[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Ask Checkit @CheckIt30330637 on x XXX followers

Created: 2025-07-25 08:07:01 UTC

Ask Checkit @CheckIt30330637 on x XXX followers

Created: 2025-07-25 08:07:01 UTC

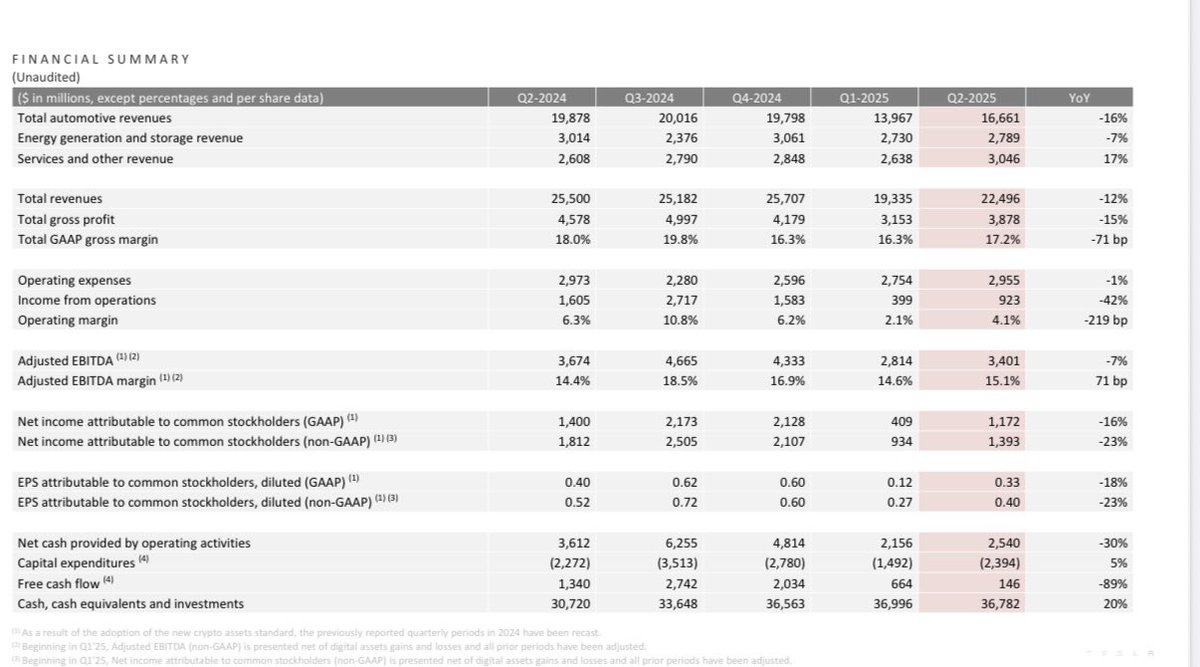

Tesla Q2 2025 earnings call summary ⸻ 🔹 S1: Financial and Operational Highlights •Automotive revenue rose XX% QoQ, driven by improved ASP from the new Model Y, despite lower regulatory credit revenue. •COGS increased significantly due to ~$300M in additional tariffs affecting both automotive and energy sectors. •Energy and solar gross profit hit record highs despite deployment challenges. •Operating expenses increased due to AI project investments, including AI compute and stock-based compensation. •R&D spending is projected to keep rising with strategic AI and robotics investments. •Financial leverage ratio was not disclosed; however, operating cash flows increased sequentially. •No new debt issuance was discussed in the call. •Operating cash flow improved, but high CapEx limited free cash flow to $146M. •CapEx projected to exceed $9B for FY2025, covering Cybertruck, Semi, and AI initiatives. •Operating income was not specified, but margins likely improved due to ASP gains despite tariff drag. •Net income details were omitted; impacted by Bitcoin revaluations and tariff-related costs. •Free cash flow for the quarter: $146M due to elevated CapEx.

⸻

🔹 S2: Market Expansion •Robo-taxi expansion planned from Austin to regions covering ~50% of the U.S. population by year-end, pending regulatory approval. •Model Y now the best-selling vehicle in multiple countries. •European sales potential is strong, contingent on FSD approval. ⸻

🔹 S3: New Product Launch •Robo-taxi service launched autonomously in Austin. •Low-cost Model Y production has begun. •Tesla diner project introduced, gaining global media interest. •Megapack and Optimus robot designs are progressing, with emphasis on ramping up Optimus production. ⸻ 🔹 S4: Next Quarter / Forward Guidance •Near-term risks include the expiration of IRA EV credits and ongoing tariff headwinds. •Focus areas include AI, energy, and robotics with a long-term positive outlook. •Cost-reduction efforts are underway, particularly in production for affordable models. •Balance sheet will be used to absorb short-term financial pressure. •Future debt financing considered once sustainable cash flows from new initiatives are established. •Technological optimism continues, especially for autonomy expansion through next year. #SmartEarningCall

XX engagements

Related Topics coins energy tariffs $300m asp quarterly earnings tesla stocks consumer cyclical stocks bitcoin treasuries