[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Eugene Ng [@EugeneNg_VCap](/creator/twitter/EugeneNg_VCap) on x 24.5K followers Created: 2024-11-27 05:51:46 UTC Workday $WDAY 3Q25 Earnings - Rev $2.2b +16% ↗️🟡 - GP $1.6b +15% ↗️🟡 margin XX% -XX bps ↘️🔴 - NG EBIT $569m +23% ↗️🟢 margin XX% +158 bps ✅ - EBIT $165m +88% ⤴️🟢 margin X% +292 bps ✅ - NG Net Inc $508m +22% ↗️🟢 margin XX% +123 bps ✅ - Net Inc $193m +69% ↗️🟢 margin X% +283 bps ✅ - OCF $406m -XX% ↘️🟠 margin XX% -XXX bps ↘️🔴 - FCF $359m -X% ↘️🟠 margin XX% -XXX bps ↘️🔴 Subscription Services - Rev $2.0b +16% ↗️🟡 - GP $1.6b +14% ↗️🟡 margin XX% -XXX bps ↘️🔴 Biz Metrics - 12m Sub Rev Backlog $7.0b +15% ↗️🟡 - Total Sub Rev Backlog $22.2b +20% ↗️🟢 > XX% Gross Revenue Retention ✅ 3Q25 Wins - added Decathlon, Lenovo 4Q25 Mgmt Guide - Rev $2.18bn +13% ↗️🟡 - Sub Rev $2.025b +15% ↗️🟡 - 12m Backlog +14.5% ↗️🟡 - NG EBIT margin XX% FY25 Mgmt Guide - Total Rev $8.4b + XX% ↗️🟡 (same) - Sub Rev $7.7b +17% ↗️🟡 (same) - NG EBIT Margin XXXX% ↗️ (raise) - OCF $2.35b +9% ↗️🟡 (same) - Capex $330m +42% (same) - FCF $2.02b FY26 Mgmt Guide - Sub Rev $8.8b +14% ↗️🟡 - NG EBIT Margin XXXX% ↗️🟢 Workday - Top dog in cloud HCM alongside Oracle - leader in the 2024 Gartner Magic Quadrant for Cloud HCM suites for 1,000-plus employee enterprises, cloud ERP for service-centric enterprises and financial planning software X | Strong quarter I'm pleased to report another quarter of solid financial performance in Q3 with XX% subscription revenue growth and non-GAAP operating margins up 26%. These results are a testament to the strong customer relationships we have across industries, the growing demand of our AI innovation and the power of our ecosystem around the world. X | Still have deal scrutiny, not much improvement, no significant change in outlook it was more a moderation of expectations and what we saw early in the year. I'm pleased to say we haven't seen any further downtick. In fact, it has moderated. We haven't necessarily seen significant improvement either. So I think it's within our expectations as we plan ahead we still believe that especially in certain areas around the globe, and we're a global business that we are still impacted in increased deal scrutiny. All that being said, we're very pleased with the momentum we've seen through the quarter and look forward to continuing that into next year. But no significant change in impact or outlook from what we've experienced through the course of the year. X | Soft OCF and FCF more due to comps with strong collections historically in 3Q24, feel good about OCF You may recall as well, we had sizable collections last scal year, which impacted FY25, and we called that out early in the year as well. So feel really good about OCF generation through the course of the year and in line with our expectations, even though I understand and you're picking up on the variability we saw in Q3, we're off about 10%. But net-net, we feel good about OCF. X | More organisations consolidating on Workday to reduce total cost, simplify operations More and more organizations are consolidating on the Workday platform for a few key reasons. They want to reduce total cost of ownership, simplify their operations and harness the power of AI across our best-in-class HR and finance solutions and provide employees with an amazing user experience. Workday gives them the ultimate advantage X | New veteran CCO Rob Enslin to replace retiring Doug Robinson Doug Robinson, who has been an incredible leader over the past XX years, will be retiring at the end of the scal year With Doug's retirement, I'm thrilled to welcome Rob Enslin to Workday as our new President, Chief Commercial Officer. I've known Rob for probably XX or XX years….I think his background, his experience ts us nicely, especially when you think about what we're doing in international. Rob has lived in Japan. He's lived all over Europe. He started the SAP business in China. Like he's just a tremendous asset for us to pick up…have almost X months of overlap between Doug and Rob. X | Majority of wins were full suite That was evident in Q3 by the growth we had in full suite and in our net new wins, customer expansions across geographies and segments along with industries. Several industries were strong in the quarter and government and higher education were X of the standouts. Roughly XX% of the wins in