[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Quality Stocks [@Quality_stocksA](/creator/twitter/Quality_stocksA) on x 35.3K followers Created: 2023-10-21 09:33:11 UTC 🔎 Sector analysis: medical device 🧪🔬 Interesting sector. A lot of different company types (margin, revenue, margin, cycle) The top XX for this rating system 🇺🇸 Agilent $A 6.7/10 🇺🇸 Johson&Johnson $JNJ 6.3/10 🇺🇸 Edwards Lifescience $EW 6.2/10 🇩🇰 Coloplast $COLO 6.2/10 🇺🇸 Thermofisher $TMO 6.1/10 🇺🇸 Abbott $ABT 6.0/10 🇫🇷 Biomerieux $BIM 6.0/10 🇺🇸 Intuitive Surgical $ISRG 6.0/10 🇺🇸 Waters $WAT 5.8/10 🇺🇸 Align $ALGN 5.6/10 💰 Usually in this sector, high quality means high valuation. Therefore it is hard to get a score above XXX. This is the case for instance for $ISRG having a XXX quality score and a XXX valuation score (even with the recent drop in price) 😲 Some may be surprised by the low score of some names. Taking them one by one: 🇫🇷 Sartorius Stedim $DIM experiences some turbulences impacting very negatively its score. Plus they have debt and with the recent margin and revenue drop, a 4.4x EBITDA leverage appears, which is not a good sign 🇺🇸 Stryker $SYK is interesting but in this screener the result is average 🇺🇸 Danaher $DHR is loved by a lot of investor. However, very bad revenue dynamic (more than XX% drop expected between 2022 and 2025), plus the ROE is not exceptionnal and they are diluting shareholder This is why this screener / rating system is only to have a first idea of a stock / sector / theme. After that, researches have to be done. 🎁 This is a very interesting sector. I own Agilent. X names interest me: 🇺🇸 Intuitive Surgical $ISRG for their interesting business model and high quality 🇺🇸 Edwards Lifescience $EW for their position in a growing market 🇺🇸 Waters $WAT the Agilent competitors with higher margin And you, do you like this sector?  XXXXXX engagements  **Related Topics** [colo](/topic/colo) [$bimpa](/topic/$bimpa) [$abt](/topic/$abt) [$colo](/topic/$colo) [$ew](/topic/$ew) [$jnj](/topic/$jnj) [stocks](/topic/stocks) [agilent technologies inc](/topic/agilent-technologies-inc) [Post Link](https://x.com/Quality_stocksA/status/1715662505408676253)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Quality Stocks @Quality_stocksA on x 35.3K followers

