[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  The Compounding Tortoise [@CompTortoise](/creator/twitter/CompTortoise) on x 8374 followers Created: 2024-07-10 10:24:43 UTC 3⃣ Deep Dive Linde Plc $LIN Now, speaking of one of our favorite Compounding Tortoises of all time: Linde Plc. It was the result of the diligently planned merger between Linde AG and Praxair which created a well-balanced industrial gases mogul with an extended reach into healthcare, petrochemicals, food & beverage, and energy. Their separate activities did not show any overlap with Praxair's end markets being located mainly in North and South America versus Linde AG's dominance in EMEA and APAC. The clean energy opportunity will eventually become another growth kicker, depending on how many identifiable opportunities will be translated into tangible investment decisions that meet LIN’s stringent criteria and backlog requirements. Given the persistent inflationary pressures, geopolitical events and new emerging trends in the semiconductor space (electronics account for X% of sales), LIN is well positioned to remain an investment for all seasons. We believe that its management team will continue to do what they do best: delivering industry-leading Return on Capital, operating margin and cash flow performance. We would go even further and say that LIN's business model benefits from increased volatility as economic shocks have recently widened the performance gap with its competitors. LIN’s underlying capital intensity is much lower than what most people realize, as evidenced by its clear project backlog criteria, small incremental investments and strong presence in packaged gases.  XXXXX engagements  **Related Topics** [coins energy](/topic/coins-energy) [beverage](/topic/beverage) [coins healthcare](/topic/coins-healthcare) [corporate finance](/topic/corporate-finance) [$lin](/topic/$lin) [deep dive](/topic/deep-dive) [linde plc](/topic/linde-plc) [stocks basic materials](/topic/stocks-basic-materials) [Post Link](https://x.com/CompTortoise/status/1810983481796653544)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

The Compounding Tortoise @CompTortoise on x 8374 followers

Created: 2024-07-10 10:24:43 UTC

The Compounding Tortoise @CompTortoise on x 8374 followers

Created: 2024-07-10 10:24:43 UTC

3⃣ Deep Dive Linde Plc $LIN

Now, speaking of one of our favorite Compounding Tortoises of all time: Linde Plc. It was the result of the diligently planned merger between Linde AG and Praxair which created a well-balanced industrial gases mogul with an extended reach into healthcare, petrochemicals, food & beverage, and energy. Their separate activities did not show any overlap with Praxair's end markets being located mainly in North and South America versus Linde AG's dominance in EMEA and APAC.

The clean energy opportunity will eventually become another growth kicker, depending on how many identifiable opportunities will be translated into tangible investment decisions that meet LIN’s stringent criteria and backlog requirements.

