[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  First Hill Capital [@FirstHillcap](/creator/twitter/FirstHillcap) on x XXX followers Created: 2024-05-27 13:21:36 UTC Why BayCurrent $6532 is a Great Compounder (Japanese) (Small-Cap) (Quality) Here is a write up on one of my newer high conviction ideas. Please tell me how it can fail. The name is BayCurrent ($6532.T). They are a consulting firm that offers Business Strategy, Digital Transformation, IT Consulting, Operations Improvement, HR and Organizational Consulting. A good example of the services they provide can be found here: The company has grown operating earnings at a CAGR of XX% since 2020. I believe this growth is from the DX transformation segment, which has seen increased demand. This means “digital transformation” which means preparing companies for the digital age. One of the reasons for this growth is they have kept on reinvesting in new hires, training them, and taking on more jobs. This has been aided by strong demand. A majority of the recent business has been DX consulting, or preparing businesses for the digital age. This includes migrating businesses to the cloud, and optimizing data storage which are early in their adoption cycles and have a long runway of growth. In addition, the importance of being up to date with digital transformation is becoming more important each year. Therefore, in order to keep up with the global economy, Japanese businesses must keep using firms like BayCurrent to stay relevant. The company's medium-term plan outlines a XX% growth target each year. This is a lofty goal, and the market does not price in this growth. If the company misses the target with XX% growth over the next XX years, the shareholders can be rewarded substantially. It is hard to forecast a growth target, but we know that companies will always require consulting services and GDP will increase in Japan. Most of the competitors are global consulting giants such as: Deloitte, PwC, and Accenture. Some believe that BayCurrent is lower cost than alternatives because they are not weighed down by global headquarters. This also makes the business leaner and more apt to respond to changes in the domestic market. Additionally, there may be advantages to being a domestic company serving the domestic market. Valuation The Current expected yield from dividends is roughly XXX% at the current price levels. The Current TTM PE is around XX. The EV/EBIT is roughly 13, which is very cheap from a historical standard. At the current levels the FCF yield is around X% per year. Over the long term, if the business continues to grow at an average rate of XX% per year, the valuation is very fair and investors can be rewarded. Why the price gap exists I’ve gathered that some of the negative sentiment behind the business is based on the labor pool. In 2024, BayCurrent’s workforce rose to XXXXX from XXXXX in 2023, many of which being less experienced consultants like new grads. Many have cited concerns with the quality of work coming from less experienced consultants. According to employee reviews on open work, it seems that the company operates on an “open pool” system. I believe this means the consultants can be swapped in and out of projects based on the experience level required. This may be a system that efficiently allocates the tenured employees to the most impactful projects. Some have pointed out that this can also create a negative loop: No Experience → Never get put on projects → Taken off projects → Never gain experience This seems like a negative quality of the business, but consider the effects of this cycle. The quality of the consulting can never be brought down by new hires, until the culture has developed from newer employees to more experienced ones. I will need to dig deeper to make a judgement, but I’m not concerned about the degradation of the business for a key reason. Even with the surplus of new hires to the company, company culture does not degrade overnight. The company was founded in 1998, even doubling the employee head count cannot reverse the long history and culture of the business. Capital Allocation The reason I’m comfortable investing in this company is the management has agreed to pay out XX% of the earnings in a mix of dividends and buybacks. Of course, this does nothing to the cash that is already on the balance sheet doing nothing. Being that the company is shareholder focused enough to have a buyback program, I trust this capital will come to its rightful owners eventually. Even without shareholder returns from the balance sheet, history has shown that Japanese investors can enjoy great returns if the business performs well. BayCurrents Financing Activities (Feb 20’ - Feb 24’) (Buybacks, Dividends, Debt repayment) Population Decline Whether population decline can impact the success of investing in Japanese securities is a complex issue. The ideal case when investing in Japan is choose a company that is tied to global wealth, like the second bet, so you don’t have to think through this issue at all. But because BayCurrent’s customers are in the Japan ecosystem, we have to consider whether an aging population will affect future growth. On the one hand, I do have concerns over dropping birth rates in Japan as with other developed nations like South Korea. On the other hand, productivity improvements from technology are likely to fuel GDP growth even in the face of an aging population. The equation for any modern economy is Productive hours X Productivity, and fewer working people means fewer productive hours. The other side of the scale, (productivity) is increased by technological improvements. Therefore, one can argue digital transformation consulting can be important and necessary in the wake of population decline. Finally, the main metric is that if real GDP growth continues at a fair pace in Japan, I am comfortable as an investor. Source: @finchat_io  XXX engagements  **Related Topics** [$6532t](/topic/$6532t) [Post Link](https://x.com/FirstHillcap/status/1795082931834163330)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

First Hill Capital @FirstHillcap on x XXX followers

Created: 2024-05-27 13:21:36 UTC

First Hill Capital @FirstHillcap on x XXX followers

Created: 2024-05-27 13:21:36 UTC

Why BayCurrent $6532 is a Great Compounder (Japanese) (Small-Cap) (Quality)

Here is a write up on one of my newer high conviction ideas. Please tell me how it can fail.