Created: 2023-10-21 09:33:11 UTC

Quality Stocks @Quality_stocksA on x 35.3K followers

Created: 2023-10-21 09:33:11 UTC

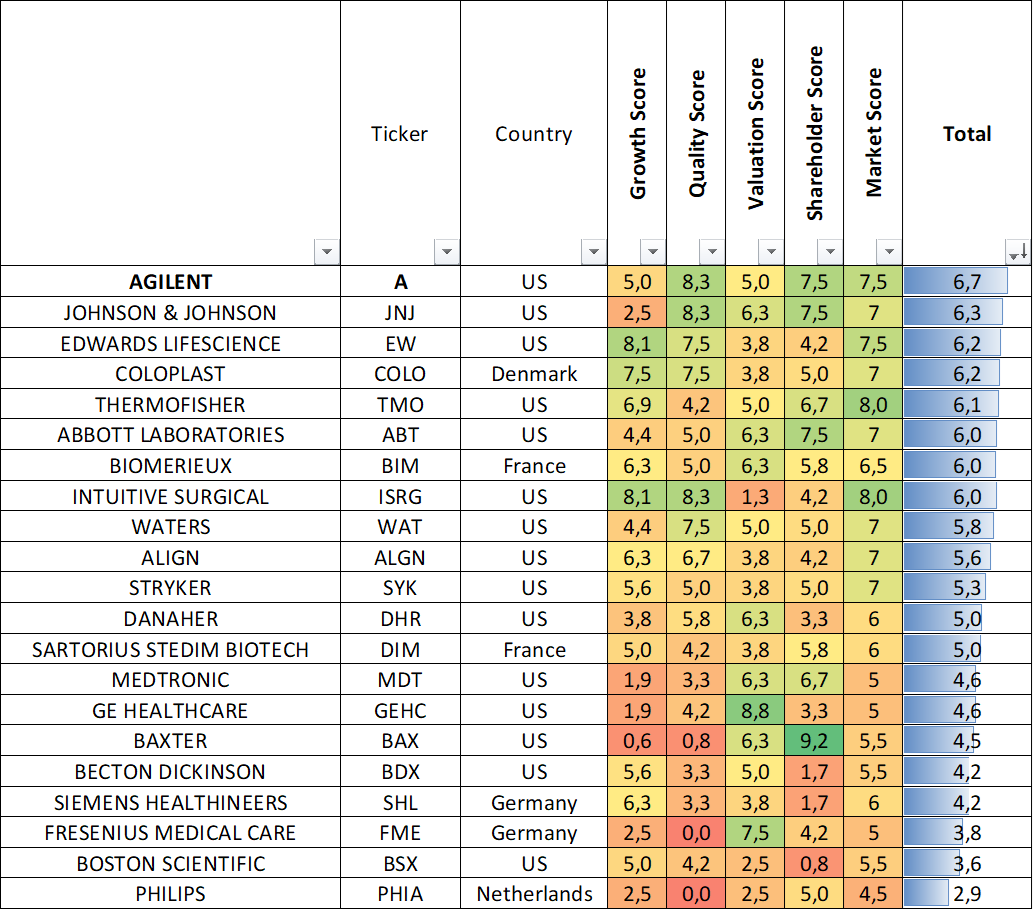

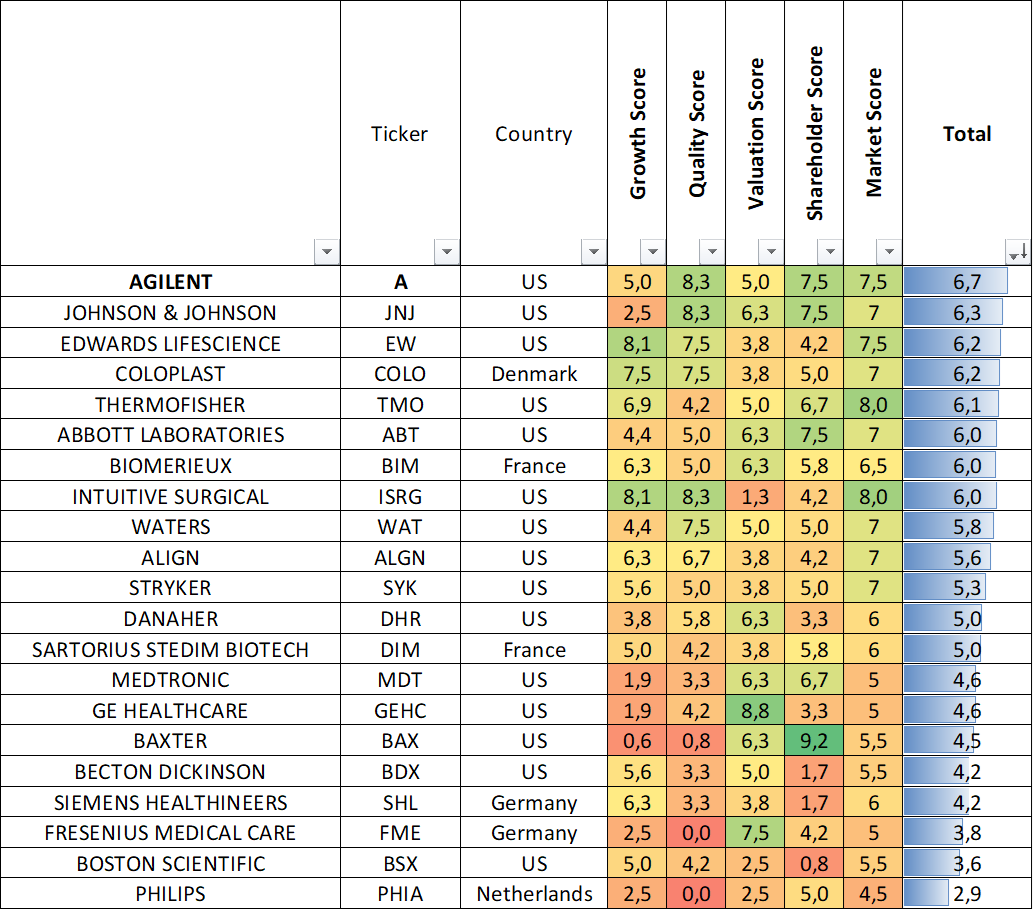

🔎 Sector analysis: medical device 🧪🔬

Interesting sector. A lot of different company types (margin, revenue, margin, cycle)

The top XX for this rating system 🇺🇸 Agilent $A 6.7/10 🇺🇸 Johson&Johnson $JNJ 6.3/10 🇺🇸 Edwards Lifescience $EW 6.2/10 🇩🇰 Coloplast $COLO 6.2/10 🇺🇸 Thermofisher $TMO 6.1/10 🇺🇸 Abbott $ABT 6.0/10 🇫🇷 Biomerieux $BIM 6.0/10 🇺🇸 Intuitive Surgical $ISRG 6.0/10 🇺🇸 Waters $WAT 5.8/10 🇺🇸 Align $ALGN 5.6/10

💰 Usually in this sector, high quality means high valuation. Therefore it is hard to get a score above XXX. This is the case for instance for $ISRG having a XXX quality score and a XXX valuation score (even with the recent drop in price)

😲 Some may be surprised by the low score of some names. Taking them one by one: 🇫🇷 Sartorius Stedim $DIM experiences some turbulences impacting very negatively its score. Plus they have debt and with the recent margin and revenue drop, a 4.4x EBITDA leverage appears, which is not a good sign 🇺🇸 Stryker $SYK is interesting but in this screener the result is average 🇺🇸 Danaher $DHR is loved by a lot of investor. However, very bad revenue dynamic (more than XX% drop expected between 2022 and 2025), plus the ROE is not exceptionnal and they are diluting shareholder

This is why this screener / rating system is only to have a first idea of a stock / sector / theme. After that, researches have to be done.

🎁 This is a very interesting sector. I own Agilent. X names interest me: 🇺🇸 Intuitive Surgical $ISRG for their interesting business model and high quality 🇺🇸 Edwards Lifescience $EW for their position in a growing market 🇺🇸 Waters $WAT the Agilent competitors with higher margin

And you, do you like this sector?

XXXXXX engagements

Related Topics colo $bimpa $abt $colo $ew $jnj stocks agilent technologies inc