[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Don Durrett - goldstockdata.com @DonDurrett on x 60.1K followers

Created: 2025-07-26 03:19:37 UTC

Don Durrett - goldstockdata.com @DonDurrett on x 60.1K followers

Created: 2025-07-26 03:19:37 UTC

Here is Appendix E from the 11th Edition of How to Invest in Gold & Silver. The Appendix title is Getting An Edge.

Producer Checklist

Properties (grade, recovery rate, mine-life, economics - NPV, Capex, AISC, IRR).

Location Issues (taxes/royalties/permitting/politics/infrastructure).

Financing Issues (if any).

Management (quality/experience/insiders).

Valuation (cheap/expensive/upside potential/good chart).

Balance Sheet (cash/debt/ability to raise money).

Costs/Margins (is the trend up or down).

Exploration/Pipeline (any growth potential/Shark?).

Share structure/share dilution (possible reverse split, balance sheet issues).

Overall Risk-Reward (average, good, very good, excellent, or not so good).

If a producer does not have any problems with these ten checklist items, then you have identified an edge. You should feel excited about owning stocks where you feel like you have an edge. If you don't have an edge, then the risk-reward is likely not strong.

Developer Checklist

Strong project (grade, recovery rate, mine-life, economics - NPV, Capex, AISC, IRR).

High upside potential (at least a 10-bagger).

Good location (ideally in a mining district, or mining-friendly country).

Strong management team (past experience, good team, good board).

Path to production (a strong plan, permitting, scoping).

Strong insiders (at least 25%).

You only want to own development stocks that can pass this checklist. Each item has an equal weighting. You want a company that has all six. Sometimes you can make an exception for the path to production if you are confident that a plan will soon appear. When you have all six, you will have found an edge.

Exploration Checklist

I have two rules for buying exploration stocks. If it does not pass one of these rules, then you likely won't have an edge, and a strong risk-reward.

A company's gold/silver in the ground is valued significantly below market value. For example, around $XX per oz of gold or XX cents per oz of silver. These are called optionality plays.

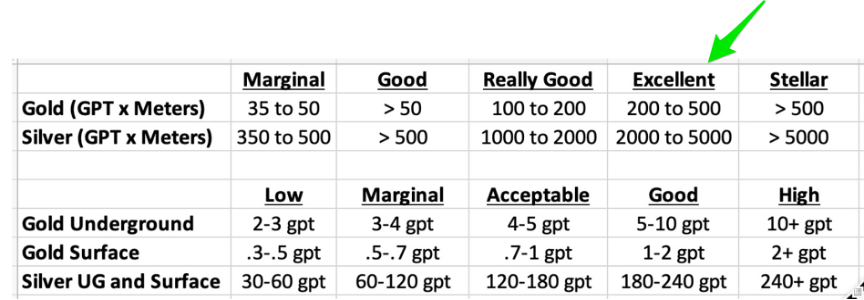

A company is early in the Lassonde Curve (the discovery just occurred), plus it has an excellent discovery hole (see image below).

There is a caveat for these three checklists to work, which is the gold/silver price. Because the gold/silver price is so important for gold/silver mining stock valuations, we need rising metal prices to make money. That is why gold/silver mining investing is speculating. We are betting on higher metal prices and then identifying which miners we think will benefit from those rising prices.

XXXXXX engagements

Related Topics iranian rial investment