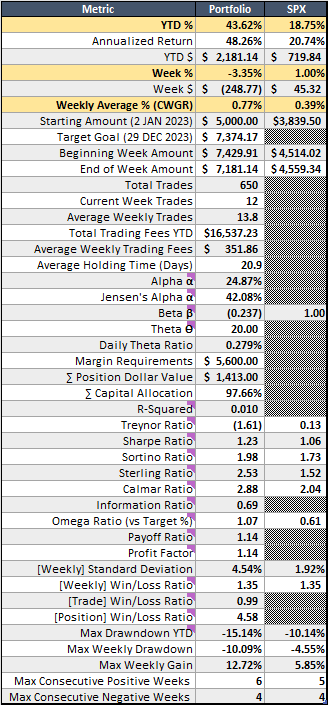

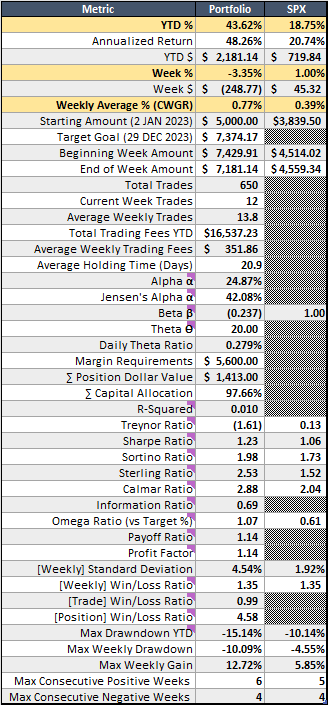

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Hermes Lux [@HermesLux](/creator/twitter/HermesLux) on x 10.6K followers Created: 2023-11-25 16:03:28 UTC XXXX% per week – WEEK XX UPDATE 💵💸🐢 YTD: +43.62% Week: -XXXX% CWGR: +0.77% Opened Positions (1) 🐢4x $QUAL Call Credit Spread for $XXX. Closed Positions (2) 💩2x $ITB Iron Butterflies after 35/22 days for -XXX% (-$397) Loss. 💰2x $XLU Iron Condors after 27/30 days for XXXX% ($14) profit. I have two different sets of dates for both my closed positions because I opened/closed the different sides of the spreads on different dates. I was assigned shares on my $ITB Iron Butterfly but I calculated the total net loss in the position above. What happened was that I was forced to SELL XXX shares at my short strike ($77.50) then BUY XXX shares at my long strike ($79.50). The net sum was the $XXX I reported above. This is why we execute risk-defined strategies. It will happen and you just need to get used to it if you’re going to trade like this. This week my portfolio continued to decline, but this won’t continue. I opened X new $QUAL Call Credit Spreads this week, and this carries a max loss of $XXX. This is in line with my strategy of opening a like-kind position higher/further out, except it’s not actually further out. I would have had to go to the 3rd week of January for this one and I chose instead to use the same expiration dates I already had since $QUAL doesn’t trade weeklies. ETFs don’t go up forever, and trends will always reverse. This week wasn’t what I was expecting but that’s ok. $SPX has been on a tear and that will not last. I am still feeling very good about beating the market by more than double with only about X weeks remaining in the trading year. Follow my trades: My strategy: Thetagang community on X:  XXXXX engagements  **Related Topics** [$xlu](/topic/$xlu) [$itb](/topic/$itb) [$qual](/topic/$qual) [hermes](/topic/hermes) [Post Link](https://x.com/HermesLux/status/1728444300982141010)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Hermes Lux @HermesLux on x 10.6K followers

Created: 2023-11-25 16:03:28 UTC

Hermes Lux @HermesLux on x 10.6K followers

Created: 2023-11-25 16:03:28 UTC

XXXX% per week – WEEK XX UPDATE 💵💸🐢 YTD: +43.62% Week: -XXXX% CWGR: +0.77%

Opened Positions (1) 🐢4x $QUAL Call Credit Spread for $XXX.

Closed Positions (2) 💩2x $ITB Iron Butterflies after 35/22 days for -XXX% (-$397) Loss. 💰2x $XLU Iron Condors after 27/30 days for XXXX% ($14) profit.

I have two different sets of dates for both my closed positions because I opened/closed the different sides of the spreads on different dates. I was assigned shares on my $ITB Iron Butterfly but I calculated the total net loss in the position above. What happened was that I was forced to SELL XXX shares at my short strike ($77.50) then BUY XXX shares at my long strike ($79.50). The net sum was the $XXX I reported above. This is why we execute risk-defined strategies. It will happen and you just need to get used to it if you’re going to trade like this.

This week my portfolio continued to decline, but this won’t continue. I opened X new $QUAL Call Credit Spreads this week, and this carries a max loss of $XXX. This is in line with my strategy of opening a like-kind position higher/further out, except it’s not actually further out. I would have had to go to the 3rd week of January for this one and I chose instead to use the same expiration dates I already had since $QUAL doesn’t trade weeklies. ETFs don’t go up forever, and trends will always reverse. This week wasn’t what I was expecting but that’s ok. $SPX has been on a tear and that will not last. I am still feeling very good about beating the market by more than double with only about X weeks remaining in the trading year.

Follow my trades: My strategy: Thetagang community on X:

XXXXX engagements