[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Jon Regenold [@TripDawg](/creator/twitter/TripDawg) on x 56K followers Created: 2025-04-04 16:26:25 UTC Dividends earned into my account this morning from holding the following stocks... $TLT 43¢ $PFF 37¢ $MUB 2¢ $LQD 15¢ $JNK 15¢ $IRM $XXXX $HYG $XXXX $EMB 29¢ $AGG 30¢ 💲🏔️ = $XXXX iShares 20+ Year Treasury Bond ETF (TLT)Dividend: $XXXX (likely monthly). Annualized: $XXXX × XX = $5.16.Typical Price (April 2025): ~$95 (based on recent trends).Estimated Yield: ($5.16 / $95) × XXX ≈ 5.4%. iShares Preferred and Income Securities ETF (PFF)Dividend: $XXXX (monthly). Annualized: $XXXX × XX = $4.44.Typical Price: ~$32.Estimated Yield: ($4.44 / $32) × XXX ≈ 13.9%. iShares National Muni Bond ETF (MUB)Dividend: $XXXX (monthly). Annualized: $XXXX × XX = $0.24.Typical Price: ~$108.Estimated Yield: ($0.24 / $108) × XXX ≈ 0.2%. iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD)Dividend: $XXXX (monthly). Annualized: $XXXX × XX = $1.80.Typical Price: ~$110.Estimated Yield: ($1.80 / $110) × XXX ≈ 1.6%. SPDR Bloomberg High Yield Bond ETF (JNK)Dividend: $XXXX (monthly). Annualized: $XXXX × XX = $1.80.Typical Price: ~$95.Estimated Yield: ($1.80 / $95) × XXX ≈ 1.9%. Iron Mountain (IRM)Dividend: $XXXX (likely quarterly). Annualized: $XXXX × X = $18.68.Typical Price: ~$80.Estimated Yield: ($18.68 / $80) × XXX ≈ XXXX% (this seems high; Iron Mountain typically yields ~4-5%, so the dividend might reflect a larger share count or special dividend). iShares iBoxx $ High Yield Corporate Bond ETF (HYG)Dividend: $XXXX (monthly). Annualized: $XXXX × XX = $15.84.Typical Price: ~$78.Estimated Yield: ($15.84 / $78) × XXX ≈ XXXX% (also high; typical yield is ~5-6%, suggesting a possible special dividend or large share count). iShares JP Morgan USD Emerging Markets Bond ETF (EMB)Dividend: $XXXX (monthly). Annualized: $XXXX × XX = $3.48.Typical Price: ~$90.Estimated Yield: ($3.48 / $90) × XXX ≈ 3.9%. iShares Core U.S. Aggregate Bond ETF (AGG)Dividend: $XXXX (monthly). Annualized: $XXXX × XX = $3.60.Typical Price: ~$98.Estimated Yield: ($3.60 / $98) × XXX ≈ 3.7%.  XXX engagements  **Related Topics** [emb](/topic/emb) [mub](/topic/mub) [$516typical](/topic/$516typical) [fund manager](/topic/fund-manager) [$agg](/topic/$agg) [$emb](/topic/$emb) [$hyg](/topic/$hyg) [$irm](/topic/$irm) [Post Link](https://x.com/TripDawg/status/1908194455372660871)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Jon Regenold @TripDawg on x 56K followers

