[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Kacper Piotr Kaminski @Kacper_PK_CH on x 3124 followers

Created: 2025-07-27 00:14:25 UTC

Kacper Piotr Kaminski @Kacper_PK_CH on x 3124 followers

Created: 2025-07-27 00:14:25 UTC

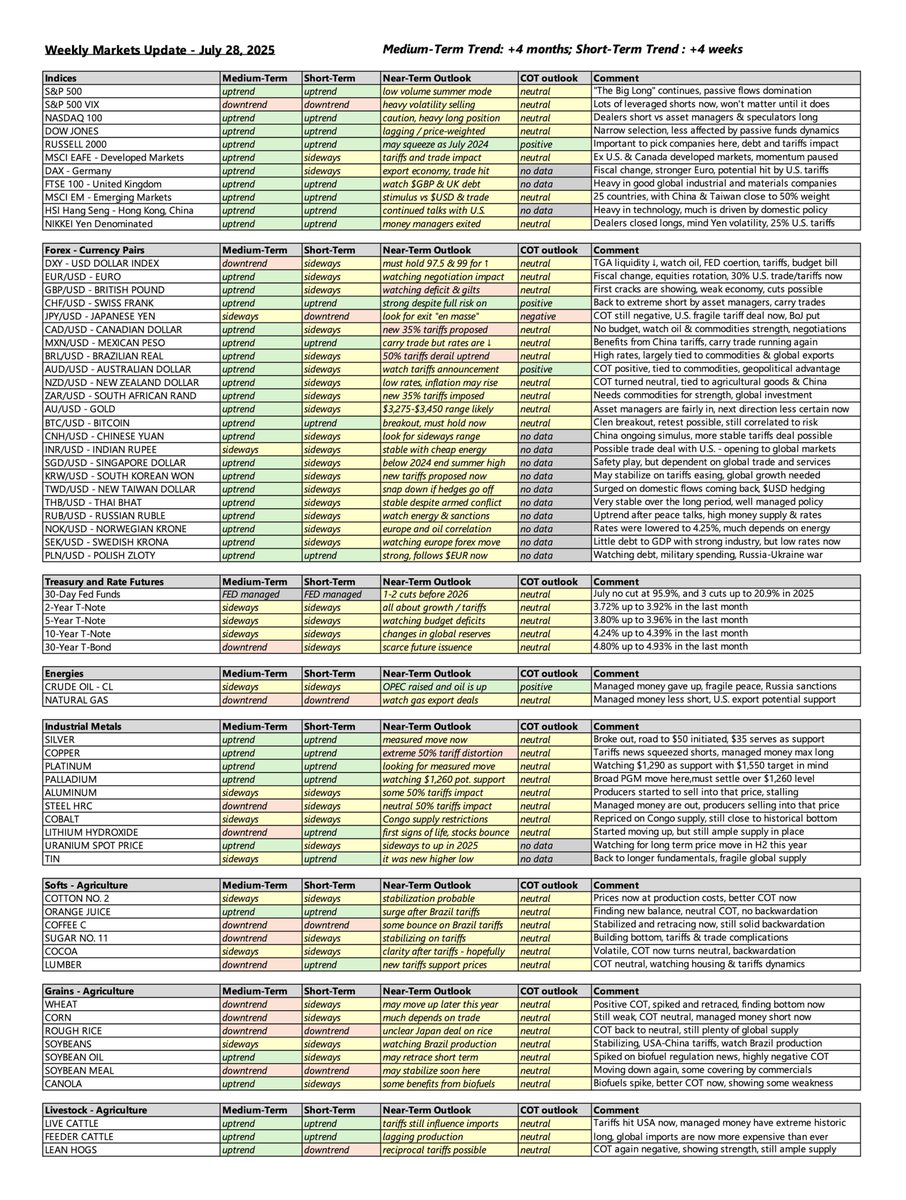

Weekly Markets Update – July 28, 2025 - Part X

“One of the important factors behind the fluctuation between bull and bear markets, between booms and crashes and bubbles, is that investor memory has to fail us – and fail universally – in order for the extremes to be reached.” – Howard Marks

I will risk saying that when Howard Marks said that, he probably did not imagine just how short investor memory would become. Today it seems to last only a few months, if that. Markets have always been manic-depressive creatures, but lately the swings feel sharper and more frequent. We go from extreme panic to extreme greed and back again every few quarters. This happens across multiple asset classes, not just major equities.

Some investors ignore the noise and stay focused on the very long term, think XX years plus. Given the direction of inevitable future money creation, they will probably be fine, at least in nominal terms. Others jump in and out, making volatility their friend. They can do very well, as long as they stay humble and know when to restrain their greed. Then there is the third group, the ones who jump in too late and hold on to losing positions. My hope is that at least some will avoid that fate, and if so, I will consider my job well done.

Howard Marks also stressed that one of the biggest mistakes is to assume that overpriced means it will go down tomorrow. Overpriced markets often keep going. But before they turn, there are signs when the trend shifts, which is why I monitor them every week for myself and share them here.

If you are long, you will know when something has changed. It’ll be hard to miss - you will start losing some money. The key is to recognize it, accept it and get out before the losses grow, no matter how good you feel about the investment.

I often remind myself of something simple but true. You can always get back in, even the next day. In the meantime, you will have time to revisit your thesis with a clear, unbiased mind and a fresh view. In any case, I often find that the best opportunities appear in unloved sectors or assets at the very start of a trend. That is usually when the market has reached its point of extreme panic, and that is where the most money is made.

That sets the tone this week. Hopefully not too long, and ideally helpful. Now let us look at what is ahead. As always, I will share what stands out before Monday.

This is update number forty-five. Over that time, I have shared trades, setups, and key insights with a clear focus on what matters. The summary table is straightforward as always, covering indices, forex, rates, metals, energy, and agricultural commodities.

XXXXX engagements

Related Topics investment