The name is BayCurrent ($6532.T). They are a consulting firm that offers Business Strategy, Digital Transformation, IT Consulting, Operations Improvement, HR and Organizational Consulting. A good example of the services they provide can be found here:

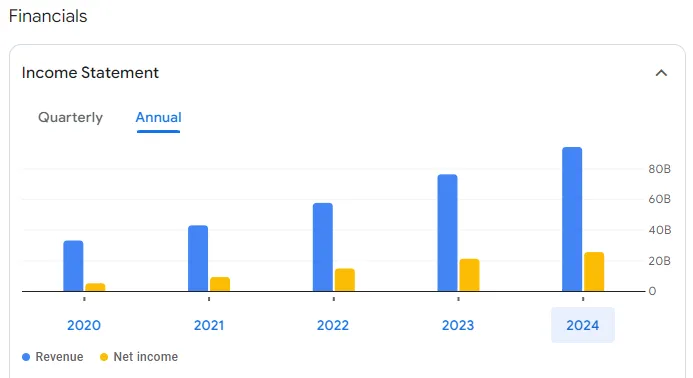

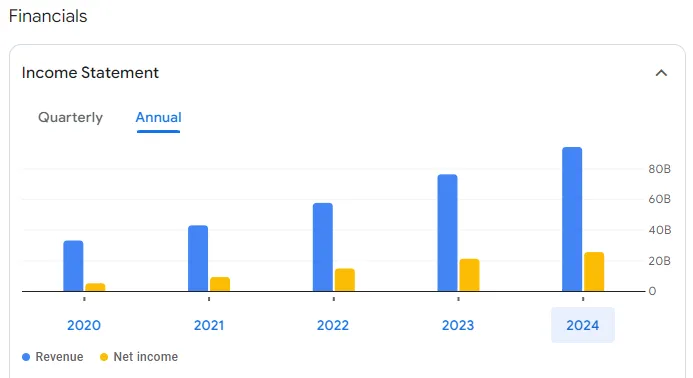

The company has grown operating earnings at a CAGR of XX% since 2020. I believe this growth is from the DX transformation segment, which has seen increased demand. This means “digital transformation” which means preparing companies for the digital age.

One of the reasons for this growth is they have kept on reinvesting in new hires, training them, and taking on more jobs. This has been aided by strong demand.

A majority of the recent business has been DX consulting, or preparing businesses for the digital age. This includes migrating businesses to the cloud, and optimizing data storage which are early in their adoption cycles and have a long runway of growth. In addition, the importance of being up to date with digital transformation is becoming more important each year. Therefore, in order to keep up with the global economy, Japanese businesses must keep using firms like BayCurrent to stay relevant.

The company's medium-term plan outlines a XX% growth target each year. This is a lofty goal, and the market does not price in this growth. If the company misses the target with XX% growth over the next XX years, the shareholders can be rewarded substantially. It is hard to forecast a growth target, but we know that companies will always require consulting services and GDP will increase in Japan.

Most of the competitors are global consulting giants such as: Deloitte, PwC, and Accenture.

Some believe that BayCurrent is lower cost than alternatives because they are not weighed down by global headquarters. This also makes the business leaner and more apt to respond to changes in the domestic market. Additionally, there may be advantages to being a domestic company serving the domestic market.

Valuation The Current expected yield from dividends is roughly XXX% at the current price levels. The Current TTM PE is around XX. The EV/EBIT is roughly 13, which is very cheap from a historical standard.

At the current levels the FCF yield is around X% per year. Over the long term, if the business continues to grow at an average rate of XX% per year, the valuation is very fair and investors can be rewarded.

Why the price gap exists

I’ve gathered that some of the negative sentiment behind the business is based on the labor pool. In 2024, BayCurrent’s workforce rose to XXXXX from XXXXX in 2023, many of which being less experienced consultants like new grads.

Many have cited concerns with the quality of work coming from less experienced consultants. According to employee reviews on open work, it seems that the company operates on an “open pool” system. I believe this means the consultants can be swapped in and out of projects based on the experience level required. This may be a system that efficiently allocates the tenured employees to the most impactful projects. Some have pointed out that this can also create a negative loop:

No Experience → Never get put on projects → Taken off projects → Never gain experience

This seems like a negative quality of the business, but consider the effects of this cycle. The quality of the consulting can never be brought down by new hires, until the culture has developed from newer employees to more experienced ones.

I will need to dig deeper to make a judgement, but I’m not concerned about the degradation of the business for a key reason. Even with the surplus of new hires to the company, company culture does not degrade overnight. The company was founded in 1998, even doubling the employee head count cannot reverse the long history and culture of the business.

Capital Allocation The reason I’m comfortable investing in this company is the management has agreed to pay out XX% of the earnings in a mix of dividends and buybacks. Of course, this does nothing to the cash that is already on the balance sheet doing nothing. Being that the company is shareholder focused enough to have a buyback program, I trust this capital will come to its rightful owners eventually. Even without shareholder returns from the balance sheet, history has shown that Japanese investors can enjoy great returns if the business performs well.

BayCurrents Financing Activities (Feb 20’ - Feb 24’) (Buybacks, Dividends, Debt repayment)

Population Decline Whether population decline can impact the success of investing in Japanese securities is a complex issue. The ideal case when investing in Japan is choose a company that is tied to global wealth, like the second bet, so you don’t have to think through this issue at all.

But because BayCurrent’s customers are in the Japan ecosystem, we have to consider whether an aging population will affect future growth.

On the one hand, I do have concerns over dropping birth rates in Japan as with other developed nations like South Korea. On the other hand, productivity improvements from technology are likely to fuel GDP growth even in the face of an aging population. The equation for any modern economy is Productive hours X Productivity, and fewer working people means fewer productive hours. The other side of the scale, (productivity) is increased by technological improvements. Therefore, one can argue digital transformation consulting can be important and necessary in the wake of population decline. Finally, the main metric is that if real GDP growth continues at a fair pace in Japan, I am comfortable as an investor.

Source: @finchat_io

XXX engagements

Related Topics $6532t