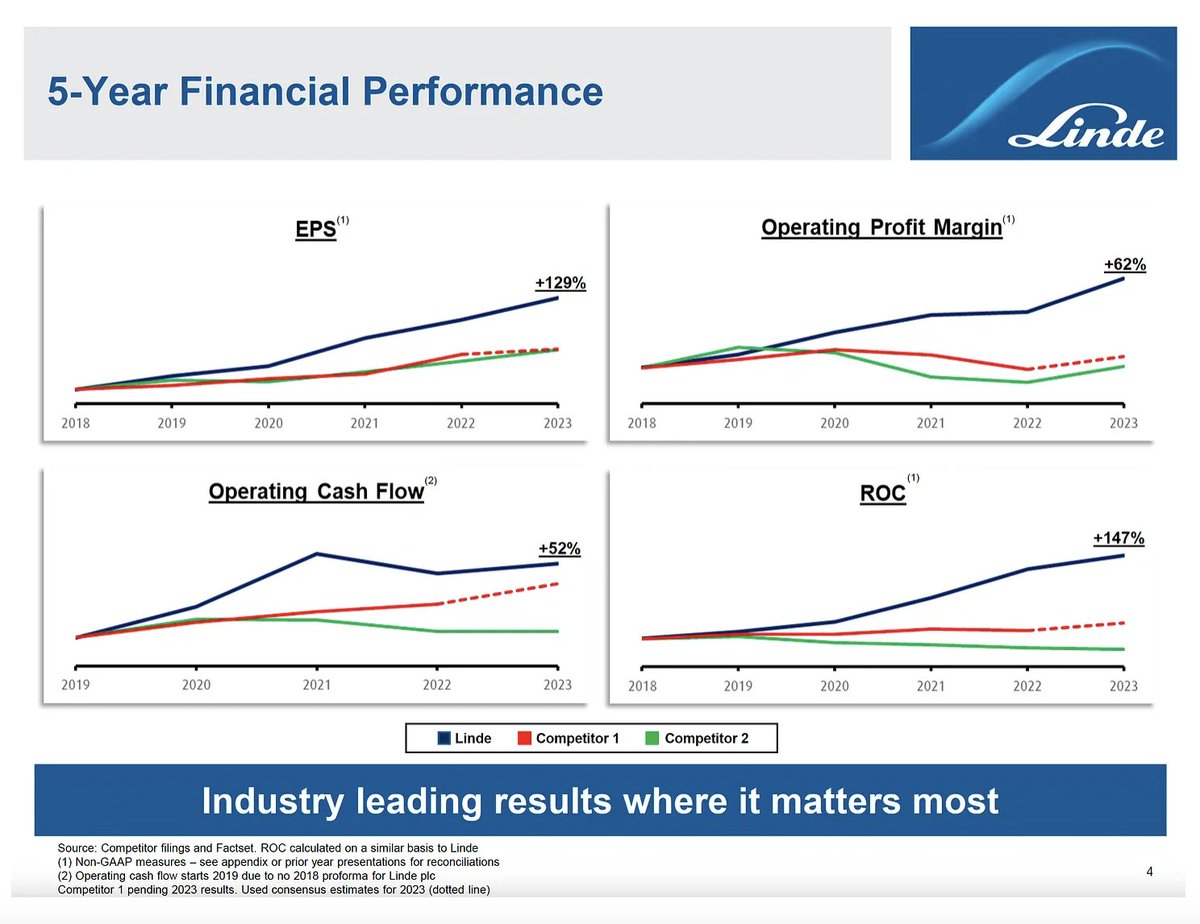

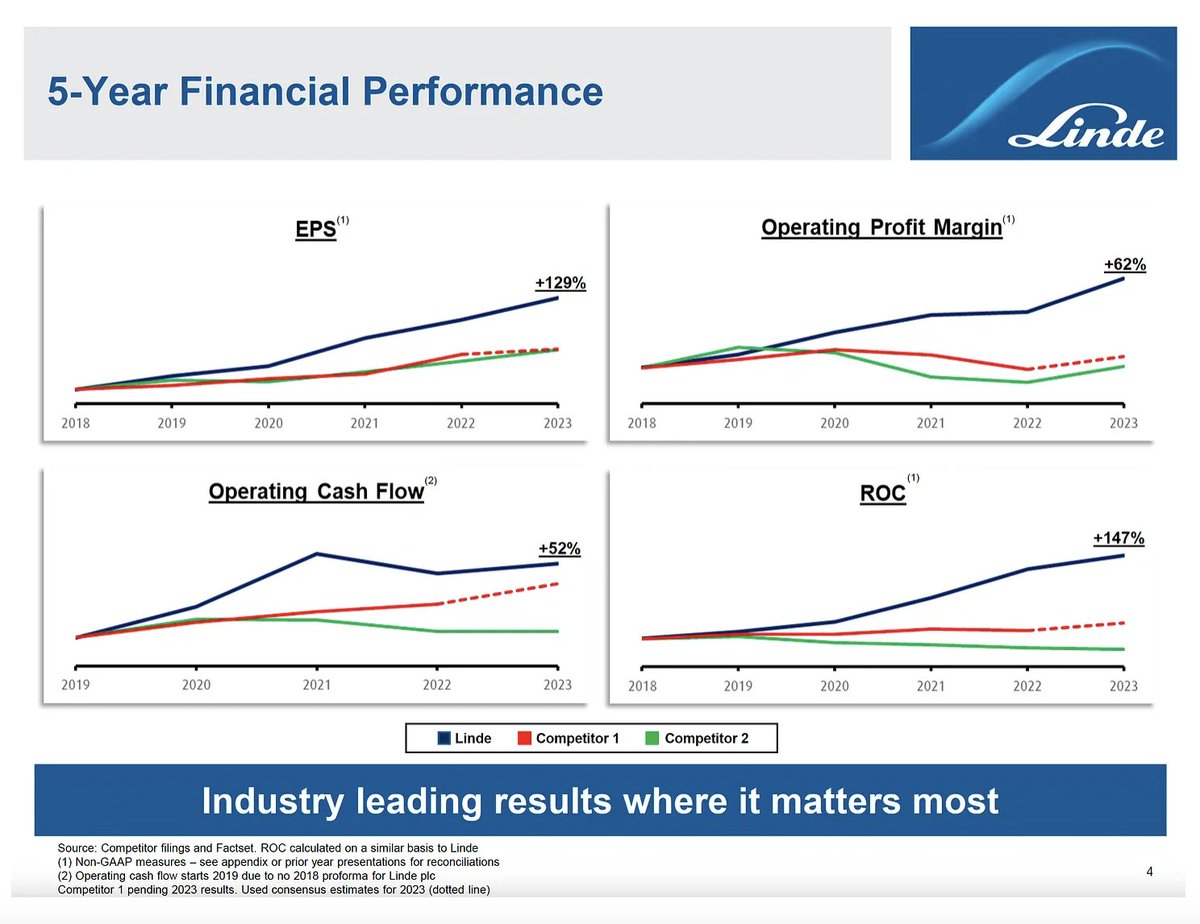

Given the persistent inflationary pressures, geopolitical events and new emerging trends in the semiconductor space (electronics account for X% of sales), LIN is well positioned to remain an investment for all seasons. We believe that its management team will continue to do what they do best: delivering industry-leading Return on Capital, operating margin and cash flow performance.

We would go even further and say that LIN's business model benefits from increased volatility as economic shocks have recently widened the performance gap with its competitors. LIN’s underlying capital intensity is much lower than what most people realize, as evidenced by its clear project backlog criteria, small incremental investments and strong presence in packaged gases.

XXXXX engagements

Related Topics coins energy beverage coins healthcare corporate finance $lin deep dive linde plc stocks basic materials