these industries were full suite. X | A few 3Q25 strategic wins will only kick in FY26 A few of our strategic wins in Q3 had future product deliverables in FY '26. This slightly impacts our near-term results as these wins don't fully benefit subscription revenue until next year. X | Workday’s critical differentiator is that it has the world's largest and cleanest HR and finance data set With more than XX million users under contract, generating more than XXX billion transactions a year on our platform, our AI leverages the world's largest and cleanest HR and finance data set. In our industry, where decisions are high stakes and complex, the quality and quantity of our data is a critical differentiator and the combination of this data with our ability to understand the context behind it enables Workday to unlock value in a way that no competitor can do. X | Acquired Evisort, a AI document intelligence platform to tap on unstructured data, ~80% of Workday’s data to unlock new customer insights Continuing to accelerate our AI road map, we closed our acquisition of Evisort, a leading document intelligence platform. Consider this, over XX% of business data is unstructured, making it difficult to search, analyze or use effectively. This includes critical information locked away in contracts, invoices and policy documents, just to name a few. With Evisort's powerful AI, our customers can now unlock critical insights from this untapped data, empowering them to make faster, more informed business decisions. XX | Unveiled Illuminate with new AI agents - Recruiter, Expense, and Optimize agents At Rising, we unveiled Illuminate, the next generation of Workday AI. With Illuminate, we're unlocking a whole new level of productivity and human potential by accelerating manual task, assisting every employee and ultimately transforming entire business processes. As part of Illuminate, we launched a set of new AI agents that uniquely transform some of the most complex business processes in HR and finance, such as recruiting, expense management and succession planning. Recruiter Agent is available now. Expense agent is expected to become available by the end of the year and several more will soon follow. We believe Optimize Agent, which is coming out next year, is going to be a true game changer. It pinpoints bottlenecks, ine ciencies in areas where processes aren't running as smoothly as they could be. The possibilities with this are endless, and I'm red up about it. XX | New GenAI Copilot has been able to cut down HR case volumes by XX% We also updated Workday Assistant with our Gen AI Copilot. Employees can use it to ask questions in natural language about anything from their pay and bene ts to company policies and get quick personalized answers. More than XXXXX of our HCM customers are using the currently available Workday Assistant to improve efficiencies, including one of our customers who has been able to cut down HR case volumes by almost 30%. We believe the new Copilot will help drive even further increase in productivity, allowing employees and HR departments to focus on more strategic work. XX | Customers want AI built for their specific needs that can deliver real results It's clear that customers are ready to invest in AI that's built for their very specific needs and delivers real results. They want solutions that are easy to implement, quickly provide value without the need of a ton of IT support. XX | Seeing customer traction in AI, more than XX% of customer expansions involve one or more AI solutions, customers are willing to pay for tangible ROI In Q3 alone, more than XX% of our customer expansions involved one or more AI solutions, including Talent Optimization, Extend Pro and Recruiter Agent powered by HiredScore. Talent Optimization remains one of our fastest-growing SKUs and is driving tangible value. Customers have experienced up to XX% reduction in turnover. where XX% of our deals now include an AI SKU is a pretty rapid uptake of these technologies. And what's really interesting is that our customers are willing to pay for these solutions because they have tangible ROI that they can get from these products. XX | Partner ecosystem doing well, and becoming a critical way to grow Our partner ecosystem has grown nearly 5x in just XX months and is more diverse than ever. Our partners are becoming increasingly