[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

optionGeek @StockShark16 on x 11.7K followers

Created: 2025-07-25 17:20:59 UTC

optionGeek @StockShark16 on x 11.7K followers

Created: 2025-07-25 17:20:59 UTC

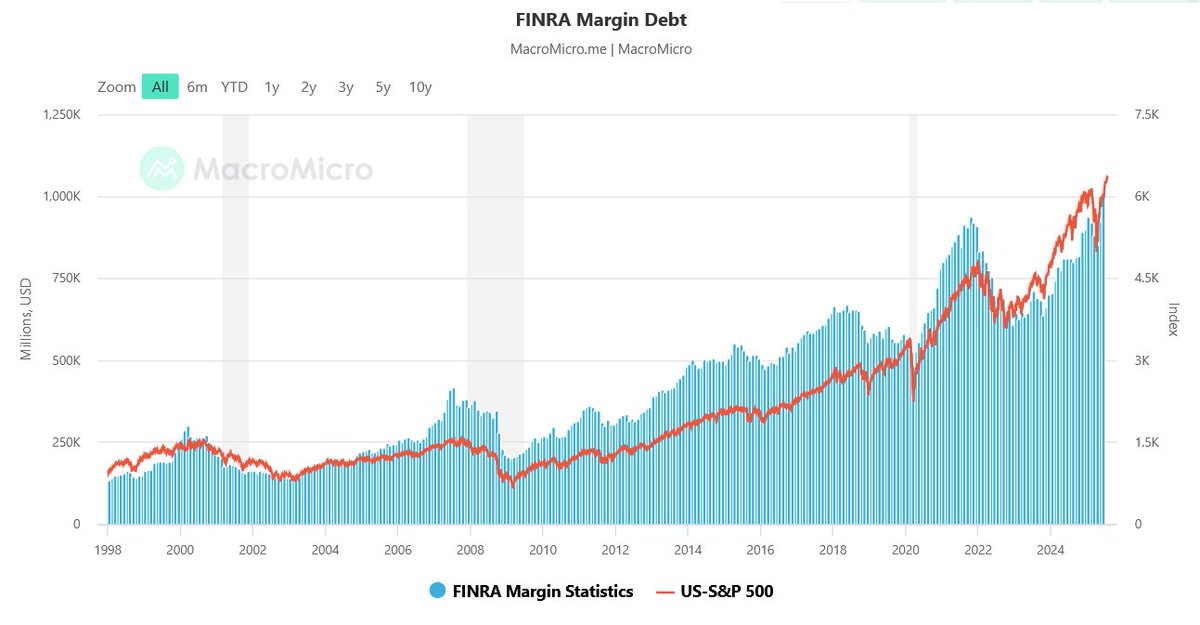

Margin debt has surged to a record $X trillion — the highest ever. The sharp rally in July caught hedge funds off guard, as many had heavily shorted the market ahead of the August X tariff deadline. Meanwhile, retail traders aggressively piled into call options, triggering a gamma squeeze. This forced hedge funds to cover and shift toward a delta-neutral stance, further fueling the rally. This exact scenario was anticipated by our OptionEdge AI model, which forecasted a move toward $XXX on $SPY, followed by a severe correction extending through October.

The market is likely to top out in the next X to X days, followed by a brief period of consolidation designed to trap late-stage bulls, before the downturn accelerates.

XXX engagements