[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Hermes Lux [@HermesLux](/creator/twitter/HermesLux) on x 10.6K followers Created: 2023-11-04 11:43:26 UTC XXXX% per week – WEEK XX UPDATE 💰💸💵 YTD: +65.05% Week: XXXX% CWGR: +1.15% Opened Positions (6): 🐢3x $TLT Put Credit Spreads for $XXX. 🐢2x $TLT Put Credit Spreads for $XXX. 🐢3x $XLV Put Credit Spreads for $XXX. 🐢2x $QUAL Call Credit Spreads for $XXX. 🐢2x $QUAL Put Credit Spreads for $XX. 🐢2x $ITB Put Credit Spreads for $XXX. Closed Positions (8): 💰3x $XLV Put Credit Spreads after X days for XX% ($94) profit. 💰2x $TLT Put Credit Spreads after X days for XX% ($127) profit. 💰4x $TBT Call Credit Spreads after XX days for XX% ($65) profit. 💰2x $TLT Put Credit Spreads after XX days for XX% ($98) profit. 💰1x $GUSH Call Credit Spread after XX days for XX% ($10) profit. 💰1x $QQQ Iron Condor after XX days for XX% ($66) profit. 💰1x $XOP Call Credit Spread after XX days for XX% ($89) profit. 💰2x $XLC Iron Condors after XX days for XX% ($153) profit. This was a good week for me. It’s always nice to pull a solid X% week; I’ve noticed these big weeks tend to follow consecutive down weeks when placing consistent probability-based trades. Both of my spreads in $TLT and $TBT recovered almost $XXX by their day of expiration (3 NOV). I opened a second $TLT Put Credit Spread on Monday to try and capture some additional premium on its climb back up; that worked out nicely and I closed that position out on Friday, after X days, for XX% profit. At the end of the day on Friday, I opened one more $TLT Put Credit Spread for good measure. I am under the belief that the 20-year treasury bond bottomed in October, and I am planning to ride this ETF back up to $XXX with recurring Put Credit Spreads. My XXX shares in $F also recovered a good amount from the previous week. I’m still in a $F Covered Call position with XXX shares / -X Call contracts ($11 strike). If $F goes back over $11, I will let those shares get called away and never buy $F shares again. I’ll keep selling calls until the shares are called away. Like a hedge fund, I also had several positions move against me this week. I converted several vertical positions into Iron Butterflies. I did this to reduce my overall risk while leaving open the possibility of some recovery later. This was a major up week for the overall market, the largest in a long time and the best single week YTD for the $SPX. I don’t imagine next week will be an up week for the market, and I would be very surprised to see $SPX end the week above $XXXXX. ➡️Follow my trades: ➡️My strategy: ➡️Thetagang community on X:  XXXXX engagements  **Related Topics** [$itb](/topic/$itb) [$qual](/topic/$qual) [$xlv](/topic/$xlv) [$tlt](/topic/$tlt) [hermes](/topic/hermes) [Post Link](https://x.com/HermesLux/status/1720768713580830797)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Hermes Lux @HermesLux on x 10.6K followers

Created: 2023-11-04 11:43:26 UTC

Hermes Lux @HermesLux on x 10.6K followers

Created: 2023-11-04 11:43:26 UTC

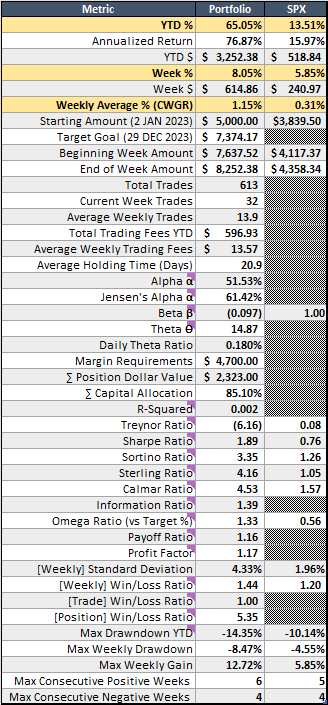

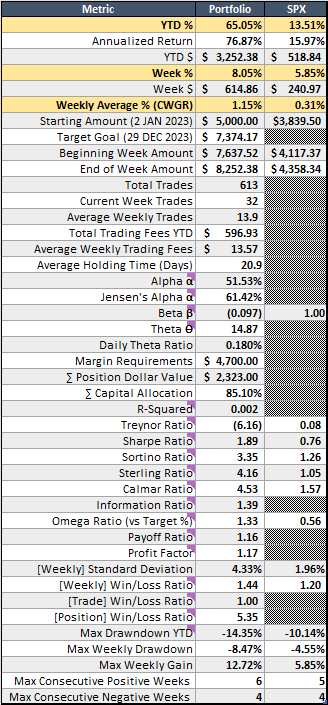

XXXX% per week – WEEK XX UPDATE 💰💸💵 YTD: +65.05% Week: XXXX% CWGR: +1.15%

Opened Positions (6): 🐢3x $TLT Put Credit Spreads for $XXX. 🐢2x $TLT Put Credit Spreads for $XXX. 🐢3x $XLV Put Credit Spreads for $XXX. 🐢2x $QUAL Call Credit Spreads for $XXX. 🐢2x $QUAL Put Credit Spreads for $XX. 🐢2x $ITB Put Credit Spreads for $XXX.

Closed Positions (8): 💰3x $XLV Put Credit Spreads after X days for XX% ($94) profit. 💰2x $TLT Put Credit Spreads after X days for XX% ($127) profit. 💰4x $TBT Call Credit Spreads after XX days for XX% ($65) profit. 💰2x $TLT Put Credit Spreads after XX days for XX% ($98) profit. 💰1x $GUSH Call Credit Spread after XX days for XX% ($10) profit. 💰1x $QQQ Iron Condor after XX days for XX% ($66) profit. 💰1x $XOP Call Credit Spread after XX days for XX% ($89) profit. 💰2x $XLC Iron Condors after XX days for XX% ($153) profit.

This was a good week for me. It’s always nice to pull a solid X% week; I’ve noticed these big weeks tend to follow consecutive down weeks when placing consistent probability-based trades.

Both of my spreads in $TLT and $TBT recovered almost $XXX by their day of expiration (3 NOV). I opened a second $TLT Put Credit Spread on Monday to try and capture some additional premium on its climb back up; that worked out nicely and I closed that position out on Friday, after X days, for XX% profit. At the end of the day on Friday, I opened one more $TLT Put Credit Spread for good measure. I am under the belief that the 20-year treasury bond bottomed in October, and I am planning to ride this ETF back up to $XXX with recurring Put Credit Spreads.

My XXX shares in $F also recovered a good amount from the previous week. I’m still in a $F Covered Call position with XXX shares / -X Call contracts ($11 strike). If $F goes back over $11, I will let those shares get called away and never buy $F shares again. I’ll keep selling calls until the shares are called away.

Like a hedge fund, I also had several positions move against me this week. I converted several vertical positions into Iron Butterflies. I did this to reduce my overall risk while leaving open the possibility of some recovery later.

This was a major up week for the overall market, the largest in a long time and the best single week YTD for the $SPX. I don’t imagine next week will be an up week for the market, and I would be very surprised to see $SPX end the week above $XXXXX.

➡️Follow my trades: ➡️My strategy: ➡️Thetagang community on X:

XXXXX engagements