critical to our growth, sourcing over XX% of our net new ACV in Q3 and a similar percentage of our new pipeline. We've seen rapid adoption of our Built on Workday program, which we launched less than X months ago. We've already got over XX partners on board and partners like Kainos are generating revenue from it. XX | Adding wellness to the platform giving insights, allowing them to better tailor employee benefits At Rising, we announced Workday Wellness, which gives companies real-time insights into how their employees are using their benefits. This helps them design more tailored benefits programs right within Workday HCM to improve the overall employee experience. We're excited to have Guardian, the Hartford, Mutual of Omaha and Unum already signed on as strategic partners XX | See huge opportunity in Federal and catching an inflection point and that’s why investing to build a secure platform we're really focusing on the federal government going forward. We think there's a huge opportunity there with probably more than XX% of HCM and ERP still on-premises that hasn't moved to the cloud. And we think we're catching it at an inection point right now, which is why we're investing so heavily in building out a secure platform. At the same time, postelection, and with DOGE coming out, people are absolutely looking to drive more economies of scale and more e ciency. And I can tell you, supporting these on-premises antiquated systems is not a way to do that. So we think this will only be a tailwind for us as we think about the federal government business going forward. XX | Want to expand international (~25% of revenues) much more, see more upside, XX% of TAM is outside US, EMEA remains intact with strong Europe win rates The relationship we are building around the world point to the significant long-term potential of our international business. While only XX% of our revenue comes outside the U.S. today, we're laying the groundwork for something much bigger. the thesis that has not changed, and that is XX% of the addressable market for Workday is outside the U.S. That has not changed. Yes, while we have seen some headwinds in the economy, speci cally, if you will, in EMEA, and I think a lot of people have called that out, our business still remains intact. XX | Expect 1Q26 revenue growth to be slightly slower due to leap year headwind and slightly higher in 2H26 due to AI opportunities and deliverables from strategic wins We expect our first quarter subscription revenue growth to be slightly lower than our overall growth rate for FY XX. This is largely due to the impact of the leap year, which creates just over X point headwind to Q1 subscription revenue growth. We expect a slightly higher growth rate in the second half, driven in part by emerging AI opportunities and deliverables tied to the strategic wins from the third quarter, which I referenced earlier. XX | Confident and see a clear path to FY27 of driving 15%+ subscription revenue growth and expanding NG EBIT margins to XX% We have a clear target between now and FY27 of driving mid-teen subscription revenue growth while expanding non-GAAP operating margins to 30%. We plan to achieve this by continuing to innovate and take share in our core markets while also streamlining operations across the company. in my prepared remarks, more than XX% of our net new lands included full suite solutions. And then you just continue what we're doing as we move down market into the medium enterprise, we feel very confident in our ability to maintain that mid-teens growth over the next couple of years. ➡️ Final Takeaways Workday $WDAY: Workday continues to keep growing profitably, benefiting from the accelerated pace of digital transformation across HCM. See upside opportunities from AI, Federal, and International, and if customer outlook/deal scrutiny improves. Topline revenues to grow medium term at 15%+ to FY27 and NG EBIT margins to improve towards 30%, will drive faster bottomline earnings/FCF growth.  XXXXX engagements  **Related Topics** [$359m](/topic/$359m) [$406m](/topic/$406m) [$193m](/topic/$193m) [$508m](/topic/$508m) [$165m](/topic/$165m) [$569m](/topic/$569m) [$16b](/topic/$16b) [$22b](/topic/$22b) [Post Link](https://x.com/EugeneNg_VCap/status/1861649095192113663)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Eugene Ng @EugeneNg_VCap on x 24.5K followers