Created: 2025-04-04 16:26:25 UTC

Jon Regenold @TripDawg on x 56K followers

Created: 2025-04-04 16:26:25 UTC

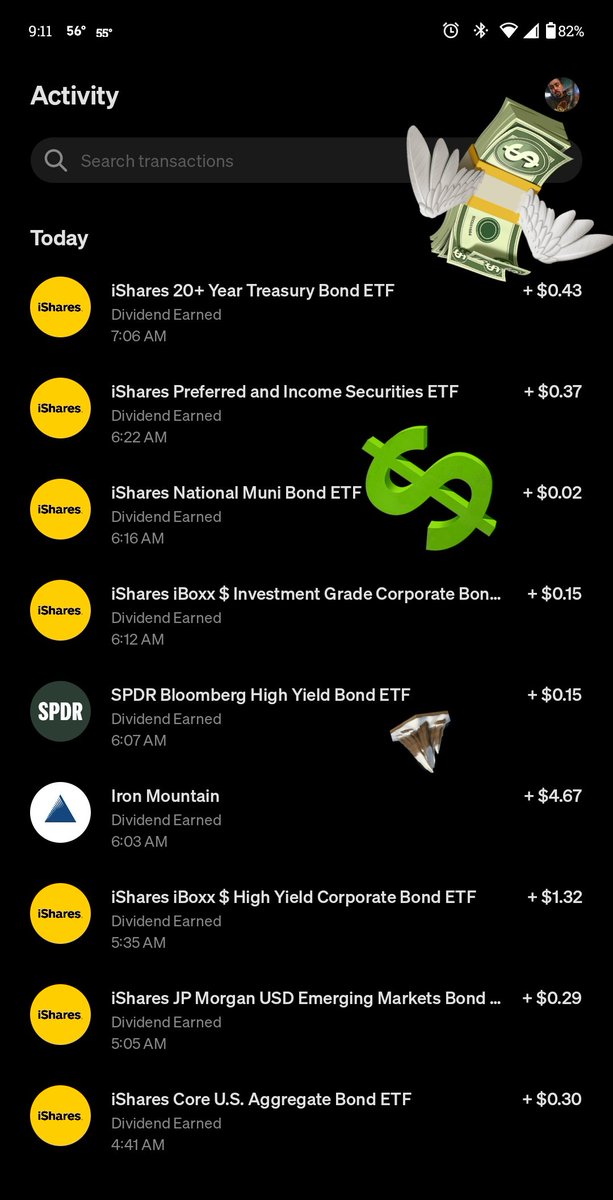

Dividends earned into my account this morning from holding the following stocks... $TLT 43¢ $PFF 37¢ $MUB 2¢ $LQD 15¢ $JNK 15¢ $IRM $XXXX $HYG $XXXX $EMB 29¢ $AGG 30¢ 💲🏔️ = $XXXX

iShares 20+ Year Treasury Bond ETF (TLT)Dividend: $XXXX (likely monthly). Annualized: $XXXX × XX = $5.16.Typical Price (April 2025): ~$95 (based on recent trends).Estimated Yield: ($5.16 / $95) × XXX ≈ 5.4%.

iShares Preferred and Income Securities ETF (PFF)Dividend: $XXXX (monthly). Annualized: $XXXX × XX = $4.44.Typical Price: ~$32.Estimated Yield: ($4.44 / $32) × XXX ≈ 13.9%.

iShares National Muni Bond ETF (MUB)Dividend: $XXXX (monthly). Annualized: $XXXX × XX = $0.24.Typical Price: ~$108.Estimated Yield: ($0.24 / $108) × XXX ≈ 0.2%.

iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD)Dividend: $XXXX (monthly). Annualized: $XXXX × XX = $1.80.Typical Price: ~$110.Estimated Yield: ($1.80 / $110) × XXX ≈ 1.6%.

SPDR Bloomberg High Yield Bond ETF (JNK)Dividend: $XXXX (monthly). Annualized: $XXXX × XX = $1.80.Typical Price: ~$95.Estimated Yield: ($1.80 / $95) × XXX ≈ 1.9%.

Iron Mountain (IRM)Dividend: $XXXX (likely quarterly). Annualized: $XXXX × X = $18.68.Typical Price: ~$80.Estimated Yield: ($18.68 / $80) × XXX ≈ XXXX% (this seems high; Iron Mountain typically yields ~4-5%, so the dividend might reflect a larger share count or special dividend).

iShares iBoxx $ High Yield Corporate Bond ETF (HYG)Dividend: $XXXX (monthly). Annualized: $XXXX × XX = $15.84.Typical Price: ~$78.Estimated Yield: ($15.84 / $78) × XXX ≈ XXXX% (also high; typical yield is ~5-6%, suggesting a possible special dividend or large share count).

iShares JP Morgan USD Emerging Markets Bond ETF (EMB)Dividend: $XXXX (monthly). Annualized: $XXXX × XX = $3.48.Typical Price: ~$90.Estimated Yield: ($3.48 / $90) × XXX ≈ 3.9%.

iShares Core U.S. Aggregate Bond ETF (AGG)Dividend: $XXXX (monthly). Annualized: $XXXX × XX = $3.60.Typical Price: ~$98.Estimated Yield: ($3.60 / $98) × XXX ≈ 3.7%.

XXX engagements

Related Topics emb mub $516typical fund manager $agg $emb $hyg $irm