[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

IbrahimXBT @IbrahimXBT on x XXX followers

Created: 2025-07-27 14:26:58 UTC

IbrahimXBT @IbrahimXBT on x XXX followers

Created: 2025-07-27 14:26:58 UTC

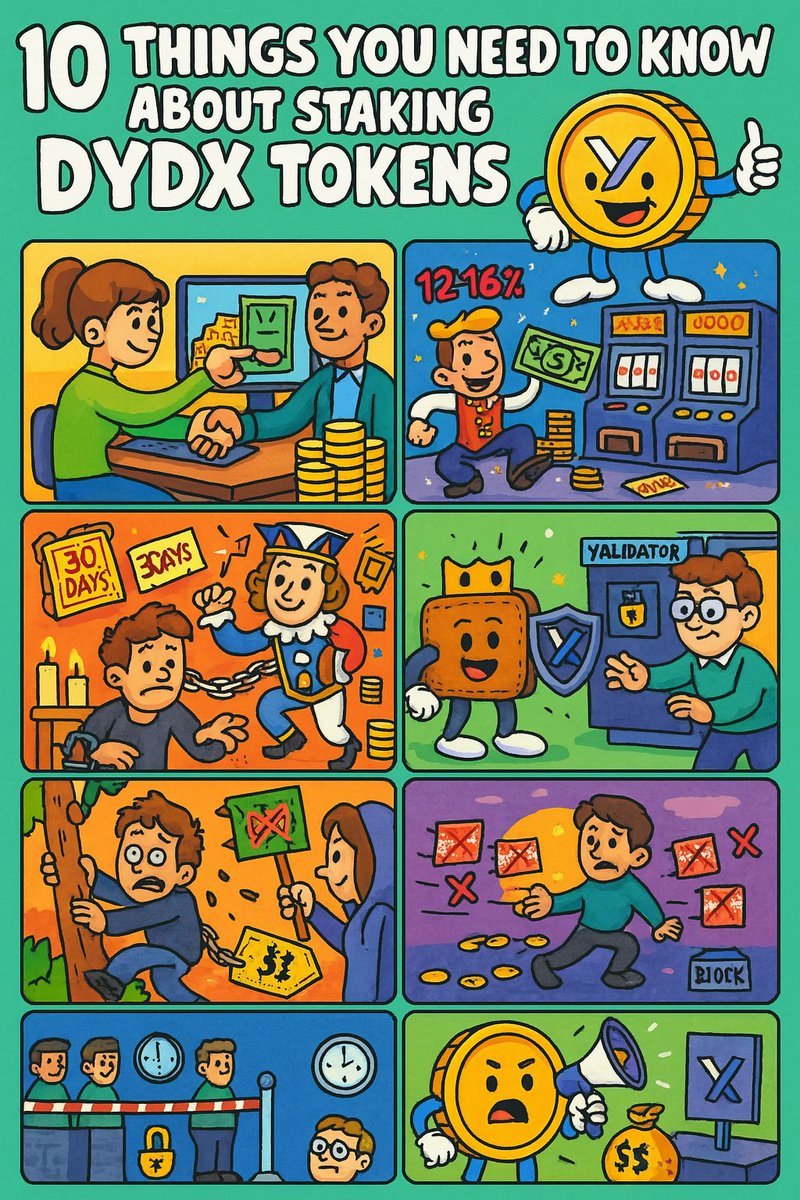

XX Things You Need to Know About Staking $DYDX Tokens

[ Part One ] Series: XXX

X. Staking DYDX secures the chain. You delegate to validators. They validate blocks, earn USDC, and share it with you.

X. Rewards are real yield, paid in USDC, not inflation. It is driven by trading fees, not token printing.

X. Current yield ranges XX to XX percent APY, depending on volume, validator cut, and your stake size.

X. There is no lock up. Unstaking takes XX days. You can redelegate instantly, but not withdraw.

X. Delegation is non custodial. Your DYDX stays in your wallet. Validators cannot touch it.

X. Top validators matter. They vote on governance, optimize MEV, and keep uptime tight. Choose based on performance, not branding.

X. Slashing risk exists but is minimal. No major events yet, but missed blocks means missed rewards.

X. Rewards are distributed per block. The more your validator participates, the more you earn.

X. Validator set is capped. If your validator is not in the active set, you earn zero. Check status before delegating.

XX. Staking is not passive optics. It is governance, revenue share, and protocol alignment, rolled into one position. You are not just earning. You are backing the chain.

This is not the time to sit idle. Real yield, no inflation, and validator skin in the game. Staking DYDX is where protocol trust gets priced in.

XXX engagements

Related Topics token inflation blocks $dydx staking usdc coins made in usa coins bsc