Created: 2024-11-27 05:51:46 UTC

Eugene Ng @EugeneNg_VCap on x 24.5K followers

Created: 2024-11-27 05:51:46 UTC

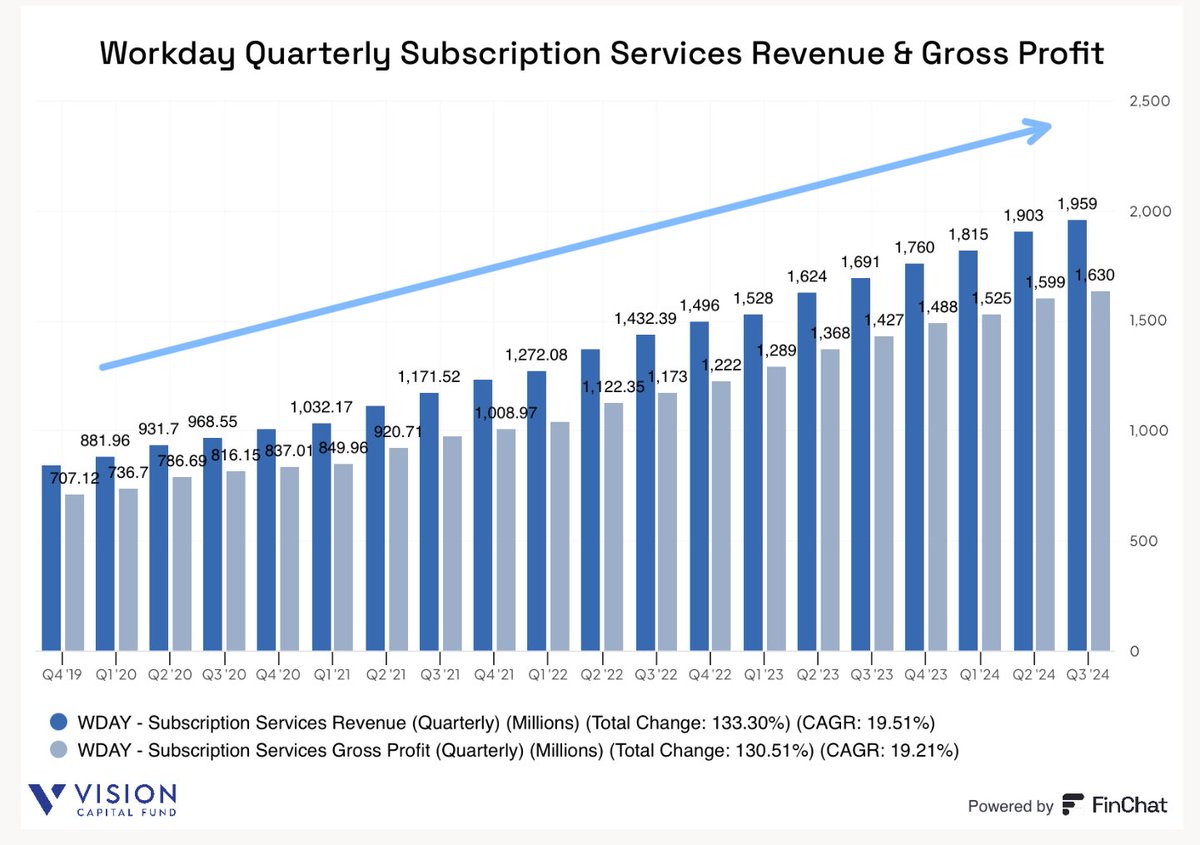

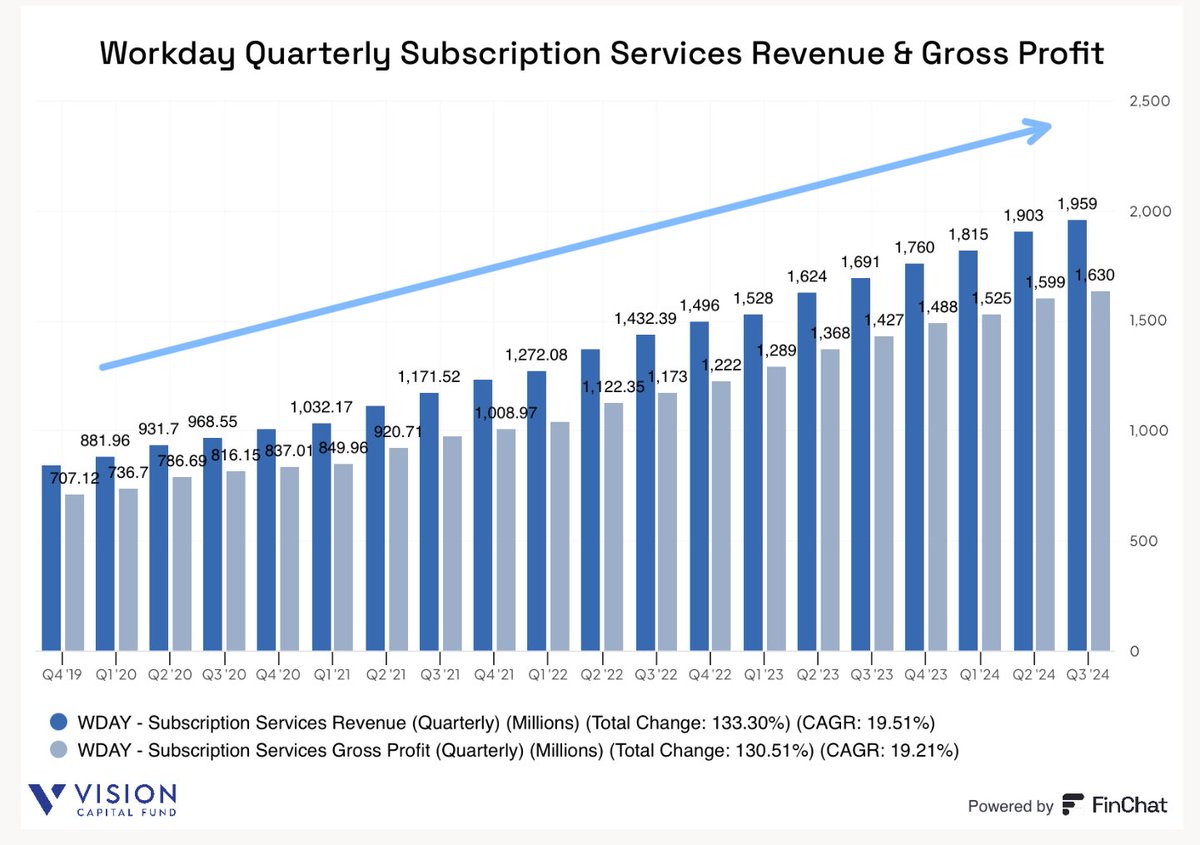

Workday $WDAY 3Q25 Earnings

- Rev $2.2b +16% ↗️🟡

- GP $1.6b +15% ↗️🟡 margin XX% -XX bps ↘️🔴

- NG EBIT $569m +23% ↗️🟢 margin XX% +158 bps ✅

- EBIT $165m +88% ⤴️🟢 margin X% +292 bps ✅

- NG Net Inc $508m +22% ↗️🟢 margin XX% +123 bps ✅

- Net Inc $193m +69% ↗️🟢 margin X% +283 bps ✅

- OCF $406m -XX% ↘️🟠 margin XX% -XXX bps ↘️🔴

- FCF $359m -X% ↘️🟠 margin XX% -XXX bps ↘️🔴

Subscription Services

- Rev $2.0b +16% ↗️🟡

- GP $1.6b +14% ↗️🟡 margin XX% -XXX bps ↘️🔴

Biz Metrics

- 12m Sub Rev Backlog $7.0b +15% ↗️🟡

- Total Sub Rev Backlog $22.2b +20% ↗️🟢

XX% Gross Revenue Retention ✅

3Q25 Wins - added Decathlon, Lenovo

4Q25 Mgmt Guide

- Rev $2.18bn +13% ↗️🟡

- Sub Rev $2.025b +15% ↗️🟡

- 12m Backlog +14.5% ↗️🟡

- NG EBIT margin XX%

FY25 Mgmt Guide

- Total Rev $8.4b + XX% ↗️🟡 (same)

- Sub Rev $7.7b +17% ↗️🟡 (same)

- NG EBIT Margin XXXX% ↗️ (raise)

- OCF $2.35b +9% ↗️🟡 (same)

- Capex $330m +42% (same)

- FCF $2.02b

FY26 Mgmt Guide

- Sub Rev $8.8b +14% ↗️🟡

- NG EBIT Margin XXXX% ↗️🟢

Workday - Top dog in cloud HCM alongside Oracle - leader in the 2024 Gartner Magic Quadrant for Cloud HCM suites for 1,000-plus employee enterprises, cloud ERP for service-centric enterprises and financial planning software

X | Strong quarter

I'm pleased to report another quarter of solid financial performance in Q3 with XX% subscription revenue growth and non-GAAP operating margins up 26%. These results are a testament to the strong customer relationships we have across industries, the growing demand of our AI innovation and the power of our ecosystem around the world.

X | Still have deal scrutiny, not much improvement, no significant change in outlook

it was more a moderation of expectations and what we saw early in the year. I'm pleased to say we haven't seen any further downtick. In fact, it has moderated. We haven't necessarily seen significant improvement either.

