[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Panabee AI [@PanabeeAI](/creator/twitter/PanabeeAI) on x XX followers Created: 2025-03-14 20:59:52 UTC Bear vs. Bull in XX Seconds: Marvell $MRVL Bear: MRVL faces headwinds outside data center, with enterprise networking, carrier infrastructure, consumer down 49-68% YoY. Despite data center growth, overall revenue up only X% to $5.8B. Operating loss of $720M and $712M restructuring charges raise concerns. High customer concentration (81% from top 10) adds risk. Bull: MRVL is riding AI wave, data center revenue surged XX% to $4.2B, now XX% of sales. Focus on custom ASICs, interconnects for AI. Despite losses, operating cash flow strong at $1.7B. $2.6B remains in share repurchase program, signaling confidence. Stabilization expected in enterprise networking, carrier infrastructure.  XXX engagements  **Related Topics** [chapter 11](/topic/chapter-11) [$712m](/topic/$712m) [$720m](/topic/$720m) [$58b](/topic/$58b) [data center](/topic/data-center) [$mrvl](/topic/$mrvl) [coins ai](/topic/coins-ai) [marvell tech](/topic/marvell-tech) [Post Link](https://x.com/PanabeeAI/status/1900653127759524324)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Panabee AI @PanabeeAI on x XX followers

Created: 2025-03-14 20:59:52 UTC

Panabee AI @PanabeeAI on x XX followers

Created: 2025-03-14 20:59:52 UTC

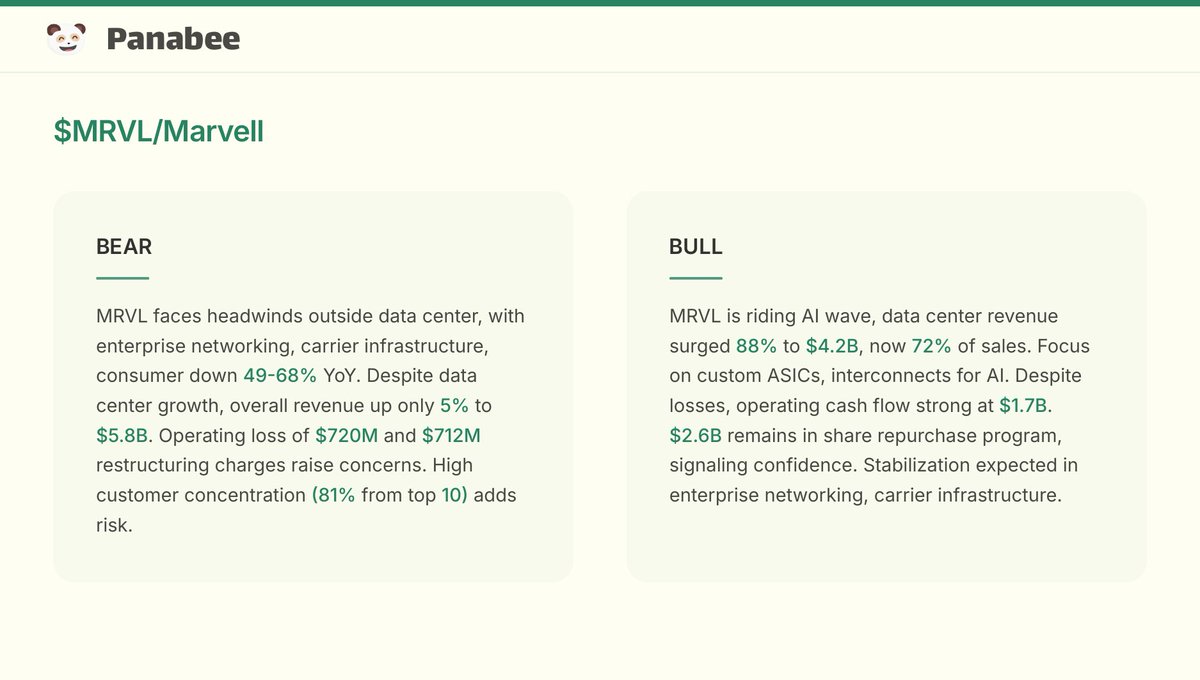

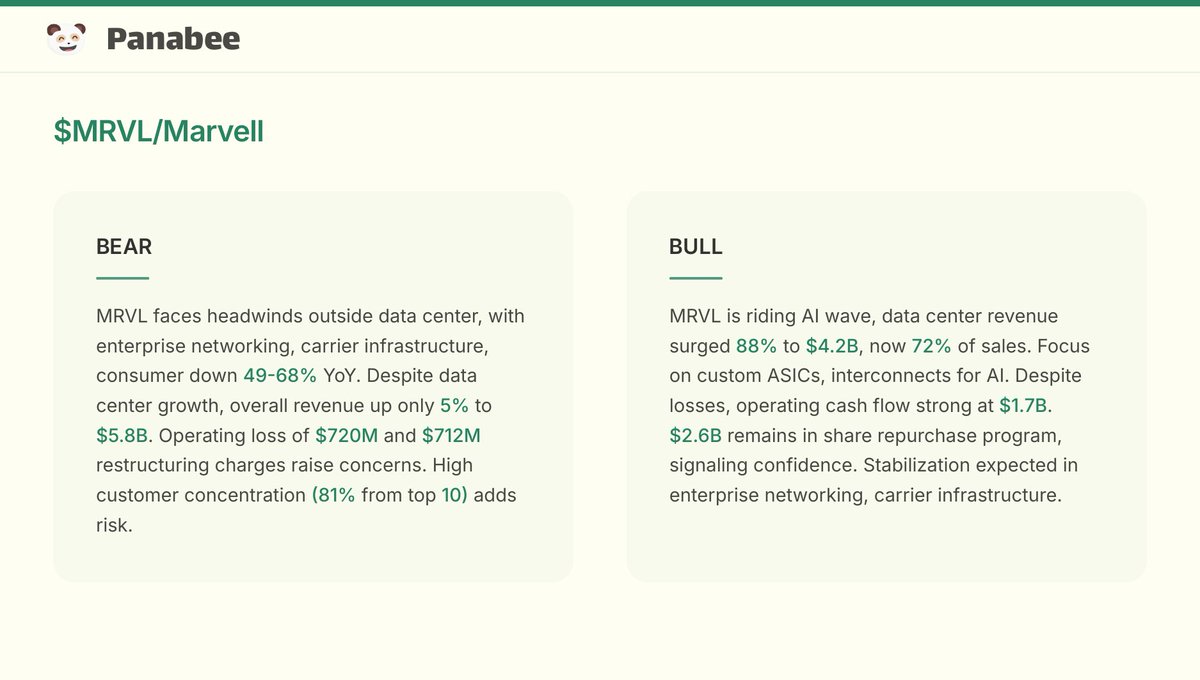

Bear vs. Bull in XX Seconds: Marvell $MRVL

Bear: MRVL faces headwinds outside data center, with enterprise networking, carrier infrastructure, consumer down 49-68% YoY. Despite data center growth, overall revenue up only X% to $5.8B. Operating loss of $720M and $712M restructuring charges raise concerns. High customer concentration (81% from top 10) adds risk.

Bull: MRVL is riding AI wave, data center revenue surged XX% to $4.2B, now XX% of sales. Focus on custom ASICs, interconnects for AI. Despite losses, operating cash flow strong at $1.7B. $2.6B remains in share repurchase program, signaling confidence. Stabilization expected in enterprise networking, carrier infrastructure.

XXX engagements

Related Topics chapter 11 $712m $720m $58b data center $mrvl coins ai marvell tech