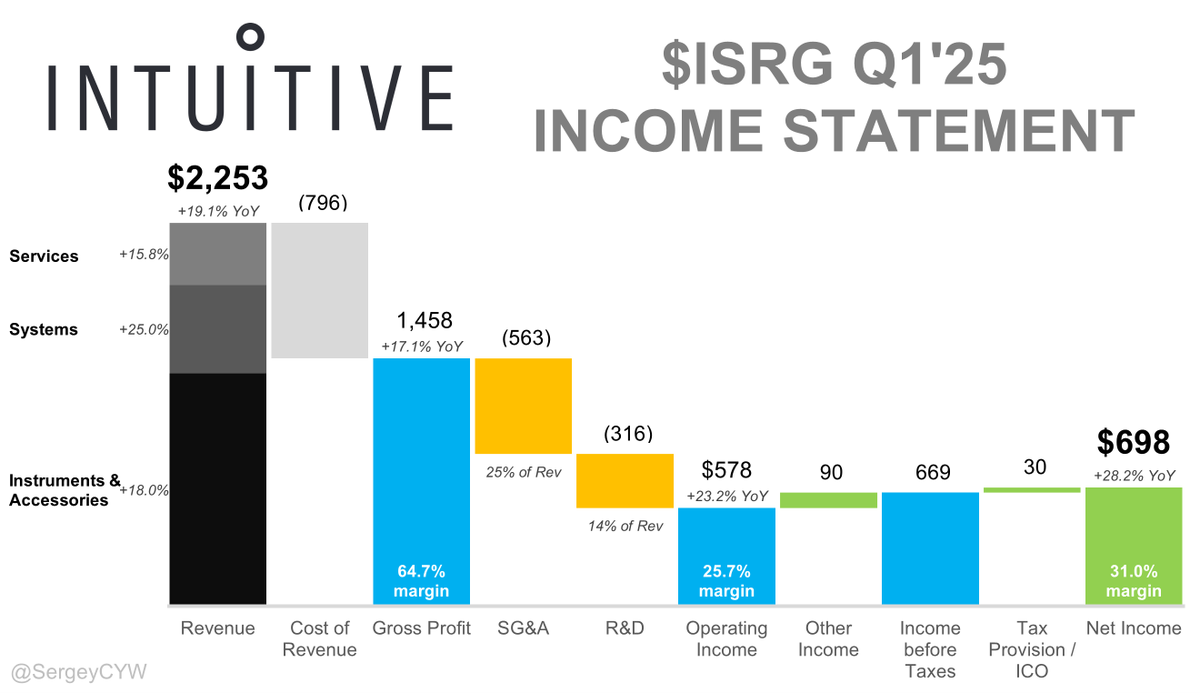

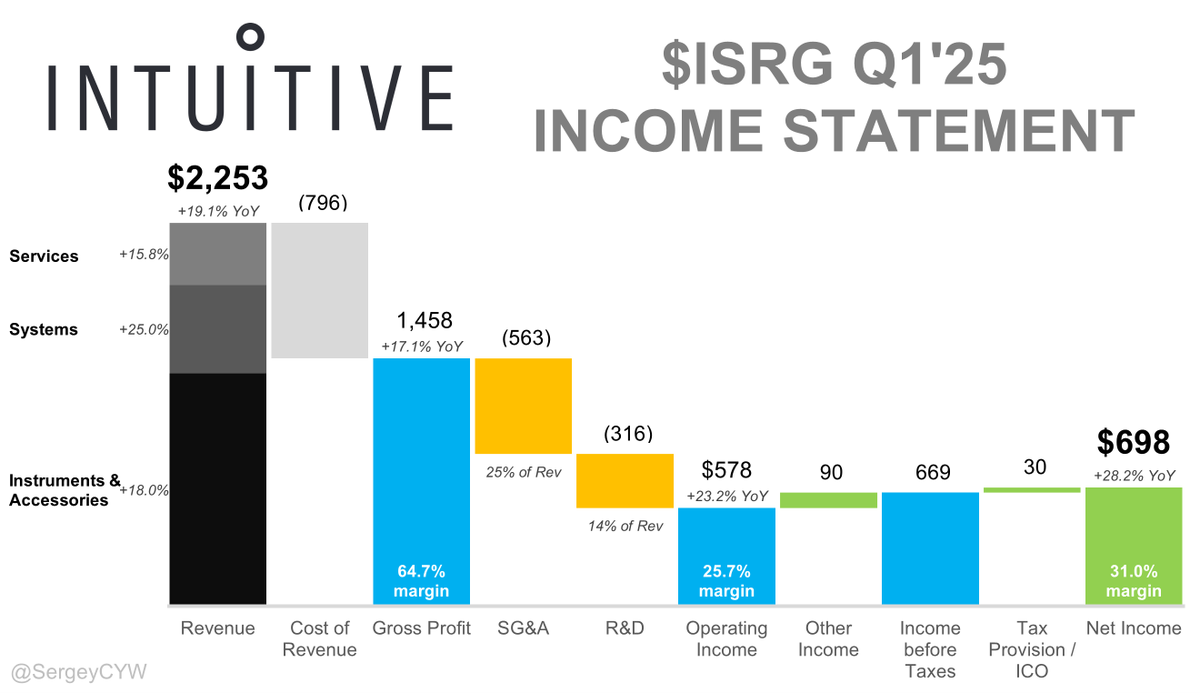

$ISRG Posts +28% Net Income Growth in Q1’25 — But Shares Dip Slightly Intuitive Surgical reported another strong quarter. Net Income climbed +28.2% YoY with Net Margin expanding to 31%, and EPS rose +27.2% YoY to $XXXX. Operating Income jumped +23.2%, supported by margin expansion to 26%, while EBITDA margin held at 31%, signaling durable profitability.

Revenue increased +19.1% YoY to $2.25B, led by +25.0% growth in System sales and a +24.5% YoY rise in Da Vinci placements, reflecting continued momentum in surgical adoption. Recurring revenue also climbed +18.9%, showing strength in platform retention.

Yet despite all of this, shares fell -XXX% post-earnings. Could it be concern around margin trends in Services?

While Product Gross Profit grew +19.3% YoY, Services margin contracted significantly by -XXXX PPs YoY, despite only modest +6.9% growth in Services Gross Profit. That could signal pressure in high-margin service activities.

Valuation remains elevated with EV/Sales at XXXX and Forward P/E at XXXX. With expectations this high, even a strong quarter might not be enough to drive upside without a beat or guidance raise.

Operationally, $ISRG is executing well. The question is whether market sentiment can keep pace with fundamentals.

XXXXX engagements

Related Topics $225b supported eps dip stocks $isrg stocks healthcare