So I think it's within our expectations as we plan ahead we still believe that especially in certain areas around the globe, and we're a global business that we are still impacted in increased deal scrutiny. All that being said, we're very pleased with the momentum we've seen through the quarter and look forward to continuing that into next year. But no significant change in impact or outlook from what we've experienced through the course of the year.

X | Soft OCF and FCF more due to comps with strong collections historically in 3Q24, feel good about OCF

You may recall as well, we had sizable collections last scal year, which impacted FY25, and we called that out early in the year as well. So feel really good about OCF generation through the course of the year and in line with our expectations, even though I understand and you're picking up on the variability we saw in Q3, we're off about 10%. But net-net, we feel good about OCF.

X | More organisations consolidating on Workday to reduce total cost, simplify operations

More and more organizations are consolidating on the Workday platform for a few key reasons. They want to reduce total cost of ownership, simplify their operations and harness the power of AI across our best-in-class HR and finance solutions and provide employees with an amazing user experience. Workday gives them the ultimate advantage

X | New veteran CCO Rob Enslin to replace retiring Doug Robinson

Doug Robinson, who has been an incredible leader over the past XX years, will be retiring at the end of the scal year With Doug's retirement, I'm thrilled to welcome Rob Enslin to Workday as our new President, Chief Commercial Officer.

I've known Rob for probably XX or XX years….I think his background, his experience ts us nicely, especially when you think about what we're doing in international. Rob has lived in Japan. He's lived all over Europe. He started the SAP business in China. Like he's just a tremendous asset for us to pick up…have almost X months of overlap between Doug and Rob.

X | Majority of wins were full suite

That was evident in Q3 by the growth we had in full suite and in our net new wins, customer expansions across geographies and segments along with industries. Several industries were strong in the quarter and government and higher education were X of the standouts. Roughly XX% of the wins in these industries were full suite.

X | A few 3Q25 strategic wins will only kick in FY26

A few of our strategic wins in Q3 had future product deliverables in FY '26. This slightly impacts our near-term results as these wins don't fully benefit subscription revenue until next year.

X | Workday’s critical differentiator is that it has the world's largest and cleanest HR and finance data set

With more than XX million users under contract, generating more than XXX billion transactions a year on our platform, our AI leverages the world's largest and cleanest HR and finance data set. In our industry, where decisions are high stakes and complex, the quality and quantity of our data is a critical differentiator and the combination of this data with our ability to understand the context behind it enables Workday to unlock value in a way that no competitor can do.

X | Acquired Evisort, a AI document intelligence platform to tap on unstructured data, ~80% of Workday’s data to unlock new customer insights

Continuing to accelerate our AI road map, we closed our acquisition of Evisort, a leading document intelligence platform. Consider this, over XX% of business data is unstructured, making it difficult to search, analyze or use effectively. This includes critical information locked away in contracts, invoices and policy documents, just to name a few. With Evisort's powerful AI, our customers can now unlock critical insights from this untapped data, empowering them to make faster, more informed business decisions.

XX | Unveiled Illuminate with new AI agents - Recruiter, Expense, and Optimize agents

At Rising, we unveiled Illuminate, the next generation of Workday AI. With Illuminate, we're unlocking a whole new level of productivity and human potential by accelerating manual task, assisting every employee and ultimately transforming entire business processes.

As part of Illuminate, we launched a set of new AI agents that uniquely transform some of the most complex business processes in HR and finance, such as recruiting, expense management and succession planning. Recruiter Agent is available now. Expense agent is expected to become available by the end of the year and several more will soon follow. We believe Optimize Agent, which is coming out next year, is going to be a true game changer. It pinpoints bottlenecks, ine ciencies in areas where processes aren't running as smoothly as they could be. The possibilities with this are endless, and I'm red up about it.

XX | New GenAI Copilot has been able to cut down HR case volumes by XX%

We also updated Workday Assistant with our Gen AI Copilot. Employees can use it to ask questions in natural language about anything from their pay and bene ts to company policies and get quick personalized answers. More than XXXXX of our HCM customers are using the currently available Workday Assistant to improve efficiencies, including one of our customers who has been able to cut down HR case volumes by almost 30%. We believe the new Copilot will help drive even further increase in productivity, allowing employees and HR departments to focus on more strategic work.

