[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Plume - RWAfi Chain [@plumenetwork](/creator/twitter/plumenetwork) on x 1M followers Created: 2025-02-26 10:55:15 UTC The hard truth: Stablecoins are the original RWAs, and are more useful than Bitcoin for most people. But they don't offer any real yield to holders. 👇 Despite that huge limitation, here’s why $XXX billion in stablecoins like USDT and USDC matter more than $XXX trillion in Bitcoin: 📍 Latin America (LATAM): Stablecoins are seen as digital dollars and a hedge against inflation. They are used for savings and daily transactions, with a volume three times that of Bitcoin. 📍 Africa: In regions with weak banking, stablecoins are a lifeline. They are used for remittances and commerce, with lower volatility than Bitcoin. 📍 Middle East: USD-pegged stablecoins are trusted for borderless payments. 📍 Europe: Businesses are integrating stablecoins for finance and commerce, surpassing Bitcoin in payments. 📍 North America: With $XXX billion in total value locked, stablecoins are gaining ground. Bitcoin remains a popular investment. 📍 Asia-Pacific (APAC): Stablecoins are becoming the default for decentralized finance. Bitcoin is popular but stablecoins are growing. ➳ What does this mean for RWAs? As more people trust onchain USD, more people trust real world assets. This shift in attitude opens the door for broader adoption of RWA-backed stablecoins and tokenized assets. If Plume brings more RWAs onchain as yield-bearing tokens, do you think more people will rotate into RWAfi? Let us know in the comments...  XXXXXX engagements  **Related Topics** [inflation](/topic/inflation) [united states](/topic/united-states) [latin](/topic/latin) [usdt](/topic/usdt) [stablecoins](/topic/stablecoins) [bitcoin](/topic/bitcoin) [coins layer 1](/topic/coins-layer-1) [coins bitcoin ecosystem](/topic/coins-bitcoin-ecosystem) [Post Link](https://x.com/plumenetwork/status/1894702766045663411)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Plume - RWAfi Chain @plumenetwork on x 1M followers

Created: 2025-02-26 10:55:15 UTC

Plume - RWAfi Chain @plumenetwork on x 1M followers

Created: 2025-02-26 10:55:15 UTC

The hard truth:

Stablecoins are the original RWAs, and are more useful than Bitcoin for most people. But they don't offer any real yield to holders.

