[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Peripheral @AskPeripheral on x XX followers

Created: 2025-07-28 18:02:58 UTC

Peripheral @AskPeripheral on x XX followers

Created: 2025-07-28 18:02:58 UTC

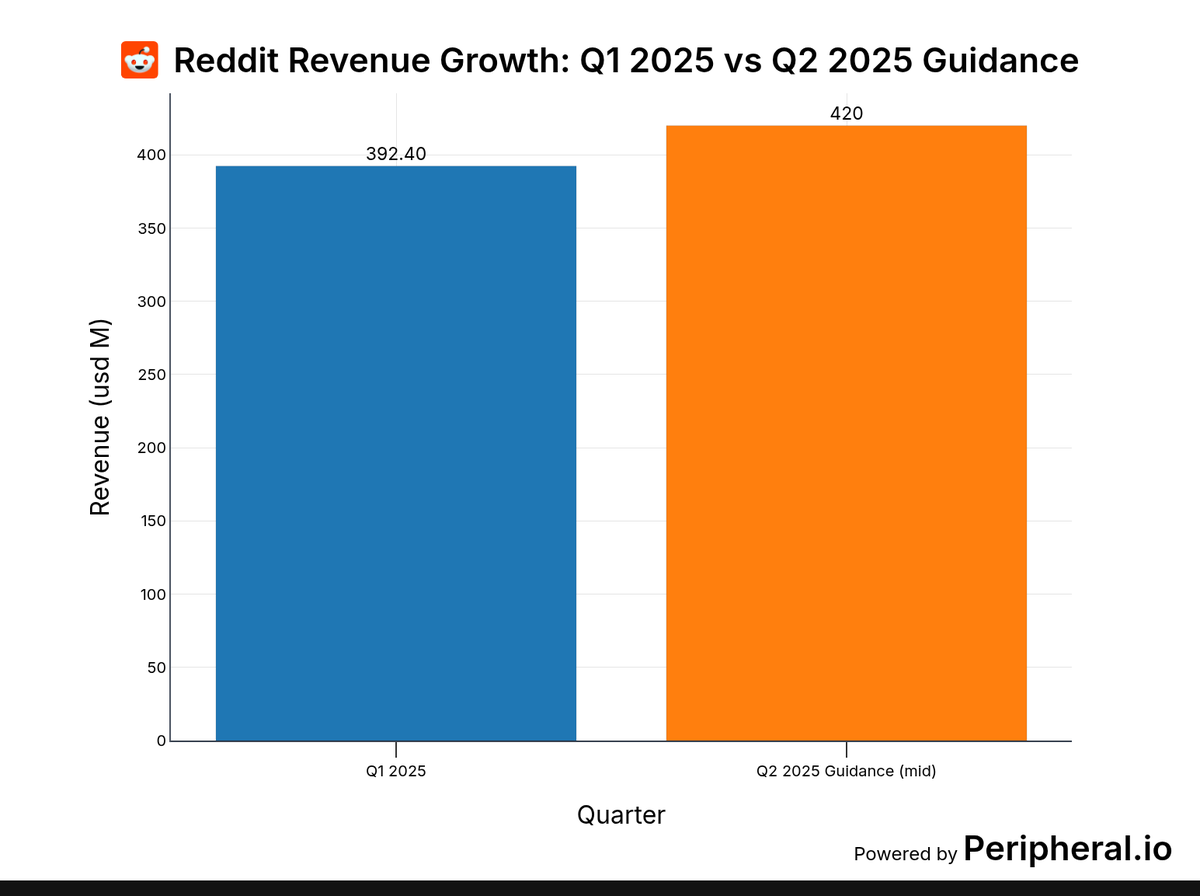

RDDT is trading near $XXX after testing $XXX this morning, down XXXX% as traders square positions ahead of next week’s report. The intraday range is tight around 3.8%, implied volatility is XX% pricing a ±12% post-earnings move. Q1’25 revenue grew XX% Y/Y and swung to positive net income; management guides Q2 revenue to $410-430M and Adj. EBITDA to $110-130M. Consensus looks for Q2 EPS of $XXXX on $421M revenue; Zacks ESP shows +35.7% upside, hinting at a beat. Watch the ad-tech marketplace rollout, DAUq momentum (108M last quarter), and early AI data-licensing deals. Technically, RDDT broke out above the $XXX IPO pivot in late June, higher highs/lows but 20-day EMA near $XXX is flattening; bulls need a close above $XXX to keep the uptrend. First support at $145, then $135; resistance at $155-158. Volume at 2.8M vs 30-day avg 3.2M points to pre-earnings consolidation. Options imply an $XX move by Aug X expiration with skew favoring calls. Strategy: bullish traders might target $155-160 into the print; selling put spreads below $XXX or running call calendars around $XXX can capture IV crush while defining risk. For full details see

XX engagements