XX | Customers want AI built for their specific needs that can deliver real results

It's clear that customers are ready to invest in AI that's built for their very specific needs and delivers real results. They want solutions that are easy to implement, quickly provide value without the need of a ton of IT support.

XX | Seeing customer traction in AI, more than XX% of customer expansions involve one or more AI solutions, customers are willing to pay for tangible ROI

In Q3 alone, more than XX% of our customer expansions involved one or more AI solutions, including Talent Optimization, Extend Pro and Recruiter Agent powered by HiredScore. Talent Optimization remains one of our fastest-growing SKUs and is driving tangible value. Customers have experienced up to XX% reduction in turnover.

where XX% of our deals now include an AI SKU is a pretty rapid uptake of these technologies. And what's really interesting is that our customers are willing to pay for these solutions because they have tangible ROI that they can get from these products.

XX | Partner ecosystem doing well, and becoming a critical way to grow

Our partner ecosystem has grown nearly 5x in just XX months and is more diverse than ever. Our partners are becoming increasingly critical to our growth, sourcing over XX% of our net new ACV in Q3 and a similar percentage of our new pipeline. We've seen rapid adoption of our Built on Workday program, which we launched less than X months ago. We've already got over XX partners on board and partners like Kainos are generating revenue from it.

XX | Adding wellness to the platform giving insights, allowing them to better tailor employee benefits

At Rising, we announced Workday Wellness, which gives companies real-time insights into how their employees are using their benefits. This helps them design more tailored benefits programs right within Workday HCM to improve the overall employee experience. We're excited to have Guardian, the Hartford, Mutual of Omaha and Unum already signed on as strategic partners

XX | See huge opportunity in Federal and catching an inflection point and that’s why investing to build a secure platform

we're really focusing on the federal government going forward. We think there's a huge opportunity there with probably more than XX% of HCM and ERP still on-premises that hasn't moved to the cloud. And we think we're catching it at an inection point right now, which is why we're investing so heavily in building out a secure platform. At the same time, postelection, and with DOGE coming out, people are absolutely looking to drive more economies of scale and more e ciency. And I can tell you, supporting these on-premises antiquated systems is not a way to do that. So we think this will only be a tailwind for us as we think about the federal government business going forward.

XX | Want to expand international (~25% of revenues) much more, see more upside, XX% of TAM is outside US, EMEA remains intact with strong Europe win rates

The relationship we are building around the world point to the significant long-term potential of our international business. While only XX% of our revenue comes outside the U.S. today, we're laying the groundwork for something much bigger.

the thesis that has not changed, and that is XX% of the addressable market for Workday is outside the U.S. That has not changed. Yes, while we have seen some headwinds in the economy, speci cally, if you will, in EMEA, and I think a lot of people have called that out, our business still remains intact.

XX | Expect 1Q26 revenue growth to be slightly slower due to leap year headwind and slightly higher in 2H26 due to AI opportunities and deliverables from strategic wins We expect our first quarter subscription revenue growth to be slightly lower than our overall growth rate for FY XX. This is largely due to the impact of the leap year, which creates just over X point headwind to Q1 subscription revenue growth. We expect a slightly higher growth rate in the second half, driven in part by emerging AI opportunities and deliverables tied to the strategic wins from the third quarter, which I referenced earlier.

XX | Confident and see a clear path to FY27 of driving 15%+ subscription revenue growth and expanding NG EBIT margins to XX%

We have a clear target between now and FY27 of driving mid-teen subscription revenue growth while expanding non-GAAP operating margins to 30%. We plan to achieve this by continuing to innovate and take share in our core markets while also streamlining operations across the company.

in my prepared remarks, more than XX% of our net new lands included full suite solutions. And then you just continue what we're doing as we move down market into the medium enterprise, we feel very confident in our ability to maintain that mid-teens growth over the next couple of years.

➡️ Final Takeaways Workday $WDAY:

Workday continues to keep growing profitably, benefiting from the accelerated pace of digital transformation across HCM. See upside opportunities from AI, Federal, and International, and if customer outlook/deal scrutiny improves. Topline revenues to grow medium term at 15%+ to FY27 and NG EBIT margins to improve towards 30%, will drive faster bottomline earnings/FCF growth.

XXXXX engagements

Related Topics $359m $406m $193m $508m $165m $569m $16b $22b