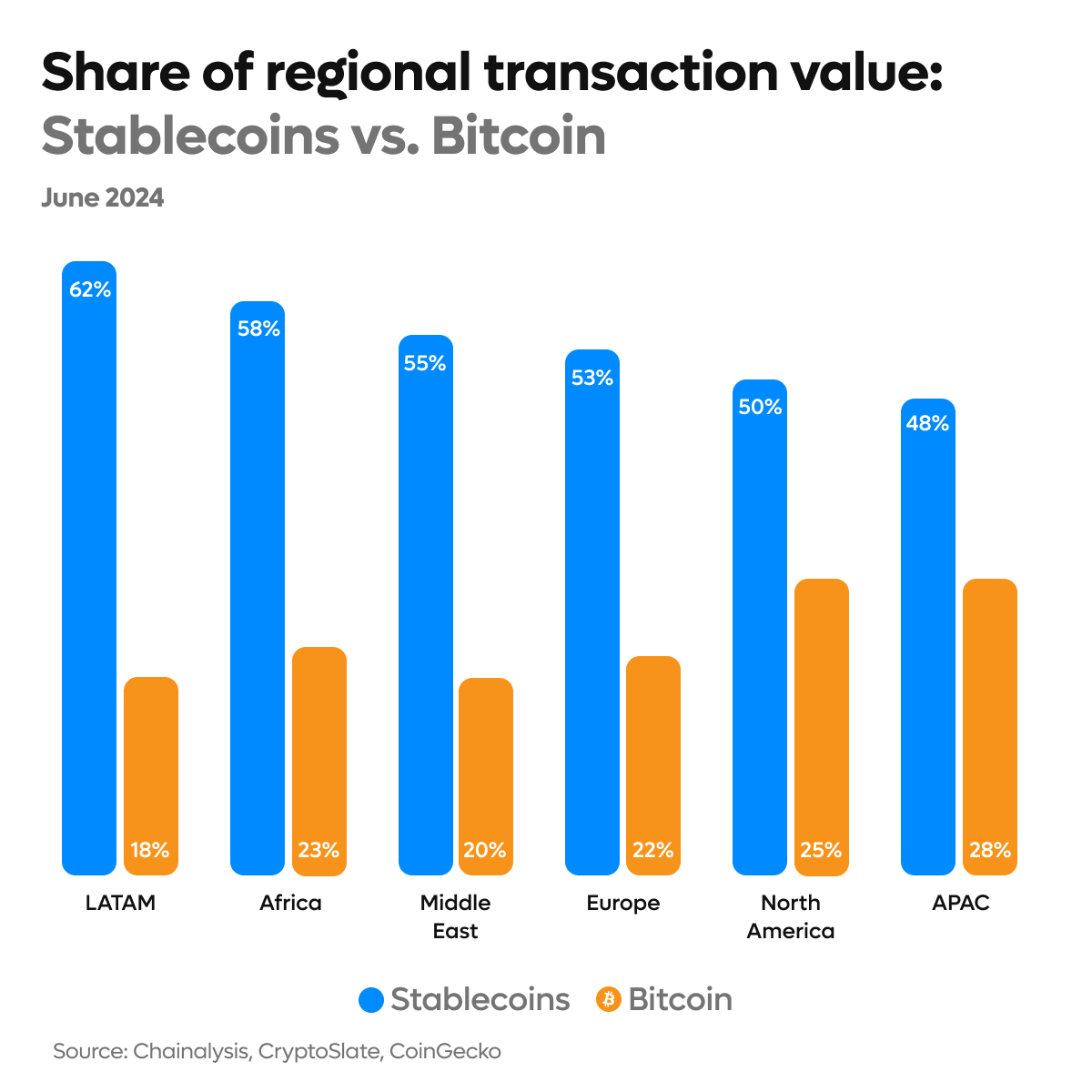

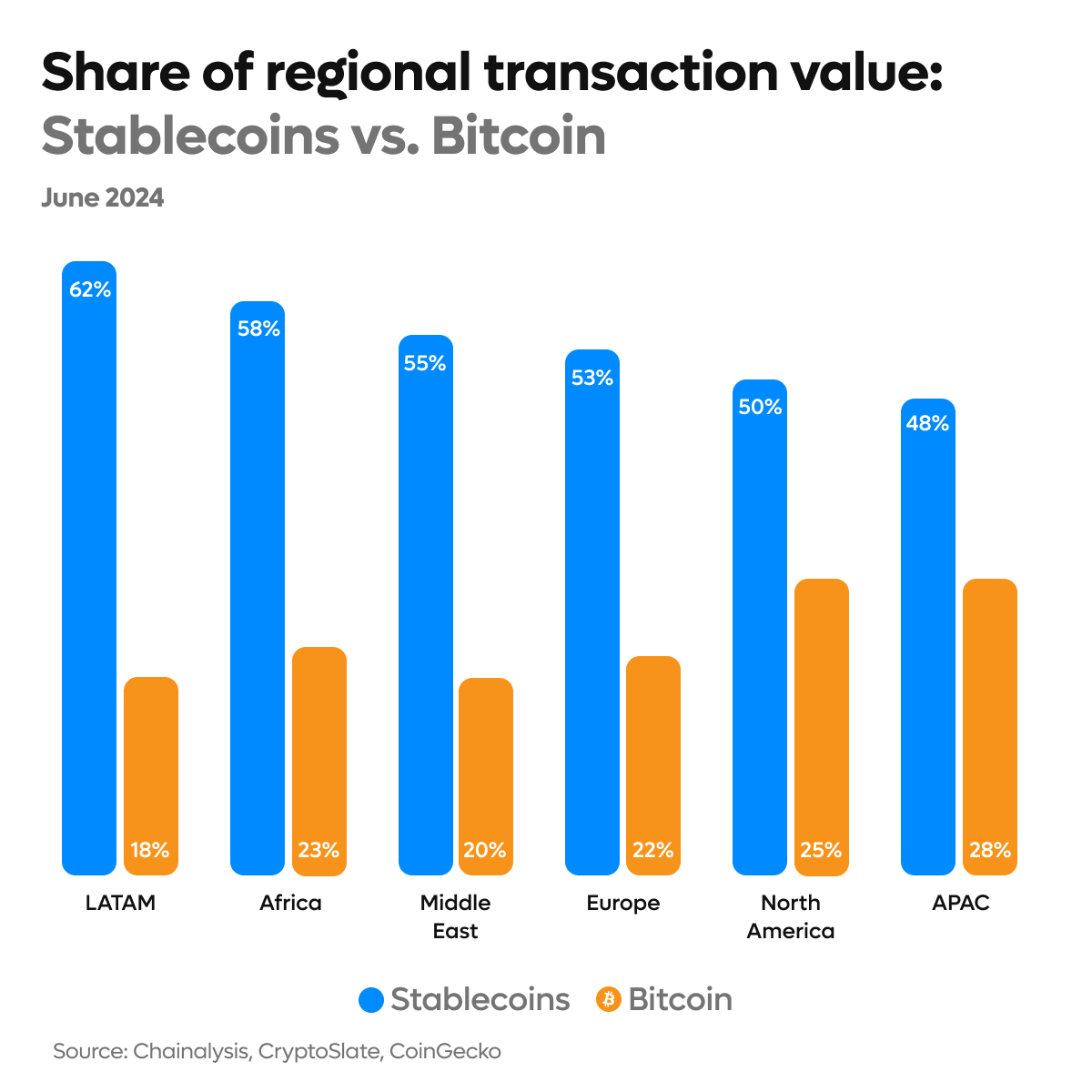

👇 Despite that huge limitation, here’s why $XXX billion in stablecoins like USDT and USDC matter more than $XXX trillion in Bitcoin:

📍 Latin America (LATAM): Stablecoins are seen as digital dollars and a hedge against inflation. They are used for savings and daily transactions, with a volume three times that of Bitcoin.

📍 Africa: In regions with weak banking, stablecoins are a lifeline. They are used for remittances and commerce, with lower volatility than Bitcoin.

📍 Middle East: USD-pegged stablecoins are trusted for borderless payments.

📍 Europe: Businesses are integrating stablecoins for finance and commerce, surpassing Bitcoin in payments.

📍 North America: With $XXX billion in total value locked, stablecoins are gaining ground. Bitcoin remains a popular investment.

📍 Asia-Pacific (APAC): Stablecoins are becoming the default for decentralized finance. Bitcoin is popular but stablecoins are growing.

➳ What does this mean for RWAs?

As more people trust onchain USD, more people trust real world assets.

This shift in attitude opens the door for broader adoption of RWA-backed stablecoins and tokenized assets.

If Plume brings more RWAs onchain as yield-bearing tokens, do you think more people will rotate into RWAfi?

Let us know in the comments...

XXXXXX engagements

Related Topics inflation united states latin usdt stablecoins bitcoin coins layer 1 coins bitcoin ecosystem