[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Mario Nawfal [@MarioNawfal](/creator/twitter/MarioNawfal) on x 2.3M followers Created: 2025-04-22 11:00:02 UTC 🇨🇳 CHINA-UAE GAS DEAL SIDELINES U.S. — AND THE DOLLAR China has signed major long-term LNG deals with the UAE, some settled in yuan — not dollars — signaling a clear challenge to the petrodollar status quo. State-owned firms like CNOOC, ENN, and Zhenhua locked in supply contracts with ADNOC spanning X to XX years, with deliveries up to X million metric tons annually starting between 2026 and 2028. The move is part of Beijing’s broader push to reduce reliance on U.S. energy, made easier by tariffs and the fact that China imported zero U.S. LNG in March. This isn’t just an energy deal — it’s a geopolitical flex, tightening China’s grip on Gulf energy flows while chipping away at dollar dominance. Source: Reuters  XXXXXX engagements  **Related Topics** [told](/topic/told) [russia](/topic/russia) [$0883hk](/topic/$0883hk) [uae](/topic/uae) [longterm](/topic/longterm) [china](/topic/china) [money](/topic/money) [Post Link](https://x.com/MarioNawfal/status/1914635301932380662)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Mario Nawfal @MarioNawfal on x 2.3M followers

Created: 2025-04-22 11:00:02 UTC

Mario Nawfal @MarioNawfal on x 2.3M followers

Created: 2025-04-22 11:00:02 UTC

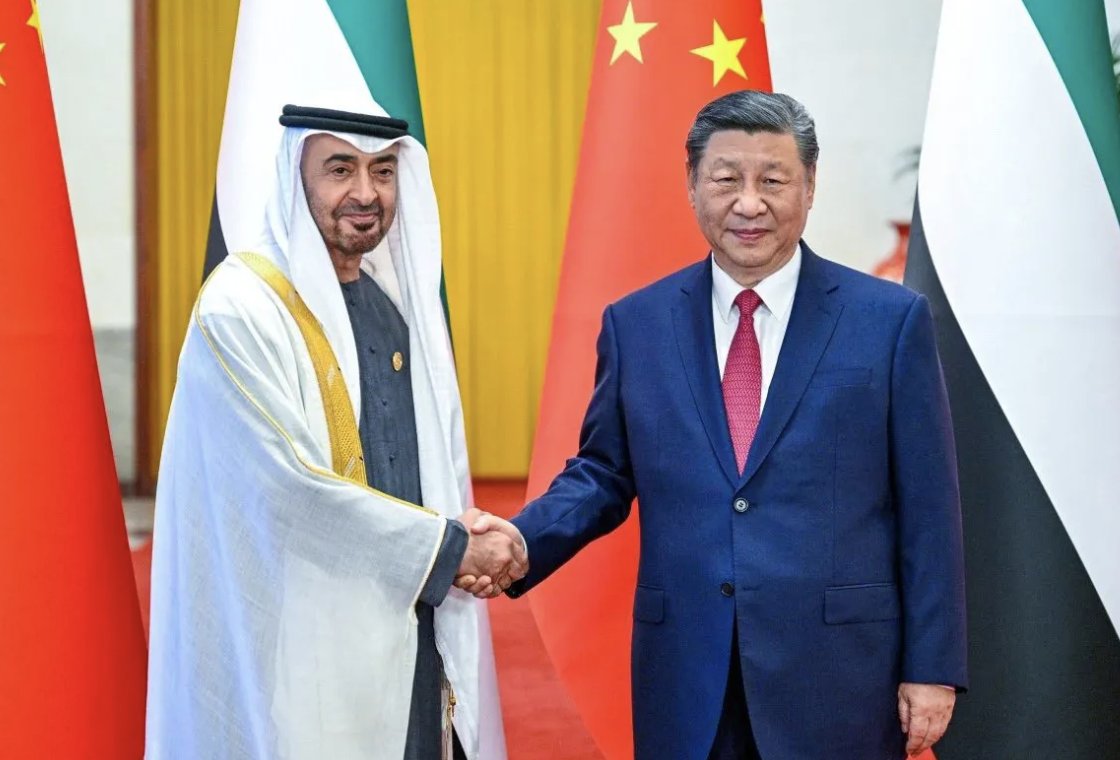

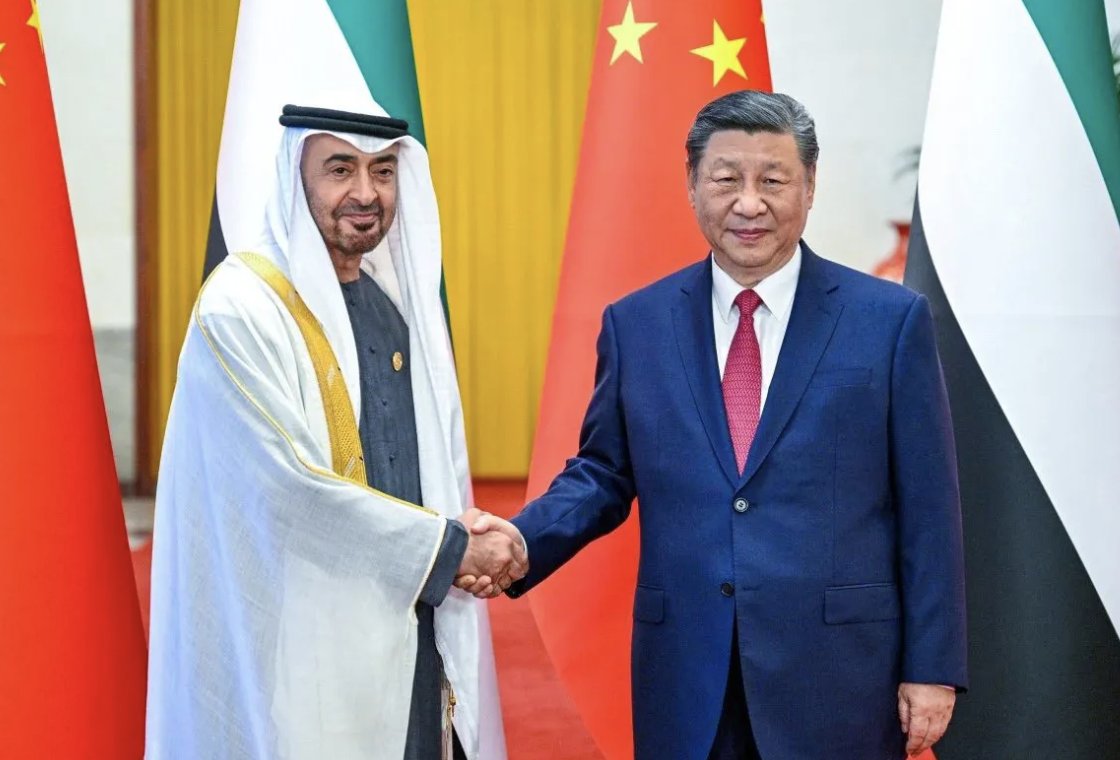

🇨🇳 CHINA-UAE GAS DEAL SIDELINES U.S. — AND THE DOLLAR

China has signed major long-term LNG deals with the UAE, some settled in yuan — not dollars — signaling a clear challenge to the petrodollar status quo.

State-owned firms like CNOOC, ENN, and Zhenhua locked in supply contracts with ADNOC spanning X to XX years, with deliveries up to X million metric tons annually starting between 2026 and 2028.

The move is part of Beijing’s broader push to reduce reliance on U.S. energy, made easier by tariffs and the fact that China imported zero U.S. LNG in March.

This isn’t just an energy deal — it’s a geopolitical flex, tightening China’s grip on Gulf energy flows while chipping away at dollar dominance.

Source: Reuters

XXXXXX engagements